What is a Medigap Plan F?

- Medigap is supplemental insurance that helps Original Medicare beneficiaries pay out-of-pocket costs.

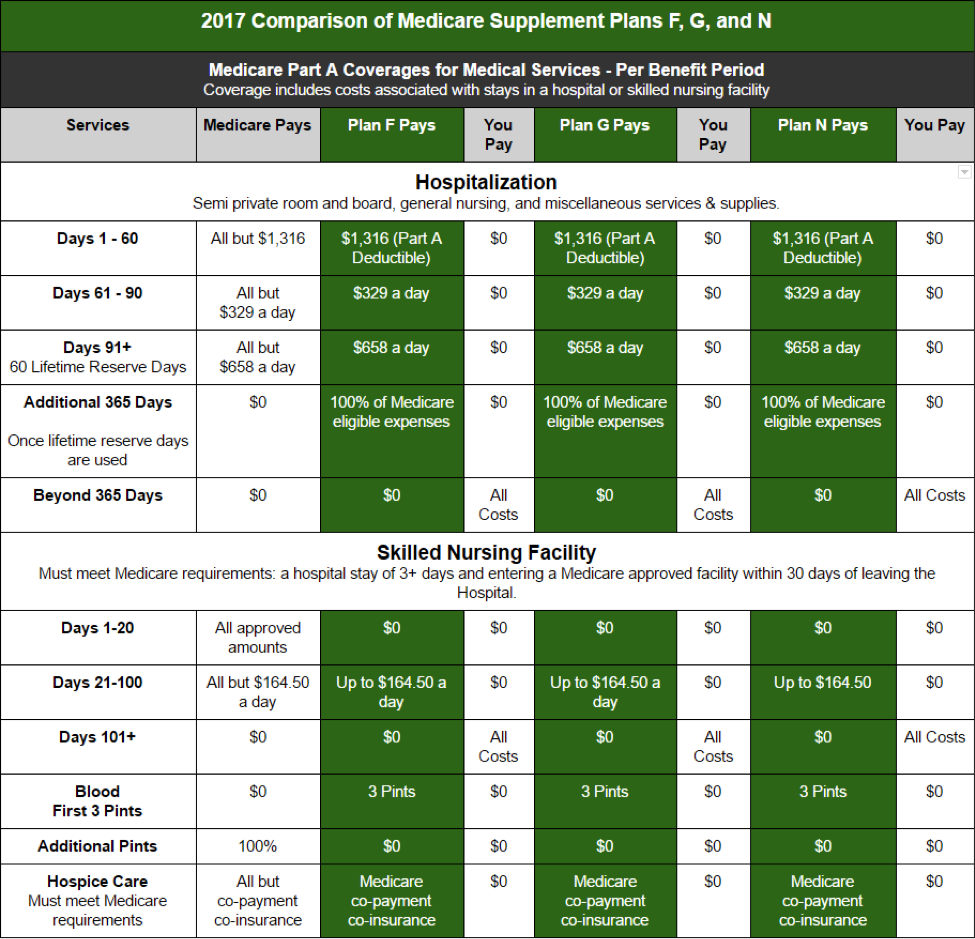

- Medigap Plan F covers copayments, coinsurance and deductible costs.

- Medicare Supplement Plan F doesn’t cover services not covered by Original Medicare, such as eye care, dental, and hearing aids.\

- Medigap Plan F also has a high-deductible option.

Is Medicare Plan G better than Plan F?

Medicare Plan G is not better than Plan F because Medicare Plan G covers one less benefit than Plan F. It leaves you to pay the Part B deductible whereas Medigap Plan F covers that deductible. Is Medicare Plan F being discontinued? Yes, but only for new enrollees on or after January 1, 2020.

How much is plan F Medicare?

In terms of popularity, Plan F is the most popular, with approximately 55 percent of all Medigap plans currently active being Plan F. Plan C is in second place but there is a huge gap as Plan C only accounts for about 9 percent of all Medigap plans.

Is Medigap Plan G better than Plan F?

Medigap Plans F, G, and N are three of the most popular plans ... underwriting or a premium penalty – but only for plans with the same or lower benefits than your existing plan. In other words, you can’t trade up. Bottom line When evaluating a Medigap ...

How much does Medigap plan F cost?

The average cost of Plan F in 2018 was the fourth highest among the 10 Medigap plans used for analysis. Plan M ( $218.75 ), Plan A ( $192.33) and Plan C ( $189.88) all had higher average premiums than Plan F in 2018. Plan J ( $160.07) and Plan D ( $157.33) had average monthly premiums that were slightly lower than Plan F in 2018.

What is the advantage of Medicare Plan F?

Medicare Supplement Plan F offers basic Medicare benefits including: Hospitalization: pays Part A coinsurance plus coverage for 365 additional days after Medicare benefits end. Medical Expenses: pays Part B coinsurance—generally 20% of Medicare-approved expenses—or copayments for hospital outpatient services.

What is the difference between Medicare Part B and Part F?

Those who have Medicare Plan F won't pay out-of-pocket costs for Medicare Parts A and B. Policyholders would only pay the monthly rates, which start at $0 for Part A and $170.10 for Part B. Additionally, individuals would not have to pay the deductible, which is $1,556 for Part A and $233 for Part B.

Who is eligible for plan F?

Plan F is only available if you first became eligible for Medicare before January 1, 2020 (which means your 65th birthday occurred before January 1, 2020). Or you qualified for Medicare due to a disability before January 1, 2020.

What is the difference between plan F and plan G?

Medigap Plan G is currently outselling most other Medigap plans because it offers the same broad coverage as Plan F except for the Part B deductible, which is $233 in 2022. The only difference when you compare Medicare Supplements Plan F and Plan G is that deductible. Otherwise, they function just the same.

Why is Medigap plan F being discontinued?

The reason Plan F (and Plan C) is going away is due to new legislation that no longer allows Medicare Supplement insurance plans to cover Medicare Part B deductibles. Since Plan F and Plan C pay this deductible, private insurance companies can no longer offer these plans to new Medicare enrollees.

Does Medicare Plan F cover vision?

Plan F is one of the most comprehensive Medicare supplement plans you can purchase, but it doesn't cover everything. This plan will not cover the following: Things that Medicare doesn't normally cover, like acupuncture, vision exams and dental work, are not included in Plan F coverage.

Can I switch back to plan F?

You pay for Medicare-covered costs up to the $2,490 deductible (as of 2022) before the plan begins to pay for anything. If you currently have Medicare Supplement Plan F, you can switch to high-deductible Plan F by contacting your insurance provider.

How much does AARP plan F Cost?

Below are the average AARP Medicare Supplement costs in each of these three categories....1. AARP Medigap costs in states where age doesn't affect the price.Plan nameAverage monthly cost for AARP MedigapPlan B$242Plan C$288Plan F$2567 more rows•Jan 24, 2022

Are Medicare Part F premiums tax deductible?

Do Medicare premiums reduce taxable income? You can deduct your Medicare and Medigap premiums from your taxes as a below-the-line deduction. This requires you to itemize the premiums. If they, along with your other medical costs, exceed 7.5% of your adjusted gross income (AGI), you qualify for the deduction.

What is Medicare Plan F being replaced with?

No plan completely replaces Medicare Part F, but the closest available is Medicare Supplement Plan G. Like Plan F, Plan G covers 100% of many benefits, including: Part A coinsurance and hospital costs. Part B copays/coinsurance (not deductibles)

Can you switch from Plan F to Plan G?

Can't I just move from a Medigap Plan F to a Plan G with the same insurance plan? Yes, you can. However, it usually still requires answering health questions on an application before they will approve the switch.

Does Plan F have copays?

Medicare Plan F (also referred to as Medigap Plan F) is the most comprehensive Medicare supplement plan. This plan covers Medicare deductibles and all copays and coinsurance, which means you pay nothing out of pocket throughout the year.

What is the difference between Plan F and Plan F high deductible?

Standard Plan F has a much lower deductible than high-deductible Plan F. A high-deductible Plan F has a lower monthly premium. As a reminder, your...

Does Plan F cover dental?

Original Medicare doesn’t cover routine dental care, like cleanings or extractions, and there are no supplement plans that fill the gap. If you wan...

Is there an alternative to Plan F?

Since Plan F has been phased out for newer members, the best alternative is Plan G. Medicare Plan G covers all the same things that Plan F covers,...

What is Medicare Plan F?

Medicare Plan F (also referred to as Medigap Plan F) is the most comprehensive Medicare supplement plan. This plan covers Medicare deductibles and...

Can I still get Plan F?

People who were eligible for Medicare prior to 2020 will continue to have the option to buy Plan F. This is regardless if you enrolled in Medicare...

What is the average cost for Medicare Plan F?

Medicare Plan F cost varies by several factors. Costs for Medicare Plan F vary by area, gender, zip code, and tobacco status. In many areas, we fin...

What is Medicare Plan F Coverage?

It covers all of your cost-sharing for Medicare Part A and B services. Medicare must approve and pay for the service before your Medicare Plan F po...

Does Medicare Plan F cover prescription drugs?

All Medigap plans cover medications administered in the hospital or in a clinical setting. However, Medigap plans do not cover retail prescriptions...

Does Medigap Plan F cover dental, vision and hearing benefits?

No Medigap plan covers routine dental, vision or hearing services either. However, there are many great standalone plans that you can enroll in to...

Does Medicare Plan F cover chiropractic?

Yes, Medicare covers 80% of adjustments, and Plan F pays the other 20%. Medicare does not cover other services provided by chiropractors though, su...

What is the most popular Medicare Supplement plan?

The best Medigap plans in 2022 are still Plan F and Plan G. While Plan F has long been the most popular, Plan G is gaining steam since Plan F is no...

What are the top 10 Medicare Supplement insurance companies in 2022?

This absolutely varies by region. Since Medicare Supplement insurance plans are standardized, you don’t have to worry about benefits being differen...

Should I switch from Plan F to Plan G?

This depends on what your Plan F premium is and where you live (you may have to answer health questions). However, you get lower premiums for Plan...

What is a Medigap Plan F?

Medigap Plan F is a Medicare supplement insurance plan that helps you pay for out-of-pocket expenses associated with Medicare. It’s only available for people who have Original Medicare. Medicare Supplement Plans don’t work with Medicare Advantage.

What does Medicare Supplement Insurance Plan F cover?

Medicare Supplement Plan F covers costs that Medicare doesn’t cover, says Laura Decker, co-founder and president of the Employee Benefits Division at SSGI, a Maryland-based employee benefits insurance agency.

What doesn't Medicare Supplement Plan F cover?

Medicare Plan F won't cover any services not covered under Original Medicare.

How much does Medicare Part F cost?

The cost of Medicare Plan F depends on a few factors, including your age.

Medicare supplement plans comparison

Medicare Plan F is no longer available for purchase. However, several other Medigap supplement plans can help cover the out-of-pocket costs associated with Original Medicare.

Frequently Asked Questions

Standard Plan F has a much lower deductible than high-deductible Plan F. A high-deductible Plan F has a lower monthly premium.

What Does Medigap Plan F Offer?

Medigap is private insurance that supplements your Medicare coverage, according to the Centers for Medicare and Medicaid Services.

Get Started Now

Interested in learning more about Medicare, Medigap, and Medicare Advantage plans? WebMD Connect to Care Advisors may be able to help.

What does Medicare Supplement Plan F Cover?

Plan F is a first-dollar coverage plan. This means you’ll pay zero out of pocket outside the monthly premium. No matter what your medical costs are, you’ll never pay any copays, coinsurance, or deductibles. If Medicare covers it, you won’t pay a penny out of pocket.

Medigap Plan F Cost

The cost for Plan F varies greatly depending on where you live, and how old you’re. There are several factors to consider that determine Plan F cost.

When to Enroll in Medigap Plan F

Since Plan F is a Medigap plan, you can enroll at any time as long as you’re healthy enough and eligible. Medigap does not come with annual enrollment periods like Medicare.

FAQs

Any Medicare beneficiaries that have both Parts A and B of Medicare & are not considered newly eligible.

What is Medicare Plan F?

Medicare Plan F (also referred to as Medigap Plan F) is the most comprehensive Medicare supplement plan. This plan covers Medicare deductibles and all copays and coinsurance, which means you pay nothing out of pocket throughout the year.

Why is Medicare Plan F so popular?

The reason Medicare Plan F is so well-liked is that it will pay for ALL of the gaps in Original Medicare Part A and Part B, including both your hospital and outpatient deductible. It even pays the 20% that Medicare Part B does not cover.

What is the most comprehensive Medicare plan?

If you became eligible for Medicare on or after January 1, 2020, you’ll find that Plan G is the most comprehensive Medigap plan available to you. (In recent years, Plan G has been the second most popular Medicare Supplement plan, and you can read more on that below.) A Medigap plan, or Medicare Supplement, pays after Medicare to help cover your ...

What is the best Medigap plan for 2021?

The best Medigap plans in 2021 are still Plan F and Plan G. While Plan F has long been the most popular, Plan G is gaining steam since Plan F is no longer available to new enrollees. Get a quote for both and see which ones offer you the best annual savings.

How much does it cost to have Gracie's surgery?

The total cost for Gracie’s surgery, hospital stay and follow-up care is $70,000.

Is Medicare Supplement Plan F the #1 seller?

This post has been updated for 2021. Medicare Supplement Plan F has also been the #1 seller with Baby Boomers for many years. According to a report from America’s Health Insurance professionals in 2016, about 57% of all Medigap policies in force were a premium Medicare Plan F policy.

Does Medicare Plan F cover outpatient deductible?

Plan F fully covers both your Part A hospital deductible and your Part B outpatient deductible. It covers all of the 20% that Medicare Part B normally leaves for you to pay. Medicare Plan F covers all Part B excess charges. You will never pay the standard 15% excess charges that doctors under Medicare are allowed to charge for Part B services.

What is Plan F for Medicare?

Plan F covers the 20% of Medicare-approved hospital expenses not covered under Part A. Plan F also covers other costs, such as: Part A hospital deductible and coinsurance. Hospital costs up to an additional 365 days after Medicare benefits are exhausted. Part A Hospice care coinsurance or copayment.

What does Plan F cover?

Plan F also covers the Medicare Part B expenses. Part B covers doctor visits and related charges covered under Medicare for providers. Like Part A, Part B only covers 80% of the Medicare-approved expenses. It leaves the remaining 20% on the Part B participant.

What is Plan F?

Plan F covers the Medicare-approved expenses not covered under Medicare Part A (deductibles, coinsurances, and copays). Part A is the hospitalization component of Original Medicare and covers Medicare expenses typically associated with a hospital stay.

How long does Medicare cover skilled nursing?

Medicare limits this benefit to the first 100 days of a stay in a skilled nursing facility.

Why is Plan F standardized?

They did this with the specific goal of making shopping for a plan more manageable. No matter which company provides Plan F, they all must pay for Medicare approved expenses.

What is the 80% travel insurance?

This plan coverage also includes 80% of approved costs associated with foreign travel emergencies, which is vital for the many seniors who enjoy taking cruises or other trips outside the United States. There are plan limits, but this coverage can help offset charges associated with becoming sick or injured while traveling outside of the U.S.

Does Plan F cover Medicare Part B?

It leaves the remaining 20% on the Part B participant. Plan F covers Medicare Part B approved services at the doctor’s office, such as: Plan F is one of only two Medicare Supplement plans that cover the Medicare Part B excess charges (the other being Plan G).

What is Medicare Advantage?

Medicaid. A joint federal and state program that helps with medical costs for some people with limited income and resources.

What is a Medigap policy?

Those plans are ways to get Medicare benefits, while a Medigap policy only supplements your Original Medicare benefits. The periodic payment to Medicare, an insurance company, or a health care plan for health or prescription drug coverage.

What happens if you buy a Medigap policy?

If you have Original Medicare and you buy a Medigap policy, here's what happens: Medicare will pay its share of the. Medicare-Approved Amount. In Original Medicare, this is the amount a doctor or supplier that accepts assignment can be paid. It may be less than the actual amount a doctor or supplier charges.

How many people does a Medigap policy cover?

for your Medigap policy. You pay this monthly premium in addition to the monthly Part B premium that you pay to Medicare. A Medigap policy only covers one person. If you and your spouse both want Medigap coverage, you'll each have to buy separate policies.

What is the difference between Medicare and Original Medicare?

Original Medicare. Original Medicare is a fee-for-service health plan that has two parts: Part A (Hospital Insurance) and Part B (Medical Insurance). After you pay a deductible, Medicare pays its share of the Medicare-approved amount, and you pay your share (coinsurance and deductibles). and is sold by private companies.

Can you cancel a Medigap policy?

This means the insurance company can't cancel your Medigap policy as long as you pay the premium. Some Medigap policies sold in the past cover prescription drugs. But, Medigap policies sold after January 1, 2006 aren't allowed to include prescription drug coverage.

Does Medicare cover all of the costs of health care?

Original Medicare pays for much, but not all, of the cost for covered health care services and supplies. A Medicare Supplement Insurance (Medigap) policy can help pay some of the remaining health care costs, like: Note: Medigap plans sold to people who are newly eligible for Medicare aren’t allowed to cover the Part B deductible.

How much is Medicare deductible for 2020?

With this option, you must pay for Medicare-covered costs (coinsurance, copayments, and deductibles) up to the deductible amount of $2,340 in 2020 ($2,370 in 2021) before your policy pays anything. (Plans C and F aren't available to people who were newly eligible for Medicare on or after January 1, 2020.)

What is covered benefits?

benefits. The health care items or services covered under a health insurance plan. Covered benefits and excluded services are defined in the health insurance plan's coverage documents. but some offer additional benefits, so you can choose which one meets your needs.

What is coinsurance in Medicare?

Coinsurance is usually a percentage (for example, 20%). The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. (unless the Medigap policy also pays the deductible).

What states have Medigap policies?

In Massachusetts, Minnesota, and Wisconsin, Medigap policies are standardized in a different way. Each insurance company decides which Medigap policies it wants to sell, although state laws might affect which ones they offer. Insurance companies that sell Medigap policies:

Where do you live in Medigap?

You live in Massachusetts, Minnesota, or Wisconsin. If you live in one of these 3 states, Medigap policies are standardized in a different way. You live in Massachusetts. You live in Minnesota. You live in Wisconsin.

Do insurance companies have to offer every Medigap plan?

Insurance companies that sell Medigap policies: Don't have to offer every Medigap plan. Must offer Medigap Plan A if they offer any Medigap policy. Must also offer Plan C or Plan F if they offer any plan.

Does Medicare cover Part B?

As of January 1, 2020, Medigap plans sold to new people with Medicare aren't allowed to cover the Part B deductible. Because of this, Plans C and F are not available to people new to Medicare starting on January 1, 2020.