What is a Medicare Employer Identification Number (EIN)?

Dec 01, 2021 · EIN. A federal government website managed and paid for by the U.S. Centers for Medicare & Medicaid Services. 7500 Security Boulevard, Baltimore, MD 21244.

What is an EIN number for Florida businesses?

You must have a provider or supplier Employer Identification Number (EIN) to enroll in Medicare. An EIN is the same as the provider or supplier organization’s IRS-issued Taxpayer Identification Number (TIN). Sole Proprietorships and Disregarded Entities.

How do I apply for an EIN number?

2022 Medicare Advantage Plan Overview Florida September 2021 ... –Participation is based on your tax ID number (TIN) –Participation shown in My Practice Profile includes all service locations for your TIN ... Medicare National Network may seek care from any contracted, participating health care professional. ...

How do I Find my Medicare provider identification number?

Wellcare Health Plans, Inc. is a corporation in Tampa, Florida. The employer identification number (EIN) for Wellcare Health Plans, Inc. is 470937650. EIN for organizations is sometimes also referred to as taxpayer identification number or TIN or simply IRS Number. It is one of the corporates which submit 10-K filings with the SEC.

What is Medicare enrollment?

The Medicare Enrollment Application Eligible Ordering, Certifying, and Prescribing Physicians and Other Eligible Professionals (Physicians, including dentists and other eligible NPPs), use to enroll to order items or certify Medicare patient services. This includes those physicians and other eligible NPPs who don't and won't send furnished patient services claims to a MAC.

How to change Medicare enrollment after getting an NPI?

Before applying, be sure you have the necessary enrollment information. Complete the actions using PECOS or the paper enrollment form.

What is a TIN number?

Tax Identification Number (TIN) of the provider or supplier organization. Federal, state, and local (city or county) business and professional licenses, certificates, and registrations specifically required to operate as a health care facility. A Medicare-imposed revocation of Medicare billing privileges.

How much is the Medicare application fee for 2021?

Application Fee Amount. The enrollment application fee sent January 1, 2021, through December 31, 2021, is $599. For more information, refer to the Medicare Application Fee webpage. How to Pay the Application Fee ⤵. Whether you apply for Medicare enrollment online or use the paper application, you must pay the application fee online:

What is Medicare revocation?

A Medicare-imposed revocation of Medicare billing privileges. A suspension, termination, or revocation of a license to provide health care by a state licensing authority or the Medicaid Program. A conviction of a federal or state felony within the 10 years preceding enrollment, revalidation, or re-enrollment.

How long does it take to become a Medicare provider?

You’ve 90 days after your initial enrollment approval letter is sent to decide if you want to be a participating provider or supplier.

Does Medicare require EFT?

If enrolling in Medicare, revalidating, or making certain changes to their enrollment, CMS requires E FT. The most efficient way to enroll in EFT is to complete the PECOS EFT information section. When submitting a PECOS web application:

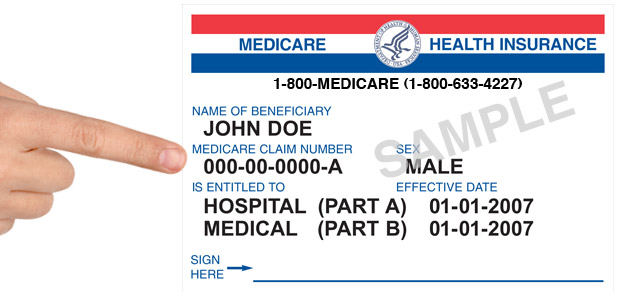

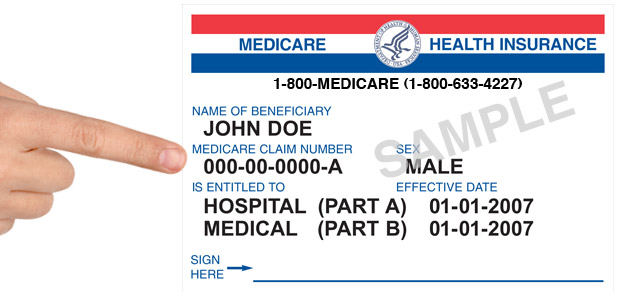

How long does it take for Medicare to arrive in the mail?

After your replacement request, the card typically arrives in the mail in about 30 days, at no cost to the beneficiary. Social Security will mail your Medicare card to the address they have on file for you, so it is important to keep your information with them up to date.

What is a B1 beneficiary?

B1 is for a husband of a primary beneficiary at age 62 or over. B2 is for a young wife with a child in her care, B3 is for an aged wife over the age of 62 who is a second claimant. B5 is also a second claimant wife, but they are under the age of 62 and have a child in their care.

What happens if you lose your Medicare card?

If you lose your Medicare card with your number on it, you can request that the Social Security Administration replace your card at no charge. The Medicare Beneficiary Identifier is for claims, billing and identification purposes.

What is the difference between E1 and E4?

The letter “E” code is for a widowed mother, while E1 is a surviving divorced mother. E4 is a widowed father, and E5 is a surviving divorced father. The letter “F” codes are for parents. A “T” code is for those who are enrolled in Medicare but are being temporarily delayed their Social Security Benefits or are uninsured.

What does B6 mean?

B6 represents a divorced wife over the age of 62. BY is for a young husband with a child in his care. Additionally, Codes C1-C9 represent children who may be minors, students, or disabled. The letter “D” follows for aged widows over the age of 60 or a surviving divorced wife over the age of 60.

What is a qualified income trust?

A Qualified Income Trust (or Miller Trust) is a tool used in Medicaid planning which helps individuals who would otherwise exceed Medicaid’s income limits qualify for Medicaid long-term care benefits.

What is a Miller Trust?

A Miller Trust / QIT does absolutely nothing to help someone who has assets above Florida's medicaid asset limits (for that we utilize other Medicaid planning strategies), rather an income trust is only for those whose income exceeds applicable thresholds.

Fictitious Name EIN Lookup

If you have the company's name, the company's fictitious name, or its DBA, you can search for its EIN on the Division of Corporations website. You can also do the search if the only information you have is the name of a company officer or the company's owner. The website search function has extra options to help you identify a company and its EIN.

Online EIN Search

From the homepage of the Florida Division of Corporations website, navigate to "Search Records" at the top of the page. This page gives you options for ways to locate the data you need about all of the companies registered to do business in Florida:

Purpose of the EIN

This identification number is used to ID businesses and taxpayers for the purpose of filing business tax returns. If if the business gets sold or ownership is transferred, it's necessary to apply for a new EIN.

When It's Required for a Business

There are several situations where a business must file for a tax identification number. It's required if the business:

Ways to Apply

You can call the IRS to apply for your EIN. The number is 800-829-4933, and the hours you're permitted to call are between 7 a.m. and 7 p.m. Monday through Friday. Calling is the fastest way to get your EIN. You can also fax in form SS-4 to 859-669-5760. You need to provide a return fax number, though.