You're eligible for a Medicare supplement guaranteed issue right if:

- You no longer live in the Medicare Advantage plan's service area.

- The organization offering your Medicare Advantage coverage lost certification to sell the plan.

- You canceled your Medicare Advantage plan within 12 months of enrolling in Medicare Part A.

What is a guaranteed issue right?

What Is Guaranteed Issue Right? In simplest terms, a guaranteed issue right can protect individuals from medical underwriting, that is, when pre-existing health issues would otherwise have an impact on one’s ability to get a policy or on the premiums to be paid.

What does guaranteed issue mean?

“Guaranteed issue” means that the health insurance coverage is guaranteed to be issued to applicants, regardless of their medical history, their age, their gender, or any other factors that might increase their likelihood of using health services. In most states, guaranteed issue doesn’t limit what you can be charged when you enroll in a plan.

What is guaranteed issue in health insurance?

- Guaranteed issue health insurance is coverage that accepts every qualified applicant

- Guaranteed issue health insurance does not consider medical history or any individual trait

- Guaranteed issue health insurance applies to individual and group insurance

- Obamacare is guaranteed issue for all eligible US citizens and residents

What is guaranteed issue insurance?

Key points

- Guaranteed issue life insurance is available regardless of medical history.

- Applying is easy, and older people can get covered.

- There are downsides, including high rates and a low death benefit.

What is the difference between open enrollment and guaranteed issue?

Whereas in open enrollment, you can choose any Medigap plan that is offered in your state, during a guaranteed issue you can typically only choose Medigap Plans A, B, C, F, K or L that's sold in your state by any insurance company.

What does guaranteed issue mean and why is this potentially very beneficial?

A requirement that health plans must permit you to enroll regardless of health status, age, gender, or other factors that might predict the use of health services.

What does guaranteed issue mean in health insurance?

Guaranteed issue laws require insurance companies to issue a health plan to any applicant – an individual or a group – regardless of the applicant's health status or other factors.

What is guaranteed issue period?

During guaranteed-issue periods, companies must sell you one of the required Medigap policies at the best price for your age, without a waiting period or health screening. Guaranteed-issue periods are generally shorter than open enrollment periods and do not include as many choices.

What is the major problem with guaranteed issue?

Except for the waiting period, guaranteed issue policies might sound too good to be true. Unhealthy people take out policies, pay their premiums, and die in a few months or a few years. The insurance company has to either return their money or pay a death benefit. How can insurers even afford to offer these policies?

What is guaranteed issue rights?

Guaranteed issue rights, also called Medigap protections, are your rights to purchase Medigap policies when you are not in your Medigap open enrollment period. These rights prevent insurance companies from denying you a Medigap policy or put conditions on buying one in certain situations.

Why do doctors not like Medicare Advantage plans?

If they don't say under budget, they end up losing money. Meaning, you may not receive the full extent of care. Thus, many doctors will likely tell you they do not like Medicare Advantage plans because private insurance companies make it difficult for them to get paid for their services.

What is guaranteed issue limit?

A guaranteed issue limit is the maximum amount for which an insurance company will insure an individual without receiving information concerning their insurability, i.e. a medical exam.

Is it necessary to have supplemental insurance with Medicare?

For many low-income Medicare beneficiaries, there's no need for private supplemental coverage. Only 19% of Original Medicare beneficiaries have no supplemental coverage. Supplemental coverage can help prevent major expenses.

Which of the following is a guaranteed issue right for Medicare beneficiaries?

You have a guaranteed issue right (which means an insurance company can't refuse to sell you a Medigap policy) in these situations: You're in a Medicare Advantage Plan, and your plan is leaving Medicare or stops giving care in your area, or you move out of the plan's service area.

What is the maximum out-of-pocket for Medicare Advantage plans?

The US government sets the standard Medicare Advantage maximum out-of-pocket limit every year. In 2019, this amount is $6,700, which is a common MOOP limit. However, you should note that some insurance companies use lower MOOP limits, while some plans may have higher limits.

What is the minimum guaranteed issue period for a Medicare supplement insurance policy?

What you can do with guaranteed issue: As early as 60 calendar days before the date your coverage will end but no later than 63 days after your coverage ends, you have the right to buy any Medicare Supplement insurance plan listed above that is sold in your state by any insurance company.

What is guaranteed issue rights?

Guaranteed issue rights are also known as Medigap protections. If you qualify, a private insurance company must abide by government regulations to give you access to certain Medicare Supplement plans, it must offer coverage for all pre-existing health conditions, and it cannot charge you a higher premium for the insurance plan due ...

How long do you have to have a trial right to buy Medicare?

In some cases, if you are in your “trial right” period for a Medicare Advantage (Part C) plan, which is up to 12 months after initial enrollment, you also have guaranteed issue rights to purchase a private supplemental health insurance plan during this special enrollment period. Federal law allows 63 days of guaranteed issue rights ...

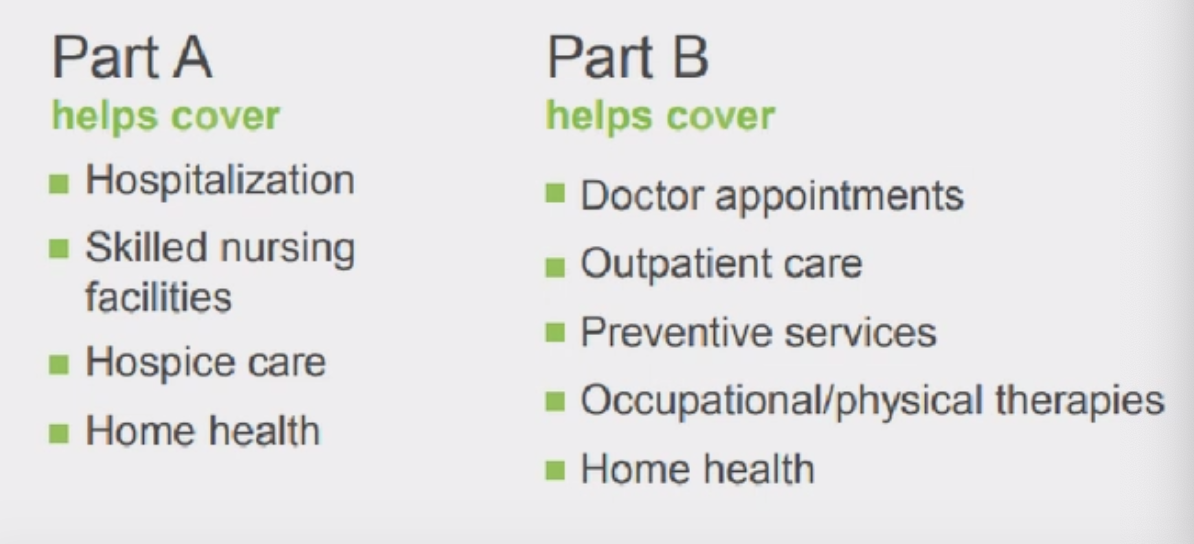

Does Medicare Supplement cover coinsurance?

A Medicare Supplement plan pays for coinsurance, copayments, and some of the deductibles that Original Medicare insurance does not cover. It also provides extended benefits in many cases.

Can you sell a Medicare Supplement policy?

Understanding Guaranteed Issue Rights. Private insurance companies are lawfully obligated to sell you a Medicare Supplement policy if you enroll during your initial enrollment period you qualify for guaranteed issue rights. Guaranteed issue rights are also known as Medigap protections.

What is a guaranteed issue right?

A Medigap guaranteed issue right allows you to purchase a Medicare Supplement insurance policy from any company without regard to your health condition. You only have a guaranteed issue right in certain situations. When you have a Medigap guaranteed issue right, insurance companies are lawfully required to sell or offer you a Medicare Supplement ...

What is Medicare Advantage?

You have a Medicare Advantage plan & you are moving out of the plan’s service area. You have Medicare Parts A and B (Original Medicare) & you need to replace an employer health plan that will soon be discontinued. You have Original Medicare and a Medicare SELECT policy & you move out of the policy’s service area.

What happens if you don't buy a Medigap policy?

If you do not buy a policy during your Medigap open enrollment period or a situation in which you have a guaranteed issue right, you will likely be required to go through medical underwriting. Medical underwriting could lead to a coverage denial or higher premiums.

Can I enroll in Medicare Supplement?

Enrolling in Medicare Supplement Insurance. If you get a Medicare Supplement insurance policy through a Medigap guaranteed issue right, you will have guaranteed access only to certain standardized Medicare Supplement Insurance plans. 1 You will be able to enroll in one of the following Medigap plans sold in your state: Plans A, B, C, F, K, or L.

Can you drop a Medigap policy to join Medicare?

You dropped a Medigap policy to join a Medicare Advantage plan for the first time & within the first year of joining you want to switch back to Medigap. Your Medigap insurance company goes bankrupt or ends your policy through no fault of your own.

Can I buy Medicare Supplement after open enrollment?

The following 8 situations may provide you with a guaranteed issue right that allows you to buy a Medicare Supplement insurance policy after your open enrollment period ends. An insurance company cannot refuse to sell you a Medicare Supplement insurance policy in the following situations: You have a Medicare Advantage plan & it is leaving Medicare ...

Can you get Medicare Supplement if you have pre-existing conditions?

When you have a Medigap guaranteed issue right, insurance companies are lawfully required to sell or offer you a Medicare Supplement insurance policy even if you have pre-existing conditions. In these situations, insurers cannot charge you more because of past or present health problems.

What are guaranteed issue rights for Medicare?

All Medicare beneficiaries are protected by law from unfair medical underwriting. Guaranteed issue rights prohibit insurance companies from denying or overcharging you a Medigap policy, regardless of any pre-existing health conditions.

What is trial rights in Medicare?

Trial rights when you enroll in Medicare Advantage or drop your Medigap coverage. Your Medicare Advantage plan is leaving your specific area or leaving Medicare. You decide to move out of the plan’s service area. An employer plan that supplements Medicare ends. The Medicare company did not follow the rules.

How long do you have to go back to Medicare if you change your mind?

The same rule applies if you enroll in a Medicare Advantage plan after turning 65. If you start with Original Medicare and a Medigap plan, you have 12 months to try Medicare Advantage.

What happens if you move out of your Medicare Advantage plan?

If you move out of your plan’s service area, you will lose coverage. As a result, you will be given a guaranteed-issue right to purchase a Medicare supplement plant in your NEW area. Your second option: choose a new Medicare Advantage plan. Another common situation is a Medicare Advantage plan folding or being terminated in your area.

How long is Medicare trial?

Medicare Advantage Trial Rights. Once you become eligible for Medicare at 65, you are given a 12 month trial with Medicare Advantage. If you change your mind, you can return back to Original Medicare. The same rule applies if you enroll in a Medicare Advantage plan after turning 65.

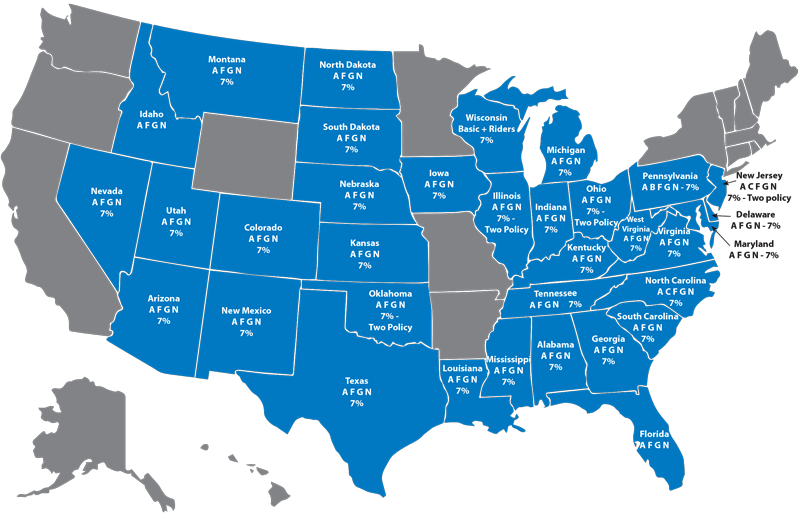

Which states have birthday rules for Medicare?

Medicare Supplement Guaranteed Issue States with The Birthday Rule. Oregon and California have “ Birthday Rules ,” allowing Medigap enrollees 30-days to change plans. The rule allows a switch to another Medigap plan with the same or lesser benefits, without medical underwriting.

What does it mean when you lose group insurance?

If you involuntary lose group coverage, this means your insurer is dropping your plan, although it is not your fault. This also includes the insurance company filing for bankruptcy. Involuntary means you did not cancel the coverage; nor are you losing coverage for non-payment. If you are losing group coverage involuntarily, ...