What does Moop mean in Medicare?

What Costs Are Credited To Your MOOP?

- Diagnostic or imaging services

- Doctor visits

- Durable medical equipment

- Emergency room visits

- Home health care

- Hospital stays

- Lab work

- Medicare-covered outpatient services

- Prosthetics

- Skilled nursing facility stays

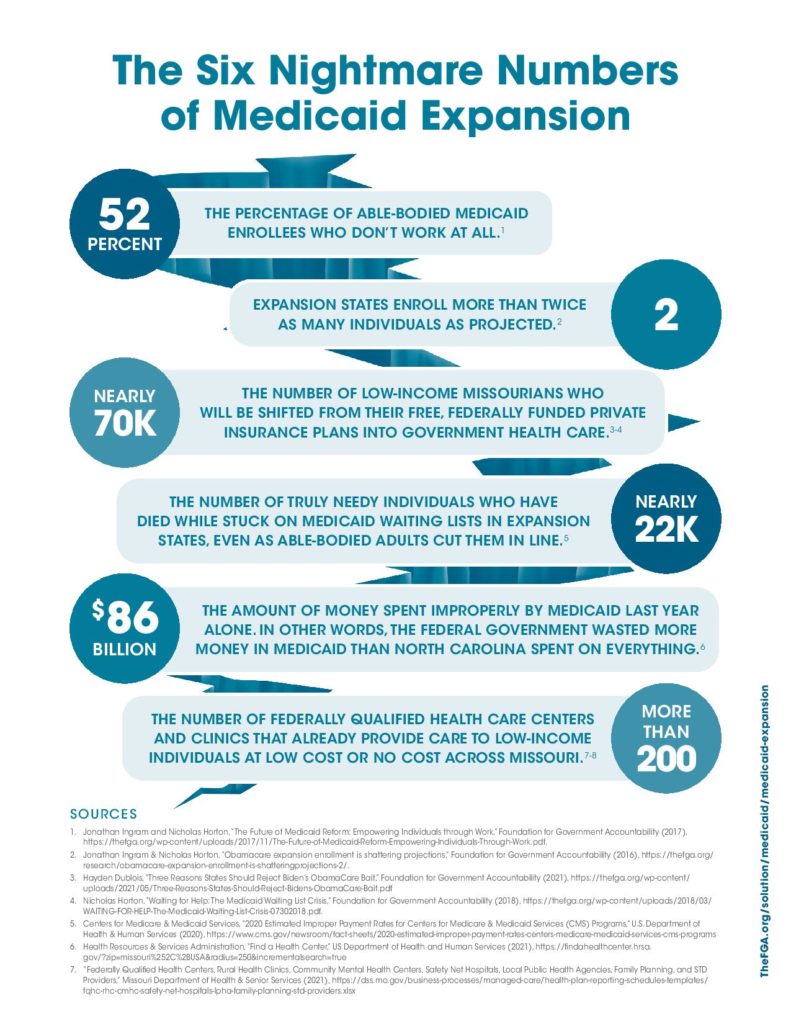

What does Moop stand for?

What does MOOP stand for? MOOP stands for Maximum Out-of-Pocket (health care expenses) Suggest new definition. This definition appears frequently and is found in the following Acronym Finder categories: Science, medicine, engineering, etc. See other definitions of MOOP. Other Resources:

Do you have a Medicare Moop?

Your Medicare Advantage plan’s Maximum Out-of-Pocket Limit (MOOP) is the total amount you will spend this year on in-network co-payments and co-insurance for covered or eligible Medicare Part A and Medicare Part B medical services.

Is there a maximum OOP with Medicare?

There isn’t a maximum out-of-pocket on Medicare. Because of this, there is no limit to the amount you can pay in medical bills. You can contribute 20% of any number of costs after meeting the deductible. Don’t worry, though; we have a few solutions to help you. Below we discuss Medicare plans that have a maximum limit and some that don’t.

What does MOOP include?

The out-of-pocket costs that help you reach your MOOP include all cost-sharing (deductibles, coinsurance, and copayments) for Part A and Part B covered services that you receive from in-network providers.

What are MOOP expenses?

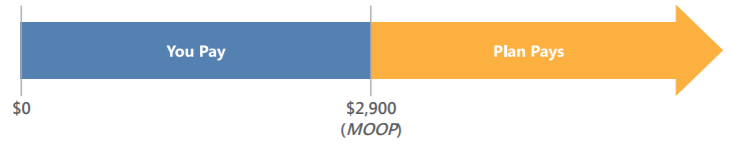

Maximum out-of-pocket coverage is essentially a cap on how much you would have to pay out of pocket each year for medical services. The idea is that, once you hit the cap, then your insurance will cover all costs that go beyond that.

What does out-of-pocket maximum mean for Medicare Advantage plans?

Out of pocket maximum is the highest yearly amount you will have to pay out of pocket for covered health-care services. This spending maximum is one important difference between Medicare Advantage plans and the traditional fee-for-service Medicare program.

What does MOOP stand for?

MOOP is an acronym for “Matter Out of Place”, a convenient way of referring to anything that is not originally of the land on which our event takes place.

What happens when you reach your out-of-pocket max?

An out-of-pocket maximum is a cap, or limit, on the amount of money you have to pay for covered health care services in a plan year. If you meet that limit, your health plan will pay 100% of all covered health care costs for the rest of the plan year.

Do premiums count towards MOOP?

The MOOP limit for each Medicare Advantage plan is the maximum amount you will spend on healthcare in a given year. Once your out-of-pocket costs reach this amount, the plan will pay 100% for your healthcare benefits until the start of the next plan year. Your MOOP limit does not apply to your monthly premium.

Do I still pay copay after out-of-pocket maximum?

The most you have to pay for covered services in a plan year. After you spend this amount on deductibles, copayments, and coinsurance for in-network care and services, your health plan pays 100% of the costs of covered benefits.

Do prescriptions count towards out-of-pocket maximum?

How does the out-of-pocket maximum work? The out-of-pocket maximum is the most you could pay for covered medical services and/or prescriptions each year. The out-of-pocket maximum does not include your monthly premiums.

What's the difference between deductible and out-of-pocket max?

Essentially, a deductible is the cost a policyholder pays on health care before the insurance plan starts covering any expenses, whereas an out-of-pocket maximum is the amount a policyholder must spend on eligible healthcare expenses through copays, coinsurance, or deductibles before the insurance starts covering all ...

How does a MOOP work?

Maximum out-of-pocket: the most money you'll pay for covered health care in a calendar year, aside from any monthly premium. After reaching your MOOP, your insurance company pays for 100% of covered services. The US government sets the standard Medicare Advantage maximum out-of-pocket limit every year.

What is the maximum out-of-pocket for Medicare in 2020?

The maximum limits will increase to $7,550 for in-network and $11,300 for in- and out-of-network combined. Once the limit is reached, the plan covers any costs for the remainder of the year.

How much is a Medicare Advantage MOOP?

The Centers for Medicare and Medicaid (CMS) regulates Medicare Advantage plans. In 2019, the Medicare Advantage MOOP is $6,700 for in-network services. If you combine in- and out-of-network limits, MOOPs for some plans can be up to $10,000.

What is a MOOP and TROOP?

Both MOOP Medicare and TrOOP are protections that limit your spending if you have a Medicare Advantage plan, and/or a Medicare Part D plan. Original Medicare does not provide the same protections.

How much is Medicare Part D deductible?

It works like this: In 2019, Medicare Part D has a $415 deductible (some plans may be less) and a $3,820 initial coverage limit for total out-of-pocket costs. The donut hole is the gap between the initial coverage limit and the annual out-of-pocket-threshold ($5,100 ). The donut hole will effectively be going away in 2020.

What does troop mean?

TrOOP stands for True Out-Of-Pocket costs. While it may sound similar to MOOP, it is not the same thing. While MOOP applies to Original Medicare-covered services with Medicare Advantage Plans, TrOOP applies to prescription drug coverage, whether that’s from Medicare Advantage Prescription Drug plans or stand-alone Medicare Part D plans.

What are the excluded drugs for Medicare?

According to the Center for Medicare Advocacy, excluded drugs include: Drugs to promote weight loss or weight gain, even if they cosmetic use, such as to treat morbid obesity. One exception is that that drugs to treat AIDS wasting are not considered to be for cosmetic purposes and are therefore NOT excluded.

Does your prescription count toward your out of pocket limit?

Not all the money you spend on your prescriptions counts toward your out-of-pocket limit. For example, the amount your plan covers does not count. For example, let’s say your prescription costs $50. Your copay is $15 and your insurance policy pays $35. Only the $15 you pay for your prescription goes toward your limit.

Does Medicare cover out of network services?

Also, your plan may not cover out-of-network services even after you reach the out-of-pocket spending limit.

What does MOOP mean in insurance?

MOOP is an acronym standing for “maximum out-of-pocket” costs. The MOOP is the limit on annual out-of-pocket expenditures paid by a health plan enrollee for medical services that are covered by a health insurance plan.

What happens after a MOOP is satisfied?

After a MOOP is satisfied during a given plan year, the health insurance plan enrollee does not pay additional cost-sharing for covered medical services until the next coverage period (which often begins at the start of a new calendar year). For example, imagine a health insurance plan has a $7,000 MOOP.