What is a Medicare fee schedule?

Mar 08, 2020 · Most people pay the standard premium amount of $144.60 (as of 2020) because their individual income is less than $87,000.00, or their joint income is less than $174,000.00 per year. Deductibles for Medicare Part B benefits are $198.00 as of 2020 and you pay this once a …

Why is the reimbursement for 65779 different in office vs facility?

If you buy Part A, you'll pay up to $499 each month in 2022. If you paid Medicare taxes for less than 30 quarters, the standard Part A premium is $499. If you paid Medicare taxes for 30-39 quarters, the standard Part A premium is $274. Part A hospital inpatient deductible and coinsurance: You pay: $1,556 deductible for each benefit period

Should I Bill 65435 or 65222 for a 92071?

In 2022, the premium is either $274 or $499 each month, depending on how long you or your spouse worked and paid Medicare taxes. You also have to sign up for Part B to buy Part A. If you don’t buy Part A when you’re first eligible for Medicare (usually when you turn 65), you might pay a penalty. How much is the Part A late enrollment penalty?

How much does Medicare Part B cost?

May 26, 2021 · The CY 2021 Medicare Physician Fee Schedule Final Rule was placed on display at the Federal Register on December 2, 2020. This final rule updates payment policies, payment rates, and other provisions for services furnished under the Medicare Physician Fee Schedule (PFS) on or after Jan. 1, 2021. This final rule updates policies affecting the ...

What is the current Medicare reimbursement rate?

How are Medicare fees calculated?

How do you bill for the amniotic membrane?

How Much Does Medicare pay for 99214 in 2021?

| 2021 Final Physician Fee Schedule (CMS-1734-F) | ||

|---|---|---|

| Payment Rates for Medicare Physician Services - Evaluation and Management | ||

| 99214 | Office/outpatient visit est | $110.43 |

| 99215 | Office/outpatient visit est | $148.33 |

| 99417 | Prolng off/op e/m ea 15 min | NEW CODE |

Can I get Medicare Part B for free?

What is the Medicare Part B premium for 2021?

The standard monthly premium for Medicare Part B enrollees will be $170.10 for 2022, an increase of $21.60 from $148.50 in 2021. The annual deductible for all Medicare Part B beneficiaries is $233 in 2022, an increase of $30 from the annual deductible of $203 in 2021.Nov 12, 2021

Does Medicare pay for V2790?

Does Medicare pay for Prokera?

Does Medicare pay for allograft?

What is the RVU for 99231?

Did Medicare reimbursement go up in 2021?

IS 99211 being deleted in 2021?

How much does Medicare Part B cost?

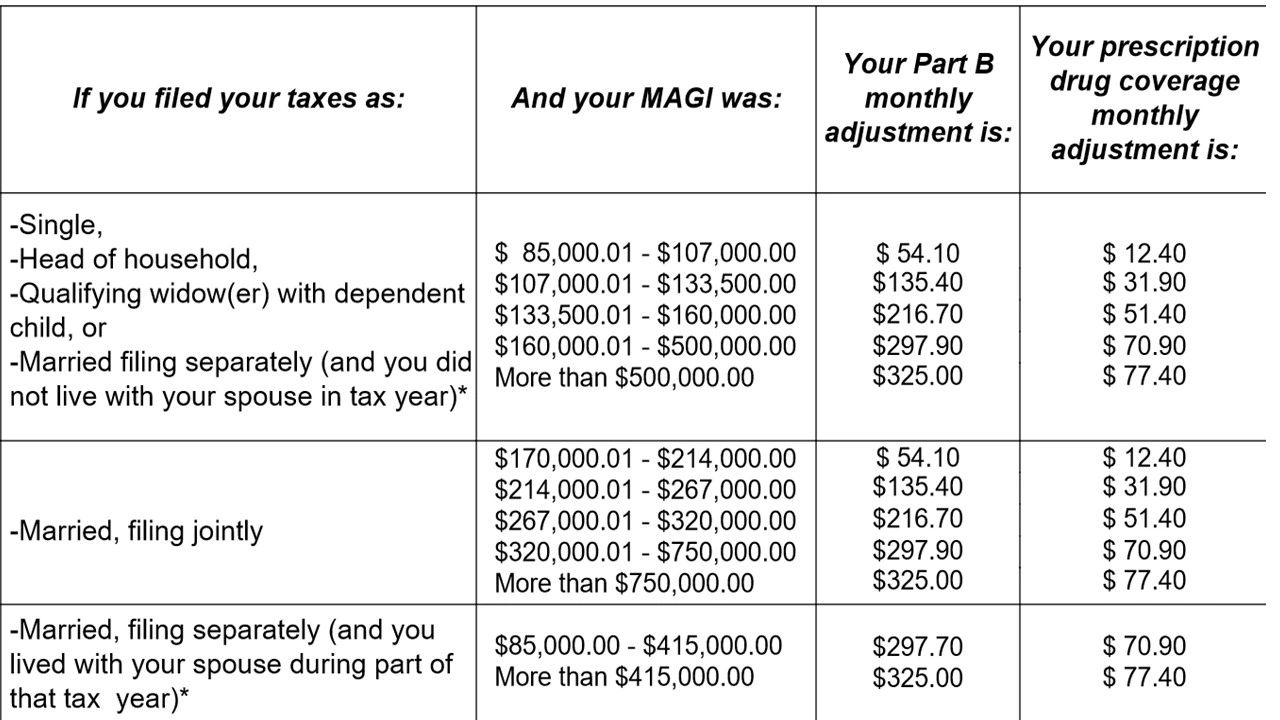

Medicare Part B has a monthly premium. The amount you pay depends on your yearly income. Most people pay the standard premium amount of $144.60 (as of 2020) because their individual income is less than $87,000.00, or their joint income is less than $174,000.00 per year.

How many parts of Medicare are there?

The four parts of Medicare have their own premiums, deductibles, copays, and/or coinsurance costs. Here is a look at each part separately to see what your costs may be at age 65.

How many people are covered by Medicare?

Today, Medicare provides this coverage for over 64 million beneficiaries, most of whom are 65 years and older.

How much is Medicare premium 2020?

Most people pay the standard premium amount of $144.60 (as of 2020) because their individual income is less than $87,000.00, or their joint income is less than $174,000.00 per year. Deductibles for Medicare Part B benefits are $198.00 as of 2020 and you pay this once a year.

Do you have to pay coinsurance before Medicare pays?

You must pay it before Medicare pays your health care expenses. After your deductible is paid, you pay a coinsurance of 20 percent of the Medicare-approved amount for most services either as an outpatient, inpatient, for outpatient therapy, and durable medical equipment.

How much is the 2020 deductible for hospital stays?

As of 2020, your Part A deductible for hospital stays is $1408.00 for each benefit period. After you meet your Part A deductible, your coinsurance costs are as follows: • Days 91 and up: $704.00 coinsurance per lifetime reserve days remaining after 90 per benefit period.

How much is Part A deductible for 2020?

If you purchase Part A, you may have to also purchase Part B and pay the premiums for both parts. As of 2020, your Part A deductible for hospital stays is $1408.00 for each benefit period. After you meet your Part A deductible, your coinsurance costs are as follows: • Days 1 – 60: $0 coinsurance per benefit period.

How much is coinsurance for 61-90?

Days 61-90: $371 coinsurance per day of each benefit period. Days 91 and beyond: $742 coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime) Beyond lifetime reserve days: all costs. Part B premium.

What is Medicare Advantage Plan?

A Medicare Advantage Plan (Part C) (like an HMO or PPO) or another Medicare health plan that offers Medicare prescription drug coverage. Creditable prescription drug coverage. In general, you'll have to pay this penalty for as long as you have a Medicare drug plan.

What happens if you don't buy Medicare?

If you don't buy it when you're first eligible, your monthly premium may go up 10%. (You'll have to pay the higher premium for twice the number of years you could have had Part A, but didn't sign up.) Part A costs if you have Original Medicare. Note.

Do you have to pay late enrollment penalty for Medicare?

In general, you'll have to pay this penalty for as long as you have a Medicare drug plan. The cost of the late enrollment penalty depends on how long you went without Part D or creditable prescription drug coverage. Learn more about the Part D late enrollment penalty.

How much is the Part B premium for 91?

Part B premium. The standard Part B premium amount is $148.50 (or higher depending on your income). Part B deductible and coinsurance.

How much is coinsurance for days 91 and beyond?

Days 91 and beyond: $742 coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime). Beyond Lifetime reserve days : All costs. Note. You pay for private-duty nursing, a television, or a phone in your room.

Do you pay more for outpatient services in a hospital?

For services that can also be provided in a doctor’s office, you may pay more for outpatient services you get in a hospital than you’ll pay for the same care in a doctor’s office . However, the hospital outpatient Copayment for the service is capped at the inpatient deductible amount.

Medicare Advantage Plan (Part C)

Monthly premiums vary based on which plan you join. The amount can change each year.

Medicare Supplement Insurance (Medigap)

Monthly premiums vary based on which policy you buy, where you live, and other factors. The amount can change each year.

When will Medicare start charging for PFS 2022?

The CY 2022 Medicare Physician Fee Schedule Proposed Rule with comment period was placed on display at the Federal Register on July 13, 2021. This proposed rule updates payment policies, payment rates, and other provisions for services furnished under the Medicare Physician Fee Schedule (PFS) on or after January 1, 2022.

When will Medicare update the PFS?

This final rule updates payment policies, payment rates, and other provisions for services furnished under the Medicare Physician Fee Schedule (PFS) on or after Jan. 1, 2019.

When will Medicare update payment policies?

This proposed rule updates payment policies, payment rates, and other provisions for services furnished under the Medicare Physician Fee Schedule (PFS) on or after January 1, 2022. This proposed rule proposes potentially misvalued codes and other policies affecting the calculation of payment rates. It also proposes to make certain revisions ...

When will CMS accept comments?

CMS will accept comments on the proposed rule until September 13, 2021, and will respond to comments in a final rule. The proposed rule can be downloaded from the Federal Register at: https://www.federalregister.gov/public-inspection.

When is the Medicare Physician Fee Schedule 2020?

This final rule updates payment policies, payment rates, and other provisions for services furnished under the Medicare Physician Fee Schedule (PFS) on or after Jan. 1, 2020.

When is the final rule for Medicare?

The CY 2020 Medicare Physician Fee Schedule Final Rule was placed on display at the Federal Register on November 1, 2019. This final rule updates payment policies, payment rates, and other provisions for services furnished under the Medicare Physician Fee Schedule (PFS) on or after Jan. 1, 2020. This final rule adds services to the telehealth list.

When will CMS accept comments on the proposed rule?

CMS will accept comments on the proposed rule until September 13, 2021, and will respond to comments in a final rule. The proposed rule can be downloaded from the Federal Register at: ...

General Information

CPT codes, descriptions and other data only are copyright 2020 American Medical Association. All Rights Reserved. Applicable FARS/HHSARS apply.

Article Guidance

This First Coast Billing and Coding Article for Local Coverage Determination (LCD) L36237 Amniotic Membrane – Sutureless Placement on the Ocular Surface provides billing and coding guidance for frequency limitations as well as diagnosis limitations that support diagnosis to procedure code automated denials.

ICD-10-CM Codes that Support Medical Necessity

It is the provider’s responsibility to select codes carried out to the highest level of specificity and selected from the ICD-10-CM code book appropriate to the year in which the service is rendered for the claim (s) submitted.

ICD-10-CM Codes that DO NOT Support Medical Necessity

All those not listed under the "ICD-10-CM Codes that Support Medical Necessity" section of this article.

Bill Type Codes

Contractors may specify Bill Types to help providers identify those Bill Types typically used to report this service. Absence of a Bill Type does not guarantee that the article does not apply to that Bill Type.

Revenue Codes

Contractors may specify Revenue Codes to help providers identify those Revenue Codes typically used to report this service. In most instances Revenue Codes are purely advisory. Unless specified in the article, services reported under other Revenue Codes are equally subject to this coverage determination.

Does Medicare ASC include 65779?

2 The 2017 Medicare ASC fee schedule does not include a value for 65779. Provided Courtesy of Bio-Tissue (888) 296-8858. Last updated January 23, 2020. The reimbursement information is provided by Corcoran Consulting Group based on publicly available information from CMS, the AMA, and other sources.

What is the procedure code for amniotic membrane?

A There are 2 procedure codes: For placement of amniotic membrane using tissue glue, use 66999. A third code, 65426 (Excision or transposition of pterygium; with graft), may also apply to surgery using AmnioGraft, but the tissue graft is not separately identified or billed since it is the graft.

Who provides reimbursement information?

The reimbursement information is provided by Corcoran Consulting Group based on publicly available information from CMS, the AMA, and other sources. The reader is strongly encouraged to review federal and state laws, regulations, code sets, and official instructions promulgated by Medicare and other payers.