What is separate payment for home health?

Separate payment is allowed for the services involved in physician certification/re-certification and development of a plan of care for Medicare covered home health services. Use for re-certification after a patient has received services for at least 60 days (or one certification period).

What services are covered by the home health insurance program?

Services are covered for home health (HH) and hospice patients but are not covered for patients of Skilled Nursing Facilities (SNFs), nursing home facilities, or hospitals. All the below requirements must be met for services to be covered.

How many times can a patient be recertified for HH?

Medicare does not limit number of continuous episode recertifications for patients who continue to be eligible for HH benefit Physician recertifying patient's eligibility is physician that has been monitoring POC and providing oversight of HH services Examples of documentation to share at the point of referral

Can a certifying physician have financial relationship with HHA?

Certifying physician cannot have financial relationship with HHA unless it meets one of exceptions in 42 CFR 411.355-42 CFR 411.357 Certifying physician must attest:

What does HHH mean for Medicare?

Home Health and HospiceAcronym/Terminology IndexAcronymDefinitionHHHHome Health and HospiceHHSDepartment of Health and Human ServicesHICHealth Insurance ClaimHICNHealth Insurance Claim Number (Medicare Number)202 more rows

How does Medicare crossover claims work?

1. What is meant by the crossover payment? When Medicaid providers submit claims to Medicare for Medicare/Medicaid beneficiaries, Medicare will pay the claim, apply a deductible/coinsurance or co-pay amount and then automatically forward the claim to Medicaid.

What are the two types of computer claims systems?

The two types of computer claims systems are clearinghouse and carrier-direct.

What is the difference between manual and electronic claims submission?

An “electronic claim" is a paperless patient claim form generated by computer software that is transmitted electronically over the telephone or computer connected to a health insurer or other third-party payer (payer) for processing and payment, while A “manual claim” is a paper claim form that refers to either the ...

When might you use a crossover claim?

A crossover claim is a claim for a recipient who is eligible for both Medicare and Medicaid, where Medicare pays a portion of the claim, and Medicaid is billed for any remaining deductible and/or coinsurance.

What does crossover mean in Medi-Cal terms?

A type of clinical trial in which all participants receive the same two or more treatments, but the order in which they receive them depends on the group to which they are randomly assigned. For example, one group is randomly assigned to receive drug A followed by drug B.

How do I submit an electronic claim to Medicare?

How to Submit Claims: Claims may be electronically submitted to a Medicare Administrative Contractor (MAC) from a provider using a computer with software that meets electronic filing requirements as established by the HIPAA claim standard and by meeting CMS requirements contained in the provider enrollment & ...

What are two ways electronic claims can be submitted?

These claims can be stored on a data server and submitted either directly to the payer through direct data entry or via a clearinghouse. Both methods are more accessible and less fragmented than the use of paper claims, especially when shared among specialists.

How are claims submitted electronically?

Electronic claims can be generated in a practice management system and then transmitted either directly to the payer electronically in accordance with the health plan's submission requirements or indirectly through an application service provider (ASP) or cloud computing service, a clearinghouse, a billing service or ...

What are 3 advantages of electronic claims?

Filing claims electronically can offer a number of benefits, including:Minimize disruptions to your cash flow. ... Track claim status. ... Increase accuracy and cut down on claim rejections. ... Cut down on paperwork. ... Decrease overhead costs and staff time.

What is one disadvantage of electronic claims processing?

What is one disadvantage of electronic claims processing? The cost to implement the software system. Why is it important to follow optical character recognition rules when completing a claim form? If the claim cannot be read, it cannot be processed.

What are the advantages and disadvantages of electronic claims?

Advantages and Disadvantages of Electronic Claims and Patient...Pro: Access. The electronic medical file of a patient is more accessible than the old recording systems that used paper. ... Pro: Legible. ... Pro: Cost. ... Con: Privacy. ... Con: Start-Up Cost.

Required Enrollment Process

The following process is required and must be completed prior to initiation of electronic claims submission or inquiry.

Waiting for a Response

After processing, a confirmation will be sent to you as notification to begin filing claims electronically. If neither confirmation nor a returned packet is received after two weeks, please contact the Technology Support Center toll-free at 1-888-379-9132.

Testing

Once you have received your Submitter ID and Password from NGS, please call the ClaimShuttle Support Team and set up an appointment for Mailbox setup and Test Transmission.

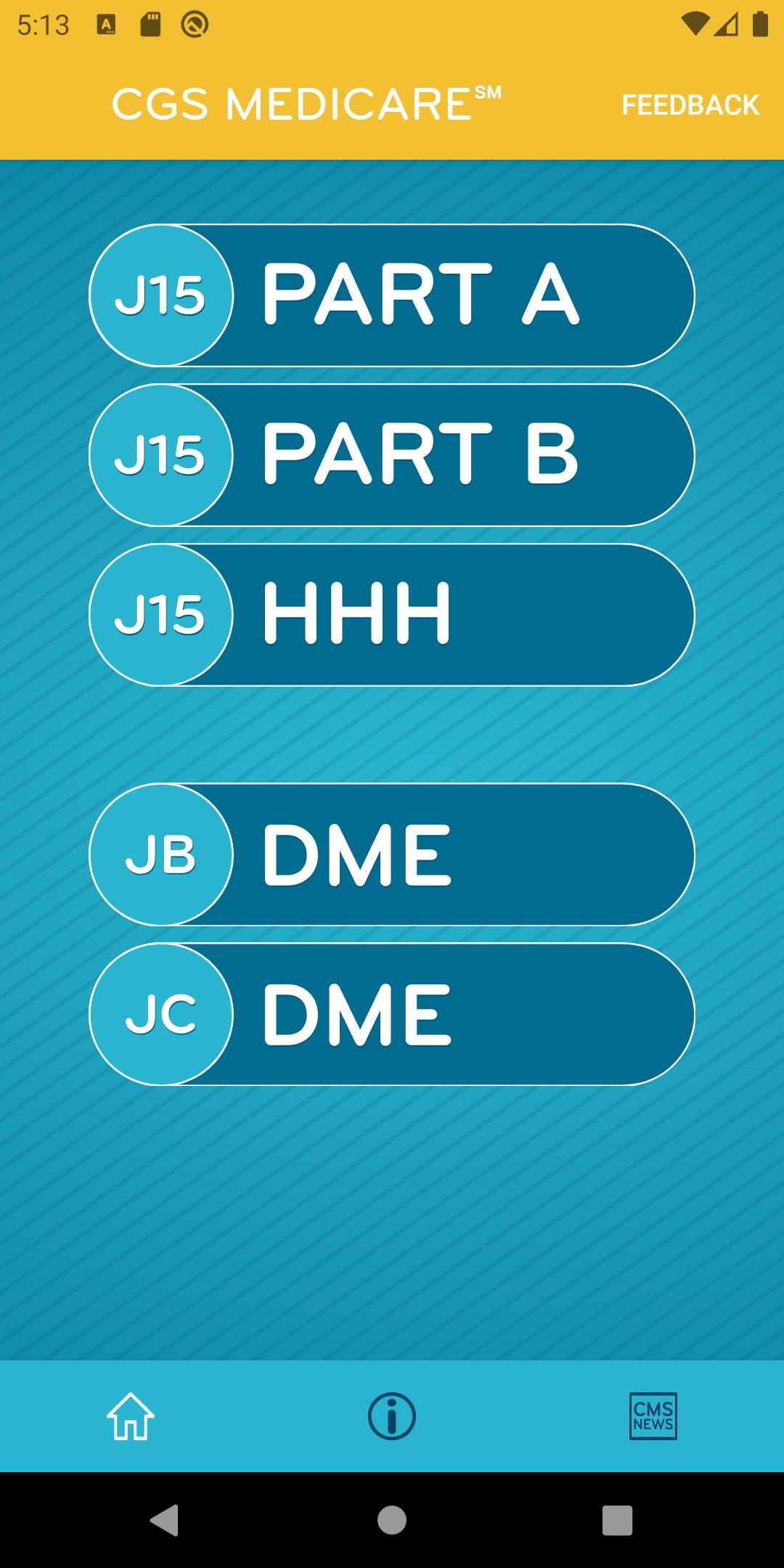

Jurisdiction M Home Health and Hospice MAC

Home Health and Hospice providers in Alabama, Arkansas, Florida, Georgia, Illinois, Indiana, Kentucky, Louisiana, Mississippi, New Mexico, North Carolina, Ohio, Oklahoma, South Carolina, Tennessee and Texas

COVID-19 Provider Enrollment and Accelerated Payment Telephone Hotline

The telephone hotline 1-833-820-6138 has been created for providers and suppliers to initiate provisional temporary Medicare billing privileges and address questions regarding provider enrollment flexibilities afforded by the COVID-19 waiver. The hotline is available Monday through Friday, from 8:30 a.m. to 5 p.m. ET. Learn More

What is the HCPCS code for hospice?

Hospices must report a HCPCS code along with each level of care revenue code (651, 652, 655 and 656) to identify the type of service location where that level of care was provided.

When did Medicare start paying hospice services?

(Rev. 3577, Issued: 08-05-16; Effective: 01-01-17; Implementation: 01-03-17) Effective January 1 , 2005, Medicare allows payment to a hospice for specified hospice pre-election evaluation and counseling services when furnished by a physician who is either the medical director of or employee of the hospice.

What is the hospice policy manual?

See Pub. 100-02, Medicare Benefit Policy Manual, chapter 9, for coverage requirements for Hospice benefits. This section addresses only claims submission. Before submitting claims, the hospice must submit a Notice of Election (NOE) to the A/B MAC (HHH). See section 20, of this chapter for information on NOE transaction types.

What is the Medicare election period?

Medicare systems refer to the 90-day or 60-day periods as ‘benefit periods.’ Therefore, hospices should be aware that when they see references to ‘election periods’ in regulation or in the Medicare Benefit Policy Manual, they are referring to what is called a ‘benefit period’ for purposes of claims processing.

What is the notr for hospice?

Hospices may submit an NOTR that corrects a revocation date previously submitted in error. In this case, the hospice reports the correct revocation date in the Through Date field and reports the original, incorrect revocation date using occurrence code 56. Medicare systems use the original, incorrect date to find the election record to be corrected, then replaces that revocation date with the corrected information.

When did hospice enter NPI?

For notice of elections effective prior to January 1, 2010, the hospice enters the National Provider Identifier (NPI) and name of the physician currently responsible for certifying the terminal illness, and signing the individual’s plan of care for medical care and treatment.

Does the hospice benefit period file have election related fields?

The hospice benefit period file pre-existed the episode period file and retains all the same fields it had historically, but election-related fields on those screens will no longer be used.

How often should I report a HHA?

It may be reported only once every 60 days, except in rare situation when patient starts a new episode before 60 days' elapses and requires a new plan of care to start a new episode. G0180. MD Certification HHA Patient. Use when patient has not received Medicare covered home health services for at least 60 days.

How many HCPCS codes are there?

There are two HCPCS codes for certification, recertification and development of plans of care for Medicare-covered home health. Separate payment is allowed for the services involved in physician certification/re-certification and development of a plan of care for Medicare covered home health services. HCPCS Code. Description.

When to use HCPCS G0180?

Use when patient has not received Medicare covered home health services for at least 60 days. The initial certification ( HCPCS G0180) cannot be filed on same date of service as supervision service ( HCPCS G0181 or G0182) Medicare will reimburse for only two CPO Hospice and Home Health Services. HCPCS Code.

What are the six disciplines of home health?

The six home health disciplines included in the 60-day episode rate are: Skilled Nurse on an intermittent/part-time basis. Home Health aides on an intermittent/part-time basis. Physical Therapy. Occupational Therapy.

Can a certified physician have a financial relationship with HHA?

Certifying physician cannot have financial relationship with HHA unless it meets one of exceptions in 42 CFR 411.355-42 CFR 411.357. Certifying physician must attest: The six home health disciplines included in the 60-day episode rate are:

Is hospice covered by SNF?

Services are covered for home health (HH) and hospice patients but are not covered for patients of Skilled Nursing Facilities (SNFs), nursing home facilities, or hospitals. All the below requirements must be met for services to be covered.

Does a hospice physician have a contractual interest in HHA?

If beneficiary is receiving Home Health Agency (HHA) services, physician does not have a significant financial or contractual interest in HHA. A physician who is an employee of a hospice, including a volunteer medical director, should not bill CPO services.