How high will the Medicare Part B deductible get?

Nov 12, 2021 · The standard monthly premium for Medicare Part B enrollees will be $170.10 for 2022, an increase of $21.60 from $148.50 in 2021. The annual deductible for all Medicare Part B beneficiaries is $233 in 2022, an increase of $30 from the annual deductible of $203 in 2021. The increases in the 2022 Medicare Part B premium and deductible are due to:

What is the maximum premium for Medicare Part B?

Part B deductible & coinsurance In 2022, you pay $233 for your Part B deductible [glossary] . After you meet your deductible for the year, you typically pay 20% of the Medicare-Approved Amount for these: Most doctor services (including most doctor services while you're a hospital inpatient) Outpatient therapy

Who pays part B Medicare?

Jan 21, 2022 · The Medicare Part B deductible increased from 2021 to 2022. The 2022 Part B deductible is $233 per year (up from $203 in 2021). This guide also explores the Part B deductible and some of the other 2022 Medicare Part B costs you may face, as well as ways you can get coverage for some of your Medicare Part B costs.

What are the rules for Medicare Part B?

Nov 12, 2021 · The annual deductible for Medicare Part B beneficiaries grows with the Part B financing and is increasing from $203 in 2021 to $233 in 2022. The Administration is taking action to address the rapidly increasing drug costs that are posing a threat to the future of the Medicare program and that place a burden on people with Medicare.

What is the deductible for Part B in 2022?

$233What is the Medicare deductible for 2022? The Part A deductible for 2022 is $1,556 for each benefit period. The Part B deductible is $233. You will usually then pay 20 percent of the cost for anything covered by Part B after you have met your deductible.

What is the Medicare deductible in 2022?

The annual deductible for Medicare Part B will increase by $30 in 2022 to $233, while the standard monthly premium for Medicare Part B will increase by $21.60 to $170.10, CMS announced.Nov 15, 2021

What is the 2022 premium for Medicare Part B?

$170.10The standard Part B premium amount in 2022 is $170.10. Most people pay the standard Part B premium amount. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA).

What is Medicare Part B annual deductible?

In 2022, you pay $233 for your Part B. deductible. The amount you must pay for health care or prescriptions before Original Medicare, your Medicare Advantage Plan, your Medicare drug plan, or your other insurance begins to pay.

What is the deductible for Plan G in 2022?

$2,490Effective January 1, 2022, the annual deductible amount for these three plans is $2,490. The deductible amount for the high deductible version of plans G, F and J represents the annual out-of-pocket expenses (excluding premiums) that a beneficiary must pay before these policies begin paying benefits.

What changes are coming to Social Security in 2022?

To earn the maximum of four credits in 2022, you need to earn $6,040 or $1,510 per quarter. Maximum taxable wage base is $147,000. If you turn 62 in 2022, your full retirement age changes to 67. If you turn 62 in 2022 and claim benefits, your monthly benefit will be reduced by 30% of your full retirement age benefit.Jan 10, 2022

Why is my Medicare Part B premium so high?

According to CMS.gov, “The increase in the Part B premiums and deductible is largely due to rising spending on physician-administered drugs. These higher costs have a ripple effect and result in higher Part B premiums and deductible.”

Did Medicare Part B go up 2022?

Medicare's Part B monthly premium for 2022 will increase by $21.60, the largest dollar increase in the health insurance program's history, the Centers for Medicare & Medicaid Services (CMS) announced on Nov. 12. Standard monthly premiums for Part B will cost $170.10 in 2022, up from $148.50 in 2021.Nov 15, 2021

Are Medicare Part B premiums tax deductible?

Yes, your monthly Medicare Part B premiums are tax-deductible. Insurance premiums are among the many items that qualify for the medical expense deduction. Since it's not mandatory to enroll in Part B, you can be “rewarded” with a tax break for choosing to pay this medical expense.

What is the deductible for Part B 2021?

$203Medicare Part B Premium and Deductible The annual deductible for all Medicare Part B beneficiaries is $233 in 2022, an increase of $30 from the annual deductible of $203 in 2021.Nov 12, 2021

What is the Medicare Part B deductible for 2021?

$203 inMedicare Part B Premiums/Deductibles The standard monthly premium for Medicare Part B enrollees will be $148.50 for 2021, an increase of $3.90 from $144.60 in 2020. The annual deductible for all Medicare Part B beneficiaries is $203 in 2021, an increase of $5 from the annual deductible of $198 in 2020.Nov 6, 2020

How do I find out my deductible?

A deductible can be either a specific dollar amount or a percentage of the total amount of insurance on a policy. The amount is established by the terms of your coverage and can be found on the declarations (or front) page of standard homeowners and auto insurance policies.

How much is Part B deductible in 2021?

Part B deductible & coinsurance. In 2021, you pay $203 for your Part B. deductible. The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. . After you meet your deductible for the year, you typically pay 20% of the.

What is Medicare Part B?

Some people automatically get. Medicare Part B (Medical Insurance) Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services. , and some people need to sign up for Part B. Learn how and when you can sign up for Part B. If you don't sign up for Part B when you're first eligible, ...

What happens if you don't get Part B?

Your Part B premium will be automatically deducted from your benefit payment if you get benefits from one of these: Social Security. Railroad Retirement Board. Office of Personnel Management. If you don’t get these benefit payments, you’ll get a bill. Most people will pay the standard premium amount.

How much is Medicare Part B deductible?

The 2019 Part B deductible is $185 per year (up from $183 in 2018). This guide also explores the Part B deductible and some of the other 2019 Medicare Part B costs you may face, as well as ways you can get coverage for some of your Medicare Part B costs.

What is Medicare Part B?

You are responsible for the first $185 worth of services or items that are covered by Medicare Part B that you receive in the calendar year of 2019. After you have paid $185 out of your own pocket, your Part B coverage will kick in. Part B covers: Qualified medical care, such as doctor's office visits and procedures. Certain preventive care.

What is the Part B premium?

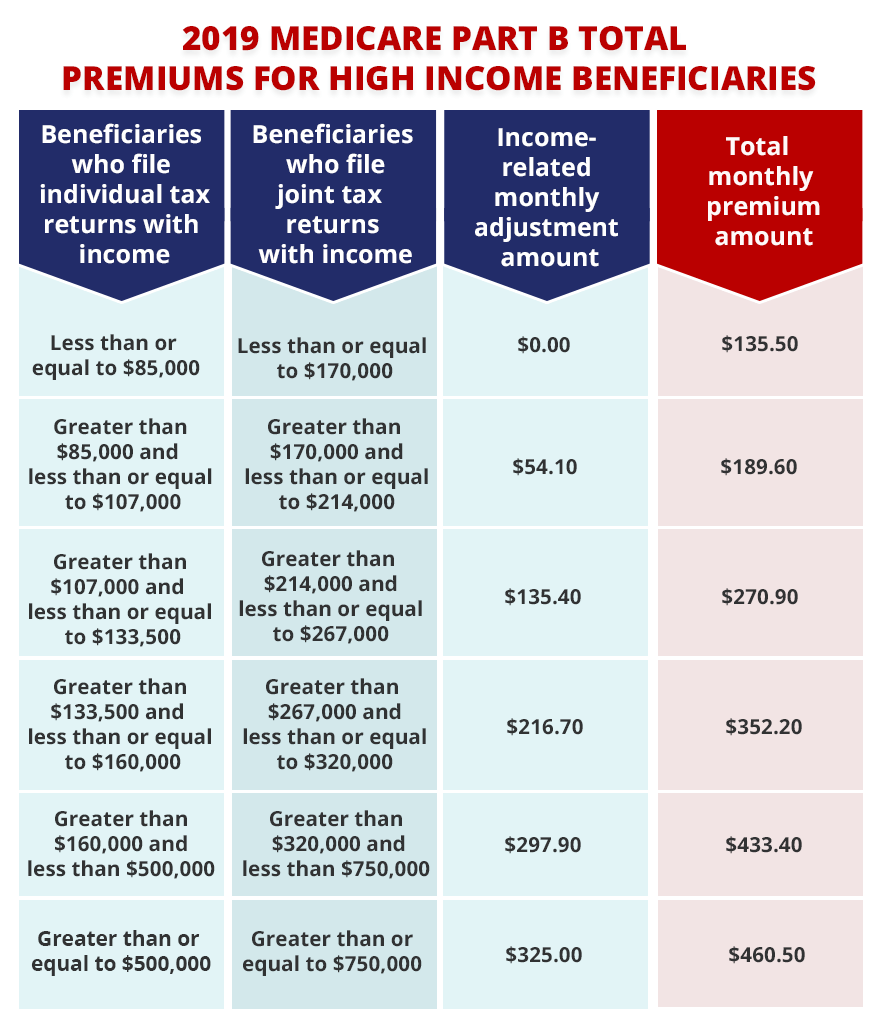

The Part B premium is based on your reported income from two years prior. So that means your 2019 premiums are based off of your reported income from 2017. Most people pay the standard Part B premium amount, but higher income earners may pay a higher amount called the Income-Related Monthly Adjusted Amount, or IRMAA.

What does it mean when a provider accepts Medicare?

When a health care provider accepts Medicare assignment, it means they have agreed to accept the Medicare-approved amount as full payment. When a provider does not accept assignment, it means they will still treat Medicare patients, but they do not accept the Medicare-approved amount as full payment .

What Is a Deductible?

A deductible is the amount of money that you must pay out of your own pocket for covered care before your plan coverage kicks in.

Medicare Part A Deductible

Medicare Part A covers inpatient care received at a hospital, skilled nursing facility or other inpatient facility.

What Is the Maximum Cost of Medicare Part B?

Medicare Part B does come with a premium cost. The monthly premium prices are set annually and depend on your annual income. Premium costs start at $148.50 per month. The maximum cost of Medicare Part B coverage is $504.90 per month in 2021, and that's for individuals reporting half a million dollars or more in income in 2019.

Medicare Part C (Medicare Advantage) Deductible

Medicare Part C plans, otherwise known as Medicare Advantage plans, are an alternative way to get Original Medicare benefits, often with additional coverage.

Medicare Part D Deductible

Medicare Part D plans cover prescription medications. Like Medicare Advantage, plans Medicare Part D plans are sold by private insurers and thus there is no standard deductible.

Medicare Supplement Deductibles by Plan

There are 10 standardized Medicare Supplement plans (also called Medigap) available in most states, and two of those plans offer a high-deductible option. Medigap Plan F and Plan G have high-deductible options that include an annual deductible of $2,370 in 2021.

How much is Medicare Part A deductible for 2021?

For 2021, the Medicare Part A deductible is $1,484 for each benefit period. If you re-enter the hospital or skilled nursing facility any time after your benefit period ends, you will have to pay the first $1,484 again as a new deductible.

What is the Medicare Advantage plan for 2021?

For 2021, the MOOP for Medicare Advantage plans is $7,550 for in-network care. It can be higher for out-of-network care or services. But once you hit your MOOP for the year, the plan has to cover 100 percent of all further costs. Some Medicare Part D prescription drug plans don’t have a deductible. Those that do may not have a deductible ...

What is a benefit period for Medicare?

The benefit period begins the day you enter the hospital or facility and ends after you have not needed inpatient care for 60 days in a row. Source: Centers for Medicare & Medicaid Services.

Does Medigap cover Part A?

Some of these plans may cover all or a portion of your Part A deductible. Medigap Plans C and F were the only two to cover the deductible for Medicare Part B. However, Plans C and F are available only to people who became eligible for Medicare before Jan. 1, 2020.

What is a Medigap plan?

Medigap, also known as Medicare Supplement plans, can help pay some of your out-of-pocket costs, including your Medicare Part A deductibles. These plans are sold through private insurers. There are eight standardized plans across 47 states and the District of Columbia.

Does Medicare Advantage cover out of pocket expenses?

Medicare Advantage plans may offer coverage that absorb some of your out-of-pocket costs. Though Medicare Advantage deductibles may vary , all plans must set a limit on your maximum out-of-pocket (MOOP) expenses.