Deductibles will also go up in 2019. The deductible for Medicare Part A, which covers hospital services, will increase from $1,340 in 2018 to $1,364 in 2019. The deductible for Medicare Part B, which covers physician services and other outpatient services, will see a mild bump from $183 to $185.

What is the Medicare Part a deductible for 2019?

Oct 12, 2018 · The annual deductible for all Medicare Part B beneficiaries is $185 in 2019, an increase of $2 from the annual deductible $183 in 2018. Premiums and deductibles for Medicare Advantage and Medicare Prescription Drug plans are already finalized and …

What is the Medicare Part B deductible for outpatient care?

Oct 12, 2018 · The deductible for Medicare Part A, which covers hospital services, will increase from $1,340 in 2018 to $1,364 in 2019. The deductible for Medicare Part B, which covers physician services and...

What is the Medicare Part a hospital deductible for 2020?

You usually pay 20% of the Medicare-Approved Amount for the doctor's or other health care provider's services. You may pay more for outpatient services you get in a hospital than you’ll pay for the same care in a doctor’s office. However, the hospital outpatient copayment for the service is capped at the inpatient deductible amount.

Is there a deductible for Medicare Part a hospital stay?

May 15, 2019 · Medicare Part B will probably handle the billing for that clinic visit because it’s typically an outpatient service. Medicare Part B also employs a deductible. Unlike Part A, Part B has an annual deductible. In 2019, the annual Part B deductible is $185.

What is the 2019 Medicare deductible?

(Note: Most Medicare beneficiaries are exempt from paying the Medicare Part A premium since they or their spouse paid into Medicare while working.) The 2019 Part A deductible is $1,364 — $24 more than in 2018. Part A coinsurance amounts will also increase in 2019 as shown in this table.

What is the deductible for Medicare patients?

Medicare Part B Premium and Deductible The standard monthly premium for Medicare Part B enrollees will be $170.10 for 2022, an increase of $21.60 from $148.50 in 2021. The annual deductible for all Medicare Part B beneficiaries is $233 in 2022, an increase of $30 from the annual deductible of $203 in 2021.Nov 12, 2021

What is the Medicare Part A and Part B deductible for 2019?

$185 inThe annual deductible for all Medicare Part B beneficiaries is $185 in 2019, an increase of $2 from the annual deductible $183 in 2018....Part A Deductible and Coinsurance Amounts for Calendar Years 2018 and 2019 by Type of Cost Sharing20182019Daily coinsurance for lifetime reserve days6706823 more rows•Oct 12, 2018

How do I get my $144 back from Medicare?

You can get your reduction in 2 ways:If you pay your Part B premium through Social Security, the Part B Giveback will be credited monthly to your Social Security check.If you don't pay your Part B premium through Social Security, you'll pay a reduced monthly amount directly to Medicare.Sep 16, 2021

How do I find out my deductible?

A deductible can be either a specific dollar amount or a percentage of the total amount of insurance on a policy. The amount is established by the terms of your coverage and can be found on the declarations (or front) page of standard homeowners and auto insurance policies.

What is the deductible for Medicare Part B 2021?

$203 inThe annual deductible for all Medicare Part B beneficiaries is $203 in 2021, an increase of $5 from the annual deductible of $198 in 2020.Nov 6, 2020

What are Medicare Part B premiums for 2019?

The Centers for Medicare & Medicaid Services has announced that the standard monthly Part B premium will be $144.60 in 2020, an increase from $135.50 in 2019. However, some Medicare beneficiaries will pay less than this amount.

Is there a deductible for Medicare Part A and B?

Yes, you have to pay a deductible if you have Medicare. You will have separate deductibles to meet for Part A, which covers hospital stays, and Part B, which covers outpatient care and treatments.

What is the standard deduction for Medicare Part B?

The standard Part B premium amount is $170.10 (or higher depending on your income). In Original Medicare, this is the amount a doctor or supplier that accepts assignment can be paid. It may be less than the actual amount a doctor or supplier charges.

Is there really a $16728 Social Security bonus?

The $16,728 Social Security bonus most retirees completely overlook: If you're like most Americans, you're a few years (or more) behind on your retirement savings. But a handful of little-known "Social Security secrets" could help ensure a boost in your retirement income.Dec 9, 2021

Will Social Security get a $200 raise in 2021?

Which Social Security recipients will see over $200? If you received a benefit worth $2,289 per month in 2021, then you will see an increase worth over $200. People who get that much in benefits worked a high paying job for 35 years and likely delayed claiming benefits.Jan 9, 2022

Can you have Medicare and Humana at the same time?

People eligible for Medicare can get coverage through the federal government or through a private health insurance company like Humana. Like Medicaid, every Medicare plan is required by law to give the same basic benefits.Mar 29, 2022

What is the Medicare deductible for 2019?

Deductibles will also go up in 2019. The deductible for Medicare Part A, which covers hospital services, will increase from $1,340 in 2018 to $1,364 in 2019. The deductible for Medicare Part B, which covers physician services and other outpatient services, will see a mild bump from $183 to $185.

How much does Medicare pay in 2019?

Answer: The Centers for Medicare & Medicaid Services announced that most people will pay $135.50 per month for Medicare Part B in 2019, up slightly from $134 per month in 2018.

Why do Medicare beneficiaries pay less?

A small group of Medicare beneficiaries (about 3.5%) will pay less because the cost-of-living increase in their Social Security benefits is not large enough to cover the full premium increase. The “hold-harmless provision” prevents enrollees’ annual increase in Medicare premiums from exceeding their cost-of-living increase in Social Security ...

How much is the premium for singles?

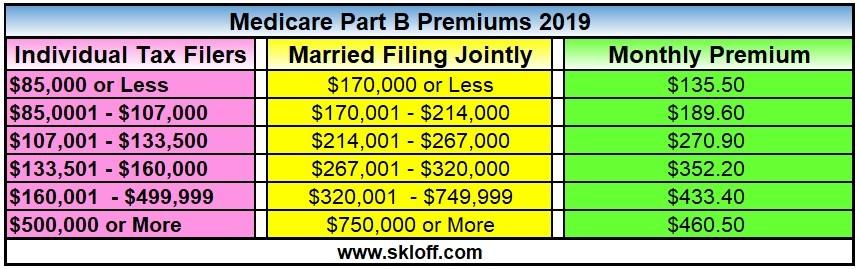

And premiums for singles earning $133,501 to $160,000 ($267,001 to $320,000 for joint filers) will rise from $348.30 to $352.20. If you had higher income than that, your monthly premium for 2018 was $428.60. In 2019, there will be an extra surcharge tier for people with the highest income.

How much is Social Security going up in 2019?

Social Security benefits are increasing by 2.8% in 2019, which will cover the increase in premiums for most people. Premium increases are also minor for most higher-income beneficiaries—those with adjusted gross income plus tax-exempt interest income of more than $85,000 if single or $170,000 if married filing jointly.

How much is the 2019 tax surcharge?

If your income is between $160,001 and $499,999 ($320,001 to $749,999 for joint filers), you’ll pay $433.40 per month. Single filers with income of $500,000 or more ($750,000 or more for joint filers) will pay $460.50 per month.

Can you contest a Medicare surcharge?

If you’ve experienced certain life-changing events that have reduced your income since then, such as retirement, divorce or the death of a spouse, you can contest the surcharge. For more information about contesting or reducing the high-income surcharge, see Save Money on Medicare.

What is a deductible for Medicare?

deductible. The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. for each service. The Part B deductible applies, except for certain. preventive services.

How much does Medicare pay for outpatient care?

You usually pay 20% of the Medicare-approved amount for the doctor or other health care provider's services. You may pay more for outpatient services you get in a hospital than you’ll pay for the same care in a doctor’s office. However, the hospital outpatient Copayment for the service is capped at the inpatient deductible amount.

What is preventive care?

preventive services. Health care to prevent illness or detect illness at an early stage, when treatment is likely to work best (for example, preventive services include Pap tests, flu shots, and screening mammograms). . If you get hospital outpatient services in a critical access hospital, your copayment may be higher and may exceed ...

What is a copayment in a hospital?

An amount you may be required to pay as your share of the cost for a medical service or supply, like a doctor's visit, hospital outpatient visit, or prescription drug. A copayment is usually a set amount, rather than a percentage.

What is covered by Medicare outpatient?

Covered outpatient hospital services may include: Emergency or observation services, which may include an overnight stay in the hospital or outpatient clinic services, including same-day surgery. Certain drugs and biologicals that you ...

Can you get a copayment for outpatient services in a critical access hospital?

If you get hospital outpatient services in a critical access hospital, your copayment may be higher and may exceed the Part A hospital stay deductible. If you get hospital outpatient services in a critical access hospital, your copayment may be higher and may exceed the Part A hospital stay deductible.

Does Part B cover prescription drugs?

Certain drugs and biologicals that you wouldn’t usually give yourself. Generally, Part B doesn't cover prescription and over-the-counter drugs you get in an outpatient setting, sometimes called “self-administered drugs.".

How much is the 2019 deductible?

Your deductible for each period in 2019 is $1364. That means you’ll be charged up to that amount for any services provided during your inpatient stay at the hospital. The same deductible applies for each benefit period if you’re admitted as an inpatient at a skilled nursing facility for a period of time.

How much is Medicare Part B deductible?

Medicare Part B also employs a deductible. Unlike Part A, Part B has an annual deductible. In 2019, the annual Part B deductible is $185. That means you’re responsible for non-inpatient bills up to that amount.

What does Medicare Part A cover?

Medicare Part A (Hospital Insurance) helps cover inpatient care in hospitals or skilled nursing facilities, in hospice, or home health care. For example, if you have an infected appendix and you are admitted to the hospital for a surgeon to perform an appendectomy, Part A will help cover the costs during your stay, ...

What is Medicare for seniors?

Medicare is the primary hospital and medical insurance coverage for tens of millions of Americans aged 65 or older or under 65 who qualify due to disabilities.

When does the benefit period start?

Your benefit period starts when you get admitted. When you get discharged, a countdown begins. If you go 60 days without receiving more inpatient care, you start a new benefit period. Your deductible goes back into effect for each benefit period.

Is it reasonable for Medicare to know about deductibles?

Any cost above what appears in their normal budget poses a risk to their financial security. Given those circumstances, it is reasonable for Medicare recipients to want to know about what, if any, kind of deductibles apply to their Medicare coverage.

What is deductible in Medicare?

deductible. The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. applies. If you get your services in a hospital outpatient clinic or hospital outpatient department, you may have to pay an additional. copayment.

What is Medicare preventive visit?

A one-time “Welcome to Medicare” preventive visit. This visit includes a review of your possible risk factors for depression. A yearly “Wellness” visit. Talk to your doctor or other health care provider about changes in your mental health. They can evaluate your changes year to year.

What is Part B?

Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services. helps pay for these outpatient mental health services: One depression screening per year. The screening must be done in a primary care doctor’s office or primary care clinic that can provide follow-up treatment and referrals. ...

What is a copayment?

copayment. An amount you may be required to pay as your share of the cost for a medical service or supply, like a doctor's visit, hospital outpatient visit, or prescription drug. A copayment is usually a set amount, rather than a percentage. For example, you might pay $10 or $20 for a doctor's visit or prescription drug.

What is a health care provider?

health care provider. A person or organization that's licensed to give health care. Doctors, nurses, and hospitals are examples of health care providers. to diagnose or treat your condition.

Do you pay for depression screening?

You pay nothing for your yearly depression screening if your doctor or health care provider accepts assignment. In Original Medicare, this is the amount a doctor or supplier that accepts assignment can be paid. It may be less than the actual amount a doctor or supplier charges.

How much does Medicare cover if you have met your deductible?

If you already met your deductible, you’d only have to pay for 20% of the $80. This works out to $16. Medicare would then cover the final $64 for the care.

What is the Medicare Part B deductible for 2020?

The Medicare Part B deductible for 2020 is $198 in 2020. This deductible will reset each year, and the dollar amount may be subject ...

How much is Medicare Part B 2020?

The Medicare Part B deductible for 2020 is $198 in 2020. This deductible will reset each year, and the dollar amount may be subject to change. Every year you’re an enrollee in Part B, you have to pay a certain amount out of pocket before Medicare will provide you with coverage for additional costs.

What is 20% coinsurance?

In this instance, you’d be responsible for 20% of the bill under Part B. Medicare would then cover the other 80%. The coinsurance amount you pay is 20% of the amount Medicare approved. This approved amount is the maximum amount your healthcare provider is allowed to charge you for an item or service. If you refer back to your broken arm example.

How much is a broken arm deductible?

If you stayed in the hospital as a result of your broken arm, these expenses would go toward your Part A deductible amount of $1,408. Part A and Part B have their own deductibles that reset each year, and these are standard costs for each beneficiary that has Original Medicare. Additionally, Part C and Part D have deductibles ...

What happens when you reach your Part A or Part B deductible?

What happens when you reach your Part A or Part B deductible? Typically, you’ll pay a 20% coinsurance once you reach your Part B deductible. This coinsurance gets attached to every item or service Part B covers for the rest of the calendar year.

How much does it cost to treat a broken arm?

If you refer back to your broken arm example. Say your treatment cost you $80. If you broke your arm before you reached your Part B deductible amount of $198, you’d have to pay the full $80 for your care or whichever amount you had left to hit your $198 cap.

What Is a Deductible?

A deductible is the amount of money that you must pay out of your own pocket for covered care before your plan coverage kicks in.

Medicare Part A Deductible

Medicare Part A covers inpatient care received at a hospital, skilled nursing facility or other inpatient facility.

What Is the Maximum Cost of Medicare Part B?

Medicare Part B does come with a premium cost. The monthly premium prices are set annually and depend on your annual income. Premium costs start at $170.10 per month. The maximum cost of Medicare Part B premiums is $578.30 per month in 2022, and that's for individuals reporting half a million dollars or more in income in 2020.

Medicare Part C (Medicare Advantage) Deductible

Medicare Part C plans, otherwise known as Medicare Advantage plans, are an alternative way to get Original Medicare benefits, often with additional coverage.

Medicare Part D Deductible

Medicare Part D plans cover prescription medications. Like Medicare Advantage, plans Medicare Part D plans are sold by private insurers and thus there is no standard deductible.

Medicare Supplement Deductibles by Plan

There are 10 standardized Medicare Supplement plans (also called Medigap) available in most states, and two of those plans offer a high-deductible option. Medigap Plan F and Plan G have high-deductible options that include an annual deductible of $2,490 in 2022.

What is the Medicare premium for 2020?

The standard monthly premium for Medicare Part B enrollees will be $144.60 for 2020, an increase of $9.10 from $135.50 in 2019. The annual deductible for all Medicare Part B beneficiaries is $198 in 2020, an increase of $13 from the annual deductible of $185 in 2019. The increase in the Part B premiums and deductible is largely due ...

How much will Medicare premiums decline in 2020?

As previously announced, as a result of CMS actions to drive competition, on average for 2020, Medicare Advantage premiums are expected to decline by 23 percent from 2018, and will be the lowest in the last thirteen years while plan choices, benefits and enrollment continue to increase. Premiums and deductibles for Medicare Advantage ...

What percentage of Medicare Part B premiums are based on income?

Since 2007, a beneficiary’s Part B monthly premium is based on his or her income. These income-related monthly adjustment amounts (IRMAA) affect roughly 7 percent of people with Medicare Part B. The 2020 Part B total premiums for high income beneficiaries are shown in the following table: Beneficiaries who file.

What is Medicare Part A premium?

491.60. Medicare Part A Premiums/Deductibles. Medicare Part A covers inpatient hospital, skilled nursing facility, and some home health care services. About 99 percent of Medicare beneficiaries do not have a Part A premium since they have at least 40 quarters of Medicare-covered employment.

How much is coinsurance for 2020?

In 2020, beneficiaries must pay a coinsurance amount of $352 per day for the 61st through 90th day of a hospitalization ($341 in 2019) in a benefit period and $704 per day for lifetime reserve days ($682 in 2019). For beneficiaries in skilled nursing facilities, the daily coinsurance for days 21 through 100 of extended care services in ...

Why is the Part B premium going up?

The increase in the Part B premiums and deductible is largely due to rising spending on physician-administered drugs. These higher costs have a ripple effect and result in higher Part B premiums and deductible. From day one, President Trump has made it a top priority to lower drug prices.

Do you have to file a separate tax return for a high income beneficiary?

Premiums for high-income beneficiaries who are married and lived with their spouse at any time during the taxable year, but file a separate return, are as follows: Beneficiaries who are married and lived with their spouses at any time during the year, but who file separate tax returns from their spouses:

How much is the 2020 Medicare deductible?

The 2020 Medicare Part A deductible for each benefit period is $1,408 —which may sound like a lot, but it’s less than the average cost of a single night in a U.S. hospital. 1.

How often do you have to pay a deductible for Medicare?

Original Medicare requires that you pay a deductible for each inpatient hospital “benefit period,” which means you may have to pay a deductible more than once in a single year.

What is Medicare Part B deductible?

Medicare Part B covers most doctor services, including those you receive while hospitalized, as well as outpatient therapy and the rental or purchase of durable medical equipment, which is equipment your doctor prescribes because it is medically necessary, like blood sugar monitor test strips, walkers or wheelchairs.

What is a copay?

Copays—A fixed amount ($20, for example) you pay for a covered healthcare service after you've paid your deductible. Coinsurance—The percentage of costs of a covered healthcare service you pay (20%, for example) after you've paid your deductible.

Does Medicare have a deductible?

Medicare plans have deductibles just like individual or employer health insurance plans do. Both Original Medicare and, typically, Medicare Advantage Plans, require you to meet a deductible—an amount you pay for healthcare or for prescriptions—before your healthcare plan begins to pay.