What is the Fed/med EE withholding on my paycheck?

Some paychecks will have the Fed/Med EE withholding listed under other names, such as: 1 Federal EE – Medicare 2 Medicare Tax 3 Medicare 4 FICA Medicare 5 Medicare 1.45%

What is the Medicare tax withholding on my paycheck?

So, if you are an employee working for somebody who pays you a regular paycheck, you will see a 1.45 percent withholding on each paycheck. The Medicare tax is collected from your wages if you work full time, part time or even just temporarily. Even self-employed people pay the Medicare tax.

What is the Medicare/employer-employee tax?

This stands for Federal Medicare/Employer-Employee and is a tax that funds the Medicare Health Insurance program. This tax is a part of FICA, the Federal Insurance Contributions Act, which consists of both Medicare and Social Security Tax.

What does EE stand for on a paycheck?

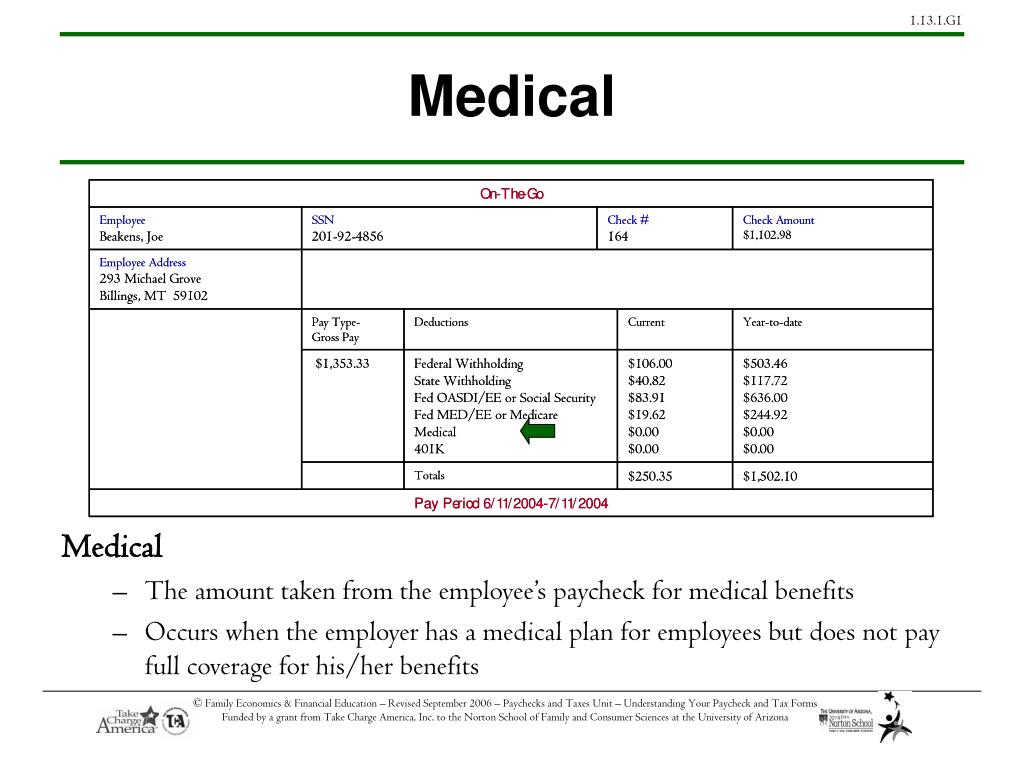

How EE Might Appear on Your Pay Stub EE is a standard code for the employee's share of certain Federal taxes. For instance, "FICA/EE," meaning the amount deducted from your paycheck for Social Security. The deduction for Medicare is coded "Fed MED/EE."

What is Medicare EE withholding?

Fed MED/EE stands for Federal Medicare/Employer-Employee, which is a tax that funds the Medicare Health Insurance program. Every American taxpayer is required to pay the Medicare tax, unless they offer a qualified exception.

Why am I getting Medicare tax taken out of my paycheck?

If you see a Medicare deduction on your paycheck, it means that your employer is fulfilling its payroll responsibilities. This Medicare Hospital Insurance tax is a required payroll deduction and provides health care to seniors and people with disabilities.

How much Medicare tax should be withheld from my paycheck?

The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total.

What does EE mean on paycheck?

MED/EE is the employee's (EE) Medicare withholding; Fed OASDI/EE is the employee's. (EE) social security withholding. Taxes. Provides a breakdown and Description of each type of tax withheld from the paycheck.

Should Medicare be taken out of paycheck?

The Social Security and Medicare programs are in place to help with your income and insurance needs once you reach retirement age. If you're on your employer's insurance plan, this deduction may come out of your paycheck to cover your medical, dental and life insurance premiums.

Do you get back Medicare tax withheld?

If your employer has withheld Social Security or Medicare taxes in error, follow these steps: Request a refund from your employer. You must first request a refund of these taxes from your employer. If your employer is able to refund these taxes, no further action is necessary.

Can I opt out of paying Medicare tax?

The problem is that you can't opt out of Medicare Part A and continue to receive Social Security retirement benefits. In fact, if you are already receiving Social Security retirement benefits, you'll have to pay back all the benefits you've received so far in order to opt out of Medicare Part A coverage.

Why do I owe additional Medicare tax?

An individual will owe Additional Medicare Tax on wages, compensation and self-employment income (and that of the individual's spouse if married filing jointly) that exceed the applicable threshold for the individual's filing status.

Does everyone have to pay Medicare tax?

If you work as an employee in the United States, you must pay social security and Medicare taxes in most cases. Your payments of these taxes contribute to your coverage under the U.S. social security system. Your employer deducts these taxes from each wage payment.

Why is there additional Medicare tax?

The Additional Medicare Tax helps to fund some elements of the Affordable Care Act. This includes the premium tax credit and other features. Notably, the Affordable Care Act provided some additional benefits to Medicare enrollees, including: lower premiums for Medicare Advantage (Part C) plans.

What is EE account?

The My EE app helps you stay in control of your pay monthly, pay as you go or 4GEE WiFi plans. It provides useful info and tools to manage your account, including usage breakdowns and FAQs. It's also somewhere you can buy add-ons like packs for calling abroad.

What does EE mean in payroll?

What "EE Clearing" Stands For. "EE Clearing" is a non-standard code in payroll accounting, but in all likelihood it stands for the employee clearing account your employer uses to process the funds for your paycheck. Clearing accounts are used in a number of other ways in business accounting, so there's a lesser chance the code on your check refers ...

What is EE in taxes?

EE is a standard code for the employee's share of certain Federal taxes. For instance, "FICA/EE," meaning the amount deducted from your paycheck for Social Security. The deduction for Medicare is coded "Fed MED/EE.".

What is the code on a paycheck stub?

Typical of these is the code "EE," which may appear in multiple places on your pay stub.

What does it mean when there is no balance on payroll checks?

This makes it very easy to track whether and if all payroll checks for a period have been cashed; if there isn't a zero balance at a certain point, it means a check has been lost or there is some other payroll discrepancy.

What does EE stand for in Fed Med?

Fed Med EE: What is EE? "EE" is a two-letter abbreviation for a single word: "employee.". The abbreviation is usually used only in payroll accounting. The "e" at the end of "employee" is added to the "e" at the front to eliminate confusion as to other things that "e" could stand for, notably "expense.". So when you see EE on your pay stub, it's ...

What is an employee clearing account?

An employee clearing account is a separate bank account that's just used for payroll funds. The money for each paycheck is deposited into the account and recorded as an asset on the employer's books. Then, as each employee cashes his check, the amount is debited from the account.

What does Medicare pay for?

Medicare Tax, or Fed Med/EE on your paycheck, pays for the Medicare Insurance Program to fund the medical needs of those over 65 years old, as well as certain individuals with disabilities or preexisting conditions.

How to contact IRS about Fed Med EE?

If there are still concerns after trying to resolve this issue with your company, you can reach out to an IRS agent at 1-800-829-1040.

How much Medicare tax is required for $300000?

Keep in mind, the Additional Medicare Tax is only applied to income that surpasses $200,000. If an employee makes $300,000 in a year, they will have to pay 1.45% in Medicare tax on the first $200,000 and 2.35% on the last $100,000. “Another result of ACA reforms is the Net Investment Income Tax (NIIT).

How much Medicare tax do you pay on W2?

If you are under contract as a W2 employee, your employer should be paying for half of your Medicare tax. As stated above, Medicare tax is 2.9% of your income, but as an employed individual, you only have to pay 1.45%, and your employer is responsible for paying the other 1.45%.

What is Fed Med EE?

What is Fed Med/EE Tax? One withholding employees see listed on their earnings statements is the Fed MED/EE Tax. This stands for Federal Medicare/Employer-Employee and is a tax that funds the Medicare Health Insurance program. This tax is a part of FICA, the Federal Insurance Contributions Act, which consists of both Medicare ...

What is FICA EE?

FICA EE is a common misnomer for the income tax, FICA. FICA stands for Federal Insurance Contributions Act, which is a total of 7.65% of your income. It is made up of both FED/Med EE (Medicare, 1.45%) and Fed OASDI/EE (Social Security, 6.2%) taxes. You typically will not see the term FICA listed out on your paycheck or pay statements since ...

What percentage of the tax is self employed?

Self-employed individuals who pay both the employer’s and employee’s share of the tax can list the employer’s 1.45 percent portion of the tax as a business expense on their company’s income tax, but not the employee’s 1.45 percent portion on their personal tax forms. Employers can find the guidelines on Fed MED/EE tax calculations at ...

What is the tax rate for Social Security?

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total. Refer to Publication 15, (Circular E), Employer's Tax Guide for more information; or Publication 51, (Circular A), Agricultural Employer’s Tax Guide for agricultural employers. Refer to Notice 2020-65 PDF and Notice 2021-11 PDF for information allowing employers to defer withholding and payment of the employee's share of Social Security taxes of certain employees.

What is the FICA 751?

Topic No. 751 Social Security and Medicare Withholding Rates. Taxes under the Federal Insurance Contributions Act (FICA) are composed of the old-age, survivors, and disability insurance taxes, also known as social security taxes, and the hospital insurance tax, also known as Medicare taxes. Different rates apply for these taxes.

How much of your paycheck is Medicare taxed?

Employers, though, are required to withhold 1.45 percent of each paycheck. While you are responsible for paying the tax, your employer is responsible for making sure the correct amount is withheld and paid. Unlike federal income taxes, you do not need to file a tax return for the Medicare tax.

How much Medicare tax do self employed people pay?

Self-employed workers must calculate and pay the full 2.9 percent Medicare tax. Technically speaking, a self-employed person is both employer and employee, so the self-employed person must pay the employee's 1.45 percent and the employer's 1.45 percent.

What is the Medicare tax rate for C corp?

The Medicare tax is collected on all wages earned in the United States, with only a few rare exceptions. The Medicare tax is 2.9 percent of all wages.

What is the purpose of Medicare tax?

The purpose of the Medicare tax is to provide funding for the U.S. Medicare health insurance program. Medicare is a form of health insurance for people age 65 and older (and also for people under age 65 with certain disabilities) and provides for all kinds of medical care, including hospital visits and treatment, as well as prescription medications.

How much tax do you have to pay on a paycheck?

Employers are required to withhold 1.45 percent of each paycheck. In addition to that withholding, employers are required to pay an additional 1.45 percent from their own pocket for a total tax of 2.9 percent.

Can self employed claim Medicare?

The good news, though, is that self-employed people can claim an income tax deduction for half of all Medicare taxes paid , so the cost of the tax is minimized at least a little. Self-employed people report their Medicare tax by filing IRS Schedule SE.

Do college students pay payroll taxes?

First, college students working for the college they currently attend are exempt from payroll taxes. Second, certain religious people are exempt from payroll taxes if both the employer and employee belong to a religion that, for spiritual reasons, opposes insurance.