The Medicare donut hole is a colloquial term that describes a gap in coverage for prescription drugs in Medicare Part D

Medicare Part D

Medicare Part D, also called the Medicare prescription drug benefit, is an optional United States federal-government program to help Medicare beneficiaries pay for self-administered prescription drugs through prescription drug insurance premiums. Part D was originally propo…

Full Answer

Is Medicare Part D Worth It?

Aug 09, 2010 · A number of visitors to www.HealthCare.gov have told us they’d like to know more about the Medicare “donut hole” in the Part D program. If you aren’t familiar with Medicare, it is a health insurance program for people 65 or older, people under 65 with certain disabilities, and people with End-Stage Renal Disease (permanent kidney failure).

What you should know about Medicare Part D?

Oct 01, 2021 · The Medicare donut hole is a coverage gap in Plan D prescription coverage. You enter it after you’ve passed an initial coverage limit. In …

What are the costs for Medicare Part D?

The Medicare donut hole is a colloquial term that describes a gap in coverage for prescription drugs in Medicare Part D.

What is the exact Medicare Part D Donut Hole amount?

The Medicare donut hole is a period of time where you’ve reached the limit of your Medicare Part D coverage, but haven’t hit the “catastrophic coverage” level where Medicare resumes assisting you with your prescription drug coverage.

What is the purpose of the donut hole in Medicare?

Can I avoid the donut hole?

How does the Medicare donut hole work in 2021?

How long do you stay in the donut hole with Medicare?

Is there insurance to cover the donut hole?

Can you use GoodRx If you are on Medicare?

Is Medicare getting rid of the donut hole?

How do you get out of the donut hole?

- Your deductible.

- What you paid during the initial coverage period.

- Almost the full cost of brand-name drugs (including the manufacturer's discount) purchased during the coverage gap.

- Amounts paid by others, including family members, most charities, and other persons on your behalf.

Does Medicare Part D still have a donut hole?

How does the Doughnut hole work?

How does Medicare Part D calculate donut holes?

- Plan deductible.

- Coinsurance/copayments for your medications.

- Any discount you get on brand-name drugs. For example, if your plan gives you a manufacturer's discount of $30 for a medication, that $30 counts toward the Medicare Part D donut hole (coverage gap).

Does the donut hole end at the end of the year?

What is the Medicare donut hole?

Medicare Part D plans can vary based on a person’s choice of plan. Each plan lists the medications that it covers, as well as other medicines for which it may cover a percentage of costs.

What is the donut hole gap in 2020?

In 2011, the government took several actions that started to close the donut hole. These included:

How does it work?

Here is an example of process of how a Medicare user crosses the donut hole and reaches catastrophic coverage in 2020.

How to get out of the donut hole

In 2020, person can get out of the Medicare donut hole by meeting their $6,350 out-of-pocket expense requirement.

Summary

Around 42.5 million people in the U.S. receive prescription drug coverage through Medicare Part D, according to an article in The New England Journal of Medicineem>.

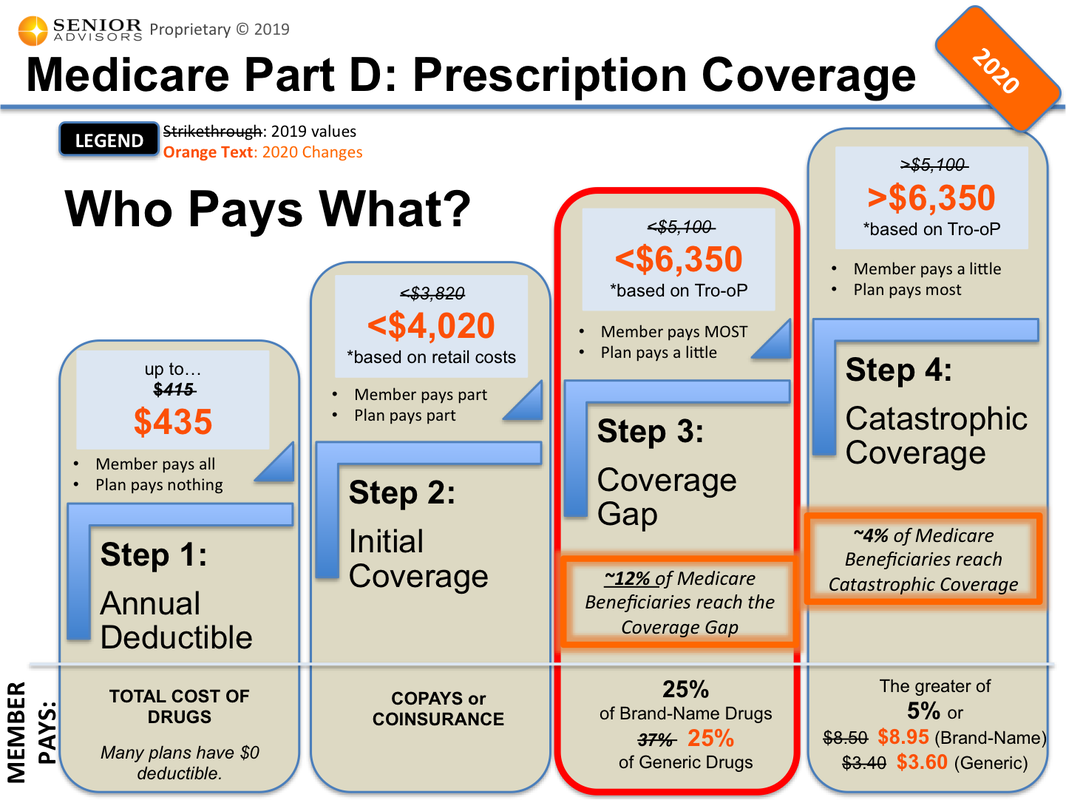

Stage 1 – Deductible

Some prescription drug plans have a yearly deductible, which is the amount you must pay out-of-pocket for your medications before your plan begins to pay its share. Deductibles vary between Medicare drug plans, and not all plans have one, but if your drug plan has a deductible, it cannot be greater than $405 in 2018.

Stage 2 – Initial Coverage

Once you reach the yearly deductible amount, your insurance plan will begin to pay some of the prescription drug costs.

Stage 3 – Coverage Gap (Donut Hole)

How will you know when you reach the donut hole? Your drug plan’s monthly “Explanation of Benefits” (EOB) notice will lay out how much you’ve spent on covered drugs and if you’ve reached the coverage gap.

Stage 4 – Catastrophic Coverage

Once you have reached the coverage gap limit – $5,000 in 2018 – your catastrophic coverage automatically begins. Your plan will begin to contribute more, and you will only pay a small coinsurance or copayment amount for covered drugs for the rest of the year.

What is the Medicare donut hole?

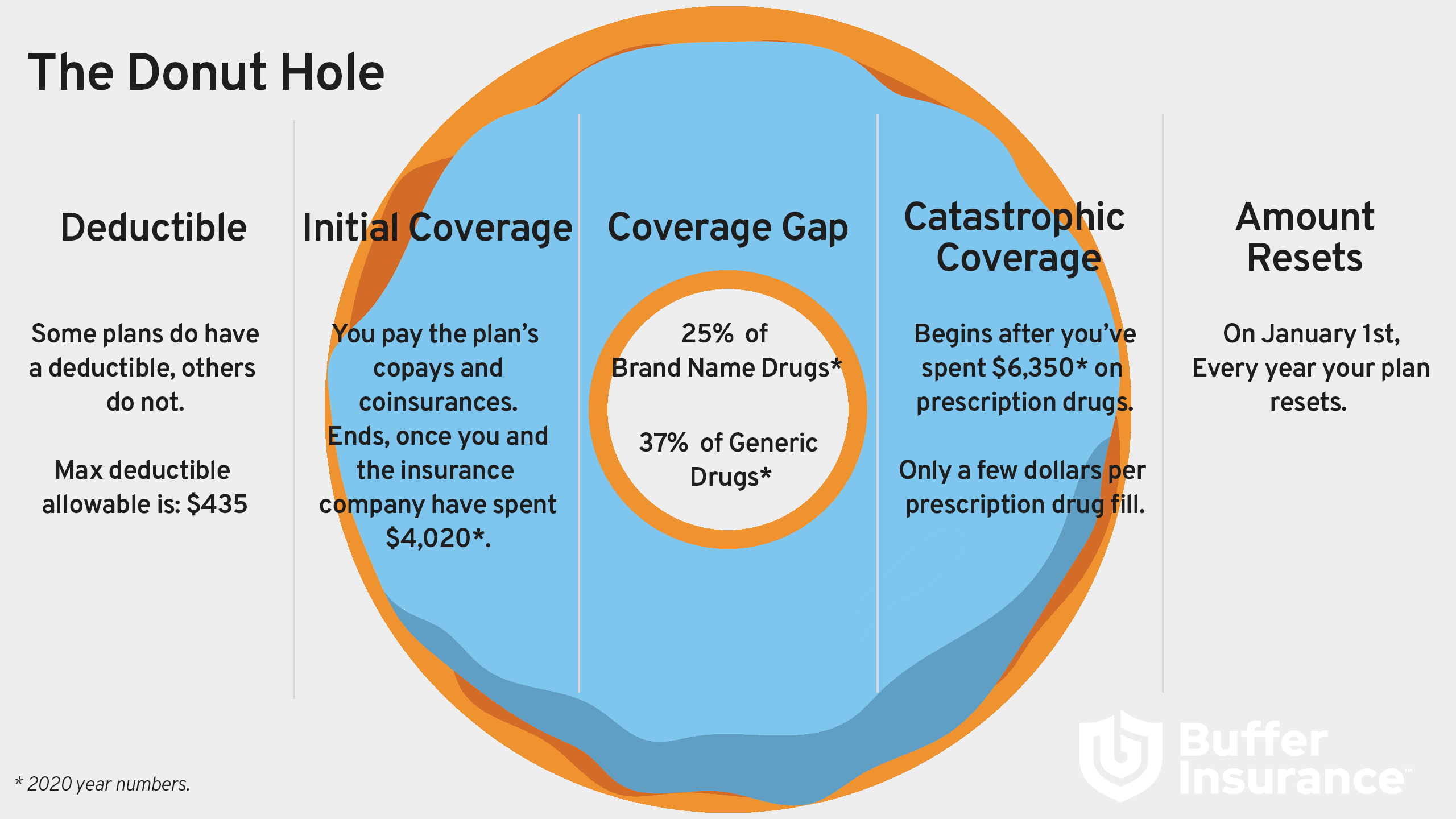

Back to the visual donut image. Picture a donut with a hole in the middle. Maybe it’s an old fashioned style, chocolate glazed, vanilla frosted with sprinkles, apple cider or any other flavor of your choice. Now that we’ve got your attention, let’s continue.

What is the Medicare donut hole for 2021?

The Medicare donut hole for 2021 starts once you hit $4,130 in out-of-pocket prescription drug costs, and it extends to $6,550. If your prescription drug spending reaches $6,550 in 2021, you’ll have catastrophic coverage for the rest of the year.

Did the Medicare donut hole go away in 2020?

No. The Medicare donut hole still exists. However, starting in 2020, instead of being responsible for 37% of the cost of generic prescription drugs and 25% of the cost of brand name prescription drugs while in the donut hole (as was the case in 2019), Medicare beneficiaries only pay 25% for both brand name and generic drugs.

Can I avoid the Medicare donut hole?

The only way to avoid the Medicare donut hole is to prevent your out-of-pocket expenses for prescription drugs from reaching $4,130 in 2021. Once you hit that amount, you enter the Medicare coverage gap.

Do Medicare Advantage plans cover the Medicare donut hole?

Some Medicare Advantage plans may offer extended gap coverage for enrollees in the Medicare donut hole, though you should check with your specific plan for more details.

Phase 1 – annual deductible

Some plans require you to pay a deductible, or 100% of the cost of prescription drugs, up to a certain limit before your plan starts to pay. The deductibles vary between plans and some Part D plans have no deductible. In 2021, the deductible can’t be more than $445. Once you hit your deductible, your initial coverage kicks in.

Phase 2 – initial coverage

During this phase, your copayments and coinsurance come into play. You pay just your share of prescription costs and your plan pays the rest for covered drugs. For example, if your plan has a 25% copayment for a $200 prescription, you would pay $50 and your plan would cover the $150 balance.

Phase 3 – coverage gap

Most Medicare drug plans have a coverage gap (also called the "donut hole"). This means there's a temporary limit on what the drug plan will cover for drugs. Not everyone will enter the coverage gap, and it doesn’t apply to members who get Extra Help to pay for their Part D costs.

Phase 4 – catastrophic coverage

In this last phase of Part D plan coverage, you’ll only pay a small coinsurance amount or copayment for covered drugs for the rest of the year.

Stage 1 – Deductible

- Some prescription drug plans have a yearly deductible, which is the amount you must pay out-of-pocket for your medications before your plan begins to pay its share. Deductibles vary between Medicare drug plans, and not all plans have one, but if your drug plan has a deductible, it cannot be greater than $405 in 2018.

Stage 2 – Initial Coverage

- Once you reach the yearly deductible amount, your insurance plan will begin to pay some of the prescription drug costs. Typically, you’re responsible for copays and coinsurance costs during this stage, but how much you pay depends on your prescription drug plan and whether you qualify for Extra Help (a government program that helps people with limited income cover the costs of pres…

Stage 3 – Coverage Gap

- How will you know when you reach the donut hole? Your drug plan’s monthly “Explanation of Benefits” (EOB) notice will lay out how much you’ve spent on covered drugs and if you’ve reached the coverage gap. If you reach this stage, you’ll typically pay a percentage – for 2018, it’s 35% of the plan’s cost for brand-name drugs and 44% of the plan’s cos...

Stage 4 – Catastrophic Coverage

- Once you have reached the coverage gap limit – $5,000 in 2018 – your catastrophic coverage automatically begins. Your plan will begin to contribute more, and you will only pay a small coinsurance or copayment amount for covered drugs for the rest of the year. These costs will depend on whether you are using generic or brand name drugs, but some plans pay as much as …