What percentage of your paycheck is Medicare?

Jan 11, 2022 · The current Social Security tax is 12.4% with employees and employers each paying 6.2%. Today, the Medicaretax rate is 2.9%. Employers and employees split that cost with each paying 1.45%. Unlike with Social Security taxes, there is no limit on the income subject to Medicare taxes.

What is the maximum payroll deduction for Medicare?

Mar 25, 2021 · Medicare tax is a federal employment tax that funds a portion of the Medicare insurance program.

Do employers match additional Medicare tax?

Dec 20, 2021 · Medicare tax, also known as “hospital insurance tax,” is a federal employment tax that funds a portion of the Medicare insurance program. Like Social Security tax, Medicare tax is withheld from an employee’s paycheck or paid as a self-employment tax.

What is the current Medicare tax rate?

Apr 02, 2020 · The Medicare tax is an automatic payroll deduction that your employer collects from every paycheck you receive. The tax is applied to regular earnings, tips, and bonuses. The tax is collected from all employees regardless of their age.

What is the Medicare tax on my paycheck?

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total.

Why do I pay Medicare employee tax?

The Medicare tax is a payroll tax that applies to all earned income and supports your health coverage when you become eligible for Medicare.Feb 18, 2022

Do I have Medicare if I pay Medicare tax?

According to the Internal Revenue Service (IRS), taxes withheld from your pay help pay for Medicare and Social Security benefits. If you're self-employed, you generally still need to pay Medicare and Social Security taxes. Payroll taxes cover most of the Medicare program's costs, according to Social Security.

Who is exempt from paying Medicare tax?

The Code grants an exemption from Social Security and Medicare taxes to nonimmigrant scholars, teachers, researchers, and trainees (including medical interns), physicians, au pairs, summer camp workers, and other non-students temporarily present in the United States in J-1, Q-1 or Q-2 status.Sep 30, 2021

Is the Medicare tax mandatory?

Generally, if you are employed in the United States, you are required to pay the Medicare tax regardless of your or your employer’s citizenship. Th...

Are tips subject to Additional Medicare Tax?

Tips are subject to Additional Medicare Tax in certain situations. If the amount of tips, when combined with other wages, exceeds the minimum thres...

Is there a wage base limit for Medicare tax?

The wage base limit is the maximum wage that’s subject to the tax for that year. There is no wage base limit for Medicare tax. All your covered wag...

What is Medicare tax?

Medicare tax, also known as “hospital insurance tax,” is a federal employment tax that funds a portion of the Medicare insurance program. Like Social Security tax, Medicare tax is withheld from an employee’s paycheck or paid as a self-employment tax. 1.

What is the Medicare tax rate for a person earning $225,000 a year?

However, the additional 0.9% only applies to the income above the taxpayer’s threshold limit. 8 For example, if you earn $225,000 a year, the first $200,000 is subject to Medicare tax of 1.45% and the remaining $25,000 is subject to additional Medicare tax of 0.9%.

How much does a W-2 pay?

W-2 employees pay 1.45% and their employer covers the remaining 1.45%. Self-employed individuals, as they are considered both an employee and an employer, must pay the full 2.9%. Unlike Social Security tax, there is no income limit to which Medicare tax is applied. 7. An individual’s Medicare wages are subject to Medicare tax.

Where are Medicare and Social Security taxes put?

Medicare taxes and Social Security taxes are put into trust funds held by the U.S. Treasury . Medicare tax is kept in the Hospital Insurance Trust Fund and is used to pay for Medicare Part A. Costs of Medicare Part B (medical insurance) and Medicare Part D (prescription drug coverage) are covered by the Supplemental Medical Insurance Trust Fund, ...

Is Medicare income taxable?

An individual’s Medicare wages are subject to Medicare tax. This generally includes earned income such as wages, tips, vacation allowances, bonuses, commissions, and other taxable benefits up to $200,000.

Do employers have to pay Medicare taxes?

Under the Federal Insurance Contributions Act (FICA ), employers are required to withhold Medicare tax and Social Security tax from employees’ paychecks. Likewise, the Self-Employed Contributions Act (SECA) mandates that self-employed workers pay Medicare tax and Social Security tax as part of their self-employment tax. 1. ...

Who is Kathryn Flynn?

Medicare Tax. Kathryn Flynn is a personal finance writer and editor with special expertise in 529 plans, student loans, budgeting, investing, tax planning, and insurance.

What does Medicare tax withheld mean?

Medicare tax, also known as “hospital insurance tax,” is a federal employment tax that funds a portion of the Medicare insurance program. Like Social Security tax, Medicare tax is withheld from an employee’s paycheck or paid as a self-employment tax. 1.

Do you get back Medicare tax withheld?

If your withholding is more than the tax you owe, then you can claim a refund for the difference. If you owe more than you had withheld, then you’ll have to pay the difference when you file your return. Employees pay 6.2% of their wages in Social Security taxes and 1.45% in Medicare taxes.

Do I have to pay Medicare tax?

Generally, all employees who work in the U.S. must pay the Medicare tax, regardless of the citizenship or residency status of the employee or employer.

What is the withholding rate for Medicare?

The employee tax rate for Medicare is 1.45% — and the employer tax rate is also 1.45%. So, the total Medicare tax rate percentage is 2.9%. Only the employee portion of Medicare taxes is withheld from your paycheck. There’s no wage-based limit for Medicare tax.

Is Medicare tax based on gross income?

It is calculated as the employee’s gross earnings less the non-taxable items, without any maximum on gross wages. Employers are required to withhold 1.45% of employee’s Medicare wages as Medicare tax and submit a matching amount to cover the costs of the Medicare program.

Who is exempt from paying Medicare taxes?

Thus, to summarize, both the Internal Revenue Code and the Social Security Act allow an exemption from Social Security/Medicare taxes to alien students, scholars, teachers, researchers, trainees, physicians, au pairs, summer camp workers, and other nonimmigrants who have entered the United States on F-1, J-1, M-1, Q-1,

Why do I have to pay Medicare tax if I have health insurance?

As part of your overall payroll taxes, the federal government requires employers to collect the FICA (Federal Insurance Contributions Act) tax. Social Security taxes fund Social Security benefits and the Medicare tax goes to pay for the Medicare Hospital Insurance (HI) that you’ll get when you’re a senior.

What percentage of your income is taxable for Medicare?

The current tax rate for Medicare, which is subject to change, is 1.45 percent of your gross taxable income.

What is the Social Security tax rate?

The Social Security rate is 6.2 percent, up to an income limit of $137,000 and the Medicare rate is 1.45 percent, regardless of the amount of income earned. Your employer pays a matching FICA tax. This means that the total FICA paid on your earnings is 12.4 percent for Social Security, up to the earnings limit of $137,000 ...

What is the FICA tax?

Currently, the FICA tax is 7.65 percent of your gross taxable income for both the employee and the employer.

Is Medicare payroll tax deductible?

If you are retired and still working part-time, the Medicare payroll tax will still be deducted from your gross pay. Unlike the Social Security tax which currently stops being a deduction after a person earns $137,000, there is no income limit for the Medicare payroll tax.

The Basics of Medicare Tax

The Medicare tax is generally withheld from your paycheck as part of your FICA taxes — what are usually called “payroll taxes.” FICA stands for Federal Insurance Contributions Act. FICA taxes include money taken out to pay for older Americans’ Social Security and Medicare benefits.

Why Do You Have to Pay a Medicare Tax?

The Medicare tax helps fund the Hospital Insurance (HI) Trust Fund. It’s one of two trust funds that pay for Medicare.

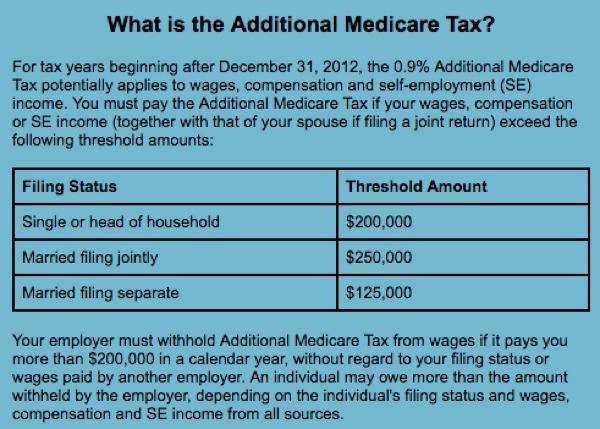

Additional Medicare Tax

The Affordable Care Act added an extra Medicare surtax for people with higher incomes starting in January 2013.

Medicare Tax for Self-Employed Workers

If you are self-employed, you are responsible for the entire 2.9 percent share of your earned income for the Medicare tax. This is covered through a self-employment (SE) tax. The self-employment tax covers your entire 15.3 percent of FICA taxes, paying your share of Social Security and Medicare taxes.

What is the tax rate for Social Security?

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total. Refer to Publication 15, (Circular E), Employer's Tax Guide for more information; or Publication 51, (Circular A), Agricultural Employer’s Tax Guide for agricultural employers. Refer to Notice 2020-65 PDF and Notice 2021-11 PDF for information allowing employers to defer withholding and payment of the employee's share of Social Security taxes of certain employees.

What is the FICA 751?

Topic No. 751 Social Security and Medicare Withholding Rates. Taxes under the Federal Insurance Contributions Act (FICA) are composed of the old-age, survivors, and disability insurance taxes, also known as social security taxes, and the hospital insurance tax, also known as Medicare taxes. Different rates apply for these taxes.

What is the wage base limit for 2021?

The wage base limit is the maximum wage that's subject to the tax for that year. For earnings in 2021, this base is $142,800. Refer to "What's New" in Publication 15 for the current wage limit for social security wages; or Publication 51 for agricultural employers. There's no wage base limit for Medicare tax.

When is Medicare tax withheld?

Beginning January 1, 2013, employers are responsible for withholding the 0.9% Additional Medicare Tax on an employee's wages and compensation that exceeds a threshold amount based on the employee's filing status. You are required to begin withholding Additional Medicare Tax in the pay period in which it pays wages and compensation in excess of the threshold amount to an employee. There is no employer match for the Additional Medicare Tax.

What is self employment tax?

Self-Employment Tax. Self-Employment Tax (SE tax) is a social security and Medicare tax primarily for individuals who work for themselves. It is similar to the social security and Medicare taxes withheld from the pay of most employees.

What is the wage base limit for Social Security?

See requirements for depositing. The social security wage base limit is $137,700 for 2020 and $142,800 for 2021. The employee tax rate for social security is 6.2% for both years.

Do employers have to file W-2?

Employers must deposit and report employment taxes. See the Employment Tax Due Dates page for specific forms and due dates. At the end of the year, you must prepare and file Form W-2, Wage and Tax Statement to report wages, tips and other compensation paid to an employee.

Do you pay federal unemployment tax?

You pay FUTA tax only from your own funds. Employees do not pay this tax or have it withheld from their pay.

How much Medicare tax do self employed pay?

Medicare taxes for the self-employed. Even if you are self-employed, the 2.9% Medicare tax applies. Typically, people who are self-employed pay a self-employment tax of 15.3% total – which includes the 2.9% Medicare tax – on the first $142,800 of net income in 2021. 2. The self-employed tax consists of two parts:

What is Medicare Part A?

Medicare Part A premiums from people who are not eligible for premium-free Part A. The Hospital Insurance Trust Fund pays for Medicare Part A benefits and Medicare Program administration costs. It also pays for Medicare administration costs and fighting Medicare fraud and abuse.

What is the Medicare tax rate for 2021?

Together, these two income taxes are known as the Federal Insurance Contributions Act (FICA) tax. The 2021 Medicare tax rate is 2.9%. Typically, you’re responsible for paying half of this total Medicare tax amount (1.45%) and your employer is responsible for the other 1.45%.

How is Medicare financed?

1-800-557-6059 | TTY 711, 24/7. Medicare is financed through two trust fund accounts held by the United States Treasury: Hospital Insurance Trust Fund. Supplementary Insurance Trust Fund. The funds in these trusts can only be used for Medicare.

How is the Hospital Insurance Trust funded?

The Hospital Insurance Trust is largely funded by Medicare taxes paid by employees and employers , but is also funded by: The Hospital Insurance Trust Fund pays for Medicare Part A benefits and Medicare Program administration costs. It also pays for Medicare administration costs and fighting Medicare fraud and abuse.

When was the Affordable Care Act passed?

The Affordable Care Act (ACA) was passed in 2010 to help make health insurance available to more Americans. To aid in this effort, the ACA added an additional Medicare tax for high income earners.

Who is Christian Worstell?

Christian Worstell is a licensed insurance agent and a Senior Staff Writer for MedicareAdvantage.com. He is passionate about helping people navigate the complexities of Medicare and understand their coverage options. .. Read full bio

How much is Medicare taxed?

Medicare is funded by a payroll tax of 1.45% on the first $200,000 of an employee's wages. Employers also pay 1.45%. Employees whose wages exceed $200,000 are also subject to a 0.9% Additional Medicare Tax.

What is the Medicare tax rate for self employed?

The Medicare tax for self-employed individuals is 2.9% to cover both the employee's and employer's portions. 2 . The 2020 CARES Act expanded Medicare's ability to cover the treatment and services of those affected by COVID-19. Employees should also consider having money deducted from their wages to fund their retirement through an ...

What is Medicare wages?

What Are Medicare Wages? Medicare wages are employee earnings that are subject to a U.S. payroll tax known as the Medicare tax. Similar to the other U.S. payroll tax, Social Security, the Medicare tax is used to fund the government's Medicare program, which provides subsidized healthcare and hospital insurance benefits to people ages 65 ...

What is the maximum Social Security tax for self employed in 2021?

5 The maximum Social Security tax for self-employed people in 2021 is $17,707.20. 6 . ...

What is a 401(k) plan?

A 401 (k) is a qualified employer-sponsored retirement plan into which eligible employees can make salary deferral contributions. Earnings in a 401 (k) accrue on a tax-deferred basis.

Is there a limit on Medicare tax?

4 . Unlike the Social Security tax, there is no income limit on the Medicare tax.

Can you deduct retirement from paycheck?

In many cases, you can elect to have a portion deducted from your paycheck for this purpose. Many employers offer certain types of retirement plans, depending on the length of time an employee has been with an organization (known as vesting) and the type of organization (company, nonprofit, or government agency).