Coordination of benefits (COB) allows plans that provide health and/or prescription coverage for a person with Medicare to determine their respective payment responsibilities (i.e., determine which insurance plan has the primary payment responsibility and the extent to which the other plans will contribute when an individual is covered by more than one plan).

How do you determine coordination of benefits?

- Having two health plans can help cover normally out-of-pocket medical expenses, but also means you'll likely have to pay two premiums and face two deductibles.

- Health plans have coordination of benefits, which is a process that decides which plan is primary and which one pays second.

- State

How to determine coordination of benefits?

“coordination of benefits.” If you have Medicare and other health or drug coverage, each type of coverage is called a “payer.” When there’s more than one potential payer, there are coordination rules to decide who pays first. The first or “primary payer” pays what it owes on your bills, and then sends the remainder of the bill

How does Medicare coordinate benefits?

They can, for example, design benefits to target people with chronic conditions or in ways that take into account socioeconomic factors. One of those possible value-based offerings is hospice benefits, which have traditionally fallen outside of Medicare Advantage. This year, 13 MA organizations are offering hospice benefits.

What is the standard coordination of benefits?

Here’s an example of how the process works:

- Let’s say you visit your doctor and the bill comes to $100.

- The primary plan picks up its coverage amount. Let’s say that’s $50.

- Then, the secondary insurance plan picks up its part of the cost up to 100% — as long as the insurer covers the health care services.

- You pay whatever the two plans didn’t cover.

How do coordination of benefits work?

Coordination of benefits (COB) COB works, for example, when a member's primary plan pays normal benefits and the secondary plan pays the difference between what the primary plan paid and the total allowed amount, or up to the higher allowed amount.

Who is responsible for coordination of benefits?

Who is responsible for coordination of benefits? The health insurance plans handle the COB. The health plans use a framework to figure out which plan pays first — and that they don't pay more than 100% of the medical bill combined. The plan type guides a COB.

What does no coordination of benefits mean?

A. No. Coordination of benefits is a coordination of reimbursement only between policies; it does not duplicate benefits or double the benefit frequency. Example: a patient has two policies, and each one covers two cleanings a year.

How do you calculate coordination of benefits?

Calculation 1: Add together the primary's coinsurance, copay, and deductible (member responsibility). If no coinsurance, copay, and/or deductible, payment is zero. Calculation 2: Subtract the COB paid amount from the Medicaid allowed amount. When the Medicaid allowed amount is less than COB paid, the payment is zero.

What does coordination of benefits mean and why is it important?

Coordination of benefits (COB) allows plans that provide health and/or prescription coverage for a person with Medicare to determine their respective payment responsibilities (i.e., determine which insurance plan has the primary payment responsibility and the extent to which the other plans will contribute when an ...

What are the different types of coordination of benefits?

Understanding How Insurance Pays: Types of Coordination of Benefits or COBTraditional. ... Non-duplication COB. ... Maintenance of Benefits. ... Carve out. ... Dependents. ... When Does Secondary Pay? ... Allowable charge. ... Covered amount.

How do you determine which insurance is primary and which is secondary?

The "primary payer" pays what it owes on your bills first, and then sends the rest to the "secondary payer" to pay. The insurance that pays first is called the primary payer. The primary payer pays up to the limits of its coverage. The insurance that pays second is called the secondary payer.

Do Medicare Advantage plans coordinate benefits?

Medicare Advantage plans can serve as your “one-stop” center for all your health and prescription drug coverage needs. Most Medicare Advantage plans combine medical and Part D prescription drug coverage. Many also coordinate the delivery of added benefits, such as vision, dental, and hearing care.

Which of the following best describes the purpose of coordination of benefits regulations?

Which of the following best describes the purpose of Coordination of Benefits regulations? They discourage overinsurance and avoid duplication of benefits by permitting a reduction of benefits when a person is covered by more than one plan.

What are the rules of cob?

Insurance Term - Coordination of Benefits (COB) This is a provision in the contract that applies when a person is covered under more than one health insurance plan. It requires that payment of benefits be coordinated by all health insurance plans to eliminate over-insurance or duplication of benefits.

How does billing work with 2 insurances?

If you have multiple health insurance policies, you'll have to pay any applicable premiums and deductibles for both plans. Your secondary insurance won't pay toward your primary's deductible. You may also owe other cost sharing or out-of-pocket costs, such as copayments or coinsurance.

When two insurance which one is primary?

If you have two plans, your primary insurance is your main insurance. Except for company retirees on Medicare, the health insurance you receive through your employer is typically considered your primary health insurance plan.

What is Medicare Secondary Payer?

The Medicare Secondary Payer (MSP) program is in place to ensure that Medicare is aware of situations where it should not be the primary, or first, payer of claims. If a beneficiary has Medicare and other health insurance, Coordination of Benefits (COB) rules decide which entity pays first. There are a variety of methods ...

Who is responsible for mistaken Medicare payment?

Based on this new information, CMS takes action to recover the mistaken Medicare payment. The BCRC is responsible for the recovery of mistaken liability, no-fault, and workers’ compensation (collectively referred to as Non-Group Health Plan or NGHP) claims where the beneficiary must repay Medicare.

What is Medicare Coordination of Benefits?

Coordination of benefits, or COB, is defined as the process which “allows plans that provide health and prescription coverage for a person with Medicare to determine their respective payment responsibilities”. In other words, COB determines which insurance carrier is primary, secondary, and so on.

How Does COB Impact Claim Processing?

There are some ways in which COB can affect claims processing like many patients have Medicare, so it stands to reason that this issue is most commonly seen when dealing with Medicare claims. Medicare-eligible patients may also have a Medicare supplemental plan, such as AARP, as their secondary.

What is the purpose of coordination of benefits?

The primary intentions of coordination of benefits are to make sure that individuals who receive coverage from two or more plans will receive their complete benefit entitlement and to prevent benefits from being duplicated when an individual has more than one policy in place. This process covers insurance pertaining to several sectors ...

When does coordination of benefits happen?

Predominantly, coordination of benefits happens when an individual has two plans in place (primary and secondary), but it may also include a tertiary plan in some circumstances.

Why is COB important?

There are numerous reasons why COB is an important process. These are summarized below: 1 A lack of coordination between the plans a person holds can result in the claim not being paid until the COB has been confirmed, thus potentially causing financial difficulties. 2 Either the individual or the insurance provider could be subjected to expenses that they did not need to pay if the insurance plans are not coordinated correctly.

What is a COB claim?

Also referred to as COB, coordination of benefits occurs when an individual is in possession of more than one insurance policy and when it comes to processing a claim, the policies are assessed to determine which will be assigned with the primary responsibility for covering the predominant share of the claim costs. The process also involves assessing the extent that other policies held will contribute toward the claim. This article will provide you with everything that you need to know about coordination of benefits.

What is a secondary insurance plan?

Any unpaid balance owed to the patient is typically paid by the claimant's second plan, within the limits of its responsibility. This secondary insurance plan can take the benefits of the patient's other plans into consideration only when it has been confirmed as being the secondary — not primary — plan.

What is the primary plan?

Order of Benefit Determination. The primary plan is always considered as the predominant provider of benefits, and it must provide these as though the claim holder does not have a second or third policy in place . The COB provisions that are specified in the insurance policy outline which plan is the primary plan.

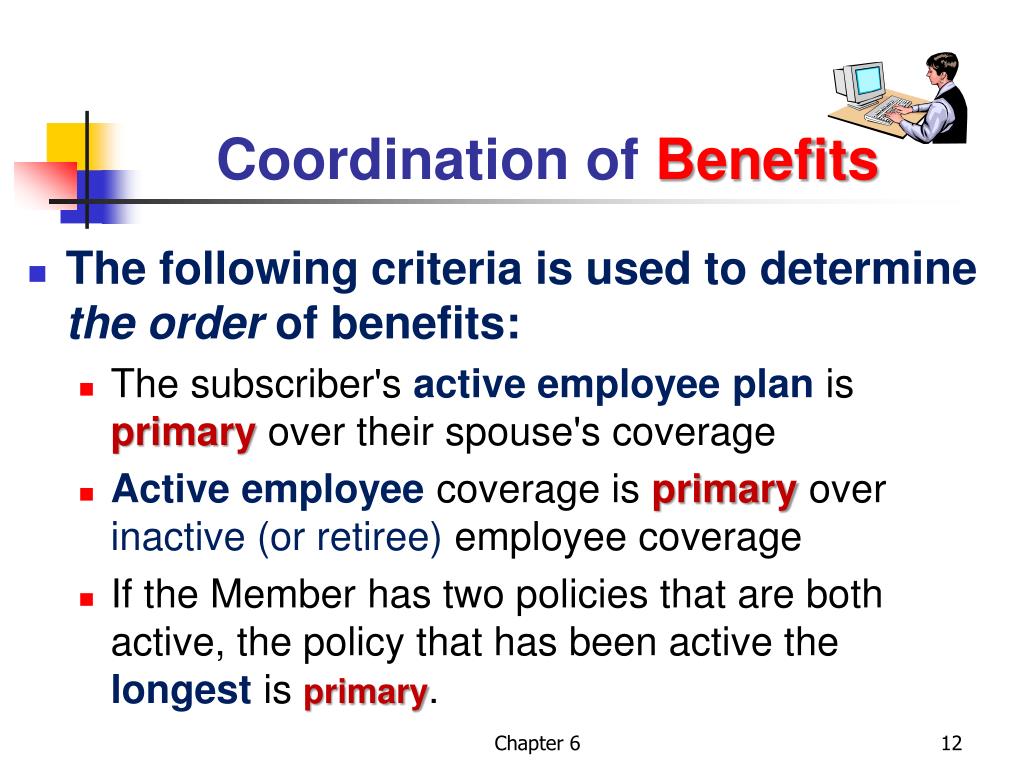

Is the newer plan the primary or secondary?

If the patient is the primary subscriber to two commercial plans, then the plan to which they have been subscribed the longest is considered as the primary plan, and the newer plan is the secondary. Employer Coverage Rule.

What is coordination of benefits?

When a person is covered by two health plans, coordination of benefits is the process the insurance companies use to decide which plan will pay first and what the second plan will pay after the first plan has paid. 1. As an example, if your spouse or partner has a health care plan at work, and you have access to a health care plan through work, ...

Why is the health plan coordination of benefits system important?

The health plan coordination of benefits system is used to ensure both health plans pay their fair share. When both health plans combine coverage in the right way, you can avoid a duplication of benefits, while still getting the health care to which you're entitled. 5

What happens when you have two health insurance plans?

When an insured person has two health plans, one is the main plan , and the other is the second one. In the event of a claim, the primary health plan pays out first. The second one kicks in to pay some or all of the costs the first plan didn't pick up.

How do health plans combine benefits?

Health plans combine benefits by looking at which health plan of the patient is the main plan and which one is the backup plan. There are guidelines set forth by the state and health plan providers that help the patient's health plans decide which health care plan is the main plan and which one the second plan.

What happens if your health insurance pays more than what the plan felt reasonable and customary?

Once your main plan pays the reasonable and customary amount on a health care service, there may still be a balance due. This could happen if the health care provider was charging more than what the main plan felt was reasonable and customary.

Does a health plan cover a cost?

Most health plans will only cover costs that are reasonable and customary. This means the health plan provider will not pay for any services or supplies that are being billed at a cost that is more than what is the usual charge for the treatment in the area where the treatment takes place.

Do you have to pay out of pocket for a second health plan?

The second plan does not have to pay the amount the first plan did not pay if the charge is deemed out of the normal limit. The insured person could still end up paying out-of-pocket. This could still happen even if there are two health plans.