How much does Medicare Part B cost?

Sep 18, 2021 · Medicare Part B Cost Sharing Medicare Medical Insurance (Part B) covers your doctor bills, including lab tests, screenings, imaging, etc. There’s a monthly premium of $144.60 per month (2020 rate) for the majority of the 61 million beneficiaries.

What is the standard Medicare Part B premium amount for 2020?

Medicare Part B: Medical Insurance Medicare. Part B helps pay for health care services such as doctor services, preventive benefits, hospital outpatient surgery and care, ambulance services, outpatient mental health services, durable medical equipment, and home health care (not covered by Part A). Part B Premium: In 2022, most beneficiaries will pay $170.10/month for Part B. …

What is the standard Part B premium amount in 2019?

Apr 20, 2022 · Beneficiaries may receive help with Medicare’s premiums ($2,041 in 2022 for Part B), deductibles ($1,156 for Part A, $233 for Part B) and other cost-sharing requirements.

How much does Medicare Part a cost?

Part B costs: What you pay 2021: Premium $170.10 each month (or higher depending on your income). The amount can change each year. You’ll pay the premium each month, even if you don’t get any Part B-covered services.

What is the cost share for Medicare Part B?

Medicare Part B Annual Deductible and Share of Cost: This program will pay your Medicare Part B deductible which is $233 in 2022. It will also pay your share (20%) of the cost of services when you receive services from a Medicare provider.

What is Medicare cost-sharing?

The share of costs covered by your insurance that you pay out of your own pocket. This term generally includes deductibles, coinsurance, and copayments, or similar charges, but it doesn't include premiums, balance billing amounts for non-network providers, or the cost of non-covered services.

How do I get my $144 back from Medicare?

You can get your reduction in 2 ways:If you pay your Part B premium through Social Security, the Part B Giveback will be credited monthly to your Social Security check.If you don't pay your Part B premium through Social Security, you'll pay a reduced monthly amount directly to Medicare.Sep 16, 2021

Do Medicare beneficiaries have cost-sharing?

The Qualified Medicare Beneficiary (QMB) program provides Medicare coverage of Part A and Part B premiums and cost sharing to low-income Medicare beneficiaries.Dec 1, 2021

What is an example of cost sharing?

A Deductible is the first part of what you pay for your health care before insurance starts to pay for some of your health care. This is called cost sharing. Example: Your health plan has a $1,000 deductible. Your deductible has not been met.

How is share price calculated?

To do this, divide the total cost share obligation by 1.52. (22,280 / 1.52 = 14,658 TDC)....Example:Cost CategoryAmount (example)Total Project Costs111,400X .20Cost share (20% Match on Total Project)22,280Request from Sponsor (80% of Total Project)89,1207 more rows

Is there really a $16728 Social Security bonus?

The $16,728 Social Security bonus most retirees completely overlook: If you're like most Americans, you're a few years (or more) behind on your retirement savings. But a handful of little-known "Social Security secrets" could help ensure a boost in your retirement income.Dec 9, 2021

Will Social Security get a $200 raise in 2021?

Which Social Security recipients will see over $200? If you received a benefit worth $2,289 per month in 2021, then you will see an increase worth over $200. People who get that much in benefits worked a high paying job for 35 years and likely delayed claiming benefits.Jan 9, 2022

Why did I get an extra Social Security payment this month 2021?

Social Security benefits are getting their biggest increase in 40 years this month, thanks to soaring inflation in 2021. A new cost of living adjustment has increased payments by 5.9%, about $93 more per month on average for seniors and other beneficiaries, or $1,116 more per year.Jan 12, 2022

Do some Medicare Advantage plans pay for a portion of the Part B premium?

premium. Some plans will help pay all or part of your Part B premium. This is sometimes called a "Medicare Part B premium reduction." The amount you must pay for health care or prescriptions before Original Medicare, your Medicare Advantage Plan, your Medicare drug plan, or your other insurance begins to pay.

What is the Medicare Part B premium for 2021?

$148.50The Centers for Medicare & Medicaid Services (CMS) has announced that the standard monthly Part B premium will be $148.50 in 2021, an increase of $3.90 from $144.60 in 2020.

What is the cost of Medicare Part D for 2021?

Premiums vary by plan and by geographic region (and the state where you live can also affect your Part D costs) but the average monthly cost of a stand-alone prescription drug plan (PDP) with enhanced benefits is about $44/month in 2021, while the average cost of a basic benefit PDP is about $32/month.

What is Medicare Cost Sharing?

Medicare’s cost-sharing is the out-of-pocket costs Out-of-Pocket Costs for Medicare are the remaining costs that are not covered by the beneficiary's health insurance plan.

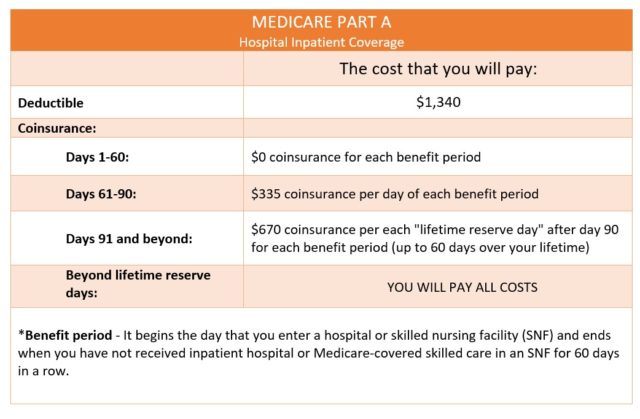

Medicare Part A Cost Sharing

Medicare Hospital Insurance (Part A) covers your hospital care when you are an inpatient. It’s free for anyone who has paid Social Security and Medicare payroll taxes for 10 years (40 quarters of work) and for the spouse of a person who has paid the taxes. Free is a bit of a misnomer.

Medicare Part B Cost Sharing

Medicare Medical Insurance (Part B) covers your doctor bills, including lab tests, screenings, imaging, etc. There’s a monthly premium of $144.60 per month (2020 rate) for the majority of the 61 million beneficiaries. However, individuals with income up to $85,000 per year, and married couples with incomes up to $170,000 pay more.

Medicare Part C (Advantage Plan) Cost Sharing

Once you see the cost-sharing that’s baked into traditional Medicare, it’s easy to see why most Americans get additional insurance. One of the popular options is Medicare Advantage.

Medicare Part D (Prescription Drug Plan) Cost Sharing

When Medicare was first enacted in 1965, prescription drug costs were quite modest, so coverage wasn’t an issue. By the 1990s drug prices skyrocketed. Part D of Medicare was added in 2003 to address this problem.

Medicare Supplement Plans for Traditional Medicare Gap Coverage

No discussion on Medicare cost-sharing would be complete without talking about Medicare Supplement insurance Medicare Supplements are additional insurance policies that Medicare beneficiaries can purchase to cover the gaps in their Original Medicare (Medicare Part A and Medicare Part B) health insurance coverage.... (Medigap).

Summary

There are a lot of moving parts with Medicare, and they all have shared costs. It pays to understand and plan for these costs before you retire.

Medicare Part A: Hospital Insurance

Part A is often called hospital insurance because it pays for care while admitted as an inpatient at the hospital. It also pays some costs outside a hospital, such as skilled nursing facility stays, home health care, and hospice care.

Medicare Part B: Medical Insurance Medicare

Part B helps pay for health care services such as doctor services, preventive benefits, hospital outpatient surgery and care, ambulance services, outpatient mental health services, durable medical equipment, and home health care (not covered by Part A).

Medicare Advantage Plan (Part C)

Monthly premiums vary based on which plan you join. The amount can change each year.

Medicare Supplement Insurance (Medigap)

Monthly premiums vary based on which policy you buy, where you live, and other factors. The amount can change each year.

When will Medicare Part A and B be released?

Medicare Parts A & B. On November 6, 2020, the Centers for Medicare & Medicaid Services (CMS) released the 2021 premiums, deductibles, and coinsurance amounts for the Medicare Part A and Part B programs.

What is the deductible for Medicare Part B in 2021?

The annual deductible for all Medicare Part B beneficiaries is $203 in 2021, an increase of $5 from the annual deductible of $198 in 2020. The Part B premiums and deductible reflect the provisions of the Continuing Appropriations Act, 2021 and Other Extensions Act (H.R. 8337).

What is Medicare Part A?

Medicare Part A Premiums/Deductibles. Medicare Part A covers inpatient hospital, skilled nursing facility, and some home health care services. About 99 percent of Medicare beneficiaries do not have a Part A premium since they have at least 40 quarters of Medicare-covered employment. The Medicare Part A inpatient hospital deductible ...

How much is Medicare Part A in 2021?

The Medicare Part A inpatient hospital deductible that beneficiaries will pay when admitted to the hospital will be $1,484 in 2021, an increase of $76 from $1,408 in 2020. The Part A inpatient hospital deductible covers beneficiaries’ share of costs for the first 60 days of Medicare-covered inpatient hospital care in a benefit period.

What is the Medicare deductible for 2021?

For 2021, the Medicare Part B monthly premiums and the annual deductible are higher than the 2020 amounts. The standard monthly premium for Medicare Part B enrollees will be $148.50 for 2021, an increase of $3.90 from $144.60 in 2020. The annual deductible for all Medicare Part B beneficiaries is $203 in 2021, an increase ...

What is Part B for 2021?

The 2021 Part B total premiums for high-income beneficiaries are shown in the following table: Premiums for high-income beneficiaries who are married and lived with their spouse at any time during the taxable year, but file a separate return, are as follows: Beneficiaries who are married and lived with their spouses at any time during the year, ...

Is Medicare Advantage the lowest in 14 years?

The Medicare Advantage average monthly premium will be the lowest in fourteen years (since 2007). Premiums and deductibles for Medicare Advantage and Medicare Part D Prescription Drug plans are already finalized and are unaffected by this announcement.

How much does Medicare pay for outpatient therapy?

After your deductible is met, you typically pay 20% of the Medicare-approved amount for most doctor services (including most doctor services while you're a hospital inpatient), outpatient therapy, and Durable Medical Equipment (DME) Part C premium. The Part C monthly Premium varies by plan.

What is Medicare Advantage Plan?

A Medicare Advantage Plan (Part C) (like an HMO or PPO) or another Medicare health plan that offers Medicare prescription drug coverage. Creditable prescription drug coverage. In general, you'll have to pay this penalty for as long as you have a Medicare drug plan.

How much is coinsurance for days 91 and beyond?

Days 91 and beyond: $742 coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime). Beyond Lifetime reserve days : All costs. Note. You pay for private-duty nursing, a television, or a phone in your room.

How much is coinsurance for 61-90?

Days 61-90: $371 coinsurance per day of each benefit period. Days 91 and beyond: $742 coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime) Beyond lifetime reserve days: all costs. Part B premium.

What happens if you don't buy Medicare?

If you don't buy it when you're first eligible, your monthly premium may go up 10%. (You'll have to pay the higher premium for twice the number of years you could have had Part A, but didn't sign up.) Part A costs if you have Original Medicare. Note.

Do you pay more for outpatient services in a hospital?

For services that can also be provided in a doctor’s office, you may pay more for outpatient services you get in a hospital than you’ll pay for the same care in a doctor’s office . However, the hospital outpatient Copayment for the service is capped at the inpatient deductible amount.

Does Medicare cover room and board?

Medicare doesn't cover room and board when you get hospice care in your home or another facility where you live (like a nursing home). $1,484 Deductible for each Benefit period . Days 1–60: $0 Coinsurance for each benefit period. Days 61–90: $371 coinsurance per day of each benefit period.

How much will Medicare cost share in 2021?

Medicare Advantage plans cannot require members to pay cost-sharing in excess of $7,550 in 2021, although many plans have cost-sharing limits below this (note that the out-of-pocket limits for Medicare Advantage plans do not include the cost of prescription drugs, which are covered separately and have separate — and unlimited — cost-sharing).

What is cost sharing?

What is cost-sharing? Cost-sharing refers to the patient’s portion of costs for healthcare services covered by their health insurance plan. The patient is responsible to pay cost-sharing amounts out-of-pocket.

What is out of pocket medical insurance?

But under private health insurance or Medicaid, “out-of-pocket costs” generally only refer to cost-sharing incurred when a person has medical claims (even though premiums are also paid out-of-pocket).

How much is the maximum OOP for 2021?

Under the Affordable Care Act, most plans must have an out-of-pocket maximum (referred to as maximum OOP, or MOOP) of no more than $8,550 in cost-sharing for a single individual in 2021 (this limit is indexed each year in the annual Notice of Benefit and Payment Parameters).

Does the ACA cover grandfathered plans?

The ACA’s limits on out-of-pocket costs only applies to in-network services that fall within the umbrella of essential health benefits. And it does not apply to grandmothered or grandfather ed plans, or to plans that aren’t regulated by the ACA at all, such as short-term health insurance.

Is health insurance a cost sharing amount?

Health insurance premiums – the monthly payments you must make to keep your coverage in force, regardless of whether or not you use a healthcare service – are not considered cost-sharing amounts.

Does Medicare have a cap on cost sharing?

Original Medicare does not have a cap on cost-sharing amounts, although most enrollees have supplemental coverage (from an employer, Medicaid, or a Medigap plan) that covers some or all of their cost-sharing expenses.

What is Part B?

Part B covers 2 types of services. Medically necessary services: Services or supplies that are needed to diagnose or treat your medical condition and that meet accepted standards of medical practice. Preventive services : Health care to prevent illness (like the flu) or detect it at an early stage, when treatment is most likely to work best.

What are the factors that determine Medicare coverage?

Medicare coverage is based on 3 main factors 1 Federal and state laws. 2 National coverage decisions made by Medicare about whether something is covered. 3 Local coverage decisions made by companies in each state that process claims for Medicare. These companies decide whether something is medically necessary and should be covered in their area.

What is national coverage?

National coverage decisions made by Medicare about whether something is covered. Local coverage decisions made by companies in each state that process claims for Medicare. These companies decide whether something is medically necessary and should be covered in their area.