Does irmaa adjust annually?

Nov 13, 2021 · IRMAA is determined by income from your income tax returns two years prior. This means that for your 2022 Medicare premiums, your 2020 income tax return is used. This amount is recalculated annually. The IRMAA surcharge will be added to your 2022 premiums if your 2020 income was over $91,000 (or $182,000 if you’re married), but as discussed below, …

Does irmaa apply to Medicare Advantage plans?

The Medicare IRMAA is based on how much you earn in one year—you must make less than $88,000 per year or less as an individual or $176,000 per year or less as a couple if you want to avoid paying an extra cost. IRMAA stands for Income Related Monthly Adjustment Amount. Medicare IRMAA is added to Part B & Part D premiums.

How to calculate irmaa income?

Nov 16, 2021 · An IRMAA is a surcharge added to your monthly Medicare Part B and Part D premiums, based on your yearly income. The Social Security Administration (SSA) uses your income tax information from 2...

How is Irma income calculated?

Apr 08, 2021 · If you have a Medicare Advantage plan, you will also be subject to IRMAA charges on the affected portions of the plan. IRMAA charges are based on your yearly income as reported on your tax return. Specifically, the Social Security Administration (SSA) uses your Modified Adjusted Gross Income (MAGI) for its calculations.

What income is Irmaa based on?

Who Pays IRMAA? As noted above, only individuals who earn more than $88,000 and married couples filing jointly who earn more than $176,000 are required to pay IRMAA.Nov 11, 2021

Is Irmaa based on AGI or magi?

IRMAA charges are based on your income. The SSA calculates the IRMAA amount using your modified adjusted gross income (MAGI) according to your tax returns from 2 years ago.Dec 14, 2020

How is Irmaa calculated 2021?

The income used to determine IRMAA is your AGI plus muni bond interest from two years ago. Your 2020 income determines your IRMAA in 2022. Your 2021 income determines your IRMAA in 2023. The untaxed Social Security benefits aren't included in the income for determining IRMAA.7 days ago

What are the 2021 Irmaa brackets?

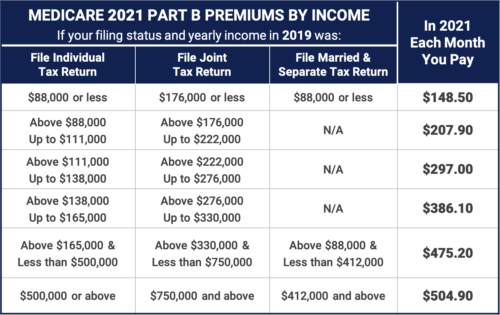

C. IRMAA tables of Medicare Part B premium year for three previous yearsIRMAA Table2021More than $138,000 but less than or equal to $165,000$386.10More than $165,000 but less than $500,000$475.20More than $500,000$504.90Married filing jointly12 more rows•Dec 6, 2021

Is Irmaa based on taxable income?

IRMAA is determined by income from your income tax returns two years prior. This means that for your 2022 Medicare premiums, your 2020 income tax return is used. This amount is recalculated annually.

How do you calculate Magi for Irmaa?

MAGI is calculated as Adjusted Gross Income (line 11 of IRS Form 1040) plus tax-exempt interest income (line 2a of IRS Form 1040).Jan 25, 2022

Does Social Security income count towards Irmaa?

Some examples of what counts as income towards IRMAA are: Wages, Social Security benefits, Pension/Rental income, Interest, Dividends, distributions from any tax-deferred investment like a Traditional 401(k) or IRA and, again, Capital Gains.

What will Irmaa be in 2022?

Your 2022 IRMAA is based on your Modified Adjusted Gross Income (MAGI) from 2020. The Medicare Part B 2022 standard monthly premium is $170.10. Updated 2022 IRMAA brackets can increase Medicare Part B monthly premiums by as much as $408.20 and Medicare Part D monthly premiums by as much as $77.90.Mar 28, 2022

Does Social Security count towards Irmaa?

The tax-exempt Social Security isn't included in the MAGI calculation for the IRMAA.Dec 18, 2018

What is IRMAA?

For Medicare beneficiaries who earn over $91,000 a year – and who are enrolled in Medicare Part B and/or Medicare Part D – it’s important to unders...

How is my income used in my IRMAA determination?

IRMAA is determined by income from your income tax returns two years prior. This means that for your 2022 Medicare premiums, your 2020 income tax r...

Can I appeal the IRMAA determination?

You can appeal the IRMAA determination – filing for a redetermination – if you believe that your calculation is erroneous. In addition, if you have...

How is Medicare Part B Premium Figure?

Most people have a $0 premium for their Medicare Part A hospital insurance. But as you probably know there is a monthly premium assigned for your Medicare Part B . The standard Medicare Part B premium in 2021 is $148.50 per month. That is for individuals making less than $88,000 a year and joint earners making less than $176,000 a year.

What Is Medicare IRMAA?

Here is a web page from Medicare’s website on IRMAA. You can see here under the “What Is It Heading.” It states, You’ll get this notice if you have Medicare Part B and/or Medicare Part D and social security determines that any Income Related Monthly Adjustment Amounts (IRMAA) apply to you.

What Aspects of Medicare are Affected by IRMAA?

Medicare is an essential public service for the elderly here in America, which helps cover medical expenses in various terms. Some people will be more affected by these changes than others due to their specific needs when it comes down to coverage.

How Much is Medicare Part B Premium 2021?

The cost for Medicare Part B premium in 2021 is $148.50 per month, and an additional IRMAA surcharge may apply depending on your income. This surcharge amount varies based on how you filed taxes two years ago (IRS tax return information).

How much will IRMAA Charge Me for Medicare Part D?

It can be a little challenging to figure out the monthly premium for Medicare Part D plans. The company offering the policy will determine its price, and since there’s no standard, it could range from one program to another. But that’s not all! You also have to add surcharges into your calculations depending on how you filed taxes two years ago.

Important YouTube Channel Details

I appreciate you looking through my article. If it is interesting to you, please subscribe to my YouTube channel.

What is an IRMAA?

Takeaway. An IRMAA is a surcharge added to your monthly Medicare Part B and Part D premiums, based on your yearly income. The Social Security Administration (SSA) uses your income tax information from 2 years ago to determine if you owe an IRMAA in addition to your monthly premium. The surcharge amount you’ll pay depends on factors like your income ...

Who does IRMAA apply to?

IRMAA applies to Medicare beneficiaries who have higher incomes. Keep reading to learn more about IRMAA, how it works, and the parts of Medicare that it applies to.

How much is the IRMAA premium for 2021?

In 2021, the standard monthly premium for Part B is $148.50. Depending on your yearly income, you may have an additional IRMAA surcharge. This amount is calculated using your income tax information from 2 years ago. So, for 2021, your tax information from 2019 will be assessed.

How to contact Medicare directly?

SSA. To get information about IRMAA and the appeals process, the SSA can be contacted directly at 800-772-1213.

What is the state health insurance program?

The State Health Insurance Assistance Program (SHIP) provides free assistance with your Medicare questions. You can find out how to contact your state’s SHIP program here. Medicaid. Medicaid is a joint federal and state program that assists people who have a lower income or resources with their medical costs.

How many people will be covered by Medicare in 2027?

It’s made up of several parts. In 2019, Medicare covered about 61.5 million Americans and is predicted to increase to 75 million by 2027. Many parts of Medicare involve paying a monthly premium. In some cases, your monthly premium may be adjusted based on your income.

What is Medicare Part C?

Medicare Part C. Part C is also referred to as Medicare Advantage. These plans often cover services that original Medicare (parts A and B) don’t cover, such as dental, vision, and hearing. Part C is not affected by IRMAA.

How to appeal an IRMAA?

If you want to appeal your IRMAA, you should visit the Social Security website for the form called Request for Reconsideration. The form will give you three options on how to appeal, with the easiest and most common way being a case review. Documentation is an essential thing in any appeal.

How does Social Security determine if you owe an IRMAA?

The Social Security Administration determines if you owe an IRMAA based on the income you reported on your IRS tax return two years prior. If you feel you’re higher Part B premium is incorrect, there are steps you can take to appeal IRMAA.

How to request a new initial determination for Medicare?

You can request a new initial determination by submitting a Medicare IRMAA Life-Changing Event form. You can also schedule an appointment with Social Security. Documentation will be required with either your correct income or of the life-changing event that caused your income to go down.

Can you appeal Medicare Part B?

You can appeal your Medicare Part B premium increase for outdated or incorrect information when you: Filed an amended tax return with the IRS. Have a more recent tax return that shows you are receiving a lower income than previously reported.

What happens if you sell real estate and earn a profit?

For example, if you sell some real estate and earn a profit, that money could push your income into a higher tax bracket and a higher IRMAA bracket.

What does IRMAA mean?

Understanding IRMAA. IRMAA stands for the Income Related Monthly Adjustment Amount that is added to some people’s Medicare premiums. While most people who receive Medicare benefits when they reach age 65 will never have to worry about IRMAA, those with higher incomes are charged extra each month for their coverage.

Why is IRMAA so tricky?

Why IRMAA Can Be Tricky. When the SSA determines your IRMAA charges, they use your MAGI from two years prior to the year in question. For example, premiums for 2021 are based on the income from your 2019 tax return. This means that decisions you make could come back to haunt you in the future.

How to increase your income?

Some common income-boosters to be aware of include: 1 Selling real estate, especially if you’ve owned it for a long time and it has significantly increased in value. 2 Selling investments subject to capital gains taxes. These transactions typically occur outside of your IRA or 401 (k) in brokerage accounts. 3 Converting a traditional IRA to a Roth, which leaves you open to a big tax liability and IRMAA charges on the lump sum, which is considered income.

How to avoid IRMAA?

Tips for Avoiding an IRMAA Charge. In general, the best way to avoid unwanted IRMAA charges is to make sure your income remains steady throughout retirement. This means remaining just as vigilant about your IRMAA bracket as you are about your marginal tax rates.

When do you have to take RMD?

Another common income-booster comes when you turn 72 and must take required minimum distributions (RMD) from a traditional IRA or 401 (k). If you plan carefully, you can reduce other portions of your income so this balances out, or you can consider giving your RMD to charity if you itemize deductions.

Does Medicare Advantage have IRMAA?

If you have a Medicare Advantage plan, you will also be subject to IRMAA charges on the affected portions of the plan. IRMAA charges are based on your yearly income as reported on your tax return. Specifically, the Social Security Administration (SSA) uses your Modified Adjusted Gross Income (MAGI) for its calculations.

What does IRMAA mean?

IRMAA is an acronym for, “the Income Related monthly Adjustment Amount.”. What IRMAA does is increase the amount you are required to pay for Medicare part B and D based upon how much income you receive in retirement.

How much does Medicare pay if you make 140,000 a year?

This means that if you are a single earner making $140,000 a year, you will pay the standard premium of $148.50 plus an additional $237.6 in IRMAA every month, or a total Medicare Part B premium of $386.10 per month.

What is the IRMAA?

The Income Related monthly Adjustment Amount (IRMAA) is an additional surcharge that raises the amount higher income individuals will pay for Medicare. IRMAA applies to Medicare parts B and D.

How much will Medicare cost in 2021?

In 2021, the average expenditure for part B is set at $594.00 a month. In other words, the government expects that the overall national expense for Medicare Part B divided by the number of individuals enrolled in Medicare part B will result in an average cost of $594.00 per person per month. Of course, $594.00 is not what retirees pay ...

Does IRMAA require you to pay more for Medicare?

In other words, IRMAA requires Individuals who make more money to pay more for Medicare to help foot the Medicare bills for individuals who make less money. Whether or not you will be subject to IRMAA is entirely dependent upon your income in retirement.

Do people with higher incomes pay more for Medicare?

Individuals with higher incomes will pay more for their Medicare premiums. The income used by the government to calculate your premiums comes from your tax return from two years previous. You are placed in one of six brackets based upon your income.

What is IRMAA in insurance?

IRMAA is an extra charge added to your premium. If your yearly income in 2019 (for what you pay in 2021) was. You pay each month (in 2021) File individual tax return. File joint tax return. File married & separate tax return. $88,000 or less. $176,000 or less. $88,000 or less.

What is Medicare Part B?

Some people automatically get. Medicare Part B (Medical Insurance) Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services. , and some people need to sign up for Part B. Learn how and when you can sign up for Part B. If you don't sign up for Part B when you're first eligible, ...

How much do you pay for Medicare after you meet your deductible?

After you meet your deductible for the year, you typically pay 20% of the. Medicare-Approved Amount. In Original Medicare, this is the amount a doctor or supplier that accepts assignment can be paid. It may be less than the actual amount a doctor or supplier charges.

Do you pay Medicare premiums if your income is above a certain amount?

If your modified adjusted gross income is above a certain amount, you may pay an Income Related Monthly Adjustment Amount (IRMAA). Medicare uses the modified adjusted gross income reported on your IRS tax return from 2 years ago.