Medicare Plan F, Plan G and Plan N are three of the most comprehensive Medicare Supplemental Insurance plans that can help you reduce unexpected, out-of-pocket expenses and stabilize your health care spending. If you have Medicare Parts A and B, then you are eligible to apply for and purchase these plans.

Full Answer

How much does Medicare Part F cost?

Since Medicare Part F is the is the most comprehensive Medigap policy, the premium can be costly. Typically, these range from $120 to $140 per month for a 65-year-old. However, the exact cost will be determined by your location, plan provider, current health condition, and age and gender.

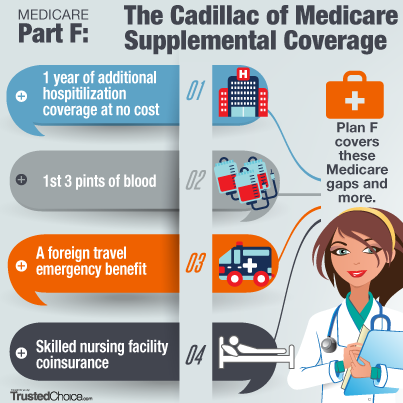

What are the benefits of Medicare Part F?

What is Plan F, Plan G, and Medigap?

- Covers the Part A hospital and Part B outpatient deductibles

- Covers your 20% Part B co-pay

- Covers Part B excess charges

- Does not have a network. You can see any doctor

- Does not require referrals

- Is guaranteed renewable

What is Medicare Part F plan?

which means that it will cover all the gaps found in Medicare. Next is Plan G, which covers almost as much as Plan F, except for the Part B deductible. And Plan N is likely to be the third most popular because it functions just like Plan G, except that the ...

What does Medicare Part G cover and more?

Plan G offers great value for beneficiaries who are willing to pay a small annual deductible. After that, Plan G provides full coverage for all of the gaps in Medicare. It pays for your hospital deductible, copays and coinsurance. It also covers the 20% that Part B doesn’t cover.

What is the difference between Medicare Part G and F?

Although the plans have several similarities, there is one key difference between Plan F and Plan G: With Medicare Plan F, you're getting the plan with the most coverage available. In addition to the above coverage, Plan F also covers Medicare Part B deductible payments. Plan G does not.

What is the difference between plan G and N?

This is where the differences between Plan G and N start. Plan G covers 100% of all Medicare-covered expenses once your Part B deductible has been met for the year. Medicare Plan N coverage, on the other hand, has a few additional out-of-pocket expenses you will have to pay, which we'll cover next.

What are the 4 types of Medicare?

There are four parts of Medicare: Part A, Part B, Part C, and Part D.Part A provides inpatient/hospital coverage.Part B provides outpatient/medical coverage.Part C offers an alternate way to receive your Medicare benefits (see below for more information).Part D provides prescription drug coverage.

What is the difference between Medigap plan F and plan N?

Plan N premiums are typically lower than Plan F premiums, meaning, you spend less out of pocket monthly with Plan N than you will with Plan F. However, Plan F covers more out-of-pocket expenses. If you know that you will have many medical expenses throughout the year, Plan F may be a better choice.

Is Medigap g or n better?

Plan G will typically have higher premiums than Plan N because it includes more coverage. But it could save you money because out-of-pocket costs with Plan N may equal or exceed the premium difference with Plan G, depending on your specific medical needs. Costs of Medigap policies vary by state and carrier.

Is plan N cheaper than plan G?

Premiums for each plan can vary by the carrier that offers it, but Plan G is typically more expensive than Plan N because it offers a higher level of coverage. However, while Plan G usually has higher premiums, it could save you money in the long run.

Why do I need Medicare Part C?

Medicare Part C provides more coverage for everyday healthcare including prescription drug coverage with some plans when combined with Part D. A Medicare Advantage prescription drug (MAPD) plan is when a Part C and Part D plan are combined. Medicare Part D only covers prescription drugs.

Is Medicare Part A free?

Most people don't pay a monthly premium for Part A (sometimes called "premium-free Part A"). If you buy Part A, you'll pay up to $499 each month in 2022. If you paid Medicare taxes for less than 30 quarters, the standard Part A premium is $499.

Is Medicare Part A free at age 65?

You are eligible for premium-free Part A if you are age 65 or older and you or your spouse worked and paid Medicare taxes for at least 10 years. You can get Part A at age 65 without having to pay premiums if: You are receiving retirement benefits from Social Security or the Railroad Retirement Board.

Is plan G as good as plan F?

Medigap Plan G is currently outselling most other Medigap plans because it offers the same broad coverage as Plan F except for the Part B deductible, which is $233 in 2022. The only difference when you compare Medicare Supplements Plan F and Plan G is that deductible. Otherwise, they function just the same.

Which Medigap plans are no longer available?

note: As of January 1, 2020, Medigap plans sold to people new to Medicare can no longer cover the Part B deductible. Because of this, Plans C and F are no longer available to people new to Medicare on or after January 1, 2020.

Is there a Medicare plan that covers everything?

Plan F has the most comprehensive coverage you can buy. If you choose Plan F, you essentially pay nothing out-of-pocket for Medicare-covered services. Plan F pays 100 percent of your Part A and Part B deductibles, coinsurance amounts, and excess charges.

What’S Covered on Medigap Plan F?

Medigap Plan F is a heavy favorite with individuals who want comprehensive benefits and first-dollar coverage on their health care costs. First-dol...

What’S Covered Under Medigap Plan G?

Medigap Plan G is currently outselling most other Medigap plans because it offers the same broad coverage as Plan F except for the Part B deductibl...

What’S Covered Under Medigap Plan N?

This is another fast-selling plan because it offers a good balance between protection against catastrophic out-of-pocket expenses and affordable pr...

When Comparing Medicare Plan F vs Plan G vs Plan N

Be sure to give some thought to the type of coverage you think you’ll want over the long term. Here’s why:In most cases, you do not have a guarante...

How much is a high deductible plan G?

A High Deductible Plan G requires you to pay $2,370 in 2021 before the plan begins to pay. Once you reach the deductible, you will receive the coverage of a regular Plan G. Monthly premiums tend to be lower than regular Plan G because of the high deductible.

How much does Plan N copay?

While Plan N pays 100% of the Part B coinsurance, providers are allowed to require copays up to $20 for doctor’s visits and up to $50 for emergency room visits .

How long does Medicare Part A coinsurance last?

Medicare Part A coinsurance and hospital costs up to an additional 365 days after Medicare benefits run out. * Medicare Supplement Plan F and Plan G also offer a plan with a high deductible in some states. You must pay $2,370 in shared costs before the plan begins to pay.

How long does Medicare open enrollment last?

The Medicare supplement open enrollment period lasts six months. It begins the month you turn 65 and are enrolled in Part B. You can enroll through a private insurance company (via their websites or by phone), or by connecting with a GoHealth licensed insurance agent. Learn more about Medicare Supplement enrollment.

How much will Medicare cost in 2021?

In 2021, you have to pay $2,370 in shared costs before you get the same benefits of regular Plan F. Please note, a High Deductible Plan F also is not available to new Medicare enrollees in 2021.

How much do you have to pay for Medicare in 2020?

You must pay $2,370 in shared costs before the plan begins to pay. * As of January 1, 2020, new Medicare enrollees are not eligible for Plan C or Plan F. If you were eligible for Medicare before January 1, 2020, but did not enroll, you may still be eligible.

What is deductible insurance?

A deductible is an amount you pay out of pocket before your insurance company covers its portion of your medical bills. For example: If your deductible is $1,000, your insurance company will not cover any costs until you pay the first $1,000 yourself.

What is Medicare Plan F?

Medicare Plan F, Plan G and Plan N are Medicare Supplement Insurance plans that can be purchased to help supplement your Original Medicare benefits. These popular plan options can help you cover the extra out-of-pocket costs that Original Medicare doesn’t cover.

Is Medicare Plan F still available?

Medicare Plan F is no longer available to new enrollees as of 2020, though it is still an option for people who were eligible for Medicare before 2020. People who already are enrolled in this plan are also able to keep it. It is also the only plan which covers the yearly Part B deductible (which is $198 in 2020).

Is Medicare Plan G the same as Medicare Plan F?

For new enrollees looking for a comprehensive plan that is very similar to Medicare Plan F, Medicare Plan G is a great option. This plan covers everything that Plan F covers EXCEPT the $198 Part B annual deductible that may need to be paid out-of-pocket. Because Plan G offers slightly less coverage than Plan F, it will usually have a less expensive monthly premiums, though these prices will vary depending on the insurance company offering the plan.

What is the difference between a plan F and a plan G?

With Plan F, you’ll have zero out of pocket costs outside your monthly premium. This is because it’s a first-dollar coverage plan. This means the first dollar is covered by Medicare. You have no deductible, no coinsurance, and no copays. All you have to pay is your monthly premium. With a Plan G, the only cost you have to pay out ...

Which is better, Plan G or Plan F?

Plan G is not too far behind. Is Plan F the best Medicare Supplement plan? Plan F is the plan that will give you the most comprehensive coverage. So, in regards to coverage, yes, Plan F is the best Medicare Supplement plan since it gives you the most coverage.

Does Medigap have standardized benefits?

However, these charges are not common. Some states don’t even allow them. With Medigap plans, the benefits are standardized by the federal government. Meaning, it doesn’t matter which carrier you choose to enroll with, the benefits across each letter plan are exactly the same.

Can I switch to a Medicare Advantage plan?

Can I change from a Medicare Advantage plan to Plan G, Plan N, or Plan F? Yes, you can change from a Medicare Advantage plan to a Medigap with Guarantee Issue Rights during the first 12 months of enrolling in a Medicare Advantage plan. After that, you may need to wait until the Annual Enrollment Period to switch.

Is Plan N a good plan?

Then there’s Plan N. Plan N is great for those that are okay paying a small copay when they visit the doctors or hospital. These small copays keep the monthly premium low. If you find yourself going to the doctor’s office often, you may want to consider Plan G.

Can you change your Medicare plan without underwriting?

But, you may need to answer health questions first. There are times when you’re eligible for Guarantee Issue Rights, in which case you could change plans without underwriting. The plans you’re eligible to enroll in, depend on when you became Medicare eligible.

Do you have to pay out of pocket for a Plan G?

All you have to pay is your monthly premium. With a Plan G, the only cost you have to pay out of pocket is the Part B deductible. After you’ve met the deductible, Plan G will cover the rest, just like Plan F. Then there’s Plan N. Plan N is great for those that are okay paying a small copay when they visit the doctors or hospital.

Which is better, Plan F or Plan G?

Plan F is the most comprehensive plan. It covers one more benefit than Plan G. Plan G typically has higher premiums than Plan N because it includes more coverage. You could save money with Plan N because out-of-pocket costs with Plan N may equal or exceed the premium difference with Plan G.

Which Medicare plan pays 100% of Part B coinsurance?

Plan N will pay 100% of the Part B coinsurance, except for copays of up to $20 for certain office visits and up to $50 for emergency room visits when you’re not admitted to the hospital. Medicare Supplement Plan F is the most comprehensive plan. Plan F covers one more benefit than Plan G, which is the Part B deductible.

Why is Plan G higher than Plan N?

Plan G and Plan N premiums are lower to reflect that. 7. Plan G will typically have higher premiums than Plan N because it includes more coverage. But it could save you money because out-of-pocket costs with Plan N may equal or exceed the premium difference with Plan G, depending on your specific medical needs.

Is Medicare Part B deductible?

Plan F, which covers Medicare Part B deductible, is not available to those newly eligible for Medicare on or after January 1, 2020. However, if you already have Plan F or its high-deductible version, you can keep it. Plans F and G offer a high-deductible option, though not every carrier offers them.

Does Medicare cover out of pocket costs?

While Original Medicare covers most things, there are out-of-pocket costs like deductibles, copayments, and coinsurance. Those gaps can be covered by purchasing Medicare Supplement Plans F, G, or N. These policies are standardized across states, meaning they all must provide roughly the same coverage no matter which state you live in.

Is Plan F better than Plan G?

However, if the premium for Plan F is minimal compared to Plan G , it may be the better option . Another thing to consider is that in 2020, Plan F will be going away, however, those who already have Plan F can be grandfathered in to keep it. If you’re looking for another similar option, consider High-Deductible Plan F.

Do you have to pay a deductible on a Plan G or F?

Therefore, even though you will have to pay a deductible, you can save money overall if Plan G has a lower premium than Plan F. However, because pricing varies among plans, states, and individuals, this isn’t always true – sometimes there will be minimal difference in the premium cost.

Which is the Best Plan: F vs G vs N?

In terms of coverage, the most comprehensive plan on the market is Plan F. Plan F covers every gap in Medicare. The second most comprehensive plan is Plan G. Plan G covers nearly as much as Plan F, with the Part B deductible being the only difference between the two plans.

How are Medigap Plans are Standardized?

In most states, there are presently 10 separate, standardized Medigap plans (Massachusetts, Minnesota, and Wisconsin have their own plan standards). For consumers, this simply means that Medigap Plan A offered by Company X in San Francisco is the exact same plan as Medigap Plan A offered by Company Y in Denver.

Medigap Plan F

Medigap Plan F is by far and away the favorite Medicare Supplement plan of choice for people that want comprehensive benefits and first-dollar coverage on their healthcare costs. First-dollar coverage means that the plan covers both your Parts A & B deductibles, so you pay absolutely nothing, even before your Medicare benefits kick in.

Medigap Plan G

Recent trends show Medigap Plan G outperforming other Medigap plans in terms of enrollment. This is likely because Plan G offers the same broad coverage as Plan F, minus the Part B deductible, which is $203 in 2021.

Medigap Plan N

Plan N is also a popular option because it balances out protection against immense out-of-pocket expenses with affordable premiums.

Comparing Medicare Plan F vs Plan G vs Plan N

Take your time when looking over coverage plans, and think about plans with a long-term lens. This is an important decision.