A capitated contract is a healthcare plan that allows payment of a flat fee for each patient it covers. Under a capitated contract, an HMO or managed care organization pays a fixed amount of money for its members to the health care provider.

What is Medicaid Managed Care?

Dec 16, 2021 · Capitation payments are common in health maintenance organizations (HMOs) and Medicaid -managed care organizations (MCOs). The primary care provider receives a certain amount of money for each member enrolled in the health care plan, and the provider agrees to take care of their covered medical needs for this amount.

What is the capitation rate for managed care?

Jun 15, 2016 · More information can be found below. Under the capitated model, the Centers for Medicare & Medicaid Services (CMS), a state, and a health plan enter into a three-way contract to provide comprehensive, coordinated care. In the capitated model, CMS and the state will pay each health plan a prospective capitation payment.

What is the capitated model of Medicaid?

Capitation payments are used by managed care organizations to control health care costs. Capitation payments control use of health care resources by putting the physician at financial risk for services provided to patients. At the same time, in order to ensure that patients do not receive suboptimal care through under-utilization of health care services, managed care organizations …

What are capitation payments in healthcare?

Sep 09, 2020 · Medicare care managed care plans are an optional coverage choice for people with Medicare. Managed care plans take the place of your original Medicare coverage. Original Medicare is made up of Part...

What does Medicare capitation mean?

Capitation is a fixed amount of money per patient per unit of time paid in advance to the physician for the delivery of health care services.

What is a capitation managed care plan?

What Is a Capitated Contract? A capitated contract is a healthcare plan that allows payment of a flat fee for each patient it covers. Under a capitated contract, an HMO or managed care organization pays a fixed amount of money for its members to the health care provider.

What does covered under capitation mean?

Capitation fee, or capitation rate, is the fixed amount paid from an insurer to a provider. This is the amount that is paid (generally monthly) to cover the cost of services performed for a patient. Capitation fees can be lower in higher population areas.

What does it mean when a claim is capitated?

Capitation is a type of a healthcare payment system in which a doctor or hospital is paid a fixed amount per patient for a prescribed period of time by an insurer or physician association.Feb 23, 2020

How does capitation denial work?

To resolve the denial issue follow the steps below:Understand from the patient to verify whether Medicare is primary or secondary insurance.Keep all the insurance information on the files up to date once the verification is complete.Contact the patient or the COB itself to verify.More items...•Jun 2, 2021

Is Medicare Advantage a capitated plan?

Medicare pays Medicare Advantage plans a capitated (per enrollee) amount to provide all Part A and B benefits. In addition, Medicare makes a separate payment to plans for providing prescription drug benefits under Medicare Part D, just as it does for stand-alone prescription drug plans (PDPs).

What is the difference between fee for service and capitation?

Capitation and fee-for-service (FFS) are different modes of payment for healthcare providers. In capitation, doctors are paid a set amount for each patient they see, while FFS pays doctors according to what procedures are used to treat a patient.

What is offset in medical billing?

This is a kind of an adjustment which is made by the insurance when excess payments and wrong payments are made. If insurance pays to a claim more than the specified amount or pays incorrectly it asks for a refund or adjusts / offsets the payment against the payment of another claim. This is called as Offset.Sep 5, 2010

Is capitation a form of value based care?

The broad phrase “value-based reimbursement” encompasses two radically different payment approaches: capitation and bundled payments. In capitation, the health care organization receives a fixed payment per year per covered life and must meet all the needs of a broad patient population.

How are patients affected by capitated payments?

Capitated payment for subspecialty care can produce indistinct boundaries of responsibility between the primary physician and the subspecialist. As a result, patients may end up without a physician who is responsible for their care.

What are the pros and cons of capitation?

Capitation:ProsConsThe physician has better contract leverage in negotiation with payersPhysician personal financial risk can be high if care of complex or chronically ill patients are taken inBrings in certain standardization of information systems2 more rows

What does the word capitated mean?

Definition of capitated : of, relating to, participating in, or being a health-care system in which a medical provider is given a set fee per patient (as by an HMO) regardless of treatment required.

SPOTLIGHT & RELEASES

02/24/2021: CMS released MMP Performance Data Technical Notes & MMP Performance Data for 2021. More information can be found under the Medicare-Medicaid Plan Performance Data section.

Medicare-Medicaid Plan Performance Data

Under the capitated model, CMS is collecting a variety of measures that examine plan performance and the quality of care provided to enrollees.

State Demonstrations

To participate in the Financial Alignment Initiative, each state had to submit a proposal outlining its proposed approach. States interested in the new financial alignment opportunities were required to submit a letter of intent by October 1, 2011.

What is Medicare managed care?

Medicare care managed care plans are an optional coverage choice for people with Medicare. Managed care plans take the place of your original Medicare coverage. Original Medicare is made up of Part A (hospital insurance) and Part B (medical insurance). Plans are offered by private companies overseen by Medicare.

How much does Medicare cost in 2021?

Most people receive Part A without paying a premium, but the standard Part B premium in 2021 is $148.50. The cost of your managed care plan will be on top of that $148.50.

What is Medicare Advantage?

Sometimes referred to as Medicare Part C or Medicare Advantage, Medicare managed care plans are offered by private companies. These companies have a contract with Medicare and need to follow set rules and regulations. For example, plans must cover all the same services as original Medicare.

Do you have to be enrolled in Medicare Part A and Part B?

You’ll need to be enrolled in both Medicare Part A and Part B to be eligible for a managed care plan. You can become eligible for parts A and B in a few ways:

What is PFFS in medical?

Private Fee-for-Service (PFFS). A PFFS is a less common type of managed care plan. PFFS plans don’t have networks. Instead, for a present price, you can see any doctor who contracts with Medicare. However, not all providers accept PFFS plans. Special Needs Plan (SNP).

What is a Medigap plan?

A Medigap plan, also known as Medicare supplement insurance, is optional coverage you can add to original Medicare to help cover out-of-pocket costs. Medigap plans can help you pay for things like: coinsurance costs. copayments. deductibles. These aren’t a type of managed care plan.

What is the difference between HMO and POS?

The difference is that an HMO-POS plan allows you to get certain services from out-of-network providers — but you’ll likely pay a higher cost for these services than if you see an in-network provider. Private Fee-for-Service (PFFS). A PFFS is a less common type of managed care plan. PFFS plans don’t have networks.

What is capitation payment?

Capitation payments are payments agreed upon in a capitated contract by a health insurance company and a medical provider. They are fixed, pre-arranged monthly payments received by a physician, clinic, or hospital per patient enrolled in a health plan, or per capita. The monthly payment is calculated one year in advance and remains fixed for ...

Why is capitation important?

Capitation is meant to help limit excessive costs and the performance of unnecessary services. But on the downside, it might also mean that patients get less facetime with the doctor. Providers may look to increase profitability under the capitation model by cutting down on the time that patients see the doctor.

What is the alternative to capitation?

The alternative to capitation payments is FFS, where providers are paid based on the number of services provided. Perhaps the biggest benefit to capitation contracts is that they provide fixed payments to providers, dissuading the incentive to order more procedures than necessary, which can be an issue with FFS (i.e. capitation provides greater provider accountability).

What is the difference between FFS and capitation?

Capitation is a model that pays a fixed amount to providers based on the number of patients they have or see. Meanwhile, fee-for-service (FFS) pays based on the procedures or services that providers perform. Both these systems are used in the U.S. healthcare system.

Who is Tom Catalano?

Tom Catalano holds the coveted CFP® designation from The Certified Financial Planner Board of Standards in Washington, DC, and is a Registered Investment Adviser with the state of South Carolina.

What is managed care plan?

Managed-care plans or Advantage plans bundles all health-care coverage under one neat plan. MA plans decide on rate amounts, making prices different from plan to plan. Processing payments are done through the private plan, not Medicare.

What is Medicare Advantage 2021?

Updated on March 19, 2021. Medicare managed care plans are an alternative to Original Medicare. Otherwise known as Medicare Advantage plans with many plan types, most are either HMOs or PPOs. Managed-care plans provide benefits for gaps in Parts A and B coverage. These alternative health-care plans make up Part C of Medicare.

Who is Lindsay Malzone?

Lindsay Malzone is the Medicare expert for MedicareFAQ. She has been working in the Medicare industry since 2017. She is featured in many publications as well as writes regularly for other expert columns regarding Medicare. You can also find her over on our Medicare Channel on YouTube as well as contributing to our Medicare Community on Facebook.

Can seniors travel internationally?

Coverage is not available when traveling internationally. Seniors often live in northern states for the summer and come winter, they head south. The better known as snow-birds may find they’re out-of-network for half of the year. Enrolling in a Medicare Supplement plan may be a better option for these individuals.

Is Medicare Supplement the same as Managed Care?

Managed-care plans and Medicare Supplement plans are not the same. This misconception is common. Both provide additional benefits to Original Medicare. However, they serve two totally different purposes. Managed-care plans or Advantage plans bundles all health-care coverage under one neat plan.

What is indemnity health insurance?

Before HMOs, PPOs, and others, Indemnity plans were the main plans to choose from. Indemnity plans pre-determine the percentage of what they consider a reasonable and customary charge for certain services. Carriers pay a percentage of charges for a service and the member pays the remainder.

Is Medicare managed care affordable?

Medicare managed care plans can provide some relief . Enrolling in the right plan for you is key to making health-care more affordable. The number of Medicare beneficiaries enrolling in managed care plans is on the rise. Instead of working alongside Medicare-like Medigap insurance, Advantage plans replace Original Medicare.

What is comprehensive risk based managed care?

Comprehensive risk-based managed care#N#Of the three main types of Medicaid managed care, the most common is the comprehensive risk-based managed care provided through managed care organizations (MCOs). In 2017, 69 percent of Medicaid enrollees had this type of plan. In this model, states contract with MCOs to provide a full package of benefits to Medicaid enrollees. In turn, states typically pay the MCOs using a capitated payment system, or one where the MCO is paid a fixed monthly rate per enrollee to provide their healthcare services.

How many states have managed care?

Of the 38 states employing managed care, 17 had at least 90 percent of their Medicaid population in MCOs. Managed care organizations are risk-based, meaning they are under contract with states to pay for enrollees’ care even if the costs exceed the capitated rates at which they are reimbursed.

Why is Medicaid important?

The Affordable Care Act allows for states to expand Medicaid to more low-income adults, which research shows has increased access to care and reduced mortality among this group. Additionally, states rely on Medicaid to cover treatment in disease outbreaks and crises, such as the Zika virus and the opioid epidemic.

What is limited benefit plan?

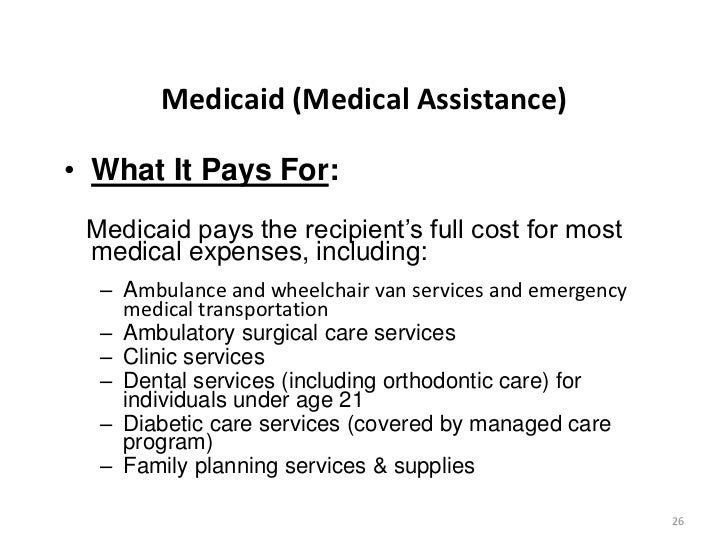

Limited benefit plans are similar to MCOs in structure in that states typically contract with a plan and pay based on a capitated payment system. However, limited benefit plans only provide certain Medicaid services such as dental or behavioral health services instead of providing a full range of health services.

How many people are covered by CMS?

Centers for Medicare and Medicaid Services (CMS): Federal agency, in partnership with states, that covers over 100 million people through Medicare, Medicaid, Children’s Health Insurance Program (CHIP) and the Health Insurance Marketplace.

What percentage of federal spending is Medicaid?

Medicaid accounted for 9.5 percent of federal spending in FY2017 and is the third-largest domestic program in the budget, after Social Security and Medicare. It was also the second-largest item in state budgets in 2017.

Is Medicaid a partnership?

Medicaid is structured as a partnership between the federal government and individual states and is therefore financed jointly by the two. The federal government reimburses states for the federal share of each state’s program costs and there is no cap or limit on the amount of federal funds a state can receive.