What is medical GAP insurance and is it worth it?

Dec 12, 2019 · The coverage gap is a temporary limit on what most Medicare Part D Prescription Drug Plans or Medicare Advantage Prescription Drug plans pay for prescription drug costs. This gap will officially close in 2020, but you can still reach this out-of-pocket threshold where your medication costs may change.

What if Medicare denies coverage?

the coverage gap? When a person gets prescription drugs through a Medicare drug plan during their coverage gap, the plan tracks and calculates the person’s out-of-pocket costs automatically. The person with Medicare should always use their Medicare drug plan card, even during the coverage gap. This will allow them to buy their

What is gap coverage and do I need It?

Mar 07, 2022 · Learn more about the Medicare Part D coverage gap (or “donut hole”), a gap in prescription drug coverage that is a budget concern for many people.

What does no gap coverage mean Medicare?

Medigap is Medicare Supplement Insurance that helps fill "gaps" in Original Medicare and is sold by private companies. Original Medicare pays for much, but not all, of the cost for covered health care services and supplies. A Medicare Supplement Insurance (Medigap) policy can help pay some of the remaining health care costs, like: Copayments

What does coverage gap mean in Medicare?

Most Medicare drug plans have a coverage gap (also called the "donut hole"). This means there's a temporary limit on what the drug plan will cover for drugs. Not everyone will enter the coverage gap. The coverage gap begins after you and your drug plan have spent a certain amount for covered drugs.

What is the coverage gap for 2021?

For 2021, the coverage gap begins when the total amount your plan has paid for your drugs reaches $4,130 (up from $4,020 in 2020). At that point, you're in the doughnut hole, where you'll now receive a 75% discount on both brand-name and generic drugs.Oct 1, 2020

How long does the Medicare gap last?

When does the Medicare Donut Hole End? The donut hole ends when you reach the catastrophic coverage limit for the year. In 2022, the donut hole will end when you and your plan reach $7,050 out-of-pocket in one calendar year.

Can I avoid the donut hole?

If you have limited income and resources, you may want to see if you qualify to receive Medicare's Extra Help/Part D Low-Income Subsidy. People with Extra Help see significant savings on their drug plans and medications at the pharmacy, and do not fall into the donut hole.

Will the donut hole go away in 2021?

En español | The Medicare Part D doughnut hole will gradually narrow until it completely closes in 2020. Persons who receive Extra Help in paying for their Part D plan do not pay additional copays, even for prescriptions filled in the doughnut hole.

How do I avoid the Medicare donut hole?

Five Ways to Avoid the Medicare Part D Coverage Gap (“Donut Hole”...Buy generic prescriptions. Jump to.Order your medications by mail and in advance. Jump to.Ask for drug manufacturer's discounts. Jump to.Consider Extra Help or state assistance programs. Jump to.Shop around for a new prescription drug plan. Jump to.Jun 5, 2021

Is Medicare going to do away with the donut hole?

The Part D coverage gap (or "donut hole") officially closed in 2020, but that doesn't mean people won't pay anything once they pass the Initial Coverage Period spending threshold. See what your clients, the drug plans, and government will pay in each spending phase of Part D.

How does Medicare Part D calculate donut holes?

Here's what counts toward the Medicare donut hole:Plan deductible.Coinsurance/copayments for your medications.Any discount you get on brand-name drugs. For example, if your plan gives you a manufacturer's discount of $30 for a medication, that $30 counts toward the Medicare Part D donut hole (coverage gap).

Does the donut hole reset each year?

You will remain in the Catastrophic Coverage Stage until January 1. This process resets every January 1.

What is the donut hole amount for 2022?

In 2022, the coverage gap ends once you have spent $7,050 in total out-of-pocket drug costs. Once you've reached that amount, you'll pay the greater of $3.95 or 5% coinsurance for generic drugs, and the greater of $9.85 or 5% coinsurance for all other drugs. There is no upper limit in this stage.Oct 30, 2021

What Is The Coverage Gap (“Donut Hole”), and When Does It Start?

For those who are new to the coverage gap, or “donut hole,” learning about the different Medicare Part D coverage phases is a good place to start....

What Costs Count Towards Getting Out of The Coverage Gap (“Donut Hole”)?

Once you’ve entered the coverage gap (“donut hole”), it’s important to understand which out-of-pocket costs count towards helping you reach the cat...

What Costs Don’T Count Towards Getting Out of The Coverage Gap (“Donut Hole”)?

Not all out-of-pocket costs count towards reaching catastrophic coverage. The following costs don’t count towards getting you out of the coverage g...

How Do I Avoid The Medicare Part D Coverage Gap (“Donut Hole”)?

Now that you know about the coverage gap (“donut hole”), here is some good news: 1. Many Medicare beneficiaries won’t have to pay the increased pri...

What If I Have Questions About The Coverage Gap (“Donut Hole”)?

If you have questions about how the coverage gap works and how to avoid it, I can help. A licensed insurance agent such as myself can help you comp...

What is the Medicare Part D coverage gap?

The Medicare Part D Coverage Gap (“Donut Hole ”) Made Simple. Summary: When it comes to Medicare prescription drug coverage, you might have questions surrounding the Medicare Part D coverage gap, also known as the “donut hole.”. The coverage gap is a temporary limit on what most Medicare Part D Prescription Drug Plans or Medicare Advantage ...

When will the Medicare coverage gap end?

This gap will officially close in 2020 , but you can still reach this out-of-pocket threshold where your medication costs may change. Find affordable Medicare plans in your area.

What happens after you reach your Medicare deductible?

After you reach the deductible, the Medicare plan begins to cover its share of prescription drug costs. The deductible amount may vary by plan, and some plans may not have a deductible. If your Medicare plan doesn’t have a deductible, then you’ll start your coverage in the initial coverage phase (see below). Initial coverage phase: After you’ve ...

How to avoid coverage gap?

Managing your out-of-pocket prescription drug costs is a big part of avoiding the coverage gap. Here are some tips for how you can lower the amount you spend on medications: Many expensive prescription drugs have a generic or lower-cost alternative. Switching to lower-cost drugs may help you avoid entering the coverage gap.

Why won't Medicare pay the $4,020 coverage gap?

Now that you know about the coverage gap (“donut hole”), here is some good news: Many Medicare beneficiaries won’t have to pay the increased prices during the coverage gap because their prescription drug costs won’t reach the initial coverage limit of $4,020 in 2020.

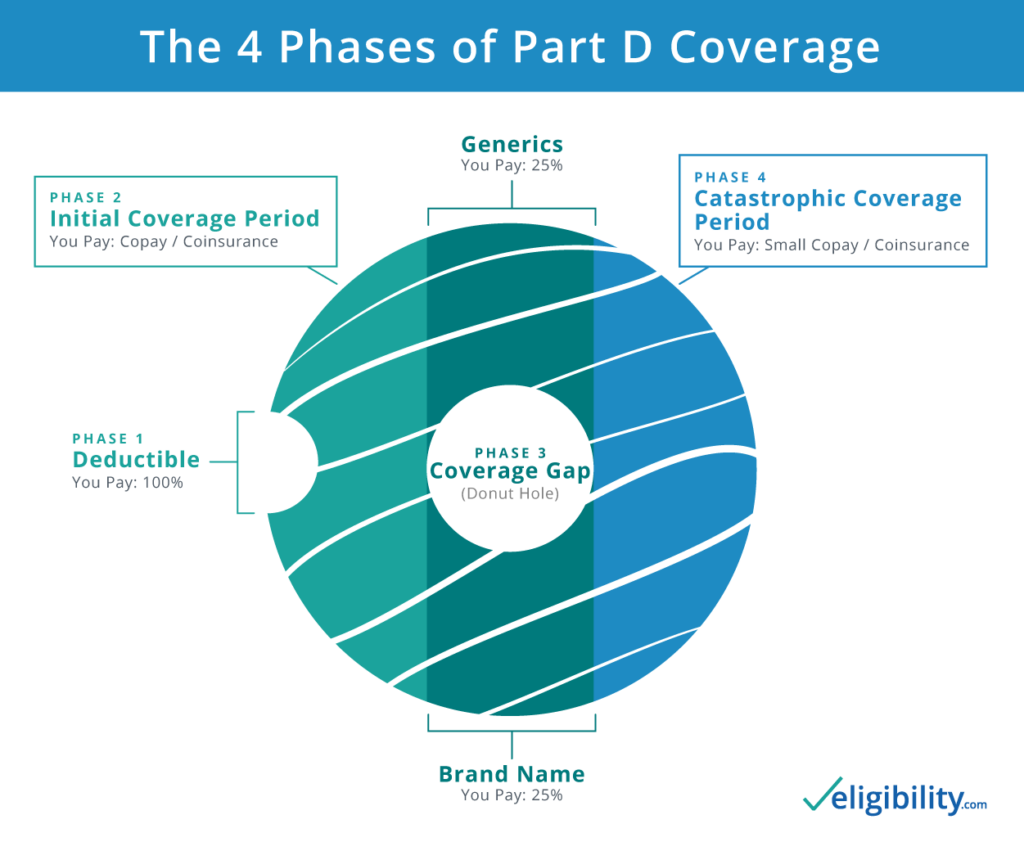

How many phases are there in Medicare?

Stand-alone Medicare Prescription Drug Plans and Medicare Advantage Prescription Drug plans can have the following four coverage phases, as applicable: Deductible phase: For most stand-alone Medicare Prescription Drug Plans and Medicare Advantage Prescription Drug plans, you’ll pay 100% for medication costs until you reach ...

How much is the coverage gap for 2020?

While in the coverage gap, you’ll typically pay up to 25% of the plan’s cost for both covered brand-name drugs and generic drugs in 2020. You’re out of the coverage gap once your yearly out-of-pocket drug costs reach $ 6,350 in 2020. Once you have spent this amount, you’ve entered the catastrophic coverage phase.

What is a donut hole in Medicare?

What Is the Medicare Part D “Donut Hole”? Most Medicare Part D prescription drug plans have a coverage gap. More commonly, this has been known as the “donut hole.”. The “donut hole” essentially refers to where a drug plan may reach its limit on what it will cover for drugs. Once you and your Medicare Part D plan have spent a certain amount on ...

What is Medicare Made Clear?

Medicare Made Clear is brought to you by UnitedHealthcare to help make understanding Medicare easier. Click here to take advantage of more helpful tools and resources from Medicare Made Clear including downloadable worksheets and guides.

How much does Medicare pay for generic drugs?

For generic drugs: You’ll pay 25% of the price. Medicare pays 75% of the price. Only the amount you pay will count towards getting you out of the “donut hole.”. NOTE: Some plans may have coverage in the gap, so if this is true for you, you will get a discount after the plan’s coverage has been applied to the drug’s price. ...

How to take a bite out of your budget?

Here are some ideas to help turn that bite into a nibble, even if you are unlikely to reach the coverage gap. 1. Plan ahead by estimating your annual drug costs and how you will handle paying for your medications if you do enter the Part D coverage gap stage. 2.

Is the Donut hole going away?

The “donut hole” isn’t really going away, because Medicare Part D still has four payment stages. The “donut hole” is the third stage, and you move through the Part D payment stages based on how much you, your plan, and others on your behalf have paid for your drugs during the year.

Does a catastrophic plan pay for out of pocket drugs?

You may pay a small copay or coinsurance, and you will remain in this stage for the rest of the year. Your out-of-pocket drug costs, including copays, coinsurance amounts and your deductible, if any, count toward the dollar limits.

What is Medicare Advantage?

Medicaid. A joint federal and state program that helps with medical costs for some people with limited income and resources.

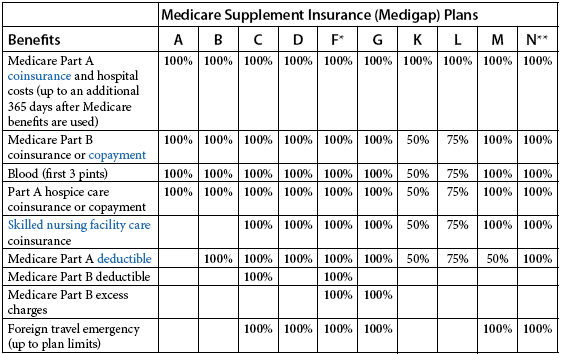

What is a Medigap policy?

Those plans are ways to get Medicare benefits, while a Medigap policy only supplements your Original Medicare benefits. The periodic payment to Medicare, an insurance company, or a health care plan for health or prescription drug coverage.

What happens if you buy a Medigap policy?

If you have Original Medicare and you buy a Medigap policy, here's what happens: Medicare will pay its share of the. Medicare-Approved Amount. In Original Medicare, this is the amount a doctor or supplier that accepts assignment can be paid. It may be less than the actual amount a doctor or supplier charges.

How many people does a Medigap policy cover?

for your Medigap policy. You pay this monthly premium in addition to the monthly Part B premium that you pay to Medicare. A Medigap policy only covers one person. If you and your spouse both want Medigap coverage, you'll each have to buy separate policies.

What is the difference between Medicare and Original Medicare?

Original Medicare. Original Medicare is a fee-for-service health plan that has two parts: Part A (Hospital Insurance) and Part B (Medical Insurance). After you pay a deductible, Medicare pays its share of the Medicare-approved amount, and you pay your share (coinsurance and deductibles). and is sold by private companies.

Can you cancel a Medigap policy?

This means the insurance company can't cancel your Medigap policy as long as you pay the premium. Some Medigap policies sold in the past cover prescription drugs. But, Medigap policies sold after January 1, 2006 aren't allowed to include prescription drug coverage.

Does Medicare cover all of the costs of health care?

Original Medicare pays for much, but not all, of the cost for covered health care services and supplies. A Medicare Supplement Insurance (Medigap) policy can help pay some of the remaining health care costs, like: Note: Medigap plans sold to people who are newly eligible for Medicare aren’t allowed to cover the Part B deductible.

How much is Medicare coverage gap?

The Medicare coverage gap, AKA donut hole, isn’t as sweet as it sounds. With more than $2,000 in potential out-of-pocket prescription costs, many seniors find it difficult to continue taking their necessary medications during the gap period.

What is a donut hole in Medicare?

The Medicare Coverage Gap (Donut Hole) Explained. Medicare is clear that you may have a coverage gap in Part D of your plan. A coverage gap means you may end up paying out-of-pocket for your medication. The donut hole (coverage gap) is one of four phases in your Medicate Part D coverage that may result in additional out-of-pocket expenses.

What is the Pharmaceutical Assistance Program?

Pharmaceutical Assistance Program. There are pharmaceutical companies that offer reduced costs on certain medications for those that are enrolled in Medicare prescription drug coverage Part D. You can find out if the medication you need is available here .

How much does Part D cost in 2020?

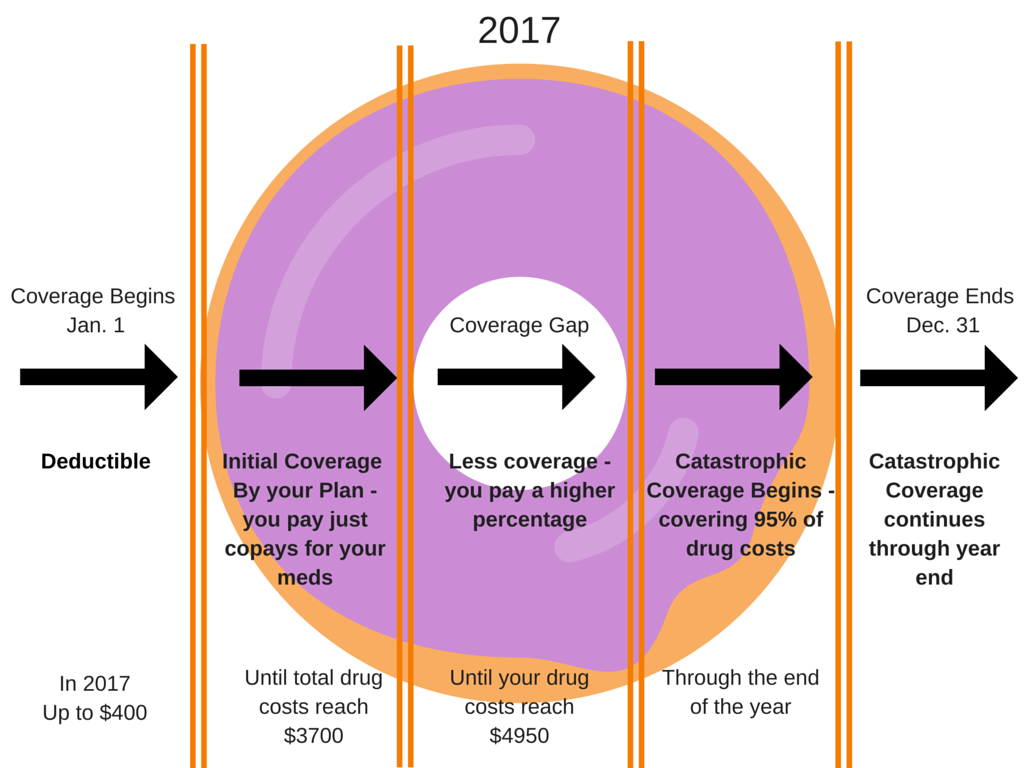

In 2020, this initial coverage period usually ends after you’ve amassed $4,020 in prescription medication costs, including your out-of-pocket expenses and what your plan has paid.

How much is the deductible for Part D 2020?

The first period is before you meet your deductible. Once you reach that, Part D will begin to cover your medications. The deductible for 2020 will not exceed $435.

When does catastrophic coverage begin?

Catastrophic coverage begins when you have paid $6,350 during 2020. Your copay will be less for the remaining of the year. The medication you purchased during the donut hole stage, your deductible, and the initial coverage period amount count towards the catastrophic coverage amount. Once you have entered the catastrophic coverage phase, ...

What happens after you reach the initial coverage period?

After you’ve reached the initial coverage period amount, then you enter the dreaded “donut hole.” When you get to this point, you are responsible for 25% of the cost of your medications. This substantial percent can get expensive if you must take more than one high priced medication.

What is a Medicare Part D gap?

When Medicare Part D prescription drug plans first became available, there was a built-in gap in coverage. This coverage gap opened after initial plan coverage limits had been reached and before catastrophic coverage kicked in. While in this gap, plan members had to pay the full cost of their covered drugs until their total costs qualified them ...

What is phase 3 coverage gap?

Most Medicare drug plans have a coverage gap (also called the "donut hole"). This means there's a temporary limit on what the drug plan will cover for drugs. Not everyone will enter the coverage gap, and it doesn’t apply to members who get Extra Help to pay for their Part D costs. Once in the gap, you’ll pay no more ...

How much will you pay for prescription drugs in 2021?

For 2021, once you've spent $6,550 out of pocket, you're out of the coverage gap and move into phase 4—catastrophic ...

What is the copayment for a prescription?

For example, if your plan has a 25% copayment for a $200 prescription, you would pay $50 and your plan would cover the $150 balance.

What is the limit for Part D coverage in 2021?

If the combined amount you and your drug plan pay for prescription drugs reaches a certain level during the year—that limit is $4,130 in 2021—you enter the Part D coverage gap or “donut hole.”.

How much is a deductible for 2021?

The deductibles vary between plans and some Part D plans have no deductible. In 2021, the deductible can’t be more than $445.

Is the donut hole closed?

Where members once paid 100% of their costs in the gap, now their share of costs in the donut hole is limited to 25% for both brand-name and generic drugs. The donut hole has essentially closed. 2.

What is the coverage gap in the ACA?

The “coverage gap” exists because the ACA’s premium tax credits (premium subsidies) are only available for people with a household income of at least 100% of FPL, up to 400% of FPL (note that for 2021, people receiving unemployment compensation are eligible for full premium subsidies even if their household income is under the poverty level, and for 2021 and 2022, there is no upper income limit for premium subsidy eligibility ).

What happens if you are in the coverage gap?

If you’re in the coverage gap, Medicaid isn’t available, and ACA-compliant coverage can only be purchased at full price – generally an unrealistic option, given that everyone in the coverage gap has an income below the poverty level. There are a few possible solutions, ...

Why are premium subsidies not available?

Premium subsidies are not available below 100% of FPL, because when the ACA was written, Medicaid expansion was an integral part of the law: It was assumed that subsidies would not be needed below 100% of FPL, since Medicaid would be available instead.

How old do you have to be to get medicaid in Washington?

In Washington, D.C. and the 36 states where Medicaid eligibility has been expanded, adults up to the age of 64 (who meet the immigration status requirements) are eligible for Medicaid with a household income up to 138% of FPL are eligible for Medicaid.

What was the Affordable Care Act?

When the Affordable Care Act was written, a cornerstone of the legislation was the expansion of Medicaid to everyone with household incomes up to 138% of federal poverty level, (FPL).

How many people are in the coverage gap?

According to Kaiser Family Foundation data, there are about 2.2 million people in the coverage gap across the 11 states that have not expanded Medicaid and do not currently have a plan in place to expand Medicaid. About 208,000 people in Missouri and Oklahoma are caught in the coverage gap until those states officially expand their Medicaid ...

How many states have not expanded Medicaid?

There are still 14 states where Medicaid eligibility has not been expanded under the ACA, although Wisconsin has a unique situation and does not have a coverage gap (Wisconsin essentially implemented a partial Medicaid expansion — without the enhanced federal funding they’d receive if they fully expanded Medicaid ).

Part 1 of your drug coverage

The Initial Deductible Phase The standard Initial Deductible can change each year. In 2022 , the Initial Deductible is $480 ($445 in 2021). If your Medicare Part D plan has an Initial Deductible , you will usually pay 100% for your medications and the amount you pay will count toward the Donut Hole.

Part 2 of your drug coverage

The Initial Coverage Phase After the Initial Deductible (if any), you will continue into your Initial Coverage phase where your Medicare Part D plan covers a portion of your prescription costs and you pay some cost-sharing (co-payment or co-insurance).

Part 3 of your drug coverage

The Coverage Gap or Donut Hole You will leave the Initial Coverage phase and enter the Donut Hole when your total retail drug cost (what you spent plus what your Medicare drug plan spent) exceeds the Initial Coverage Limit ($4,430). As mentioned, the Coverage Gap this is the portion of your Medicare Part D coverage where you traditionally paid a larger percentage of the retail drug cost.

Part 4 of your drug coverage

The Catastrophic Coverage Phase You will stay in the Coverage Gap or Donut Hole phase until your out-of-pocket costs (called TrOOP or total drug spend) reaches a certain level. The TrOOP level in 2022 is $7,050 .