Full Answer

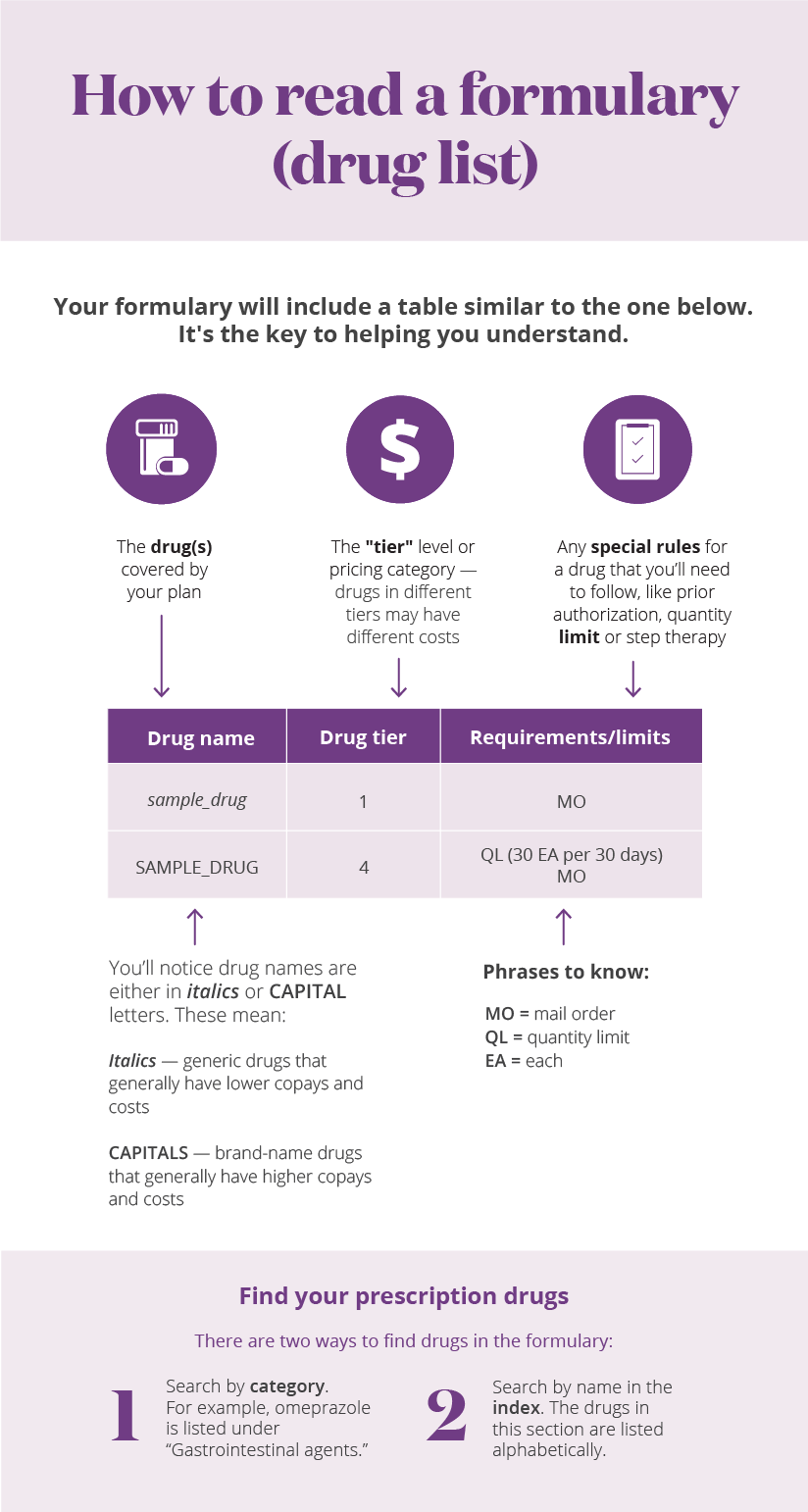

What is a drug quantity limit?

Quantity limits define how much of a drug you can fill during a specific time period, but they can be a hassle. Here’s how to navigate your plan’s policies, so you can still get the medications you need. Generally speaking, plans will review clinical and FDA literature to decide how much of a drug they will cover in a certain time period.

How much prescription medication does a health insurance plan cover?

For safety and cost reasons, plans may limit the amount of prescription drugs they cover over a certain period of time. For example, most people prescribed heartburn medication take 1 tablet per day for 4 weeks. Therefore, a plan may cover only an initial one month supply of the heartburn medication.

Are there any Medicare limits?

There are some limits on Medicare coverage, enrollment, eligibility and more. Here are certain types of Medicare limits every beneficiary should be aware of. As a Medicare beneficiary, you might wonder if there are any limits on your coverage. There are certain limits to what Medicare covers, when you can enroll, the costs you might pay and more.

What does Medicare pay for prescription drugs?

Medicare pays for these drugs if you need them for the hospital outpatient services you're getting. In most cases, you pay 20% of the Medicare-approved amount for covered Part B prescription drugs that you get in a doctor’s office or pharmacy, and the Part B Deductible applies.

What does quantity limit mean for prescriptions?

Page 1. A quantity limit is the highest amount of a prescription drug that can be given to you by your pharmacy in a period of time (for example, 30 tablets per month). Some drugs have quantity limits to help encourage appropriate usage, ensure effectiveness and reduce costs.

What is quantity limits for Part D?

A quantity limit is a restriction used by Part D plans and Medicare Advantage Plans. It limits coverage of a drug to a certain amount over a certain period of time, such as 30 pills per month.

How many drugs must a Part D plan cover?

Part D plans are required to cover all drugs in six so-called “protected” classes: immunosuppressants, antidepressants, antipsychotics, anticonvulsants, antiretrovirals, and antineoplastics.

What are the 4 standardized levels of Medicare prescription drug coverage?

Throughout the year, your prescription drug plan costs may change depending on the coverage stage you are in. If you have a Part D plan, you move through the CMS coverage stages in this order: deductible (if applicable), initial coverage, coverage gap, and catastrophic coverage.

What is quantity of a drug?

Description. The quantity or weight of the drug given as a proportion of the PACK size.

Why are there quantity limits on medications?

Quantity limits are designed to allow a sufficient supply of medication based upon FDA-approved or medically accepted maximum daily doses and length of therapy of a particular drug.

What is the opioid quantity limitation at retail and home delivery pharmacies for Medicare Part D patients?

Seven-day supply limit for opioid naïve patients This alert limits initial opioid fills for Part D patients who haven't filled an opioid prescription recently (like within the past 60 days) to a supply of 7 days or less. This alert shouldn't affect patients who already take opioids.

Which medication would not be covered under Medicare Part D?

Medicare does not cover:Drugs used to treat anorexia, weight loss, or weight gain. ... Fertility drugs.Drugs used for cosmetic purposes or hair growth. ... Drugs that are only for the relief of cold or cough symptoms.Drugs used to treat erectile dysfunction.More items...

Do all Part D plans cover the same drugs?

All plans must cover a wide range of prescription drugs that people with Medicare take, including most drugs in certain protected classes,” like drugs to treat cancer or HIV/AIDS. A plan's list of covered drugs is called a “formulary,” and each plan has its own formulary.

What is the max out-of-pocket for Medicare Part D?

As expected, a $2,000 cap on out-of-pocket spending would generate larger savings than a $3,100 cap. Average out-of-pocket spending was $3,216 among the 1.2 million Part D enrollees with out-of-pocket spending above $2,000 in 2019.

What is the coverage gap for 2021?

For 2021, the coverage gap begins when the total amount your plan has paid for your drugs reaches $4,130 (up from $4,020 in 2020). At that point, you're in the doughnut hole, where you'll now receive a 75% discount on both brand-name and generic drugs.

What is the initial coverage limit Medicare Part D?

$4,430The Initial Coverage Limit (ICL) will go up from $4,130 in 2021 to $4,430 in 2022. This means you can purchase prescriptions worth up to $4,430 before entering what's known as the Medicare Part D Donut Hole, which has historically been a gap in coverage.

How long does Medicare cover ESRD?

If you're entitled to Medicare only because of ESRD, your Medicare coverage ends 36 months after the month of the kidney transplant.

What happens if you get a drug that Part B doesn't cover?

If you get drugs that Part B doesn’t cover in a hospital outpatient setting, you pay 100% for the drugs, unless you have Medicare drug coverage (Part D) or other drug coverage. In that case, what you pay depends on whether your drug plan covers the drug, and whether the hospital is in your plan’s network. Contact your plan to find out ...

What is formulary in insurance?

If you have drug coverage, check your plan's. formulary. A list of prescription drugs covered by a prescription drug plan or another insurance plan offering pre scription drug benefits. Also called a drug list. to see what outpatient drugs it covers. Return to search results.

Does Medicare pay for osteoporosis?

Injectable osteoporosis drugs: Medicare helps pay for an injectable drug if you’re a woman with osteoporosis who meets the criteria for the Medicare home health benefit and has a bone fracture that a doctor certifies was related to post-menopausal osteoporosis.

Does Medicare cover transplant drugs?

Medicare covers transplant drug therapy if Medicare helped pay for your organ transplant. Part D covers transplant drugs that Part B doesn't cover. If you have ESRD and Original Medicare, you may join a Medicare drug plan.

Does Medicare cover infusion pumps?

Drugs used with an item of durable medical equipment (DME) : Medicare covers drugs infused through DME, like an infusion pump or a nebulizer, if the drug used with the pump is reasonable and necessary.

Does Medicare pay for nutrition?

Parenteral and enteral nutrition (intravenous and tube feeding): Medicare helps pay for certain nutrients if you can’t absorb nutrition through your intestinal tract or take food by mouth.

What Medicare plans limit the number of providers you can visit?

Some private Medicare plans such as Medicare Advantage plans and Part D plans may feature provider or pharmacy networks that limit the providers you can visit for covered services.

What is the Medicare Advantage spending limit?

Medicare Advantage (Medicare Part C) plans, however, do feature an annual out-of-pocket spending limit for covered Medicare expenses. While each Medicare Advantage plan carrier is free to set their own out-of-pocket spending limit, by law it must be no greater than $7,550 in 2021. Some plans may set lower maximum out-of-pocket (MOOP) limits.

What is the Medicare donut hole?

Medicare Part D prescription drug plans feature a temporary coverage gap, or “ donut hole .”. During the Part D donut hole, your drug plan limits how much it will pay for your prescription drug costs. Once you and your plan combine to spend $4,130 on covered drugs in 2021, you will enter the donut hole. Once you enter the donut hole in 2021, you ...

How much is Medicare Part A deductible in 2021?

You are responsible for paying your Part A deductible, however. In 2021, the Medicare Part A deductible is $1,484 per benefit period. During days 61-90, you must pay a $371 per day coinsurance cost (in 2021) after you meet your Part A deductible.

What is Medicare Part B and Part D?

Medicare Part B (medical insurance) and Part D have income limits that can affect how much you pay for your monthly Part B and/or Part D premium. Higher income earners pay an additional amount, called an IRMAA, or the Income-Related Monthly Adjusted Amount.

What is Medicare Advantage Plan?

When you enroll in a Medicare Advantage plan, it replaces your Original Medicare coverage and offers the same benefits that you get from Medicare Part A and Part B.

How long does Medicare cover hospital care?

Depending on how long your inpatient stay lasts, there is a limit to how long Medicare Part A will cover your hospital costs. For the first 60 days of ...

Why do insurance companies have quantity limits?

As with other forms of coverage restrictions, insurance plans use quantity limits to ensure patient safety and control healthcare costs. Quantity limits define how much of a drug you can fill during a specific time period, but they can be a hassle. Here’s how to navigate your plan’s policies, so you can still get the medications you need.

How to request an exception for a quantity limit?

To request an exception, ask your doctor to help you submit a quantity limit exception form. Your doctor will need to provide an explanation of your health issue and why the quantity limit would be harmful. You may also need to show that you’ve already tried lower doses of the medication or alternative treatments.

How can I get an emergency prescription refill?

If for whatever reason you need an emergency prescription refill, there are ways that a pharmacist can help handle this. Reasons you might need an emergency refill include:

How much does GoodRx save?

Shop around. GoodRx lists prices of medications at various pharmacies as well as coupons that have helped patients save as much as 80% off the price of their medication.

What is the emergency refill restriction?

These are enforced by insurance companies to make sure you’re taking your medication as directed, and not filling prescriptions too frequently. The restrictions also apply specifically to controlled substances, like opioids, to prevent abuse.

How long does it take for a prescription to be reviewed?

Your plan will usually review your request within 3 days, after which, you’ll hear from your doctor or pharmacist about whether you can fill your prescription. Your doctor may even be able to request an expedited review in cases of health emergencies.

Can you bypass a pharmacy?

Also, unless your pharmacy has a quantity limit on the drug you need, you can bypass trying to get coverage altogether and pay for your medication out of pocket. Here are some tips to save:

How is drug coverage calculated?

Drug coverage: We calculated the drug coverage for each plan in each year by taking the number of drugs covered on that plan as a proportion of the drugs covered on the “best plan.” We deemed the “best plan” the total unique number of drugs covered across all Medicare Part D plans in each year for drugs in the GoodRx database. To summarize, we took the average of all plans’ drug coverage proportions in each year.

What are the ways that Medicare Part D plans can change drug coverage from year to year?

Medicare prescription drug plans can make the following changes to prescription drug coverage:

How will Medicare Part D coverage change in 2022?

In 2022, there are over 5,300 plans, 85% of which are Medicare Advantage plans. However, this doesn’t mean people have all plans available to them . In actuality, an enrollee’s Medicare plan availability will depend on where they live.

What is the definition of drug coverage in 2021?

We defined drug coverage as the share of drugs covered by a plan relative to the best plan in each year. We found that the average plan in both years covered a similar share of drugs (56% and about 55%, respectively).

When will Medicare stop offering insulin?

In 2022 , Medicare will continue to offer beneficiaries some enhanced alternative prescription drug plan options that offer lower out-of-pocket costs for insulin. The enhanced plans will cap what a beneficiary pays for a month’s supply of a broad set of insulins at $35. This program will be in effect until the end of 2025.

When will Medicare start reevauling?

However, it is good practice to reevaluate the prescription drug plan that you’re in for 2022, especially before the end of open enrollment on December 7, 2021. Remember that individual plans can make substantial changes to their drug coverage.

How much insulin will Medicare pay in 2022?

Medicare will continue to offer enhanced Part D plans that cap certain insulin drugs at $35 for a month’s supply in 2022.

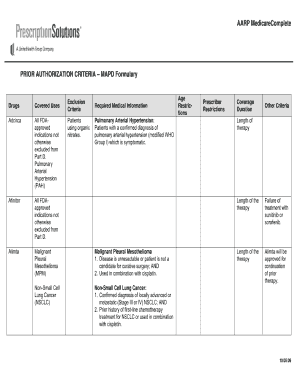

What is a formulary exception?

A formulary exception should be requested to obtain a Part D drug that is not included on a plan sponsor's formulary, or to request to have a utilization management requirement waived ( e.g., step therapy, prior authorization, quantity limit) for a formulary drug.

Can a prescriber submit a supporting statement to a plan sponsor?

A prescriber may submit his or her supporting statement to the plan sponsor verbally or in writing. If submitted verbally, the plan sponsor may require the prescriber to follow-up in writing.