Does Medicare have a deductible?

Yes, you have to pay a deductible if you have Medicare. You will have separate deductibles to meet for Part A, which covers hospital stays, and Par...

What is the Medicare deductible for 2022?

The Part A deductible for 2022 is $1,556 for each benefit period. The Part B deductible is $233. You will usually then pay 20 percent of the cost f...

How do Medicare deductibles work?

A deductible is the amount of money that you have to pay out-of-pocket before Medicare begins paying for your health costs. For example, if you rec...

How much is Medicare Part A deductible for 2021?

For 2021, the Medicare Part A deductible is $1,484 for each benefit period. If you re-enter the hospital or skilled nursing facility any time after your benefit period ends, you will have to pay the first $1,484 again as a new deductible.

What is a benefit period for Medicare?

The benefit period begins the day you enter the hospital or facility and ends after you have not needed inpatient care for 60 days in a row. Source: Centers for Medicare & Medicaid Services.

What is the Medicare Advantage plan for 2021?

For 2021, the MOOP for Medicare Advantage plans is $7,550 for in-network care. It can be higher for out-of-network care or services. But once you hit your MOOP for the year, the plan has to cover 100 percent of all further costs. Some Medicare Part D prescription drug plans don’t have a deductible. Those that do may not have a deductible ...

Does Medigap cover Part A?

Some of these plans may cover all or a portion of your Part A deductible. Medigap Plans C and F were the only two to cover the deductible for Medicare Part B. However, Plans C and F are available only to people who became eligible for Medicare before Jan. 1, 2020.

What is a Medigap plan?

Medigap, also known as Medicare Supplement plans, can help pay some of your out-of-pocket costs, including your Medicare Part A deductibles. These plans are sold through private insurers. There are eight standardized plans across 47 states and the District of Columbia.

Does Medicare Advantage cover out of pocket expenses?

Medicare Advantage plans may offer coverage that absorb some of your out-of-pocket costs. Though Medicare Advantage deductibles may vary , all plans must set a limit on your maximum out-of-pocket (MOOP) expenses.

What is Medicare Part B deductible?

Medicare Part B covers most doctor services, including those you receive while hospitalized, as well as outpatient therapy and the rental or purchase of durable medical equipment, which is equipment your doctor prescribes because it is medically necessary, like blood sugar monitor test strips, walkers or wheelchairs.

How often do you have to pay a deductible for Medicare?

Original Medicare requires that you pay a deductible for each inpatient hospital “benefit period,” which means you may have to pay a deductible more than once in a single year.

What are the out-of-pocket costs of Medicare?

There are 3 primary out-of-pocket costs you’ll want to consider as you begin evaluating Medicare plans: 1 Copays—A fixed amount ($20, for example) you pay for a covered healthcare service after you've paid your deductible 2 Coinsurance—The percentage of costs of a covered healthcare service you pay (20%, for example) after you've paid your deductible 3 Deductibles—The amount you pay for covered healthcare services before your insurance plan starts to pay.

How much is the 2020 Medicare deductible?

The 2020 Medicare Part A deductible for each benefit period is $1,408 —which may sound like a lot, but it’s less than the average cost of a single night in a U.S. hospital. 1.

What is a copay?

Copays—A fixed amount ($20, for example) you pay for a covered healthcare service after you've paid your deductible. Coinsurance—The percentage of costs of a covered healthcare service you pay (20%, for example) after you've paid your deductible.

Does Medicare have a deductible?

Medicare plans have deductibles just like individual or employer health insurance plans do. Both Original Medicare and, typically, Medicare Advantage Plans, require you to meet a deductible—an amount you pay for healthcare or for prescriptions—before your healthcare plan begins to pay.

What Is a Deductible?

A deductible is the amount of money that you must pay out of your own pocket for covered care before your plan coverage kicks in.

Medicare Part A Deductible

Medicare Part A covers inpatient care received at a hospital, skilled nursing facility or other inpatient facility.

What Is the Maximum Cost of Medicare Part B?

Medicare Part B does come with a premium cost. The monthly premium prices are set annually and depend on your annual income. Premium costs start at $148.50 per month. The maximum cost of Medicare Part B coverage is $504.90 per month in 2021, and that's for individuals reporting half a million dollars or more in income in 2019.

Medicare Part C (Medicare Advantage) Deductible

Medicare Part C plans, otherwise known as Medicare Advantage plans, are an alternative way to get Original Medicare benefits, often with additional coverage.

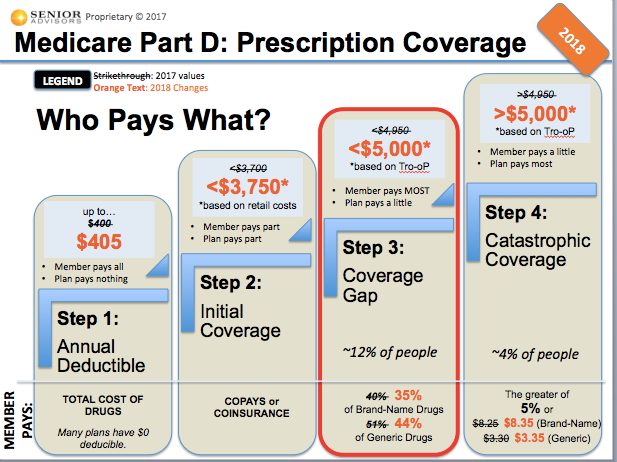

Medicare Part D Deductible

Medicare Part D plans cover prescription medications. Like Medicare Advantage, plans Medicare Part D plans are sold by private insurers and thus there is no standard deductible.

Medicare Supplement Deductibles by Plan

There are 10 standardized Medicare Supplement plans (also called Medigap) available in most states, and two of those plans offer a high-deductible option. Medigap Plan F and Plan G have high-deductible options that include an annual deductible of $2,370 in 2021.

What is Medicare Part A?

Medicare Part A is hospital insurance. It may cover your care in certain situations, such as: You’re admitted to a hospital or mental hospital as an inpatient. You’re admitted to a skilled nursing facility and meet certain conditions. You qualify for hospice care.

How much does Medicare pay in 2019?

On the other hand, most people do pay a monthly premium for Medicare Part B. The standard premium in 2019 is $135.50, but you may pay more if your income is above a certain level. If you have a low income or no income, in some cases Medicaid might pay your Part B premium.

How many Medicare Supplement Plans are there?

There are up to 10 standardized Medicare Supplement plans available in most states. Learn more about Medicare Supplement insurance. You can compare Medicare Supplement plans and Medicare coverage options anytime you like, with no obligation. Type your zip code in the box on this page to begin.

Do you have to pay Medicare Part A or B?

Although both Medicare Part A and Part B have monthly premiums, whether you’re likely to pay a premium – and how much – depends on the “part” of Medicare. Most people don’t have to pay a monthly premium for Medicare Part A. If you’ve worked and paid Medicare taxes for at least 10 years (40 quarters), you typically don’t pay a premium.

What are preventive services?

Preventive services, like annual checkups and flu shots. Medical supplies and durable medical equipment, such as walkers and wheelchairs. Certain lab tests and screenings. Diabetes care, such as screenings, supplies, and a prevention program. Chemotherapy.

Can you get hospice care with Medicare?

You qualify for hospice care. Your doctor orders home health care for you and you meet the Medicare criteria. Medicare Part A may cover part-time home health care for a limited time. Even when Medicare Part A covers your care: You may have to pay a deductible amount and/or coinsurance or copayment.

What happens when you reach your Part A or Part B deductible?

What happens when you reach your Part A or Part B deductible? Typically, you’ll pay a 20% coinsurance once you reach your Part B deductible. This coinsurance gets attached to every item or service Part B covers for the rest of the calendar year.

What is the Medicare Part B deductible for 2020?

The Medicare Part B deductible for 2020 is $198 in 2020. This deductible will reset each year, and the dollar amount may be subject ...

How much is Medicare Part B 2020?

The Medicare Part B deductible for 2020 is $198 in 2020. This deductible will reset each year, and the dollar amount may be subject to change. Every year you’re an enrollee in Part B, you have to pay a certain amount out of pocket before Medicare will provide you with coverage for additional costs.

How much is a broken arm deductible?

If you stayed in the hospital as a result of your broken arm, these expenses would go toward your Part A deductible amount of $1,408. Part A and Part B have their own deductibles that reset each year, and these are standard costs for each beneficiary that has Original Medicare. Additionally, Part C and Part D have deductibles ...

What is Medicare Supplement?

Medicare Supplement, or Medigap, insurance plans are sold by private insurance companies to help pay some of the costs that Original Medicare does not. They can offer coverage for some of the expenses you’ll have as a Medicare beneficiary like deductibles and coinsurance. Medicare Advantage. An alternative to Original Medicare, a Medicare ...

What is Medicare Advantage?

Medicare Advantage. An alternative to Original Medicare, a Medicare Advantage, or Medicare Part C, plan will offer the same benefits as Original Medicare, but most MA plans include additional coverage. Most MA plans will have an annual out-of-pocket maximum limit. Extra Help Program. Finally, the Extra Help program is something low-income Medicare ...

How much does it cost to treat a broken arm?

If you refer back to your broken arm example. Say your treatment cost you $80. If you broke your arm before you reached your Part B deductible amount of $198, you’d have to pay the full $80 for your care or whichever amount you had left to hit your $198 cap.

How much does Medicare pay for outpatient therapy?

After your deductible is met, you typically pay 20% of the Medicare-approved amount for most doctor services (including most doctor services while you're a hospital inpatient), outpatient therapy, and Durable Medical Equipment (DME) Part C premium. The Part C monthly Premium varies by plan.

What is Medicare Advantage Plan?

A Medicare Advantage Plan (Part C) (like an HMO or PPO) or another Medicare health plan that offers Medicare prescription drug coverage. Creditable prescription drug coverage. In general, you'll have to pay this penalty for as long as you have a Medicare drug plan.

What happens if you don't buy Medicare?

If you don't buy it when you're first eligible, your monthly premium may go up 10%. (You'll have to pay the higher premium for twice the number of years you could have had Part A, but didn't sign up.) Part A costs if you have Original Medicare. Note.

Does Medicare cover room and board?

Medicare doesn't cover room and board when you get hospice care in your home or another facility where you live (like a nursing home). $1,484 Deductible for each Benefit period . Days 1–60: $0 Coinsurance for each benefit period. Days 61–90: $371 coinsurance per day of each benefit period.

What is Medicare Part A and B?

What Is Original Medicare Part A and B? Part A and Part B are often referred to as “Original Medicare.”. Original Medicare is one of your health coverage choices as part of the Medicare program managed by the federal government. Unless you choose a Medicare health plan, you will be enrolled in Original Medicare.

What is the number to call for Medicare Advantage?

Some of these services not covered by Original Medicare may be covered by a Medicare Advantage Plan (like an HMO or PPO). To find out if Medicare covers a service you need, visit medicare.gov and select “What Medicare Covers,” or call 1-800-MEDICARE (1-800-633-4227). TTY users should call 1-877-486-2048, 24 hours a day/7 days a week.

What is fee for service?

It is fee-for-service coverage, meaning that, generally, there is a cost for each service. You generally pay a set amount for your health care (deductible) before Medicare pays its share. Then, Medicare pays its share, and you pay your share (coinsurance / copayment) for covered services and supplies. You usually pay a monthly premium for Part B.

Does Medicare cover dental care?

Items and services that Medicare does not cover include, but are not limited to, cosmetic surgery, health care you get while traveling outside of the United States (except in limited cases), hearing aids and exams for fitting hearing aids, long-term care, most eyeglasses, routine dental care, dentures, and acupuncture.

Does Medicare cover prescription drugs?

Generally, Original Medicare does not cover prescription drugs, also called Part D, although it does cover some drugs in limited cases such as immunosuppressive drugs (for transplant patients) and oral anti-cancer drugs.

Does Medicare cover everything?

Original Medicare doesn’t cover everything. If you need certain services that Medicare does not cover, you will have to pay out–of-pocket unless you have other insurance to help cover the costs. Even if Medicare covers a service or item, you generally have to pay deductibles, coinsurance, and copayments. Items and services that Medicare does not ...

How long does Medicare Part A deductible last?

At the beginning of each benefit period, the Medicare Part A deductible must be paid by beneficiaries. A benefit period extends from the day a patient is admitted to the hospital until the final day treatment is received. If a beneficiary goes 60 days in a row without receiving treatment, the benefit period restarts and a deductible will have ...

What is Medicare for seniors?

Medicare was designed with the goal of providing all senior citizens in America with reliable and affordable health care coverage. The program also strives to provide senior citizens with quality coverage and while the program eliminates many costs associated with health care for seniors, the system still has premiums, co-insurances, ...