Understanding Medicare Out-of-Pocket Maximums

- There is no limit on out-of-pocket costs in original Medicare (Part A and Part B).

- Medicare supplement insurance, or Medigap plans, can help reduce the burden of out-of-pocket costs for original Medicare.

- Medicare Advantage plans have out-of-pocket limits that vary based on the company selling the plan.

Full Answer

Does Medicare have a standard "out-of-pocket maximum"?

May 16, 2020 · For 2020, the largest out-of-pocket maximum that a plan can have is $8,150 for an individual plan and $16,300 for a family. These numbers are up from $7,900 and $15,600 in 2019. In general, if you select a plan with a lower monthly premium, it is associated with a higher out-of-pocket maximum amount.

Does Medicare have an out-of-pocket spending limit?

This means there is an automatic limit on the amount of money you will spend for covered healthcare during any given year. For in-network services in 2021, the highest Medicare out-of-pocket maximum a Part C plan could allow was $7,550. Many Part C plans also offer lower out-of-pocket limits of $6,000 or less.

Is there a cap on out of pocket for Medicare?

Jul 13, 2021 · There isn’t a maximum out-of-pocket on Medicare. Because of this, there is no limit to the amount you can pay in medical bills. You can contribute 20% of any number of costs after meeting the deductible. Don’t worry, though; we have a few solutions to help you. Below we discuss Medicare plans that have a maximum limit and some that don’t.

What is Medicare Advantage maximum out of pocket?

Nov 24, 2021 · All 2021 Medicare Advantage plans must include an out-of-pocket maximum that can be no higher than $7,550 for in-network care, and no higher than $11,300 total for the year. Most Medicare Advantage plans voluntarily set an out-of-pocket maximum that is lower than the required limit in order to make the plan more attractive to consumers.

What is the maximum out-of-pocket for Medicare in 2020?

Does Medicare have a maximum out-of-pocket limit? There is no limit to your potential medical bills under Original Medicare. Under current rules, there is no Medicare out of pocket maximum; if you have a chronic health condition or an unexpected health crisis, you could pay thousands in medical costs.

What is the Medicare out-of-pocket for 2021?

$7,550Since 2011, federal regulation has required Medicare Advantage plans to provide an out-of-pocket limit for services covered under Parts A and B. In 2021, the out-of-pocket limit may not exceed $7,550 for in-network services and $11,300 for in-network and out-of-network services combined.Jun 21, 2021

Is there an out-of-pocket limit for Medicare?

There is no limit on out-of-pocket costs in original Medicare (Part A and Part B). Medicare supplement insurance, or Medigap plans, can help reduce the burden of out-of-pocket costs for original Medicare. Medicare Advantage plans have out-of-pocket limits that vary based on the company selling the plan.

Does Medicare cover 80 of costs?

Medicare Part B pays 80% of the cost for most outpatient care and services, and you pay 20%. For 2022, the standard monthly Part B premium is $170.10.

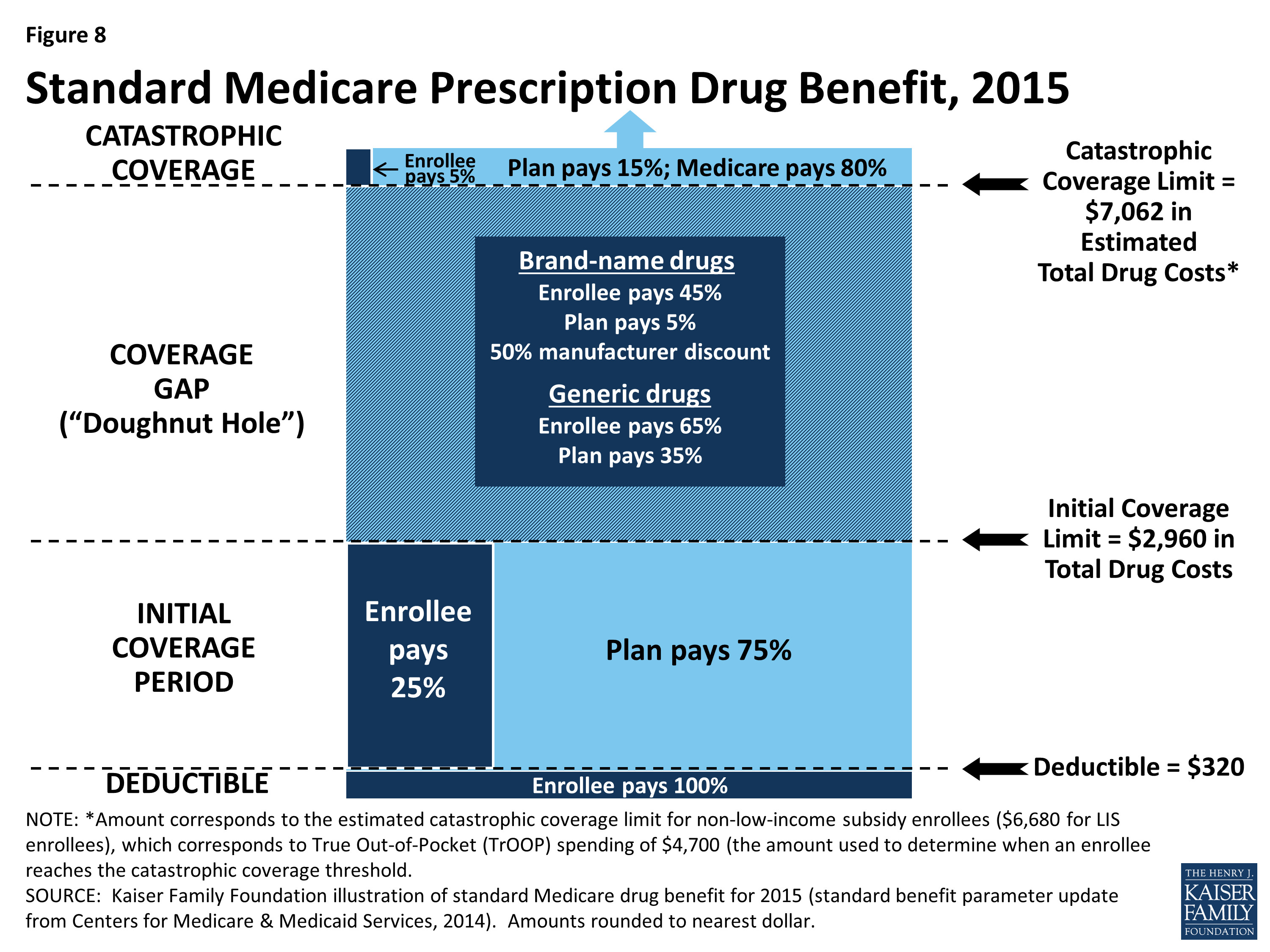

What is the initial coverage limit for 2021?

$4,130The Initial Coverage Limit (ICL) will go up from $4,130 in 2021 to $4,430 in 2022. This means you can purchase prescriptions worth up to $4,430 before entering what's known as the Medicare Part D Donut Hole, which has historically been a gap in coverage.

Does Medicare pay 100 percent of hospital bills?

Most medically necessary inpatient care is covered by Medicare Part A. If you have a covered hospital stay, hospice stay, or short-term stay in a skilled nursing facility, Medicare Part A pays 100% of allowable charges for the first 60 days after you meet your Part A deductible.

Does Medicare have a lifetime limit?

In general, there's no upper dollar limit on Medicare benefits. As long as you're using medical services that Medicare covers—and provided that they're medically necessary—you can continue to use as many as you need, regardless of how much they cost, in any given year or over the rest of your lifetime.

How much does Medicare cost at age 83?

How much does the average Medicare Supplement Plan F cost?Age in yearsAverage monthly premium for Plan F80$221.0581$226.9382$236.5383$220.8118 more rows•Dec 8, 2021

What is the Maximum Medicare Out-of-Pocket Limit for in 2022?

Many people are surprised to learn that Original Medicare doesn’t have out-of-pocket maximums. Original Medicare consists of two parts — Part A and...

What is the Medicare out-of-pocket maximum ?

Let’s face it, higher-than-expected medical bills can happen to anyone, even those in perfect health. That’s a scary reality we hope won’t happen t...

How Much do Medicare Patients Pay Out-of-Pocket?

To summarize, Medicare beneficiaries pay varying out-of-pocket amounts, based upon the type of coverage they have.

What’s included in the out-of-pocket maximum for Medicare Part C plans?

The costs you pay for covered healthcare services all go towards your Part C out-of-pocket maximum. These include:

What happens if a doctor doesn't accept my insurance?

And, if the doctor doesn’t accept the policy, you don’t have coverage. Any expense you incur that doesn’t have coverage won’t apply to your maximum out of pocket. Further, that service will be 100% your bill. Some choose PPO plans to have some coverage outside the plan.

Does Medicare cover surgery?

Medicare doesn’t have a limit on the amount you can spend on healthcare. But, they do cover a portion of most medical bills. Yes, there is some help, but 20% of $100,000+ surgery or accident could be bank-breaking. But, there are options to supplement your Medicare. Some options have a maximum limit. Yet, some options don’t.

Is there a limit on Medicare 2021?

Updated on July 13, 2021. There isn’t a maximum out of pocket on Medicare. Because of this, there is no limit to the amount you can pay in medical bills. You can contribute 20% of any number of costs after meeting the deductible. Don’t worry, though; we have a few solutions to help you.

Can you pay Medicare out of pocket?

No, with Medicare you can pay any amount out of pocket on medical bills. So, those with chronic health conditions can expect to pay endlessly on coinsurances with Medicare. There is no Part A or Part B maximum out of pocket.

Does Medigap have a maximum out of pocket?

Medigap plans don’t have a maximum out of pocket because they don’t need one. The coverage is so good you’ll never spend $5,000 a year on medical bills. Sure, the premium is a little higher, but the benefits are more significant. If high medical bills are your concern, consider choosing Medigap.

Who is Lindsay Malzone?

Lindsay Malzone is the Medicare expert for MedicareFAQ. She has been working in the Medicare industry since 2017. She is featured in many publications as well as writes regularly for other expert columns regarding Medicare.

Does Medicare Advantage have out-of-pocket limits?

All Medicare Advantage plans and Part D drug plans include out-of-pocket maximums (spending limits). Original Medicare (Parts A and B), which is provided by the government, doesn’t. Learn how the out-of-pocket maximums for each part of Medicare.

Does Medicare Part A have an out-of-pocket maximum?

As previously mentioned, Medicare Part A and Medicare Part B do not have an out-of-pocket maximum. Technically speaking, beneficiaries who have Original Medicare coverage are responsible for a potentially very high amount of out-of-pocket costs (such as deductibles and copays) in a year.

What is Medicare out of pocket?

Medicare out-of-pocket costs are the amount you are responsible to pay after Medicare pays its share of your medical benefits. In Medicare Part A, there is no out-of-pocket maximum. Most people do not pay a premium for Part A, but there are deductibles and limits to what is covered.

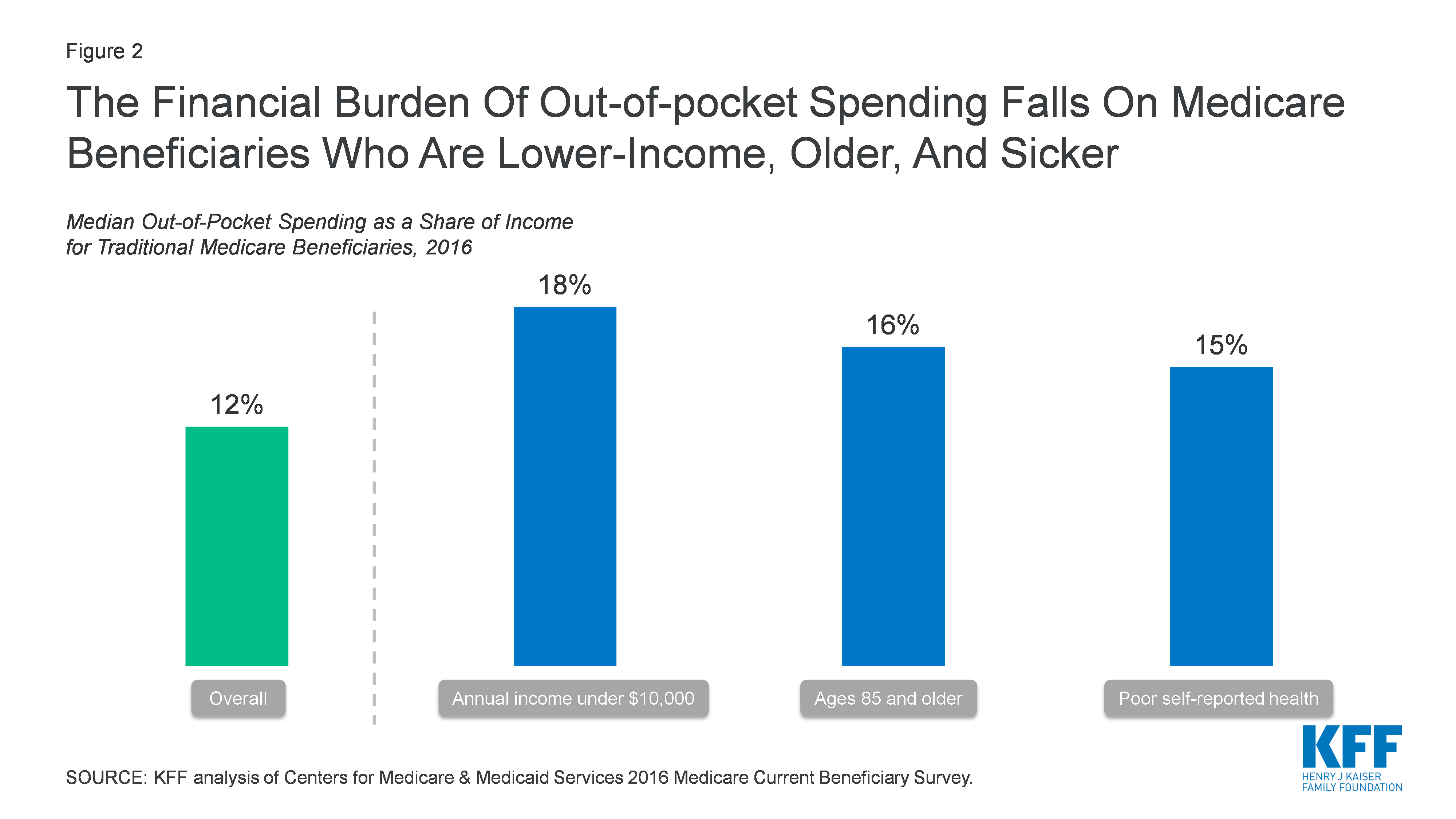

How much of Medicare is spent on out of pocket?

More than a quarter of all Medicare recipients spend about 20 percent of their annual income on out-of-pocket costs after Medicare reimbursements. People lower income or complex health conditions are likely to pay the most.

What percentage of Medicare deductible do you pay?

After you meet your deductible, you will pay 20 percent of the Medicare-approved amount for most of your medical costs. Some services, like preventive care, are supplied without a coinsurance cost. Out-of-pocket maximum. There is no out-of-pocket maximum for your share of Medicare Part B costs.

What is the Medicare Part A deductible for 2021?

Medicare Part A costs include your share of expenses for any inpatient treatments or care. In 2021, the Part A deductible is $1,484. Once you’ve paid this amount, your coverage will kick in and you’ll only pay a portion of your daily costs, based on how long you’ve been in the hospital.

What is Medicare Supplemental Insurance?

There are a number of private insurance products that can help cover the out-of-pocket costs of your Medicare coverage. These Medicare supplemental insurance plans are called Medigap, and they are regulated by both federal and state guidelines. Each plan is different, and out-of-pocket costs may vary by plan.

What is Medicare Part C?

Medicare Part C is a private insurance product that replaces your original Medicare coverage. These plans may also include Medicare Part D, which covers prescription drug costs.

What is the Medicare Advantage out of pocket limit for 2021?

In 2021, the Medicare Advantage out-of-pocket limit is set at $7,550. This means plans can set limits below this amount but cannot ask you to pay more than that out of pocket. Out-of-pocket limit levels.

What is a Medigap plan?

These plans, also known as “ Medigap ,” provide coverage for some of Medicare’s out-of-pocket costs, such as deductibles, coinsurance and copayments. Some Medigap plans even include annual out-of-pocket spending limits. Sign up for a Medicare Advantage plan.

How much is the deductible for Part D in 2021?

Part D. Deductibles vary according to plan. However, Part D deductibles are not allowed to exceed $455 in 2021, and many Part D plans do not have a deductible at all. The average Part D deductible in 2021 is $342.97. 1.

How much coinsurance is required for hospice?

A 5 percent coinsurance payment is also required for inpatient respite care. For durable medical equipment used for home health care, a 20 percent coinsurance payment is required.

How much is Medicare Part B?

Part B. The standard Medicare Part B premium is $148.50 per month. However, the Part B premium is based on your reported taxable income from two years prior. The table below shows what Part B beneficiaries will pay for their premiums in 2021, based off their 2019 reported income. Medicare Part B IRMAA.

What is Medicare Part D based on?

Part D premiums also come with an income-based tier system that uses your reported income from two years prior, similar to how Medicare Part B premiums are calculated. Part D premiums for 2021 will be based on reported taxable income from 2019, and the breakdown is as follows: Medicare Part D IRMAA. 2019 Individual tax return.

How much is a copayment for a mental health facility?

For an extended stay in a hospital or mental health facility, a copayment of $371 per day is required for days 61-90 of your stay, and $742 per “lifetime reserve day” thereafter.

How much can you save if you don't accept Medicare?

If you are enrolled in Original Medicare, avoiding health care providers who do not accept Medicare assignment can help you save up to 15 percent on excess charges. Read additional medicare costs guides to learn more about Medicare costs and how they will affect you.

Bottom Line: How Much

Enrolling in Medicare Part A and Part B, without additional coverage, is not a wise decision. It may save money on premiums initially. But get sick and, because there is no cap, the bills may never stop.

Caps For Medicare Advantage And Part D

Out-of-pocket expenses can be worrisome, especially if you are diagnosed with a serious illness or have a chronic medical condition. Such costs can draw the focus away from getting proper medical care.

What Should You Do

Realize this may have an impact on you. There are almost 600 plans that will have the maximum limits in 2021. I found them from Connecticut to California. A family member in Arkansas just shared that the maximum limits in her PPO plan are increasing by $1,800 in-network and $6,200 for in- and out-of-network combined.

What Is The Out

The Medicare out of pocket maximum for Medicare Advantage plans in 2021 is $7,550 for in-network expenses and $11,300 for combined in-network and out-of-network expenses, according to Kaiser Family Foundation.

What Is A Maximum Out

When it comes to health insurance, there are lots of terms that get thrown around. However, not all of them are a simple as they seem. One of these terms is the out-of-pocket maximum. It is important to be aware of what this term means and how it relates to your Medicare Advantage plan.

What Is A Medicare Advantage Plan Out Of Pocket Maximum

All Medicare Advantage plans have an out of pocket maximum. A Medicare Advantage out of pocket maximum is a limit on the amount you will pay out of pocket before your covered medical expenses are paid for the rest of the calendar year.

Basic Terms For Medicare Costs

Lets begin by defining the different forms of Medicare costs that you may experience.

What is Medicare Supplement Plan C?

Medicare Supplement Plan C, also called Medigap Plan C, is one of the most comprehensive of the 10 standardized supplemental Medicare plans available in most states.

What is coinsurance in Medicare?

Coinsurance is a percentage of the total you are required to pay for a medical service. ... costs for all Medicare-approved healthcare services. Medicare Advantage plans (Medicare Part C) have an annual maximum out-of-pocket limit (MOOP) on health care services only. Plan members pay copayments when they get medical care.

What is the maximum out of pocket limit for Medicare Part B 2021?

And, unlike Medicare Advantage coverage, there is no maximum out-of-pocket limit. Fortunately, you can get a Medigap plan to cover some or all of the Part B coinsurance.

What is Medicare Part A?

Medicare Part A is hospital inpatient coverage for people with Original Medicare, whereas Part B is medical coverage for doctor visits, tests, etc.... and Medicare Part B. Medicare Part B is medical coverage for people with Original Medicare.

How long does Medicare cover skilled nursing?

Medicare Part A covers 100 percent of the cost of skilled nursing facility care for the first 20 days so long as you had at least a three-night inpatient hospital stay prior to the skilled nursing facility stay. Supplemental Medicare coverage helps pay some or all of your Part A coinsurance.

How much does Medicare pay if you don't work 10 years?

How much you pay depends on the number of quarters you paid the Medicare tax. $263/month for beneficiaries who paid into Medicare for 7.5 to 10 years.

What is a Part A deductible?

Part A is for hospital inpatient care.... A deductible is an amount a beneficiary must pay for their health care expenses before the health insurance policy begin s to pay its share.... Coinsurance is a percentage of the total you are required to pay for a medical service. ...