What amount is currently deducted from your pay for Medicare?

Your employer also withholds Social Security and Medicare taxes, known as FICA payroll taxes. Generally, 6.2% of your income is taken out for Social Security taxes and 1.45% is taken out for Medicare taxes. But, if you’re a high earner, you might not pay Social Security taxes on your entire paycheck.

How much is the Medicare yearly deductible?

- Medicare Part D premiums

- Annual Medicare Part D deductible

- Copayments (flat fee per prescription)

- Coinsurance (a percentage of actual medication costs)

Does Medicare have a yearly deductible?

Yearly deductible for drug plans. This is the amount you must pay each year for your prescriptions before your Medicare drug plan pays its share. Deductibles vary between Medicare drug plans. No Medicare drug plan may have a deductible more than $480 in 2022 ($445 in 2021). Some Medicare drug plans don't have a deductible.

Do I have to pay the annual Medicare deductible?

Medicare Advantage plans may have their own deductible, but you will not be responsible for the Medicare Part B deductible if you are enrolled in a Medicare Advantage plan. You will only be responsible for paying your Medicare Advantage plan deductible.

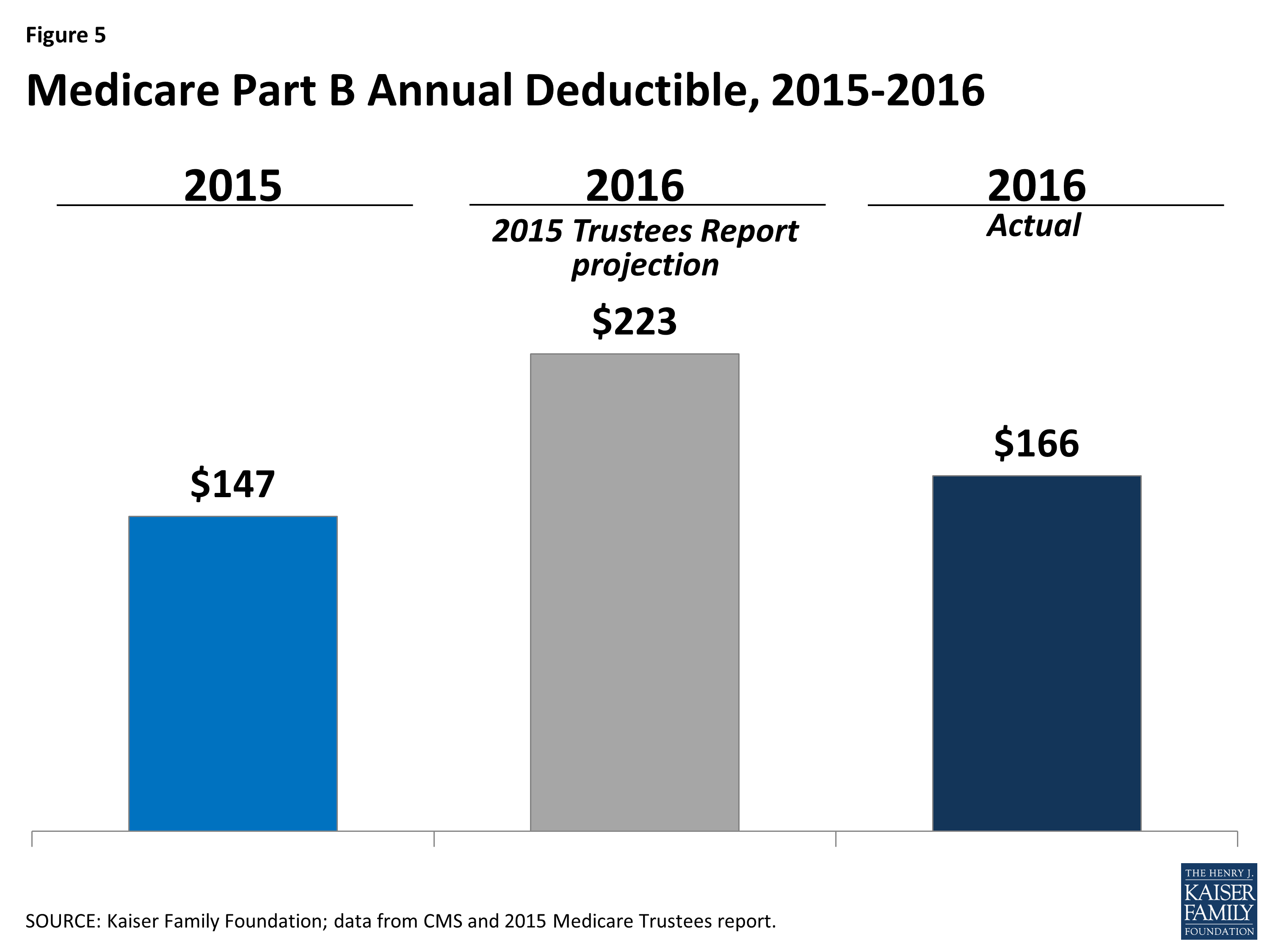

What was the Medicare deductible for 2016?

The 2016 Medicare Part A premium for those who are not eligible for premium free Medicare Part A is $411. The Medicare Part A deductible for all Medicare beneficiaries is $1,288.

What was the Medicare deductible for 2018?

$183 for 2018The Medicare Part B deductible, which covers physician and outpatient services, will remain at $183 for 2018.

What is the deductible for Medicare each year?

The standard monthly premium for Medicare Part B enrollees will be $170.10 for 2022, an increase of $21.60 from $148.50 in 2021. The annual deductible for all Medicare Part B beneficiaries is $233 in 2022, an increase of $30 from the annual deductible of $203 in 2021.

How do I find my Medicare deductible?

You can find out if you've met your Medicare Part A or Part B deductible for the year at MyMedicare.gov.

What was the Medicare deductible for 2019?

(Note: Most Medicare beneficiaries are exempt from paying the Medicare Part A premium since they or their spouse paid into Medicare while working.) The 2019 Part A deductible is $1,364 — $24 more than in 2018.

Are Medicare premiums tax deductible?

You can deduct your Medicare premiums and other medical expenses from your taxes. You can deduct premiums you pay for any part of Medicare, including Medigap. You can only deduct amounts that are more than 7.5 percent of your AGI.

How much is the Medicare Part A deductible for 2022?

$1,556The Medicare Part A deductible for inpatient hospital services will increase by $72 in calendar year 2022, to $1,556, the Centers for Medicare & Medicaid Services announced Friday.

What is the annual Medicare deductible for 2022?

Yes—the deductible is the annual amount you pay for covered services before Medicare starts to pay. The Centers for Medicare & Medicaid Services recently released the 2022 Medicare Part A deductible ($1,556) and Part B deductible ($233).

How much is deducted from Social Security for Medicare?

In 2021, based on the average social security benefit of $1,514, a beneficiary paid around 9.8 percent of their income for the Part B premium. Next year, that figure will increase to 10.6 percent.

Is the Medicare deduction the same for everyone?

Most people will pay the standard premium amount. If your modified adjusted gross income is above a certain amount, you may pay an Income Related Monthly Adjustment Amount (IRMAA). Medicare uses the modified adjusted gross income reported on your IRS tax return from 2 years ago.

At what income level do Medicare premiums increase?

For example, when you apply for Medicare coverage for 2022, the IRS will provide Medicare with your income from your 2020 tax return. You may pay more depending on your income. In 2022, higher premium amounts start when individuals make more than $91,000 per year, and it goes up from there.

What income is used to determine Medicare premiums?

modified adjusted gross incomeMedicare premiums are based on your modified adjusted gross income, or MAGI. That's your total adjusted gross income plus tax-exempt interest, as gleaned from the most recent tax data Social Security has from the IRS.

What is the Medicare premium for 2017?

For the remaining roughly 30 percent of beneficiaries, the standard monthly premium for Medicare Part B will be $134.00 for 2017, a 10 percent increase from the 2016 premium of $121.80. Because of the “hold harmless” provision covering the other 70 percent of beneficiaries, premiums for the remaining 30 percent must cover most of the increase in Medicare costs for 2017 for all beneficiaries. This year, as in the past, the Secretary has exercised her statutory authority to mitigate projected premium increases for these beneficiaries, while continuing to maintain a prudent level of reserves to protect against unexpected costs. The Department of Health and Human Services (HHS) will work with Congress as it explores budget-neutral solutions to challenges created by the “hold harmless” provision.

What is the average Social Security premium for 2017?

Among this group, the average 2017 premium will be about $109.00, compared to $104.90 for the past four years.

What does Medicare Part A cover?

Medicare Part A covers inpatient hospital, skilled nursing facility, and some home health care services. About 99 percent of Medicare beneficiaries do not have a Part A premium since they have at least 40 quarters of Medicare-covered employment.

How much does Medicare Part A cost?

Enrollees age 65 and over who have fewer than 40 quarters of coverage and certain persons with disabilities pay a monthly premium in order to receive coverage under Medicare Part A. Individuals who had at least 30 quarters of coverage or were married to someone with at least 30 quarters of coverage may buy into Part A at a reduced monthly premium rate, which will be $227 in 2017, a $1 increase from 2016. Uninsured aged and certain individuals with disabilities who have exhausted other entitlement and who have less than 30 quarters of coverage will pay the full premium, which will be $413 a month, a $2 increase from 2016.

Is Medicare Part B a hold harmless?

Medicare Part B beneficiaries not subject to the “hold harmless” provision include beneficiaries who do not receive Social Security benefits, those who enroll in Part B for the first time in 2017, those who are directly billed for their Part B premium, those who are dually eligible for Medicaid and have their premium paid by state Medicaid agencies, and those who pay an income-related premium. These groups represent approximately 30 percent of total Part B beneficiaries.

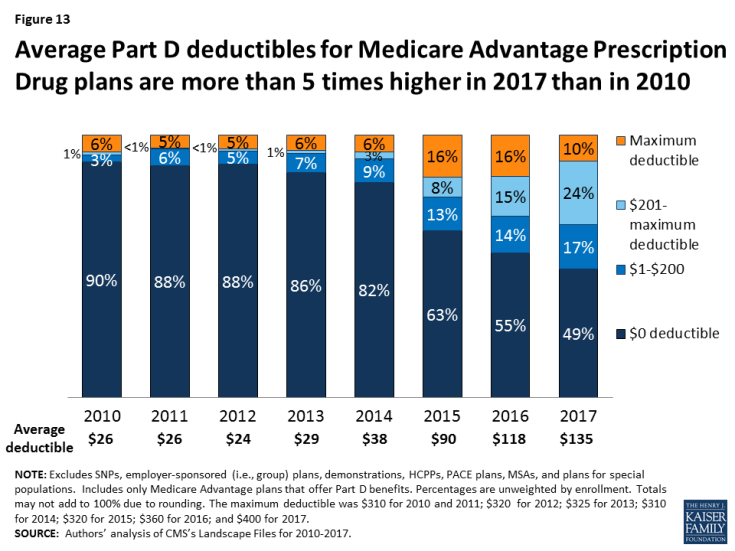

What is Medicare Part D?

Medicare Part D covers outpatient prescription drugs and is solely offered by private insurance companies who contract with Medicare. Each insurer can design plans with varying benefits and costs provided that each plan is determined to be at least as good as the standard benefit design as regulated by Medicare. The average basic premium for Part D plans in 2017 is estimated to be $34 per month, an increase of 4.6 percent from 2016; however, like Part B, individuals are subject to income-related premium adjustments. [iv] The maximum deductible allowed in 2017 for Part D is $400, an 11 percent increase from 2016. [v] Upon reaching the deductible, beneficiaries enter the initial coverage period in which they pay 25 percent of their costs. Once overall costs exceed $3,700, the beneficiary enters the coverage gap, known as the “donut hole”. In the coverage gap, beneficiaries pay 51 percent of drug costs for generics and 40 percent for brand-name drugs. The True Out-of-Pocket (TrOOP) limit for Part D in 2017 is $4,950. Upon reaching this limit, beneficiaries enter catastrophic coverage and have limited cost-sharing for any remaining drug expenses for the year.

Does Medicare require a monthly premium?

Medicare beneficiaries are required to pay monthly premiums and annual deductibles like most individuals enrolled in other health insurance plans. Medicare coverage is separated into four “parts”, each covering different health care products and services. Medicare Part A covers inpatient hospital services, as well as skilled nursing facility stays and some home health care services. Most beneficiaries qualify to receive Part A coverage without paying a monthly premium if they have paid Medicare taxes on their earned income for 10 or more years. There is a deductible, though, of $1,316 in 2017 for inpatient hospital services (compared with $1,288 in 2016), as well as co-payments required for long-term hospital and skilled nursing facility stays. [i]