- GAP health insurance coverage is designed to cover the “gaps” in your health insurance policy.

- GAP health insurance is not designed to replace primary health insurance coverage.

- GAP insurance claims are the responsibility of the insured.

- GAP health insurance coverage can help provide peace of mind.

What is medical GAP insurance and is it worth it?

The short answer is that no, gap health insurance is not worth the money. But let us look at the statistics to better understand this. The Brooking Institute has helped us out with their report on A Dozen Facts About the Economics of the U.S. Healthcare System.

Why is there a coverage gap in Medicare?

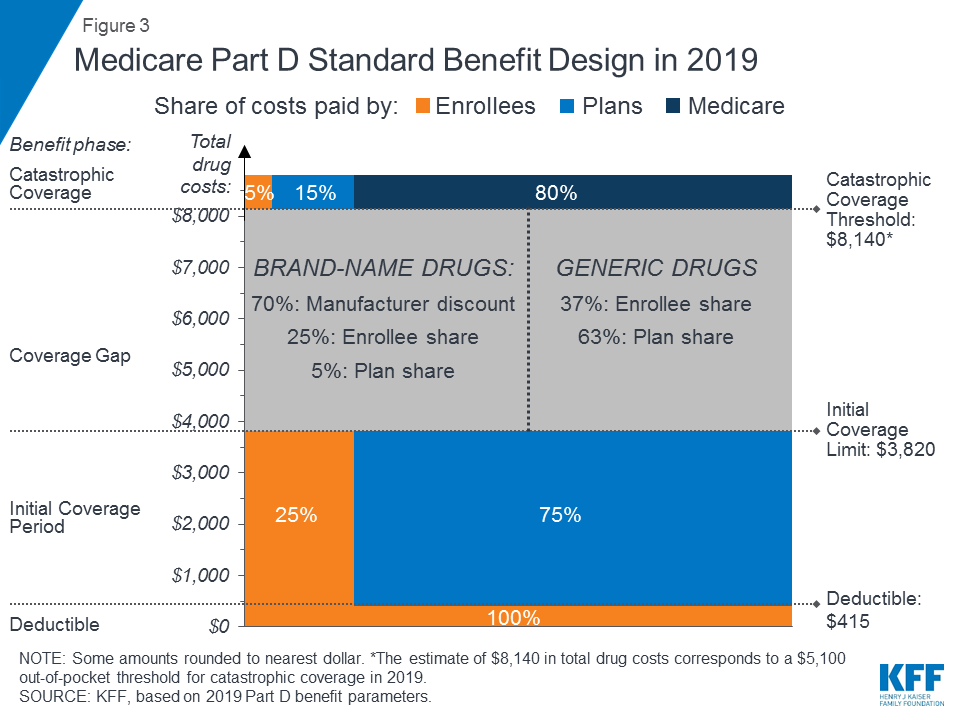

Your Medicare drug copayments change over the course of the year, depending on how much you’ve already spent. The Medicare “donut hole,” or coverage gap, is an increase in your medication copays that occurs after you reach a certain spending threshold.

What does no gap coverage mean Medicare?

The Medicare coverage gap, or “donut hole,” is a temporary limit on what drug plans will pay for eligible medications. Each year, Medicare Part D beneficiaries may enter the prescription drug coverage gap if they and their drug plan have paid a specified amount on covered drugs. Once in the Medicare coverage gap, beneficiaries must pay a percentage of their drug cost.

What are gaps in coverage with Medicare?

What are gaps in coverage with Medicare?

- Original Medicare doesn't cover some essentials. ...

- Even when Medicare covers a treatment, you still have to pay copays (a fixed amount you pay for some services) and coinsurance (a percentage share of the medical bills not ...

- Most people have to pay a monthly fee, called a premium, for Medicare Part B.

What is the difference between Medicare gap and Medicare Advantage?

Medigap is supplemental and helps to fill gaps by paying out-of-pocket costs associated with Original Medicare while Medicare Advantage plans stand in place of Original Medicare and generally provide additional coverage.

What is meant by Medicare gap?

Medigap policies are private insurance policies that assist you with paying for costs Original Medicare doesn't cover. Examples of these costs may include: Coinsurance. Co-payments. Deductibles.

Why is there a Medicare gap?

Most Medicare drug plans have a coverage gap (also called the "donut hole"). This means there's a temporary limit on what the drug plan will cover for drugs. Not everyone will enter the coverage gap. The coverage gap begins after you and your drug plan have spent a certain amount for covered drugs.

Is Medicare gap insurance deductible?

If you have Original Medicare along with a Medigap insurance plan, your Medigap premiums are tax-deductible. They are treated as a medical expense on Form 1040, Schedule A, Itemized Deductions and subject to the same guidelines as any other medical expense in this category.

Why do doctors not like Medicare Advantage plans?

If they don't say under budget, they end up losing money. Meaning, you may not receive the full extent of care. Thus, many doctors will likely tell you they do not like Medicare Advantage plans because private insurance companies make it difficult for them to get paid for their services.

Is it necessary to have supplemental insurance with Medicare?

For many low-income Medicare beneficiaries, there's no need for private supplemental coverage. Only 19% of Original Medicare beneficiaries have no supplemental coverage. Supplemental coverage can help prevent major expenses.

Does the Medicare donut hole reset each year?

Your Medicare Part D prescription drug plan coverage starts again each year — and along with your new coverage, your Donut Hole or Coverage Gap begins again each plan year. For example, your 2021 Donut Hole or Coverage Gap ends on December 31, 2021 (at midnight) along with your 2021 Medicare Part D plan coverage.

How do I avoid the Medicare Part D donut hole?

Here are some ideas:Buy Generic Prescriptions. ... Order your Medications by Mail and in Advance. ... Ask for Drug Manufacturer's Discounts. ... Consider Extra Help or State Assistance Programs. ... Shop Around for a New Prescription Drug Plan.

How do I get out of Medicare donut hole?

In 2020, person can get out of the Medicare donut hole by meeting their $6,350 out-of-pocket expense requirement.

Do Medicare supplement premiums increase with age?

Age is one factor that Medicare Supplement Insurance (Medigap) companies can use when determining the premiums for plans. Your Medigap premium is how much you pay per month to be a member of the plan. Medicare Supplement Insurance premiums tend to increase with age.

What is the most comprehensive Medicare supplement plan?

Medicare Supplement Plan F is the most comprehensive Medicare Supplement plan available. It leaves you with 100% coverage after Medicare pays its portion. Medigap Plan F covers the Medicare Part A and Part B deductible and the Medicare Part B 20% coinsurance.

What is the difference between plan F and plan G in Medicare?

The main difference between the two plans is how Plan G interacts with the Part B deductible. With Plan F, the Medicare Supplement plan pays for the Part B deductible. Under Plan G, you are responsible for the Part B deductible only. Otherwise, all Part A deductibles, copays, and coinsurance are covered.

What are My Costs in the Coverage Gap?

Once you reach $4,430 in total spending on your covered drugs, you’re responsible for a certain percentage of the costs. When you enter the coverage gap, you’ll pay no more than 25% of the actual drug cost.

What Plans Provide Gap Coverage?

A Part D drug plan or Part C Medicare Advantage plan may include gap coverage, though these plans aren’t available everywhere and may have a higher premium. Plans are available by location, if you don’t live in the service area, you’re not eligible for that policy.

Is the Medicare Coverage Gap Going Away?

While the coverage gap has closed, it doesn’t mean that it goes away. After the Initial Coverage Period, people with Medicare will pay a higher portion of their drug costs.

Which Plan Covers My Medications at the Lowest Cost?

There is not one specific plan that suits everyone’s needs. Most of the time spouses will find they have different plan needs. Perhaps you have a brand-name medication that fewer plans cover, or maybe there is a plan option that allows you to avoid the donut hole.

What are the gaps in Medicare?

What are gaps in coverage with Medicare? 1 Original Medicare doesn't cover some essentials. For instance, it does not pay for most prescription drug costs. 2 Even when Medicare covers a treatment, you still have to pay copays (a fixed amount you pay for some services) and coinsurance (a percentage share of the medical bills not covered by Medicare). 3 Most people have to pay a monthly fee, called a premium, for Medicare Part B.

What is Medicare for 65?

Medicare is a federal health insurance plan for people 65 and older, or with certain disabilities. The main Medicare plans are called A, which covers hospital services, and B, which pays for doctor visits, lab tests, and other outpatient services. Original Medicare doesn't cover some essentials.

Does Medicare pay for prescription drugs?

For instance, it does not pay for most prescription drug costs. Even when Medicare covers a treatment, you still have to pay copays (a fixed amount you pay for some services) and coinsurance (a percentage share of the medical bills not covered by Medicare). Most people have to pay a monthly fee, called a premium, for Medicare Part B.

Why do people get gap insurance?

Employers often pay or allow their employees to pay for GAP coverage to supplement their health insurance deductibles. Many Americans are settling for insurance policies with large deductibles because they can’t afford anything more.

Why is gap insurance so popular?

GAP health insurance is rising in popularity with those that don’t qualify for a subsidy because health insurance costs are growing. People who are faced with high deductibles are eyeing GAP insurance as a way to reduce their financial risk in case they have to use their medical insurance.

What do you need to know before buying a gap?

What You Need to Know Before You Buy GAP Insurance. Before you buy GAP health care coverage, there are a few things you need to know. First, GAP insurance is not the same thing as health insurance. GAP insurance is a “limited benefit” policy.

Why do you need a gap policy?

For those without a savings account or funds to cover a large medical bill, a GAP policy could be what helps them avoid bankruptcy or financial distress. If you have medical procedures or services scheduled, it’s important to realize whether the service will be covered by your GAP policy before you attempt to use it.

Can gap insurance replace primary insurance?

GAP insurance won’t replace your primary health insurance. GAP insurance claims are the insured’s responsibility. GAP health coverage can provide affordable peace of mind. su_box] GAP insurance is designed to help the insured manage the gaps in their health insurance coverage. GAP insurance is most popular with individuals who have insurance ...

Does gap insurance cover a foot fracture?

For example, if someone purchases GAP insurance simply for the peace of mind, they will be grateful they have it if their appendix decides to erupt or they fracture a foot while walking the dog. While GAP insurance isn’t designed to cover every gap a person may incur with their health insurance, it is designed to reduce ...

Is gap insurance the same as mini med insurance?

GAP insurance coverage is not the same as a mini-med policy. Before the Affordable Care Act, mini-med policies were very popular. After the Affordable Care Act was put into effect, mini-med policies were determined to be illegal. Buying a GAP insurance policy alone does not satisfy the Affordable Care Act requirements for coverage.

What is Medicare Supplemental?

What is Medigap (Medicare Supplemental) insurance? En español | Medigap is also sometimes referred to as a Medicare supplemental insurance. A Medigap policy, sold by private insurance companies, can help pay some of the health care costs (“gaps”) Original Medicare doesn’t cover, such as Medicare deductibles, coinsurance ...

Does Medigap cover Medicare Supplemental?

Then your Medigap policy pays its share of covered benefits. Every Medigap policy must follow federal and state laws designed to protect you, and it must be clearly identified as Medicare supplemental insurance. Insurance companies that sell Medigap can only sell you “standardized” Medigap policies, identified in most states by letters.

Does Medigap cover the same benefits?

Plans identified by the same letter cover the same benefits regardless of what company sells it. Note: In Massachusetts, Minnesota and Wisconsin, Medigap policies may be standardized in a different way. Note: Types of coverage that are NOT Medigap plans are Medicare Advantage plans, Medicare prescription drug plans, employer or union plans, ...

What is covered benefits?

benefits. The health care items or services covered under a health insurance plan. Covered benefits and excluded services are defined in the health insurance plan's coverage documents. but some offer additional benefits, so you can choose which one meets your needs.

What is coinsurance in Medicare?

Coinsurance is usually a percentage (for example, 20%). The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. (unless the Medigap policy also pays the deductible).

How much is Medicare deductible for 2020?

With this option, you must pay for Medicare-covered costs (coinsurance, copayments, and deductibles) up to the deductible amount of $2,340 in 2020 ($2,370 in 2021) before your policy pays anything. (Plans C and F aren't available to people who were newly eligible for Medicare on or after January 1, 2020.)

What states have Medigap policies?

In Massachusetts, Minnesota, and Wisconsin, Medigap policies are standardized in a different way. Each insurance company decides which Medigap policies it wants to sell, although state laws might affect which ones they offer. Insurance companies that sell Medigap policies:

Where do you live in Medigap?

You live in Massachusetts, Minnesota, or Wisconsin. If you live in one of these 3 states, Medigap policies are standardized in a different way. You live in Massachusetts. You live in Minnesota. You live in Wisconsin.

Do insurance companies have to offer every Medigap plan?

Insurance companies that sell Medigap policies: Don't have to offer every Medigap plan. Must offer Medigap Plan A if they offer any Medigap policy. Must also offer Plan C or Plan F if they offer any plan.

Does Medicare cover Part B?

As of January 1, 2020, Medigap plans sold to new people with Medicare aren't allowed to cover the Part B deductible. Because of this, Plans C and F are not available to people new to Medicare starting on January 1, 2020.

What is the coverage gap in the ACA?

The “coverage gap” exists because the ACA’s premium tax credits (premium subsidies) are only available for people with a household income of at least 100% of FPL, up to 400% of FPL (note that for 2021, people receiving unemployment compensation are eligible for full premium subsidies even if their household income is under the poverty level, and for 2021 and 2022, there is no upper income limit for premium subsidy eligibility ).

What happens if you are in the coverage gap?

If you’re in the coverage gap, Medicaid isn’t available, and ACA-compliant coverage can only be purchased at full price – generally an unrealistic option, given that everyone in the coverage gap has an income below the poverty level. There are a few possible solutions, ...

What was the Affordable Care Act?

When the Affordable Care Act was written, a cornerstone of the legislation was the expansion of Medicaid to everyone with household incomes up to 138% of federal poverty level, (FPL).

How many people are in the coverage gap?

According to Kaiser Family Foundation data, there are about 2.2 million people in the coverage gap across the 11 states that have not expanded Medicaid and do not currently have a plan in place to expand Medicaid. About 208,000 people in Missouri and Oklahoma are caught in the coverage gap until those states officially expand their Medicaid ...

How many states have not expanded Medicaid?

There are still 14 states where Medicaid eligibility has not been expanded under the ACA, although Wisconsin has a unique situation and does not have a coverage gap (Wisconsin essentially implemented a partial Medicaid expansion — without the enhanced federal funding they’d receive if they fully expanded Medicaid ).

Did the ACA create a coverage gap?

The ACA did not create any sort of coverage gap; it was purposely designed to ensure that there would be no coverage gaps for low-income Americans, even for recent immigrants (as long as they’re lawfully present in the US). Now, for the details:

Is Medicaid expansion optional?

Expansion is optional, and some states continue to say no. But in 2012, the Supreme Court, while upholding the rest of the ACA, struck down the Medicaid expansion requirement, leaving it up to each state to decide whether or not to participate. As of early 2021, 36 states plus the District of Columbia had expanded Medicaid.