What does Medicare cover and what can you claim?

Aug 10, 2020 · For Medicare to consider a health plan to be creditable coverage, it must provide benefits at least as good as those Medicare provides. When a person has creditable coverage, they may delay enrollment in Medicare without accruing penalties. Below, we review common forms of coverage and discuss their creditability for Medicare.

What if Medicare denies coverage?

Oct 04, 2020 · Medicare creditable coverage is coverage that is considered to be just as good as Medicare, meaning that the coverage pays as well as Medicare does. When someone has creditable coverage for Medicare, he can delay enrollment in Medicare without owing a late enrollment penalty. There are a few forms of creditable coverage for Medicare.

What does creditable coverage mean in health insurance?

Jan 20, 2022 · A certificate of creditable coverage is a document that insurance companies can issue to indicate that someone has terminated their coverage. It shows the insured person's name, the period they held insurance, and when they canceled their policy. Certificates of creditable coverage are no longer necessary. However, if you're enrolling in a Part D plan or a …

What does you'll pay Medicare Part D coverage?

Jan 05, 2021 · Creditable coverage is defined as health insurance that meets or exceeds what Medicare covers. If you have creditable coverage, you can delay signing up for Medicare without penalty. If you lose...

What does Medicare creditable coverage mean?

Medicare defines “creditable coverage" as coverage that is at least as good as what Medicare provides. Therefore, creditable drug coverage is as good as or better than Medicare Part D.

What is not considered creditable coverage?

If your coverage is through an employer with at least 20 employees, it is considered creditable for Medicare. If the coverage is through an employer with fewer than 20 employees or through the Marketplace, it is not creditable.

How do I know if I have creditable coverage?

A group health plan's prescription drug coverage is considered creditable if its actuarial value equals or exceeds the actuarial value of standard Medicare Part D prescription drug coverage. Prescription drug coverage that does not meet this standard is called “non-creditable.”Sep 12, 2018

Is Medicare Part A and B considered creditable coverage?

If you have health insurance through a large employer, it will qualify as creditable coverage for Medicare Part A and Part B, provided it covers as much as or more than original Medicare.Jan 5, 2021

What is considered creditable coverage for Medicare Part D?

Under §423.56(a) of the final regulation, coverage is creditable if the actuarial value of the coverage equals or exceeds the actuarial value of standard prescription drug coverage under Medicare Part D, as demonstrated through the use of generally accepted actuarial principles and in accordance with CMS actuarial ...

Who gets Medicare creditable coverage notice?

You'll get this notice each year if you have drug coverage from an employer/union or other group health plan. This notice will let you know whether or not your drug coverage is “creditable.”

Can creditable coverage notice be emailed?

Notices of creditable/non-creditable coverage may be included in annual enrollment materials, sent in separate mailings or delivered electronically.

Is GoodRx creditable?

Let's go back to your initial question, “Why do I need insurance if I can use GoodRx?” GoodRx is NOT insurance. If you have Medicare you have a requirement to be enrolled in an approved (creditable) Prescription Drug Plan.May 23, 2019

How do I know if my Medicare Part D credit is creditable?

Prescription drug coverage is creditable if the actuarial value of the coverage equals or exceeds the actuarial value of standard prescription drug coverage under Medicare Part D, as demonstrated through the use of generally accepted actuarial principles and in accordance with Centers for Medicare and Medicaid Services ...

Is COBRA coverage creditable?

COBRA is not normally considered to be creditable coverage for Medicare major medical benefits, so people who are enrolled in COBRA and do not enroll in Medicare Part B within 8 months of turning 65 face substantial financial penalties for the rest of their lives, even if they have months or years left on their COBRA ...

What is creditable coverage?

The most common type of creditable coverage is a large employer group plan. Meaning, a company that employs 20 or more people. When working for an employer, you likely receive health coverage through the company. If the company you work for has more than 20 employees, you have creditable coverage for Medicare.

How does a notice of creditable coverage work?

The Notice of Creditable Coverage works as proof that you obtained coverage elsewhere when you first became eligible for Medicare. Your Notice of Creditable Coverage comes in the mail each year for those who obtain drug coverage through an employer or union.

What is small group insurance?

An employer with small group insurance is a company with less than 20 employees and may not be creditable coverage under Medicare. Further, a variety of government programs are also considered creditable coverage. Examples of other types of coverage are individual, group, and student health plans.

Is VA coverage creditable?

VA benefits are only creditable coverage under Part D. VA benefits are NOT creditable under Part A and Part B. This is something that is HIGHLY miscommunicated to veterans. Even if you have medical coverage under the VA, there are still many reasons to enroll in Medicare coverage to work with your VA benefits.

Is Medicare coverage good for 2021?

Updated on July 12, 2021. Coverage that’s as good as Medicare is creditable coverage, meaning the plan benefits are up to the same standards as Medicare. When a person has creditable coverage, they may postpone enrollment in Medicare. Creditable coverage allows beneficiaries to delay enrolling without worrying about being late enrollment penalties.

Is Part D a creditable plan?

A plan is creditable for Part D as long as it meets four qualifications. Pays at least 60% of the prescription cost. Covers both brand-name and generic medications. Offers a variety of pharmacies. Does not have an annual benefit cap amount, or has a low deductible.

Is FEHB considered creditable?

No, FEHB is NOT considered creditable coverage. However, some beneficiaries choose to still delay enrolling in Medicare when they have FEHB benefits. Some may find the FEHB benefits to be more cost-effective and vice versa.

Creditable Coverage for Part B

Unlike Medicare Part A, Part B requires a monthly premium for most beneficiaries. If you have creditable coverage for Medicare Part B, you can delay starting your Part B and paying for it. If you don’t have creditable coverage, you’ll incur penalties for delaying Part B coverage.

Creditable Coverage for Part D

Medicare Part D covers your prescriptions — if you don’t take it when you’re first eligible, you’ll see penalties. However, you can delay Part D without a penalty with creditable coverage.

Creditable Coverage Notice

Some insurers are required by law to send a notice of creditable coverage. This was part of the Medicare Modernization Act. Companies that may or may not have creditable drug coverage must notify Medicare-eligible beneficiaries annually.

FAQs

Tricare isn’t considered creditable coverage for Medicare Part B but is for Medicare Part D.

How to enroll in Medicare if you lose your Social Security?

Once you lose your creditable coverage, you’ll want to go to your local Social Security office and apply in person. Be sure to take your Notice of Creditable Coverage. This notice will exempt you from having to pay any late penalties that may have accumulated.

Is Medicare non-creditable?

Examples of Non-creditable coverage for Medicare. Unless you have a large employer group health plan, odds are you don’t have creditable coverage for Part A and Part B. If you have any of the following forms of coverage, you’ll need to enroll in Part A and Part B when you’re first eligible to avoid late penalties. COBRA.

Is a small employer group health plan a creditable plan?

If you actively work for a small employer, Medicare will be your primary coverage. Therefore, small employer group health plans are not creditable coverage for Medicare. Even though the small employer group health plan isn’t creditable coverage ...

Can you delay Medicare enrollment?

When someone has creditable coverage for Medicare, he can delay enrollment in Medicare without owing a late enrollment penalty. There are a few forms of creditable coverage for Medicare. However, the most common form of creditable coverage is a large employer group plan. Below, we will discuss the forms of creditable coverage ...

Is Medicare more cost effective than Medicare?

Remember, just because you have creditable coverage for Medicare, doesn’t mean that the coverage you have is more cost-effective than Medicare. With Medicare, you may be able to get better coverage for lower premiums. You can call our team to compare Medicare options to your employer coverage. Call for Medicare Help.

Is VA coverage creditable for Part A?

VA Medical and Drug Benefits. Similar to small employer group coverage, VA coverage is not creditable coverage for Part A or Part B. However, VA drug benefits are creditable coverage for Part D. Although you may have medical coverage through the VA, you still might want to consider enrolling in Part A and Part B for a couple of reasons.

Is FEHB a creditable insurance?

FEHB is a little more complicated. While FEHB isn’t creditable coverage for Medicare, some FEHB enrollees still choose to delay Medica re. To figure out which coverage option is the most cost-effective for you, check out our YouTube video below on FEHB and Medicare. SUBSCRIBE.

What Does Medicare Consider Creditable Health Insurance Coverage?

Medicare states that any health plan offering benefits equal to or greater than its own is creditable coverage. So if you have this level of coverage, you won't get penalized for delaying Medicare enrollment.

What's the Difference Between Creditable and Non-Creditable Coverage?

Unlike creditable coverage, non-creditable coverage has fewer benefits than Medicare.

Is a Medicare Advantage Plan Considered Creditable Coverage?

Medicare Advantage (Medicare Part C) plans are a private insurance alternative to the federal government's Original Medicare program (Medicare Part A and Part B). Part C plans bundle hospital and outpatient coverage and usually include prescription drug coverage.

How Do You Calculate Creditable Coverage?

There are penalties for late enrollment in Medicare Parts B and D, so it's essential to ensure you have creditable coverage for outpatient services and prescription drugs.

How Do You Prove Creditable Drug Coverage?

If you have creditable drug coverage, your plan provider will send you a Notice of Creditable Coverage .

Do I Need a Certificate of Creditable Coverage?

A certificate of creditable coverage is a document that insurance companies can issue to indicate that someone has terminated their coverage. It shows the insured person's name, the period they held insurance, and when they canceled their policy.

Deciding to Enroll in Medicare

Before deciding whether to enroll in Medicare or continue your existing health plan, make sure you know whether you have creditable coverage.

What is creditable coverage?

The takeaway. Creditable coverage refers to health insurance that covers at least as much as — or more than — Medicare. If you have creditable coverage, you may choose to keep it instead of or in addition to Medicare.

When do you need to show coverage to Medicare?

You’ll need to show it to Medicare when you enroll to avoid having to pay late enrollment penalties. If your current insurance is not creditable, you’ll receive a noncreditable coverage disclosure notice. These notices typically mail out each September.

What happens if you lose your Medicare?

If you lose your current coverage, this triggers a special enrollment period during which you can sign up for Medicare without penalty. If you don’t have creditable insurance coverage and delay signing up for Medicare, late fees and penalties may apply.

What happens if you enroll in Medicare and keep your insurance?

If you enroll in Medicare, have creditable coverage, and keep your insurance, your current provider would be your primary insurer. Medicare would be your secondary insurer. You may decide to let your current insurance lapse.

How long do you have to enroll in Medicare if you lose your current coverage?

If you lose your current coverage, you should enroll in Medicare within 8 months. This is known as a special enrollment period.

What is Cobra insurance?

COBRA (Continuation of Health Coverage). COBRA is designed to prolong your health insurance coverage if you’re no longer employed. It isn’t creditable coverage for original Medicare but may be creditable coverage for Part D.

How much is the late enrollment fee for Medicare Part B?

For Part B, you’ll be required to pay a late enrollment fee of an extra 10 percent of your monthly premium amount for each 12-month period you didn’t sign up. This penalty lasts for as long as you have Medicare Part B coverage.

What Does Medicare Mean by Creditable Coverage?

If your plan pays, on average, the same amount that Medicare does, it is said to offer creditable coverage.

What Employer Plans Qualify as Creditable Coverage?

Employer plans qualify as creditable coverage as long as the organization employs at least 20 people. You must also be an active employee. That means that your coverage ceases to be creditable as soon as you retire. If your group health plan is courtesy of your spouse's employer, then your spouse must be the active employee.

What Happens if You Have Creditable Coverage and Enroll in Medicare?

You may choose to enroll in Medicare even though you already have creditable coverage. In this case, your employer-sponsored plan is your primary insurance and Medicare is your secondary carrier.

Insurance Plans That Do Not Qualify as Medicare Creditable Coverage

Even though most of the following are considered high-quality insurance, they do not qualify as Medicare creditable coverage for Parts A and B. In some cases, though, they qualify as creditable coverage for Medicare Part D. Review your notice of creditable coverage to be sure.

Is Creditable Coverage Better than Medicare?

Creditable coverage doesn't mean better coverage. It doesn't even mean cheaper. You could have lower out-of-pocket costs AND better coverage with Medicare. It's always a good idea to weigh all of your options and see which choice offers the best coverage at the best price. Our Find a Plan tool lets you compare options easily.

What is it?

You'll get this notice each year if you have drug coverage from an employer/union or other group health plan. This notice will let you know whether or not your drug coverage is “creditable.”

What should I do if I get this notice?

Keep the notice. You may need it if you decide to join a Medicare drug plan later. (Don't send creditable coverage letters/certificates to Medicare.)

When do you have to notify Medicare of creditable coverage?

Your plan must send you a notice of creditable drug coverage when you join the plan. It must also notify you yearly, prior to October 15 (when Annual Enrollment begins).

How long do you have to enroll in Medicare after retiring?

COBRA: After starting COBRA, you have 8 months to enroll in Medicare without incurring late penalties. Retiree insurance: After retiring, you have 63 days to enroll in Medicare without penalty.

How to sign up for Medicare if you are 65?

If you had creditable coverage when you turned 65 and chose to delay Medicare enrollment, you can sign up without late penalties. Follow these steps: 1 Ask your employer or benefits administrator for a Notice of Creditable Coverage for each part of Medicare for which you delayed enrollment 2 Visit your local Social Security office to sign up in person, so you can give them a copy of your Notice of Creditable Coverage 3 Sign up within two months of losing your current coverage

What happens if you don't have Medicare?

If they don’t have what Medicare calls creditable coverage, they may face a lifetime of late fees. In this post, we explain what Medicare means by creditable coverage and how to delay enrollment without incurring penalties.

Does Medicare require creditable coverage?

If you are eligible for Medicare, the Medicare Modernization Act (MMA) requires your insurance carrier to notify you whether you have creditable coverage. This requirement only applies to employer and union plans that provide prescription drug coverage.

Is FEHB considered creditable?

However, please note that FEHB is not considered creditable coverage. We advise beneficiaries to compare their costs carefully.

Is Medicare the primary insurer?

If you have both, Medicare is the primary insurer. Not creditable for Parts A and B. Check Notice of Creditable Coverage to determine whether creditable for Part D. Avoid late penalties by enrolling in Original Medicare as soon as you become eligible.

Why does creditable drug coverage matter?

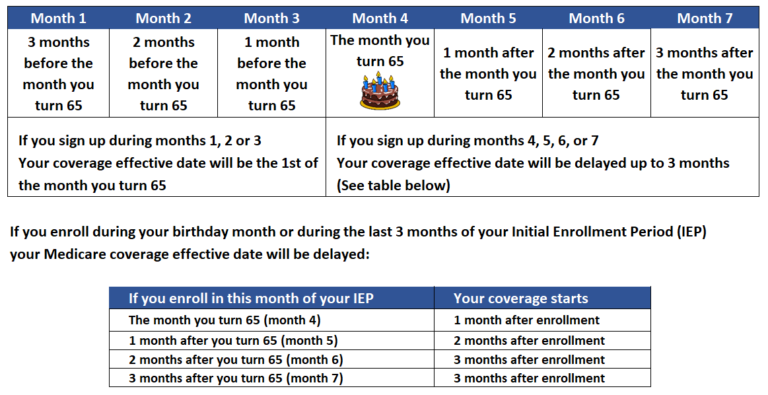

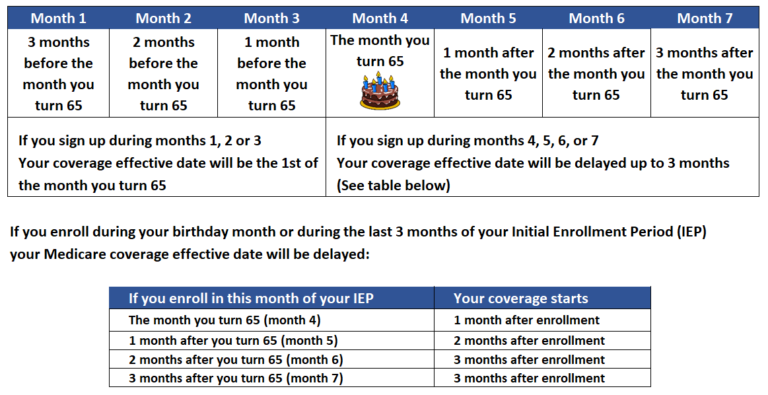

Creditable drug coverage matters because it may allow you to delay enrolling in Medicare and avoid the Part D late enrollment penalty. The penalty is charged if you enroll in a Medicare Part D plan after your Initial Enrollment Period (IEP) ends and don’t qualify for an exception.

What is Medicare Made Clear?

Medicare Made Clear is brought to you by UnitedHealthcare to help make understanding Medicare easier. Click here to take advantage of more helpful tools and resources from Medicare Made Clear including downloadable worksheets and guides.

How much is the late penalty for Medicare?

The late penalty for Medicare Part D is an additional 1 percent of the premium amount for each month you’re late. You pay the penalty for as long as you have Part D. For example, you enroll in a Part D plan that starts on November 1 but your IEP ended on June 30. As a result, you are four months late signing up for Part D.

Do you need Part A and Part B for Medicare?

You will need to have Part A and/or Part B to get a stand-alone Part D plan, and you will need both Parts A & B to get a Medicare Advantage plan.

Creditable Coverage For Part B

Creditable Coverage For Part D

- Medicare Part D covers your prescriptions — if you don’t take it when you’re first eligible, you’ll see penalties. However, you can delay Part D without a penalty with creditable coverage. Coverage considered creditable for Part D must offer a variety of pharmacies and cover both brand and generic drugs. In addition, the insurance must pay at least...

Creditable Coverage Notice

- Some insurers are required by law to send a notice of creditable coverage. This was part of the Medicare Modernization Act. Companies that may or may not have creditable drug coverage must notify Medicare-eligible beneficiaries annually. These usually come out around September. If you plan on delaying coverage for Medicare, you must save this notice. Medicare can require a copy …

FAQs

- Is Tricare considered creditable coverage?

Tricare isn’t considered creditable coverage for Medicare Part B but it is forMedicare Part D. - Are VA benefits considered creditable coverage?

VA benefits are creditable coverage for Medicare Part D only.