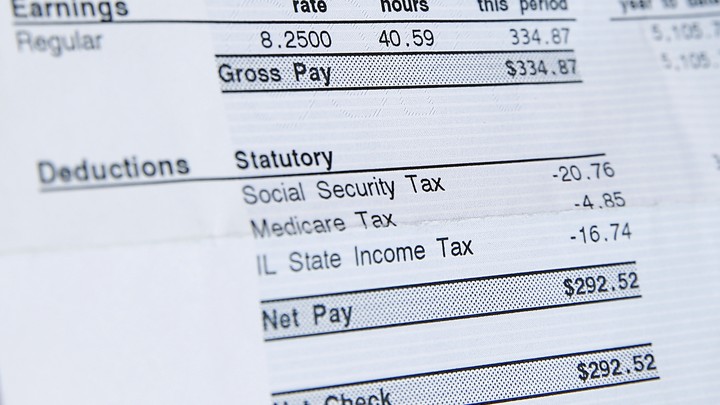

On a pay stub MED is the shortened code for Medicare tax and FICA is the shortened code for Federal Income Contributions Act. Both of these deductions contribute to some sort of long term plan that should help you out should there be a problem with your health (MED) or for when you retire (FICA).

What do the items on a paycheck stub mean?

Apr 02, 2020 · Your employer automatically deducts your Medicare liability from your taxable income. The Internal Revenue Service determines the percentage of your income that will be taxed for Medicare. The current tax rate for Medicare, which is subject to change, is 1.45 percent of your gross taxable income. Your employer also pays a matching Medicare tax based on your …

What does Medicare mean on my paycheck?

Mar 24, 1991 · This year, of the 7.65% payroll tax employees and employers each contribute to Social Security, 6.2% is strictly for Social Security while the remaining 1.45% is for Medicare. It was easier just to...

What do the pay stub deduction codes mean?

Jul 10, 2019 · Every worker contributes 1.45% of their gross income to Medicare and every employer pays an additional 1.45% on behalf of each employee. Insurance If you signed up for medical, dental or life insurance through your employer, your contributions to these plans will be deducted from your pay as well. Retirement Savings Plans

How much of my paycheck should go toward Medicare?

Feb 07, 2022 · On your pay statement, Medicare is shown as Fed MED/EE to designate the employee’s amount of Medicare tax that was withheld. Employer’s also pay Medicare withholding on your behalf, which does not come out of your pay.

Is Medicare automatically deducted from paycheck?

If you have an employer, your employer automatically withholds the Medicare tax from your paycheck. If not, you pay the tax yourself. The Medicare tax makes up one part of the Federal Insurance Contributions Act (FICA).

Why do I have Medicare tax?

Why Do You Have to Pay a Medicare Tax? The Medicare tax helps fund the Hospital Insurance (HI) Trust Fund. It's one of two trust funds that pay for Medicare. The HI Trust Fund pays for Medicare Part A benefits including inpatient hospital care, skilled nursing facility care, home health care and hospice care.

Do I get Medicare tax back?

You might overpay Social Security and Medicare taxes for a number of reasons. Some workers are exempt from paying these taxes. The government will give the money back to you if this happens, either as a refund or you can claim it as a tax credit in some cases.

How do I stop paying Medicare tax?

If your group meets these requirements and opposes accepting Social Security benefits, you can apply for an exemption. To do that, you'll use IRS Form 4029, Application for Exemption From Social Security and Medicare Taxes and Waiver of Benefits.Apr 5, 2022

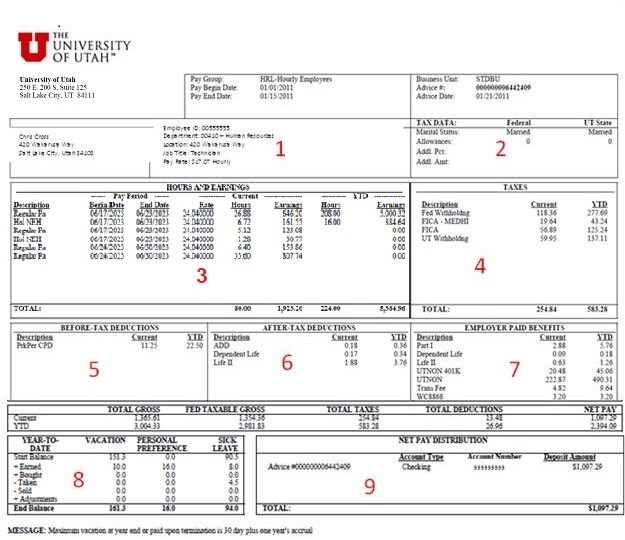

What Is Included on A Paycheck stub?

Although every company prints paychecks that are unique in their own way, there are some aspects of the employee paycheck that employers must inclu...

Additional Items That May Appear on Your Paycheck Stub

Although not required, the following are items that may appear on your paycheck stub and are useful to money management and relevant to your employ...

Common Abbreviations Used on Paycheck Stubs

1. YTD: Year-to-Date 2. FT or FWT: Federal Tax or Federal Tax Withheld 3. ST or SWT: State Tax or State Tax Withheld 4. SS or SSWT: Social Security...

Exercise Good Money Management Skills: Be Proactive

If you need further explanation on how to read your paycheck stub or if a particular calculation doesn’t seem correct, consult your Human Resources...

What deductions are on pay stubs?

Common pay stub deductions include federal and state income tax, as well as Social Security. These federal and state withholdings account for much of the difference between your gross income and net income. There may be other deductions as well, depending on the programs that you sign up for with your employer.

What is included in the earnings section of a paycheck?

The earnings section shows your earnings from the pay period and includes overtime. It also shows pre-tax deductions for different employee benefits that you may receive, such as health insurance and retirement contributions.

What taxes are deducted from paycheck?

In a payroll period, the taxes deducted from a paycheck typically include Social Security and Medicare taxes , otherwise known as FICA (Federal Insurance Contributions Act). The following taxes and deductions are what you can expect to see on your paycheck, explained in detail below.

What is withholding on a paycheck?

Withholding refers to the money that your employer is required to take out of your paycheck on your behalf. This includes federal and state income tax payments, Social Security, Unemployment Insurance, and Worker’s Comp.

How often do you have to get paychecks in Colorado?

Colorado state law, for example, requires that employees recieve paystubs from their employers at least once a month, which must list gross and net wages, as well as all deductions. Learn more about US paycheck law by state.

What is federal withholding tax?

This is known as your withholding tax — a partial payment of your annual income taxes that gets sent directly to the government. These payments are managed by the IRS.

What is a flexible spending plan?

A flexible spending plan allows you to set aside pre-tax dollars for medical expenses including health insurance copayments, deductibles and prescription drugs. Contributions to a flexible spending account are deducted from your pre-tax income.

What are the items on a pay stub?

Additional Items that May Appear on Your Paycheck Stub 1 Insurance Deductions: Monthly payments for such types of insurance as health (medical and dental), and life insurance. 2 Retirement Plan Contributions: Plans such as 401 (K) or 403 (B) retirement savings plans. 3 Leave Time: Including vacation hours or sick hours. Most employers will detail how many hours have been used to date and how many hours are remaining for the calendar year. 4 Childcare Assistance: If offered by your employer, this amount may appear on each paycheck as a pre-tax benefit. 5 Important Notices: Employers often use a portion of the paycheck stub to communicate important pieces of information to their employees such as wage increases or notifications about tax filings.

What is the other part of your paycheck called?

But if you find yourself living paycheck to paycheck and need to improve your money management skills, you need to pay close attention to the other perforated portion of your paycheck, called the paycheck stub (also known as the explanation statement.)

How often is a pay period?

A pay period is determined by your employer , but is typically weekly, bi-weekly (every two weeks), semi-monthly (twice per month), or monthly. This figure does not factor in tax withholdings. Net Pay: Includes the amount of income that you actually take home after all withholdings have been applied.

What happens if your retirement plan is not calculated correctly?

If a calculation is incorrect, the issue may reappear on every paycheck. Also, you may not be making the best choice for a retirement plan contribution, or losing money if your earnings are not calculated properly. It is ultimately your responsibility to ensure that you are being properly compensated.

Is childcare assistance a pre-tax benefit?

Childcare Assistance: If offered by your employer, this amount may appear on each paycheck as a pre-tax benefit. Important Notices: Employers often use a portion of the paycheck stub to communicate important pieces of information to their employees such as wage increases or notifications about tax filings.

Is Medicare withholding mandatory?

Medicare: Like Social Security withholdings, Medicare withholdings are also mandatory. Every employee pays 1.45% of their paycheck toward Medicare, and every employer contributes an additional 1.45% on behalf of the employee. Upon eligibility for Social Security, an employee is entitled to coverage for a majority of their medical expenses.

What Is FICA Tax?

FICA stands for the Federal Contributions Act that requires employers to withhold three different types of taxes taken out of an employee's paychecks. These taxes are mainly used for two things: first, to cover Social Security retirement payments for older Americans; and, second, to cover premiums for Medicare (Hospital Insurance) benefits.

What Does FICA Stand For?

The Federal Insurance Contributions Act (FICA) is a federal tax law equally split between the employer and employee. The amount is a percentage of each employee's taxable income consisting of the Social Security and Medicare payments.

Is FICA Mandatory?

As per law, FICA taxes are mandatory employment taxes that an employer needs to calculate and withhold in each employee payroll. The employer splits the cost in half with the employee deducting the amount due from the employee's paycheck.

How Is FICA Calculated?

As discussed earlier, the FICA tax for most employees is mainly composed of two amounts, the Social Security portion and the Medicare portion. The next question is how much the FICA tax is and how FICA on a paycheck stub is calculated for each employee.

Should Self-Employed Workers Pay FICA Tax?

Unless your business is incorporated, you must pay both portions of the FICA tax for the employer and employee as a self-employed worker. Instead of the federal tax, your check stub would show "Self-Employment" tax in its place.

What is the Employers' Responsibility for FICA Payroll Taxes?

After each payroll, employers are responsible for withholding and submitting FICA taxes for their share and the employee's share. Some employers could submit the payments semi-weekly or monthly depending on their tax liability for the previous four quarters.

FICA Tax Exemptions

Almost everyone working has to pay Social Security and Medicare Taxes. Whether you are a part-time or full-time employee or self-employed, you are required to withhold FICA taxes. This also includes resident aliens and many non-resident aliens.