“Guaranteed issue” means that the insurance company guarantees that it will issue you a policy at the best rate without any underwriting for health or preexisting conditions. You cannot be denied a policy. What’s the confusion with the initial question?

Full Answer

What is Medicare supplement guaranteed issue right?

A Medigap guaranteed issue right allows you to purchase a Medicare Supplement insurance policy from any company without regard to your health condition.

What is a Medigap guaranteed issue right?

A Medigap guaranteed issue right allows you to purchase a Medicare Supplement insurance policy from any company without regard to your health condition. You only have a guaranteed issue right in certain situations.

What is a guaranteed issue period for Medicare?

Guaranteed issue periods have the same basic implications as the Medigap open enrollment period, in that you cannot be turned down for coverage or made to pay more based on your health. However, there are some additional considerations.

What are guaranteed issue rights?

What are Guaranteed Issue Rights? For millions of Americans, supplementing their Original Medicare benefits with a Medigap policy in order to fill in the gaps left by Medicare is a necessity. A Medicare Supplement plan pays for coinsurance, copayments, and some of the deductibles that Original Medicare insurance does not cover.

What is guaranteed issue right?

You have a guaranteed issue right (which means an insurance company can't refuse to sell you a Medigap policy) in these situations: You're in a Medicare Advantage Plan, and your plan is leaving Medicare or stops giving care in your area, or you move out of the plan's service area.

What are the guaranteed issue states?

Guaranteed Issue StatesIn California and Oregon, there is a birthday rule. ... In Washington, residents with a Plan A may switch to a Plan A without underwriting. ... In New York and Connecticut, Medigap policies are guaranteed issue year-round.In Vermont, some Medigap carriers offer guaranteed issue year-round.More items...•

What is the difference between open enrollment and guaranteed issue?

Whereas in open enrollment, you can choose any Medigap plan that is offered in your state, during a guaranteed issue you can typically only choose Medigap Plans A, B, C, F, K or L that's sold in your state by any insurance company.

Is plan G guaranteed issue in 2021?

First of all, Plan G is not offered as a “guaranteed issue” (no health questions) option in situations where someone is losing group coverage or Medicare Advantage plan coverage.

What is the major problem with guaranteed issue?

Except for the waiting period, guaranteed issue policies might sound too good to be true. Unhealthy people take out policies, pay their premiums, and die in a few months or a few years. The insurance company has to either return their money or pay a death benefit. How can insurers even afford to offer these policies?

What does guaranteed issue amount mean?

A plan's guaranteed issue (GI) is the amount of life insurance available to an employee without having to provide Evidence of Insurability, or EOI.

What does guaranteed issue mean in health insurance?

Guaranteed issue laws require insurance companies to issue a health plan to any applicant – an individual or a group – regardless of the applicant's health status or other factors.

Are Part D plans guaranteed issue?

In most cases, enrollment outside of your initial enrollment period is limited to an annual enrollment period between October 15 and December 7, with coverage starting January 1 of the following year. During this time, you can switch to a new PDP or Medicare Advantage plan, and coverage is guaranteed issue.

Is Medigap plan G guaranteed issue?

Medigap Plan G is only available as a guaranteed issue plan to people who became eligible for Medicare on or after January 1st, 2020. You may still apply for Medigap Plan G through the usual methods (link to article) if you entered Medicare before 2020, but your acceptance may not be guaranteed.

Why do doctors not like Medicare Advantage plans?

If they don't say under budget, they end up losing money. Meaning, you may not receive the full extent of care. Thus, many doctors will likely tell you they do not like Medicare Advantage plans because private insurance companies make it difficult for them to get paid for their services.

What is the deductible for plan G in 2022?

$2,490Effective January 1, 2022, the annual deductible amount for these three plans is $2,490. The deductible amount for the high deductible version of plans G, F and J represents the annual out-of-pocket expenses (excluding premiums) that a beneficiary must pay before these policies begin paying benefits.

What is the out-of-pocket maximum for Medigap plan G?

Similarly, Plan G has no out-of-pocket limit to protect you from spending too much on covered health care in a year. If you are interested in an out-of-pocket limit, consider Plan K or Plan L. Plan G is most similar in coverage to Plan F.

What is guaranteed issue rights?

Guaranteed issue rights are also known as Medigap protections. If you qualify, a private insurance company must abide by government regulations to give you access to certain Medicare Supplement plans, it must offer coverage for all pre-existing health conditions, and it cannot charge you a higher premium for the insurance plan due ...

How long do you have to have a trial right to buy Medicare?

In some cases, if you are in your “trial right” period for a Medicare Advantage (Part C) plan, which is up to 12 months after initial enrollment, you also have guaranteed issue rights to purchase a private supplemental health insurance plan during this special enrollment period. Federal law allows 63 days of guaranteed issue rights ...

Does Medicare Supplement cover coinsurance?

A Medicare Supplement plan pays for coinsurance, copayments, and some of the deductibles that Original Medicare insurance does not cover. It also provides extended benefits in many cases.

Can you sell a Medicare Supplement policy?

Understanding Guaranteed Issue Rights. Private insurance companies are lawfully obligated to sell you a Medicare Supplement policy if you enroll during your initial enrollment period you qualify for guaranteed issue rights. Guaranteed issue rights are also known as Medigap protections.

What is guaranteed issue for Medicare?

A different type of eligibility for Medicare Supplement coverage is called Medicare Supplement guaranteed issue. Guaranteed issue periods have the same basic implications as the Medigap open enrollment period, in that you cannot be turned down for coverage or made to pay more based on your health. However, there are some additional considerations.

What is the difference between open enrollment and guaranteed issue?

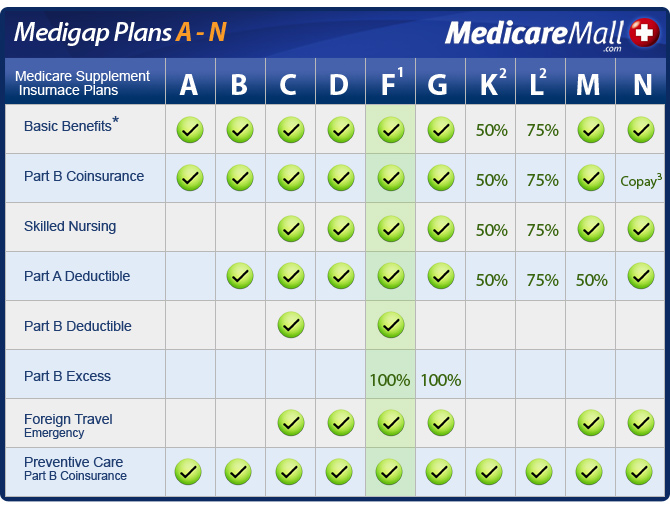

One of the big differences between open enrollment and guaranteed issue is which plans are offered . Whereas in open enrollment, you can choose any Medigap plan that is offered in your state, during a guaranteed issue you can typically only choose Medigap Plans A, B, C, F, K or L that’s sold in your state by any insurance company.

How long do you have to be in Medicare before you can enroll?

Additionally, most insurance companies allow you to enroll in a Medigap plan up to 6 months before your Medicare coverage starts. When you do that, the coverage does not start ...

What is Medicare Supplement?

A Medicare Supplement gives you predictable out of pocket costs once you are on Medicare and limits, or eliminates, your exposure to potentially high medical costs. But, if you don’t sign up for one when you are eligible to do so, you may have difficulty getting a plan at a later time. Because of this, it’s important to understand ...

How long is Medicare Supplement Open Enrollment?

What is Medicare Supplement Open Enrollment? Open enrollment, as it pertains to Medicare Supplement plans, is a 6 month period that begins the first day of the month that you are both 65 or older and enrolled in Medicare Part B (see page 14 of the “Choosing a Medigap” booklet ).

What is 65Medicare.org?

65Medicare.org is a leading, independent Medicare insurance agency for people turning 65 and going on Medicare. If you have any questions about this information, you can contact us online or call us at 877.506.3378.

Do all insurance companies have to abide by guaranteed issue periods?

However, there are some additional considerations. First of all, you must fall into one of the situation-specific guaranteed issue periods. These are mandated, under Federal law, and all insurance companies must abide by them in order to offer Medicare Supplement plans. The main ones are:

What are guaranteed issue rights for Medicare?

All Medicare beneficiaries are protected by law from unfair medical underwriting. Guaranteed issue rights prohibit insurance companies from denying or overcharging you a Medigap policy, regardless of any pre-existing health conditions.

How long do you have to go back to Medicare if you change your mind?

The same rule applies if you enroll in a Medicare Advantage plan after turning 65. If you start with Original Medicare and a Medigap plan, you have 12 months to try Medicare Advantage.

What is trial rights in Medicare?

Trial rights when you enroll in Medicare Advantage or drop your Medigap coverage. Your Medicare Advantage plan is leaving your specific area or leaving Medicare. You decide to move out of the plan’s service area. An employer plan that supplements Medicare ends. The Medicare company did not follow the rules.

What happens if you move out of your Medicare Advantage plan?

If you move out of your plan’s service area, you will lose coverage. As a result, you will be given a guaranteed-issue right to purchase a Medicare supplement plant in your NEW area. Your second option: choose a new Medicare Advantage plan. Another common situation is a Medicare Advantage plan folding or being terminated in your area.

How long is Medicare trial?

Medicare Advantage Trial Rights. Once you become eligible for Medicare at 65, you are given a 12 month trial with Medicare Advantage. If you change your mind, you can return back to Original Medicare. The same rule applies if you enroll in a Medicare Advantage plan after turning 65.

Which states have birthday rules for Medicare?

Medicare Supplement Guaranteed Issue States with The Birthday Rule. Oregon and California have “ Birthday Rules ,” allowing Medigap enrollees 30-days to change plans. The rule allows a switch to another Medigap plan with the same or lesser benefits, without medical underwriting.

Does Medicare discontinue according to zip code?

Medicare Advantage Plan Discontinues According to my Zip Code. Life can be unpredictable, and it is important to understand how your zip code affects your Medicare Advantage plan. Notify Medicare of your move as soon as possible. Here are two real-life examples that can affect your coverage.

What is a guaranteed issue right?

A Medigap guaranteed issue right allows you to purchase a Medicare Supplement insurance policy from any company without regard to your health condition. You only have a guaranteed issue right in certain situations. When you have a Medigap guaranteed issue right, insurance companies are lawfully required to sell or offer you a Medicare Supplement ...

What is Medicare Advantage?

You have a Medicare Advantage plan & you are moving out of the plan’s service area. You have Medicare Parts A and B (Original Medicare) & you need to replace an employer health plan that will soon be discontinued. You have Original Medicare and a Medicare SELECT policy & you move out of the policy’s service area.

What happens if you don't buy a Medigap policy?

If you do not buy a policy during your Medigap open enrollment period or a situation in which you have a guaranteed issue right, you will likely be required to go through medical underwriting. Medical underwriting could lead to a coverage denial or higher premiums.

Can I enroll in Medicare Supplement?

Enrolling in Medicare Supplement Insurance. If you get a Medicare Supplement insurance policy through a Medigap guaranteed issue right, you will have guaranteed access only to certain standardized Medicare Supplement Insurance plans. 1 You will be able to enroll in one of the following Medigap plans sold in your state: Plans A, B, C, F, K, or L.

Can you drop a Medigap policy to join Medicare?

You dropped a Medigap policy to join a Medicare Advantage plan for the first time & within the first year of joining you want to switch back to Medigap. Your Medigap insurance company goes bankrupt or ends your policy through no fault of your own.

Can I buy Medicare Supplement after open enrollment?

The following 8 situations may provide you with a guaranteed issue right that allows you to buy a Medicare Supplement insurance policy after your open enrollment period ends. An insurance company cannot refuse to sell you a Medicare Supplement insurance policy in the following situations: You have a Medicare Advantage plan & it is leaving Medicare ...

Can you get Medicare Supplement if you have pre-existing conditions?

When you have a Medigap guaranteed issue right, insurance companies are lawfully required to sell or offer you a Medicare Supplement insurance policy even if you have pre-existing conditions. In these situations, insurers cannot charge you more because of past or present health problems.