Medicare Part D coverage gap

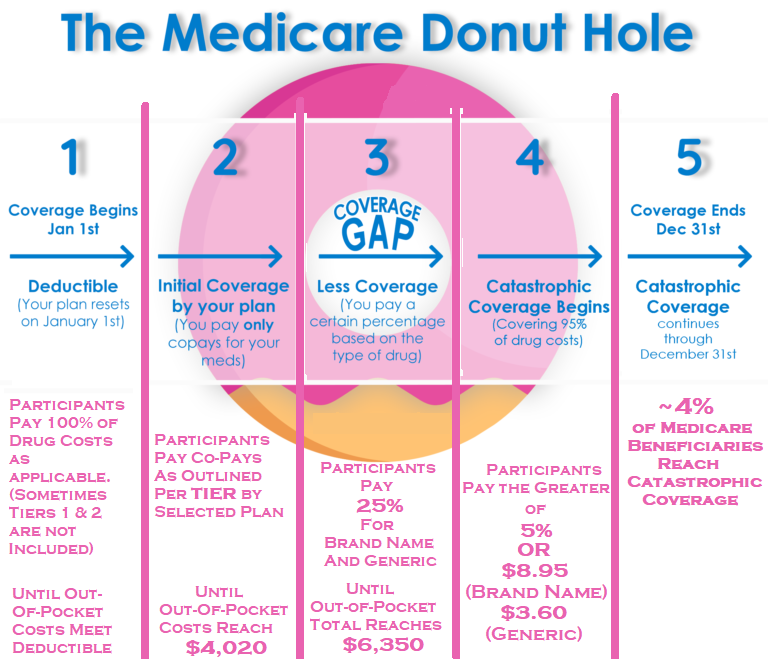

The Medicare Part D coverage gap is a period of consumer payment for prescription medication costs which lies between the initial coverage limit and the catastrophic-coverage threshold, when the consumer is a member of a Medicare Part D prescription-drug program administered by the United States federal government. The gap is reached after shared insurer payment - consumer payment fo…

Full Answer

How big is the Medicare Donut Hole?

Aug 09, 2010 · By 2020, the coverage gap will be closed, meaning there will be no more “donut hole,” and you will only pay 25% of the costs of your drugs until you reach the yearly out-of-pocket spending limit. Throughout this time, you will get continuous Medicare Part D coverage for your prescription drugs as long as you are on a prescription drug plan.

What is the Medicare Part D Donut Hole?

Feb 22, 2021 · What is the Medicare Part D donut hole? The Medicare Part D “donut hole” is a temporary coverage gap in how much a Medicare prescription drug plan will pay for your prescription drug costs. What is the donut hole amount for 2022? The donut hole amount for 2022 is $4,430. Once you and your prescription drug plan have spent this amount on covered …

What is Medicare D coverage gap?

Dec 10, 2019 · In 2020, once both you and your plan reach $4,020 total cost for your covered medications, you'll enter the donut hole. So, for example, if you pay $2 for a generic drug but your plan covers the remaining $8 of the cost, that would …

What is Medicare Part D catastrophic coverage?

Sep 04, 2019 · In 2020, the Initial Coverage Limit or Donut Hole entry point is when your retail drug costs reach $4,020 - in 2019, the Initial Coverage Limit is when retail drug costs reach $3,820. Bottom Line: If the retail cost of your medications is over $335 per month, you will enter the 2020 Donut Hole. A note on using high-cost medications.

What is the Medicare Part D donut hole?

The Medicare Part D “donut hole” is a temporary coverage gap in how much a Medicare prescription drug plan will pay for your prescription drug cost...

What happens in the donut hole coverage gap in 2020?

Once you enter the donut hole in 2020, your Part D plan’s coverage becomes more limited. In 2020, you’ll pay no more than 25 percent of the price f...

What happens when the donut hold goes away in 2020?

Once you reach the $6,350 threshold in 2020, you enter the final phase of Part D coverage. This is called catastrophic coverage. During the catastr...

What is the donut hole?

Once you and your prescription drug plan have spent this amount on covered drugs, you enter the coverage gap called the donut hole. Ever since 2020, Medicare Part D plan beneficiaries pay 25 percent of their brand name and generic drug costs while they’re in this coverage gap, or "donut hole.".

What is the maximum deductible for Medicare 2021?

In 2021, the maximum deductible allowed by law is $445 for the year. Some Medicare prescription drug plans have a $0 deductible. After you meet your plan deductible, you enter the initial coverage period.

Who is Christian Worstell?

Christian Worstell is a licensed insurance agent and a Senior Staff Writer for MedicareAdvantage.com. He is passionate about helping people navigate the complexities of Medicare and understand their coverage options. .. Read full bio

What is extra help?

Extra Help is an assistance program that helps lower the cost of Part D premiums, deductibles, coinsurance and copayments. There is no coverage gap for Medicare beneficiaries who receive Extra Help.

How much will you pay for generic drugs in 2021?

In 2021, you’ll pay no more than 25 percent of the price for brand name drugs and generic drugs while you’re in the donut hole. You remain in this Part D donut hole coverage gap until you have paid $6,550 in out-of-pocket costs for covered drugs in 2021. You then enter the catastrophic coverage phase.

Does Medicare Part D have a deductible?

Some (but not all) Medicare Part D plans have a deductible, which is the amount of money you must spend on covered drugs before your Medicare drug plan coverage kicks in. For example, if you have a Part D plan with a $200 deductible, you’re required to pay the first $200 of costs for covered drugs in a calendar year out of your own pocket.

What is the OOP limit for 2020?

For 2020, the initial coverage limit has increased to $4,020. This is up from $3,820 in 2019.

What is extra help for Medicare?

Individuals that have Medicare drug coverage and have limited income and resources may qualify for Extra Help. This helps to pay for premiums, deductibles, and copayments associated with a Medicare drug plan.

What percentage of medication is considered OOP?

For brand-name drugs, 95 percent of the total medication price will count towards reaching the OOP threshold. This includes the 25 percent that you pay OOP plus a manufacturer discount.

What is the donut hole in Medicare?

The donut hole (also called the coverage gap) is the third out of four Part D phases of coverage, which starts once you and your plan have spent a specified amount on medications. It comes after the first phase (the deductible phase) and the second phase (the initial coverage phase)—you’ll read more on these phases later.

How much is deductible for 2020?

This deductible may be any amount, but no more than $435 in 2020 (up from $415 in 2019). 3 Once you reach the deductible set by your plan, you move on to the next phase of coverage: the initial coverage period.

What is Medicare Part D?

Licensed Insurance Agent and Medicare Expert Writer. December 10, 2019. Medicare Part D is an optional prescription drug program that Medicare beneficiaries may add to their Original Medicare ( Part A, Part B, or both) coverage. Sold by private insurance companies and regulated federally, there are hundreds of stand-alone Part D plans as ...

Is eligibility.com a Medicare provider?

Eligibility.com is a DBA of Clear Link Technologies, LLC and is not affiliated with any Medicare System Providers.

What is phase 3 coverage gap?

Phase 3: Coverage gap, a.k.a. the “donut hole”. By the time you reach the donut hole, your drug costs may not change nearly as much as they would have in previous years. Since the Affordable Care Act took effect in 2010, you pay (at most) 25% of the cost of both brand name drugs and generics.

Is the Donut Hole closed?

In 2020, the donut hole is fully “closed,” meaning that the coverage provided by your drug plan should be as good as the minimum federal requirements during your initial coverage phase. Practically speaking, this means that your coinsurance in the donut hole will be at least this amount (but your plan may cover more):

Can Medicare beneficiaries get extra help?

If a Medicare Beneficiary is under a specified resource level, they may qualify for Extra Help—in which case the donut hole doesn’ t apply. To see if you are eligible for Extra Help, see the Social Security website. Use your plan’s Medication Therapy Management (MTM) program.

What is Medicare Donut Hole?

Summary. The Medicare donut hole is a colloquial term that describes a gap in coverage for prescription drugs in Medicare Part D. For 2020, Medicare are making some changes that help to close the donut hole more than ever before. Medicare Part D is the portion of Medicare that helps a person pay for prescription drugs.

When did the donut hole close?

In 2011, the government took several actions that started to close the donut hole. These included: 2011: The Affordable Care Act required pharmaceutical manufacturers to introduce discounts of up to 50% for brand name drugs and up to 14% for generic drugs, making it easier for people to buy medications once in the donut hole.

What is Medicare Part D?

Medicare Part D is the portion of Medicare that helps a person pay for prescription drugs. A person enrolled in Medicare does not have to choose Medicare Part D. However, they must have some other prescription drug coverage, usually through private- or employer-based insurance. In this article, we define the donut hole and how it applies ...

What is a donut hole?

The term donut hole refers to the way a person needs to pay for coverage. A person pays a specified amount for their prescription drugs, and once they meet this deductible, their plan takes over the funding. However, when the plan has paid up to a specified limit, the person has reached the donut hole.

What is catastrophic coverage?

A person is now in the catastrophic coverage stage of their medication coverage. Their insurance company now requires that they pay either 5% of a drug’s cost or a minimum copay, whichever is higher. Ideally, these changes will allow a person to have long-term access to the medications their doctor prescribes.

What is extra help?

These include: Extra Help: Extra Help is a Medicare program that helps people pay for medications and other aspects of medical care. A person can qualify for Extra Help if their income is $18,735 or less when single or $25,365 or less as a couple.

What is the bipartisan budget act?

2018: The Bipartisan Budget Act sped up changes to prescription drug discounts when a person was in the donut hole. Examples included manufacturer discounts and decreasing a person’s costs on brand name drugs once they enter the donut gap.

How much will Medicare cover in 2021?

Once you and your plan have spent $4,130 on covered drugs in 2021, you're in the coverage gap. This amount may change each year. Also, people with Medicare who get Extra Help paying Part D costs won’t enter the coverage gap.

What is the coverage gap for Medicare?

Most Medicare drug plans have a coverage gap (also called the "donut hole"). This means there's a temporary limit on what the drug plan will cover for drugs. Not everyone will enter the coverage gap. The coverage gap begins after you and your drug plan have spent a certain amount for covered drugs. Once you and your plan have spent $4,130 on ...

What is out of pocket cost?

out-of-pocket costs. Health or prescription drug costs that you must pay on your own because they aren’t covered by Medicare or other insurance. to help you get out of the coverage gap. What you pay and what the manufacturer pays (95% of the cost of the drug) will count toward your out-out-pocket spending.

How much does Medicare pay for generic drugs?

Generic drugs. Medicare will pay 75% of the price for generic drugs during the coverage gap. You'll pay the remaining 25% of the price. The coverage for generic drugs works differently from the discount for brand-name drugs. For generic drugs, only the amount you pay will count toward getting you out of the coverage gap.

What is deductible in Medicare?

deductible. The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. , coinsurance, and copayments. The discount you get on brand-name drugs in the coverage gap. What you pay in the coverage gap.

Does Medicare cover gap?

If you have a Medicare drug plan that already includes coverage in the gap, you may get a discount after your plan's coverage has been applied to the drug's price. The discount for brand-name drugs will apply to the remaining amount that you owe.

What is the Medicare donut hole?

The Medicare donut hole is a coverage gap in Plan D prescription coverage. You enter it after you’ve passed an initial coverage limit. In 2021, you’ll have to pay 25 percent OOP from when you enter the donut hole until you reach the OOP threshold.

What is the donut hole?

The donut hole is a gap in prescription drug coverage during which you may pay more for prescription drugs. You enter the donut hole once Medicare has paid a certain amount toward your prescription drugs in one coverage year. Once you fall into the donut hole, you’ll pay more out of pocket (OOP) for the cost of your prescriptions ...

What is Medicare Part D?

Understanding Medicare Part D. Medicare Part D is an optional plan under Medicare for coverage of prescription drugs. Insurance providers approved by Medicare provide this coverage. Prior to Part D, many people received prescription drug coverage through their employer or a private plan. Some had no coverage.

Is generic drug covered by Medicare?

Both brand-name and generic drugs are covered in Medicare Part D plans. At least two drugs in commonly prescribed drug categories are included on the list of covered medications, which is called a formulary. However, the specific drugs covered in your Part D plan can vary from year to year.

What is extra help for Medicare?

Individuals that have Medicare drug coverage and have limited income and resources may qualify for Extra Help. This helps to pay for premiums, deductibles, and copayments associated with a Medicare drug plan.

What is the initial coverage limit?

The initial coverage limit includes the total (retail) cost of drugs — what both you and your plan pay for your prescriptions.

What percentage of medication is considered OOP?

For brand-name drugs, 95 percent of the total medication price will count towards reaching the OOP threshold. This includes the 25 percent that you pay OOP plus a manufacturer discount.