Medigap, also known Medicare Supplement insurance, offers guaranteed renewal and issuance, however you only have one opportunity in most states to enroll. Guaranteed renewal means that your insurance company cannot cancel your policy regardless of your health condition. Medigap policies must offer guaranteed renewal.

Full Answer

Can Medigap insurance be renewed without renewal?

If you bought your Medigap policy before 1992, it might not be guaranteed renewable. This means the Medigap insurance company can refuse to renew the Medigap policy. But, the insurance company must get the state's approval to cancel your Medigap policy.

What is a renewable Medigap policy?

An insurance policy that can't be terminated by the insurance company unless you make untrue statements to the insurance company, commit fraud, or don't pay your premiums. All Medigap policies issued since 1992 are guaranteed renewable.

What do you need to know about Medicare Medigap insurance?

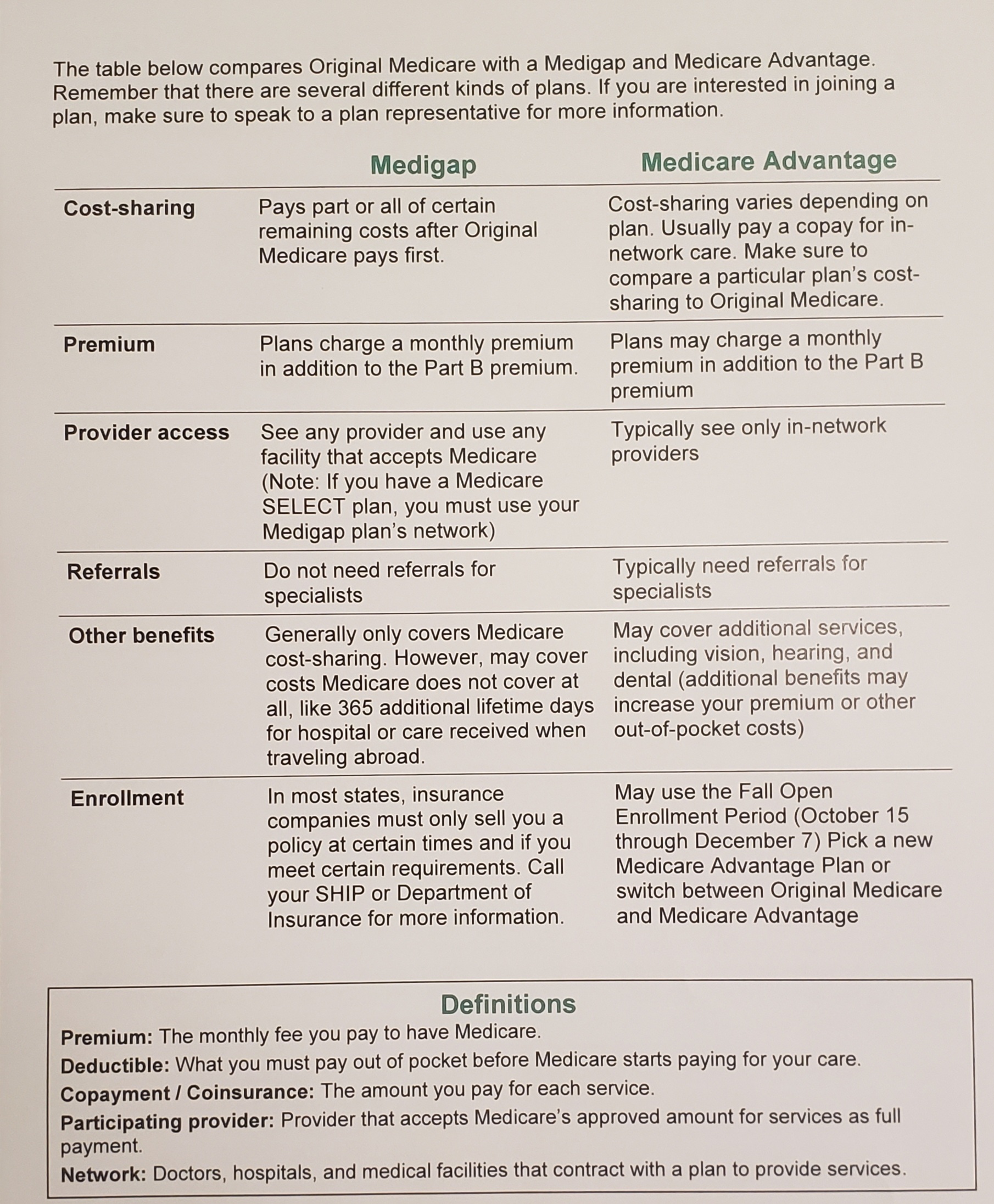

You must have Medicare Part A and Part B. A Medigap policy is different from a Medicare Advantage Plan. Those plans are ways to get Medicare benefits, while a Medigap policy only supplements your Original Medicare benefits. You pay the private insurance company a monthly

What is Medicare supplement insurance (Medigap)?

A Medicare Supplement Insurance (Medigap) policy, sold by private companies, may help pay some of the health care costs that Original Medicare doesn’t cover: Your Medicare deductibles.

Does my Medigap plan automatically renew?

As long as you pay your premium, your Medigap policy is guaranteed renewable. This means it is automatically renewed each year. Your coverage will continue year after year as long as you pay your premium. In some states, insurance companies may refuse to renew a Medigap policy bought before 1992.

Do I need to renew my Medicare Supplement every year?

The plain and simple answer to this question is no, you don't have to renew your Medigap plan each year. All Medicare Supplement plans are guaranteed renewable for life as long as you're paying your premium, either monthly, quarterly, semi-annually, or annually.

Do Medigap plans go up every year?

Medigap premium increases will occur nearly every year. Any agent who tells you otherwise is untrustworthy. Most Medigap policies have a rate increase once a year, usually on your policy anniversary. Some carriers increase on your birthday month instead.

Is Medicare Supplement and Medigap the same thing?

A Medigap policy is different from a Medicare Advantage Plan. Those plans are ways to get Medicare benefits, while a Medigap policy only supplements your Original Medicare benefits. The periodic payment to Medicare, an insurance company, or a health care plan for health or prescription drug coverage.

Can Medigap plans drop you?

All Medigap policies issued since 1992 are guaranteed renewable. . This means your insurance company can't drop you unless one of these happens: You stop paying your premiums.

How often do you have to reapply for Medicare?

annuallyYou will be automatically re-enrolled in your Medicare Advantage plan annually – unless the company that provides your plan stops offering it. Then you'll get a chance to buy a different one during the annual Open Enrollment Period from October 15 to December 7.

What is the downside to Medigap plans?

Some disadvantages of Medigap plans include: Higher monthly premiums. Having to navigate the different types of plans. No prescription coverage (which you can purchase through Plan D)

Does Medigap cost increase with age?

Generally the same monthly premium is charged to everyone who has the Medigap policy, regardless of age. Your premium isn't based on your age. Premiums may go up because of inflation and other factors, but not because of your age.

How Much Is Medigap per month?

In 2020, the average premium for Medicare supplemental insurance, or Medigap, was approximately $150 per month or $1,800 per year, according to Senior Market Sales, a full-service insurance organization.

Who pays for Medigap?

You pay the private insurance company a monthly premium for your Medigap plan in addition to the monthly Part B premium you pay to Medicare. A Medigap plan only covers one person. If you and your spouse both want Medigap coverage, you'll each have to buy separate policies.

Do Medigap plans have a maximum out-of-pocket?

Medigap plans don't have a maximum out-of-pocket because they don't need one. The coverage is so good you'll never spend $5,000 a year on medical bills.

Is a Medigap plan better than an Advantage plan?

If you are in good health with few medical expenses, Medicare Advantage can be a suitable and money-saving choice. But if you have serious medical conditions with expensive treatment and care costs, Medigap is generally better.

What is the difference between Medigap and Medicare?

Generally, the only difference between Medigap policies sold by different insurance companies is the cost. You and your spouse must buy separate Medigap policies.Your Medigap policy won't cover any health care costs for your spouse. Some Medigap policies also cover other extra benefits that aren't covered by Medicare.

What is a medicaid supplement?

Medigap (Medicare Supplement Health Insurance) A Medigap policy is health insurance sold by private insurance companies to fill the “gaps” in Original Medicare Plan coverage. Medigap policies help pay some of the health care costs that the Original Medicare Plan doesn't cover.

Do you have to pay for Medigap?

Generally, when you buy a Medigap policy you must have Medicare Part A and Part B. You will have to pay the monthly Medicare Part B premium. In addition, you will have to pay a premium to the Medigap insurance company. As long as you pay your premium, your Medigap policy is guaranteed renewable.

Can insurance companies sell standardized Medicare?

Insurance companies can only sell you a “standardized” Medigap policy. Medigap policies must follow Federal and state laws. These laws protect you. The front of a Medigap policy must clearly identify it as “Medicare Supplement Insurance.”. It's important to compare Medigap policies, because costs can vary. The standardized Medigap policies that ...

What does Medigap cover?

What Medigap Plans Can and Cannot Cover. A Medicare Supplement Insurance (Medigap) policy, sold by private companies, may help pay some of the health care costs that Original Medicare doesn’t cover: Your Medicare deductibles. Your coinsurance. Hospital costs after you run out of Medicare-covered days. Skilled nursing facility costs ...

What is Medicare Supplement Insurance?

Each plan has different , yet standardized, benefits and coverage that must follow federal and state laws, and must be clearly identified as “Medicare Supplement Insurance.”. This means that no matter which insurer you buy from, the basic benefits of each plan type of the same letter will be the same. In Massachusetts, Minnesota, and Wisconsin, ...

How to apply for Medicare Supplement?

You can apply for a Medicare Supplement plan insurance policy if you are: 1 A resident of a state where the policy is offered. 2 Enrolled in Medicare Parts A and B. 3 Age 65 or over, or in some states, under age 65 with a disability and/or end stage renal disease (plan offerings and eligibility vary by state).

What is the age limit for Medicare?

A resident of a state where the policy is offered. Enrolled in Medicare Parts A and B. Age 65 or over, or in some states, under age 65 with a disability and/or end stage renal disease (plan offerings and eligibility vary by state). Note: Medigap Plans are different from Medicare Advantage Plans. In fact, Medigap policies can’t work ...

When to enroll in Medigap?

How to Enroll in Medigap Plans. It is highly recommended that you buy a Medigap policy during your six-month Medigap open enrollment period which starts the month you turn 65 and are enrolled in Medicare Part B (Medical Insurance).

Can you get a Medigap policy with Medicare Advantage?

Note: Medigap Plans are different from Medicare Advantage Plans. In fact, Medigap policies can’t work with Medicare Advantage Plans. You must have Original Medicare Parts A and B to get a Medigap policy.

Does Medigap cover out of pocket expenses?

Medigap can help pay out-of-pocket expenses that Original Medicare doesn’t cover. An Original Medicare plan paired with a Medigap policy can offer comprehensive coverage, which will likely result in lower out-of-pocket expenses.

Medigap Guaranteed Renewal

Guaranteed renewal means that your insurance company cannot cancel your policy regardless of your health condition. Medigap policies must offer guaranteed renewal.

Medigap Guaranteed Issuance

Guaranteed issuance means that your insurance company must enroll you in a plan regardless of preexisting conditions. In most states Medigap only offers guaranteed issuance during your Medicare Supplement Insurance initial enrollment period.

Stay in touch

Subscribe to be always on top of news on Medicare, Medigap, Medicare Advantage, Part D and more!

What Is Medicare?

The federal Medicare program is a health insurance coverage for individuals 65 or older, disabled people and those that suffer from ESRD.

If I Have Original Medicare, Will It Renew Automatically?

Original Medicare coverage is the government’s insurance program for Part A and Part B medical expenses.

Will Medicare Advantage plans, Medicare Supplement Insurance plans, and Part D plans Automatically Renew?

Medicare Advantage plans follow the same rules for renewal and enrollment as basic Medicare (Part A and B cover).

When Might My Medicare Advantage, Supplement Insurance Plan, and Part D Plans Not Automatically Renew?

Your private Medicare policies will renew automatically each year as long as you pay your monthly premiums. But certain events can lead to your subscription not being renewed.

Will I Need to Renew My Medicare Card Each Year?

You will not have to renew your Medicare card each year. However, you will need to replace your card if it is lost, damaged, stolen, or if your details have changed.

How Can I Learn More about My Health Care?

Visit our Medicare Hub to get the latest information about Medicare, Medicare eligibility, and Medicare Advantage. You’ll be able to find in-depth guides on the next enrollment period and how you can make the most of your Medicare coverage, costs, and benefits.

What is Medicare Supplement?

Medigap insurance, also known as Medicare Supplement, is special private insurance standardized by the Medicare system. It's sold to people with Original Medicare (Parts A and B). In addition to paying deductibles, copayments, and coinsurance, some Medigap plans also cover additional services, or kick in when your Medicare benefits are maxed out.

Does Medicare Advantage cover traditional insurance?

However, Medicare Advantage plans, which are private alternatives to traditional insurance, often do cover these services. So, it’s important to consider which services you need most and compare the costs not only of each plan but of the services they do not cover.

Does Medicare cover everything?

Original Medicare pays for a wide range of services, but it won’t cover everything. Even when something is included in your Medicare policy, you may have to pay a copay or hit a deductible before getting full coverage. Medigap insurance can help fill these gaps, offering you broader insurance coverage.

Does Medigap cover hearing aids?

It’s also worth noting that Medigap policies do not typically cover services like hearing aids or dental care.

Can I get Medigap if I have Medicare Advantage?

In addition, you can’t buy Medigap insurance if you have a Medicare Advantage plan, according to the Centers for Medicare and Medicaid Services.

When to buy a Medigap policy

The best time to buy a Medigap Medicare Supplement Insurance (Medigap) An insurance policy you can buy to help lower your share of certain costs for Part A and Part B services (Original Medicare). policy is when you’re 65 (or older) and first get both Part A and Part B. You need both Part A and Part B to buy a Medigap policy.

How to buy a Medigap policy

Medigap plans are standardized, and in most cases named by letters, like Plan G or Plan K.

Drop your Medigap policy

If you want to drop your policy, contact your insurance company to cancel it.

If you're losing Medigap coverage

An insurance policy that can't be terminated by the insurance company unless you make untrue statements to the insurance company, commit fraud, or don't pay your premiums. All Medigap policies issued since 1992 are guaranteed renewable.

How to switch Medigap insurance?

How to switch Medigap policies. Call the new insurance company and arrange to apply for your new Medigap policy. If your application is accepted, call your current insurance company, and ask for your coverage to end. The insurance company can tell you how to submit a request to end your coverage.

How long is the free look period for Medigap?

Medigap free-look period. You have 30 days to decide if you want to keep the new Medigap policy. This is called your "free look period.". The 30- day free look period starts when you get your new Medigap policy. You'll need to pay both premiums for one month.

What happens if you buy a Medigap policy before 2010?

If you bought your policy before 2010, it may offer coverage that isn't available in a newer policy. If you bought your policy before 1992, your policy: Might not be a Guaranteed renewable policy. May have a bigger Premium increase than newer, standardized Medigap policies currently being sold. expand.

How long do you have to have a Medigap policy?

If you've had your Medicare SELECT policy for more than 6 months, you won't have to answer any medical questions.

Does Medicare cover Part B?

As of January 1, 2020, Medigap plans sold to new people with Medicare aren't allowed to cover the Part B deductible. Because of this, Plans C and F are not available to people new to Medicare starting on January 1, 2020.

Can I keep my Medigap policy if I move out of state?

I'm moving out of state. You can keep your current Medigap policy no matter where you live as long as you still have Original Medicare. If you want to switch to a different Medigap policy, you'll have to check with your current or new insurance company to see if they'll offer you a different policy. If you decide to switch, you may have ...