Original Medicare measures your coverage for hospital or skilled nursing care in terms of a benefit period. Beginning the day you are admitted into a hospital or skilled nursing facility, the benefit period will end when you go 60 consecutive days without care in a hospital or skilled nursing facility. A deductible applies for each benefit period.

Full Answer

What is Medicare Part a (hospital insurance)?

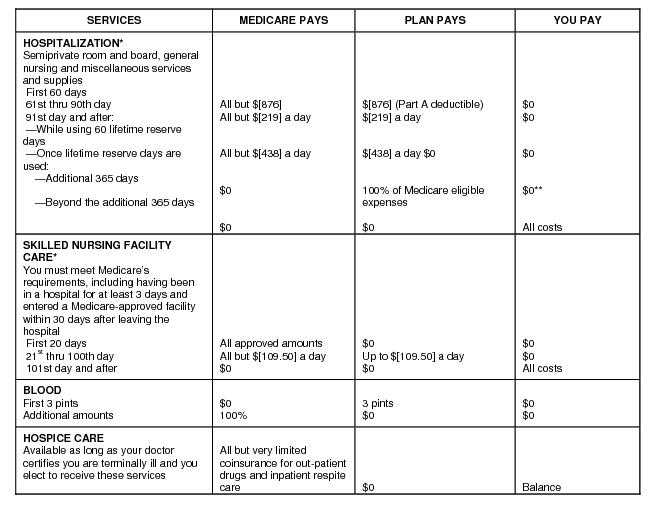

Medicare Part A (Hospital Insurance) covers hospital services, including these: Semi-private rooms. Meals. General nursing. Drugs as part of your inpatient treatment. Other hospital services and supplies.

When does Medicare cover inpatient hospital care?

Inpatient hospital care. covers inpatient hospital care when all of these are true: You’re admitted to the hospital as an inpatient after an official doctor’s order, which says you need inpatient hospital care to treat your illness or injury. The hospital accepts Medicare.

What are the rules for meeting with a Medicare agent?

Independent agents and brokers selling plans must be licensed by the state, and the plan must tell the state which agents are selling their plans. If you're going to meet with an agent, the agent must follow all the rules for Medicare plans and some specific rules for meeting with you.

How does Medicare pay for health insurance?

Medicare will pay based on what the group health plan paid, what the group health plan allowed, and what the doctor or health care provider charged on the claim. You'll have to pay any costs Medicare or the group health plan doesn't cover.

How Long Does Medicare pay for a hospital stay?

90 daysMedicare covers a hospital stay of up to 90 days, though a person may still need to pay coinsurance during this time. While Medicare does help fund longer stays, it may take the extra time from an individual's reserve days. Medicare provides 60 lifetime reserve days.

What is the 21 day rule for Medicare?

How much is covered by Original Medicare? For days 1–20, Medicare pays the full cost for covered services. You pay nothing. For days 21–100, Medicare pays all but a daily coinsurance for covered services.

Does Medicare pay 100 percent of hospital bills?

According to the Centers for Medicare and Medicaid Services (CMS), more than 60 million people are covered by Medicare. Although Medicare covers most medically necessary inpatient and outpatient health expenses, Medicare reimbursement sometimes does not pay 100% of your medical costs.

What are the rules of Medicare?

7 Essential Medicare Rules You Need to KnowEligibility begins at 65. ... There are penalties for signing up late. ... Higher earners pay more for Part B. ... You can have original Medicare or Medicare Advantage -- but not both. ... You can have Medicare plus private insurance. ... Medicare and health savings accounts don't mix.More items...•

What happens when Medicare hospital days run out?

Medicare will stop paying for your inpatient-related hospital costs (such as room and board) if you run out of days during your benefit period. To be eligible for a new benefit period, and additional days of inpatient coverage, you must remain out of the hospital or SNF for 60 days in a row.

How are hospital days counted?

Determine total inpatient days of care by adding together the daily patient census for 365 days. Determine total bed days available by multiplying the total number of beds available in the hospital or inpatient unit by 365. Divide total inpatient days of care by the total bed days available.

What is the 3 day rule for Medicare?

The 3-day rule requires the patient have a medically necessary 3-day-consecutive inpatient hospital stay. The 3-day-consecutive stay count doesn't include the day of discharge, or any pre-admission time spent in the ER or outpatient observation.

What is the out of pocket max for Medicare?

Out-of-pocket limit. In 2021, the Medicare Advantage out-of-pocket limit is set at $7,550. This means plans can set limits below this amount but cannot ask you to pay more than that out of pocket.

What procedures are not covered by Medicare?

Some of the items and services Medicare doesn't cover include:Long-Term Care. ... Most dental care.Eye exams related to prescribing glasses.Dentures.Cosmetic surgery.Acupuncture.Hearing aids and exams for fitting them.Routine foot care.

What are the 4 types of Medicare?

There are four parts of Medicare: Part A, Part B, Part C, and Part D.Part A provides inpatient/hospital coverage.Part B provides outpatient/medical coverage.Part C offers an alternate way to receive your Medicare benefits (see below for more information).Part D provides prescription drug coverage.

Who qualifies for free Medicare Part A?

You are eligible for premium-free Part A if you are age 65 or older and you or your spouse worked and paid Medicare taxes for at least 10 years. You can get Part A at age 65 without having to pay premiums if: You are receiving retirement benefits from Social Security or the Railroad Retirement Board.

Do I automatically get Medicare when I turn 65?

Yes. If you are receiving benefits, the Social Security Administration will automatically sign you up at age 65 for parts A and B of Medicare. (Medicare is operated by the federal Centers for Medicare & Medicaid Services, but Social Security handles enrollment.)

How many employees does a spouse have to have to be on Medicare?

Your spouse’s employer must have 20 or more employees, unless the employer has less than 20 employees, but is part of a multi-employer plan or multiple employer plan. If the group health plan didn’t pay all of your bill, the doctor or health care provider should send the bill to Medicare for secondary payment.

What is the phone number for Medicare?

It may include the rules about who pays first. You can also call the Benefits Coordination & Recovery Center (BCRC) at 1-855-798-2627 (TTY: 1-855-797-2627).

What is a Medicare company?

The company that acts on behalf of Medicare to collect and manage information on other types of insurance or coverage that a person with Medicare may have, and determine whether the coverage pays before or after Medicare. This company also acts on behalf of Medicare to obtain repayment when Medicare makes a conditional payment, and the other payer is determined to be primary.

How long does it take for Medicare to pay a claim?

If the insurance company doesn't pay the claim promptly (usually within 120 days), your doctor or other provider may bill Medicare. Medicare may make a conditional payment to pay the bill, and then later recover any payments the primary payer should have made. If Medicare makes a. conditional payment.

What is a group health plan?

If the. group health plan. In general, a health plan offered by an employer or employee organization that provides health coverage to employees and their families.

How does Medicare work with other insurance?

When there's more than one payer, "coordination of benefits" rules decide which one pays first. The "primary payer" pays what it owes on your bills first, and then sends the rest to the "secondary payer" (supplemental payer) ...

Which pays first, Medicare or group health insurance?

If you have group health plan coverage through an employer who has 20 or more employees, the group health plan pays first, and Medicare pays second.

How many days can a skilled nursing facility be covered by Medicare?

The facility must be Medicare-approved to provide skilled nursing care. Coverage is limited to a maximum of 100 days per benefit period, with coinsurance requirements of $164.50 per day in 2017 for Days 21 through 100. Coverage includes: A semiprivate room.

How long does Medicare cover nursing?

Original Medicare measures your coverage for hospital or skilled nursing care in terms of a benefit period. Beginning the day you are admitted into a hospital or skilled nursing facility, the benefit period will end when you go 60 consecutive days without care in a hospital or skilled nursing facility. A deductible applies for each benefit period.

How much do you have to pay for Medicare after day 91?

For Days 61-90, beneficiaries are responsible for coinsurance costs. (In 2017, beneficiaries must pay $329 per day.) Beneficiaries are entitled to use lifetime reserve days (60 additional days) after Day 91. If those reserve days are used, beneficiaries must pay $658 per day in 2017. If you choose not to use your lifetime reserve, all Medicare coverage stops after 90 days of inpatient care or after 60 days without any skilled care for this benefit period.

How long does Medicare deductible last?

A deductible applies for each benefit period. Your benefit period with Medicare does not end until 60 days after discharge from the hospital or the skilled nursing facility. Therefore, if you are readmitted within those 60 days, you are considered to be in the same benefit period.

What is Medicare Part A?

Medicare Part A – Hospital Insurance. Medicare Part A, often referred to as hospital insurance, is Medicare coverage for hospital care , skilled nursing facility care, hospice care, and home health services. It is usually available premium-free if you or your spouse paid Medicare taxes for a certain amount of time while you worked, ...

How much does Medicare pay for Grandpa's stay?

Grandpa is admitted to the hospital September 1, 2017. After he pays the deductible of $1,316, Medicare will pay for the cost of his stay for 60 days. If he stays in the hospital beyond 60 days, he will be responsible for paying $329 per day, with Medicare paying the balance.

What is home health care?

Home health care is care provided to you at home, typically by a visiting nurse or home health care aide. Medicare Part A covers medically necessary home health care offered by a provider certified by Medicare to provide home health care. Medicare pays the lower of:

How much of Medicare coinsurance do you pay?

at the start of each year, and you usually pay 20% of the cost of the Medicare-approved service, called coinsurance. If you want drug coverage, you can add a separate drug plan (Part D).

What is deductible in Medicare?

deductible. The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. at the start of each year, and you usually pay 20% of the cost of the Medicare-approved service, called coinsurance.

What is a medicaid supplement?

A Medicare Supplement Insurance (Medigap) policy can help pay some of the remaining health care costs, like copayments, coinsurance, and deductibles. Some Medigap policies also cover services that Original Medicare doesn't cover, like medical care when you travel outside the U.S.

How much will Medicare cost in 2021?

If you aren't eligible for premium-free Part A, you may be able to buy Part A. You'll pay up to $471 each month in 2021. If you paid Medicare taxes for less than 30 quarters, the standard Part A premium is $458. If you paid Medicare taxes for 30–39 quarters, the standard Part A premium is $259.

What is Medicare for people 65 and older?

Medicare is the federal health insurance program for: People who are 65 or older. Certain younger people with disabilities. People with End-Stage Renal Disease (permanent kidney failure requiring dialysis or a transplant, sometimes called ESRD)

Do you pay Medicare premiums if you are working?

You usually don't pay a monthly premium for Part A if you or your spouse paid Medicare taxes for a certain amount of time while working. This is sometimes called "premium-free Part A."

Does Medicare Advantage cover vision?

Most plans offer extra benefits that Original Medicare doesn’t cover — like vision, hearing, dental, and more. Medicare Advantage Plans have yearly contracts with Medicare and must follow Medicare’s coverage rules. The plan must notify you about any changes before the start of the next enrollment year.

What does Medicare Part B cover?

Part B also covers durable medical equipment, home health care, and some preventive services.

Does Medicare cover tests?

Medicare coverage for many tests, items, and services depends on where you live . This list includes tests, items, and services (covered and non-covered) if coverage is the same no matter where you live.

Does Medicare cover travel?

If you have Original Medicare and have a Medigap policy, it may provide coverage for foreign travel emergency health care. Learn more about Original Medicare outside the United States.

Can you voluntarily terminate Medicare Part B?

Voluntary Termination of Medicare Part B. You can voluntarily terminate your Medicare Part B (medical insurance). It is a serious decision. You must submit Form CMS-1763 ( PDF, Download Adobe Reader) to the Social Security Administration (SSA). Visit or call the SSA ( 1-800-772-1213) to get this form.