What Are Medicare Lifetime Reserve Days?

- Medicare Part A pays for inpatient hospital care.

- During each benefit period, Medicare covers up to 90 days of inpatient hospitalization.

- After 90 days, Medicare gives you 60 additional days of inpatient hospital care to use during your lifetime.

- For each of these “lifetime reserve days” you use in 2021, you’ll pay a daily coinsurance of $742.

Full Answer

Does Medicare have lifetime limits?

Jan 21, 2022 · Medicare lifetime reserve days are used if you have an inpatient hospital stay that lasts beyond the 90 days per benefit period covered under Medicare Part A. Medicare recipients have 60 Medicare lifetime reserve days available to them, and they come with a $778 daily co-insurance cost in 2022. Medicare Part A inpatient hospital insurance covers “hospital services, …

Is there a lifetime maximum for Medicare?

Lifetime reserve days Original Medicare covers up to 90 days of inpatient hospital care each benefit period. You also have an additional 60 days of coverage, called lifetime reserve days. These 60 days can be used only once, and you will pay a …

Are retirement dates required on Medicare claim?

• A Medicare beneficiary will be deemed to have elected not to use LRDs in the following situations: • The average daily charge for covered services furnished during a lifetime reserve billing period is equal to or less than the coinsurance amount for LRDs; and • The hospital is reimbursed on a cost reimbursement basis; or

What is the lifetime cap on Medicare?

A beneficiary runs out of the inpatient hospital care given by the Medicare plan on crossing a 90-day mark. However, Medicare Part A covers the expenses of such additional 60 days, called lifetime reserve days. You can use your lifetime reserve days only once throughout your lifetime.

What does lifetime reserve mean in Medicare?

Lifetime reserve days are additional days in the hospital that Original Medicare pays for if you are hospitalized for more than 90 days. You have only 60 of these days over the course of your lifetime. Medicare pays all covered costs for each lifetime reserve day, but you have to pay daily coinsurance.

What happens when you run out of Medicare days?

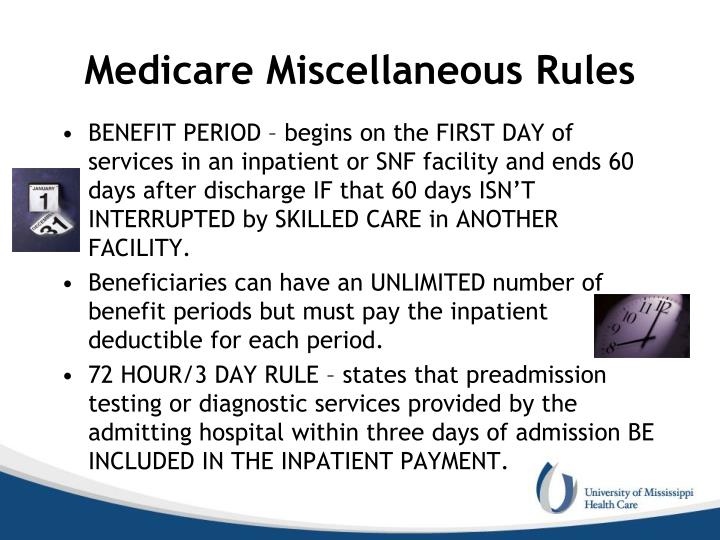

Medicare will stop paying for your inpatient-related hospital costs (such as room and board) if you run out of days during your benefit period. To be eligible for a new benefit period, and additional days of inpatient coverage, you must remain out of the hospital or SNF for 60 days in a row.

What is the meaning of lifetime reserve days?

Key Takeaways. Lifetime reserve days are the number of days of hospital stay that an insurance policy covers beyond the number of days allotted per benefit period.They are most commonly associated with Medicare policies.As of 2020, Medicare Part A offered 60 lifetime reserve days during a patient's lifetime.

How many lifetime reserve days does Medicare cover?

60 daysOriginal Medicare covers up to 90 days of inpatient hospital care each benefit period. You also have an additional 60 days of coverage, called lifetime reserve days. These 60 days can be used only once, and you will pay a coinsurance for each one ($778 per day in 2022).

Are lifetime reserve days renewable?

What are lifetime reserve days? Medicare Part A covers up to 60 additional lifetime reserve days. These are available when you have used all 90 covered hospital days during a single benefit period. Reserve days are not renewable and can be used only once during your lifetime.

When can lifetime reserve days in Medicare Part A be renewed?

First, your 60 lifetime reserve days don't renew if you start a new benefit period. This set of extra days can only be used once in your life. Second, you'll pay coinsurance for each lifetime reserve day you use. In 2021, this amount is $742 for each lifetime reserve day.Jun 30, 2020

Does Medicare have a maximum lifetime benefit?

A. In general, there's no upper dollar limit on Medicare benefits. As long as you're using medical services that Medicare covers—and provided that they're medically necessary—you can continue to use as many as you need, regardless of how much they cost, in any given year or over the rest of your lifetime.

How Long Does Medicare pay for hospital stay?

90 daysMedicare covers a hospital stay of up to 90 days, though a person may still need to pay coinsurance during this time. While Medicare does help fund longer stays, it may take the extra time from an individual's reserve days. Medicare provides 60 lifetime reserve days.May 29, 2020

How long is a Medicare Part A benefit period?

60 daysKey Points to Remember About Medicare Part A Costs: A benefit period begins when you enter the hospital and ends when you are out for 60 days in a row. One benefit period may include more than one hospitalization. Medicare Advantage plans may or may not charge deductibles for hospital stays.

What is the Medicare 2 midnight rule?

The Two-Midnight rule, adopted in October 2013 by the Centers for Medicare and Medicaid Services, states that more highly reimbursed inpatient payment is appropriate if care is expected to last at least two midnights; otherwise, observation stays should be used.Nov 1, 2021

What is Medicare Part A deductible for 2021?

Medicare Part A Premiums/Deductibles The Medicare Part A inpatient hospital deductible that beneficiaries will pay when admitted to the hospital will be $1,484 in 2021, an increase of $76 from $1,408 in 2020.Nov 6, 2020

What does maximum lifetime benefit mean?

Lifetime maximum benefit – or maximum lifetime benefit – is the maximum dollar amount a health plan will pay in benefits to an insured individual during that individual's lifetime. The ACA did away with lifetime benefit maximums for essential health benefits.

How long does Medicare cover hospital stays?

For each inpatient hospital stay, you’re eligible for up to 90 days of coverage.

How many days can you use Medicare Part A?

If you receive inpatient care in a hospital or long-term care facility for longer than 90 days, Medicare Part A gives you 60 extra days of coverage called lifetime reserve days. This set number of lifetime reserve days can be used only once over the course of your lifetime. Once you’ve used them all, you’ll pay the full cost ...

How many days of hospitalization does Medicare cover?

During each benefit period, Medicare covers up to 90 days of inpatient hospitalization. After 90 days, Medicare gives you 60 additional days of inpatient hospital care to use during your lifetime. For each of these “lifetime reserve days” you use in 2021, you’ll pay a daily coinsurance of $742. When you’re sick or injured ...

How long does Medicare cover inpatient care?

If you’re admitted to a hospital or long-term care facility for inpatient care, Medicare Part A covers up to 90 days of treatment during each benefit period. If you need to remain in the hospital after those 90 days are up, you have an additional 60 days of coverage, known as lifetime reserve days. You should know a couple ...

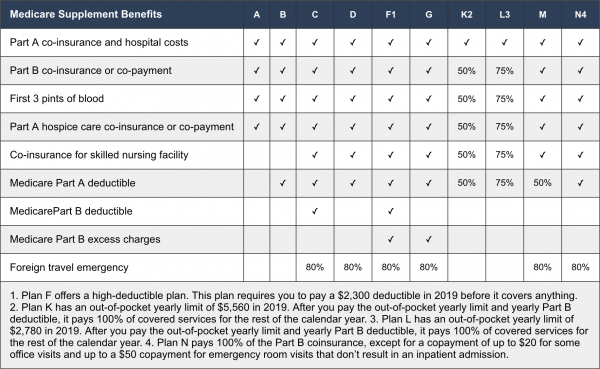

Does Medigap pay for coinsurance?

If you have a Medigap policy, it can help you pay your coinsurance costs. All Medigap plans will pay your hospital coinsurance and give you up to an additional 365 days of inpatient hospital care after you’ve used your lifetime reserve days.

What is a lifetime reserve day?

Summary. Lifetime reserve days are additional days that Medicare Part A covers for extended hospital stays. Medicare offers 60 lifetime reserve days that begin on day 91 that a person is required to remain in hospital. When a person chooses to use their lifetime reserve days, copayments will still apply.

How long does Medicare cover hospital stays?

Medicare Part A covers eligible inpatient costs for a hospital admission that lasts between 1 and 90 days. Medicare provides additional coverage for hospital stays that go beyond 90 days. This extra coverage is known as lifetime reserve days. Beneficiaries receive 60 lifetime reserve days that begin on day 91 of hospitalization.

What is the best Medicare plan?

We may use a few terms in this piece that can be helpful to understand when selecting the best insurance plan: 1 Deductible: This is an annual amount that a person must spend out of pocket within a certain time period before an insurer starts to fund their treatments. 2 Coinsurance: This is a percentage of a treatment cost that a person will need to self-fund. For Medicare Part B, this comes to 20%. 3 Copayment: This is a fixed dollar amount that an insured person pays when receiving certain treatments. For Medicare, this usually applies to prescription drugs.

How long can you stay in a hospital with Medicare?

Medicare Part A plans have lifetime reserve days that a person can use for an inpatient hospital stay that stretches beyond 90 days. Out-of-pocket costs may still apply. Medicare is a health program federally funded for adults aged 65 and older, or those under 65 with specific disabilities. Medicare Part A covers eligible inpatient hospital charges ...

What is Medicare Part A?

Medicare Part A coverage includes most services and care related to an inpatient hospital stay, including: hospital rooms (semi-private) general nursing care. hospital services and equipment. medication. meals. Before Medicare covers an inpatient stay, the beneficiary pays a deductible.

How much is the Medicare deductible for 2021?

In 2021, the Part A deductible is $1,484 per benefit period. Medicare Part A measures the use of inpatient services according to the benefit period. The Medicare benefit period starts on the first day a person is admitted to a hospital and ends when a person has been home from the hospital for 60 days.

What is the difference between coinsurance and deductible?

Coinsurance: This is a percentage of a treatment cost that a person will need to self-fund. For Medicare Part B, this comes to 20%.

How many LTR days are there in a hospital?

Each beneficiary has 60 lifetime reserve (LTR) days of inpatient hospital services available upon exhausting 90 regular benefit days (60 full / 30 coinsurance) in a benefit period. Payment will be made for LTR days unless the individual elects not to have such payment made.

When are LTR days used?

When a beneficiary receives inpatient services after all of their 90 regular days (60 full / 30 coinsurance) have been exhausted during a benefit period, the LTR days are used unless:

When is an election not to use reserve days effective?

Ordinarily, an election not to use reserve days will apply prospectively. If the election is filed at the time of admission to a hospital, it may be made effective beginning with the first day of hospitalization or with any day thereafter. If the election is filed later, it may be made effective beginning with any day after the day it is filed.

Can you use LTR days for hospital stay?

A beneficiary election not to use LTR days for a particular hospital stay may apply to the entire stay or to a single period of consecutive days in the stay, but cannot apply to selected days in a stay. If an election, made prospectively or retroactively, not to use LTR days is made effective with the first day in which LTR days are available, it may be terminated at any time. After termination of the election, all hospital days would be covered to the extent that LTR days are available.

Can a beneficiary use LRT days?

A beneficiary's election not to use LRT days should specify the name of the hospital and the starting date of the election. For additional information and model language/format of the election, please refer to the CMS IOM Publication 100-02, Benefit Policy Manual, Chapter 5, Section 40.1.

Can you use lifetime reserve days?

An election not to use lifetime reserve days may be made by the beneficiary (or by someone acting on his or her behalf) at the time of admission to a hospital or at any time thereafter, subject to the limitations on retroactive elections.

When will Medicare pay for available reserve days?

When a patient receives services after exhaustion of 90 days of coverage, benefits will be paid for available reserve days on the basis of the patient's request for payment, unless the patient has indicated in writing that he or she elects not to have the program pay for such services.

How long does a hospital stay in a beneficiary's lifetime?

Each beneficiary has a lifetime reserve of 60 days of inpatient hospital services to draw upon after having used 90 days of inpatient hospital services in a benefit period. Payment will be made for such additional days of hospital care after the 90 days of benefits have been exhausted unless the individual elects not to have such payment made (and thus saves the reserve days for a later time).

Does Medicare pay for long term care?

When a Long Term Care Hospital inpatient stay triggers a full LTC-DRG payment (i.e., it exceeds the short-stay outlier threshold), Medicare’s payment is for the entire stay up to the high cost outlier threshold, regardless of patient coverage. But for lengths of stay equal to or below 5/6 of the average length of stay for a specific LTC-DRG, Medicare’s payment is only for covered days.

What is a critical access hospital?

Critical access hospitals. Inpatient rehabilitation facilities. Inpatient psychiatric facilities. Long-term care hospitals. Inpatient care as part of a qualifying clinical research study. If you also have Part B, it generally covers 80% of the Medicare-approved amount for doctor’s services you get while you’re in a hospital.

What is general nursing?

General nursing. Drugs as part of your inpatient treatment (including methadone to treat an opioid use disorder) Other hospital services and supplies as part of your inpatient treatment.

What is an inpatient hospital?

Inpatient hospital care. You’re admitted to the hospital as an inpatient after an official doctor’s order, which says you need inpatient hospital care to treat your illness or injury. The hospital accepts Medicare.