What is the maximum premium for Medicare Part B?

Nov 13, 2021 · IRMAA is determined by income from your income tax returns two years prior. This means that for your 2022 Medicare premiums, your 2020 income tax return is used. This amount is recalculated annually. The IRMAA surcharge will be added to your 2022 premiums if your 2020 income was over $91,000 (or $182,000 if you’re married), but as discussed below, there’s an …

What is Medicare premium Part B?

In 2022, the standard Part B premium is $170.10 for these individuals: Individuals earning $91,000 or less Those who filed jointly with an income of $182,000 or less Those who filed married and separately with an income of $91,000 or less The IRMAA isn’t the cost of the premium, but the dollar amount added to the standard premium.

How much does Part B insurance cost?

Feb 24, 2022 · Part B IRMAA Premiums In 2022, the standard premium for Medicare Part B — which covers doctor visits, outpatient services and durable medical equipment — is $170.10 a month. Most people pay the standard Part B premium amount.

How much does Medicare Part B costs?

2 days ago · Income-Related Monthly Adjustment Amount, often abbreviated as IRMAA, is a surcharge added to monthly Medicare Part B and Part D premiums, for Medicare recipients based on their annual income. In effect, IRMAA reduces the subsidy that high-income beneficiaries receive from Medicare. Although not described as a tax, it can behave as a tax-like cost for …

What are the Irmaa income brackets for 2021?

How much are Part D IRMAA surcharges?Table 2. Part D – 2021 IRMAAIndividualJointMonthly Premium$91,000 or less$182,000 or lessYour Premium> $91,000 – $114,000> $182,000 – $228,000$12.40 + Plan Premium> $114,000 – $142,000> $228,000 -$284,000$32.10 + Plan Premium3 more rows

What are the Irmaa brackets for 2020?

Combined Medicare Part B premiums and IRMAA surcharges will range from $220.40 per month to $491.60 per month per person in 2020. High-income Medicare beneficiaries are also subject to monthly surcharges for their Medicare Part D prescription drug plans.Nov 11, 2019

What is the income threshold for Irmaa?

Who Pays IRMAA? As noted above, only individuals who earn more than $88,000 and married couples filing jointly who earn more than $176,000 are required to pay IRMAA.Nov 11, 2021

How do I stop Irmaa?

To avoid getting issued an IRMAA, you can proactively tell the SSA of any changes your income has seen in the past two years using a “Medicare Income-Related Monthly Adjustment Amount – Life-Changing Event” form or by scheduling an interview with your local Social Security office (1-800-772-1213).Dec 21, 2021

Is Irmaa based on AGI or magi?

IRMAA charges are based on your income. The SSA calculates the IRMAA amount using your modified adjusted gross income (MAGI) according to your tax returns from 2 years ago.Dec 14, 2020

Is Irmaa based on AGI or taxable income?

An income-related monthly adjustment amount, or IRMAA, is an extra Medicare cost added to your Part B and Part D premiums. The Social Security Administration determines whether you're required to pay an IRMAA based on the modified adjusted gross income reported on your IRS tax return from two years prior.

Does Social Security count towards Irmaa?

The tax-exempt Social Security isn't included in the MAGI calculation for the IRMAA.Dec 18, 2018

What will Irmaa be in 2023?

2023 IRMAA Brackets (Projected)PROJECTED 2023 IRMAA BRACKETS FOR MEDICARE PART BAbove $149,000 – $178,000Above $298,000 – $356,000Standard Premium x 2.6Above $178,000 – $500,000Above $356,000 – $750,000Standard Premium x 3.2Greater than $500,000Greater than $750,000Standard Premium x 3.45 more rows•Mar 28, 2022

WHAT IS THE MAGI for 2021?

You can expect to pay more for your Medicare Part B premiums if your MAGI is over a certain amount of money. For 2021, the threshold for these income-related monthly adjustments will kick in for those individuals with a MAGI of $88,000 and for married couples filing jointly with a MAGI of $176,000.Oct 22, 2021

How long does the Irmaa last?

Unlike late enrollment penalties, which can last as long as you have Medicare coverage, the IRMAA is calculated every year. You may have to pay the adjustment one year, but not the next if your income falls below the threshold.

Is Social Security taxed after age 70?

Are Social Security benefits taxable regardless of age? Yes. The rules for taxing benefits do not change as a person gets older.

Are Irmaa payments tax deductible?

Yes, IRMAA is allowed as a medical deduction on Schedule A, which could come off against your adjusted gross income (AGI). Put the amount in Medicare D Premiums Deducted From Your Benefit.Jun 1, 2019

What is IRMAA?

For Medicare beneficiaries who earn over $91,000 a year – and who are enrolled in Medicare Part B and/or Medicare Part D – it’s important to unders...

How is my income used in my IRMAA determination?

IRMAA is determined by income from your income tax returns two years prior. This means that for your 2022 Medicare premiums, your 2020 income tax r...

Can I appeal the IRMAA determination?

You can appeal the IRMAA determination – filing for a redetermination – if you believe that your calculation is erroneous. In addition, if you have...

What is Medicare Part B?

Some people automatically get. Medicare Part B (Medical Insurance) Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services. , and some people need to sign up for Part B. Learn how and when you can sign up for Part B. If you don't sign up for Part B when you're first eligible, ...

How much is Part B deductible in 2021?

Part B deductible & coinsurance. In 2021, you pay $203 for your Part B. deductible. The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. . After you meet your deductible for the year, you typically pay 20% of the.

What happens if you don't get Part B?

Your Part B premium will be automatically deducted from your benefit payment if you get benefits from one of these: Social Security. Railroad Retirement Board. Office of Personnel Management. If you don’t get these benefit payments, you’ll get a bill. Most people will pay the standard premium amount.

What is an IRMAA?

That’s because high-income earners pay more for two different monthly Medicare premiums. An income-related monthly adjustment amount, or IRMAA, is an extra Medicare cost added to your Part B and Part D premiums. The Social Security Administration determines whether you’re required to pay an IRMAA based on the modified adjusted gross income reported ...

What form do I need to fill out to adjust my IRMAA?

If you believe your IRMAA should be adjusted due to a life changing event, you need to fill out Form SSA-44 and provide supporting documents to prove your income is lower. The form includes a list of eight situations that may eliminate or reduce your income-based premium hike.

Who is Rachel Christian?

Rachel Christian is a writer and researcher for RetireGuide. She covers annuities, Medicare, life insurance and other important retirement topics. Rachel is a member of the Association for Financial Counseling & Planning Education.

What happens if you don't pay Medicare Part D?

If it isn’t deducted from your check, you’ll receive a separate bill from Medicare. If you don’t pay the Part D IRMAA, you’ll lose your Part D coverage.

Does IRMAA apply to Medicare?

Depending on your income, an IRMAA can be added, increased, decreased or removed each year. IRMAAs don’t apply to Part A premiums or Medicare Advantage plans without prescription drug coverage.

What is IRMAA?

The income-related monthly adjustment amount, or IRMAA, is a surcharge that high-income people may pay in addition to their Medicare Part B and Part D premiums. The Medicare IRMAA for Part B went into effect in 2007, while the IRMAA for Part D was implemented as part of the Affordable Care Act in 2011.

What are the income brackets for IRMAA Part D and Part B?

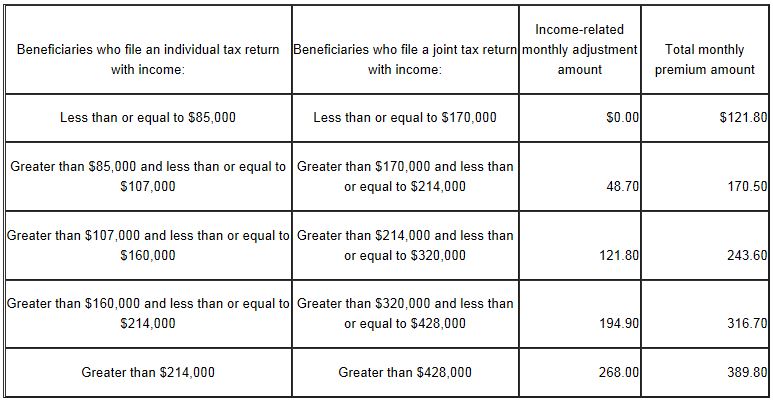

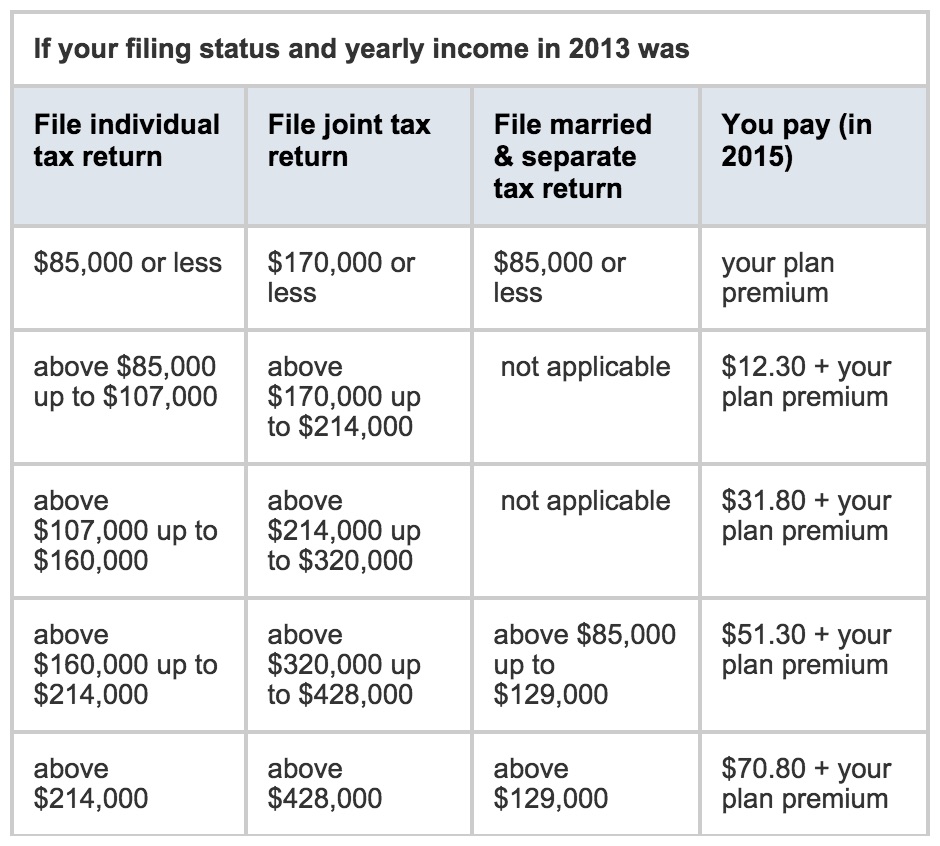

The income brackets for both IRMAA for Medicare Part B and Medicare Part D are the same in 2021. They’re based on your 2019 tax returns.

How do I pay my IRMAA Part D and the Medicare IRMAA for Part B?

Your Part B IRMAA is added to your Part B premium automatically; the amount will be reflected in your monthly premium bill. Most people have their premiums automatically deducted from their Social Security or Railroad Retirement Board benefits each month.

What is an IRMAA?

Takeaway. An IRMAA is a surcharge added to your monthly Medicare Part B and Part D premiums, based on your yearly income. The Social Security Administration (SSA) uses your income tax information from 2 years ago to determine if you owe an IRMAA in addition to your monthly premium. The surcharge amount you’ll pay depends on factors like your income ...

What is a Part D insurance plan?

Part D is prescription drug coverage. Like Part C plans, Part D plans are sold by private companies. Part D is affected by IRMAA. As with Part B, a surcharge can be added to your monthly premium, based on your yearly income. This is separate from the surcharge that can be added to Part B premiums.

How to contact Medicare directly?

SSA. To get information about IRMAA and the appeals process, the SSA can be contacted directly at 800-772-1213.

What is Medicare Part C?

Medicare Part C. Part C is also referred to as Medicare Advantage. These plans often cover services that original Medicare (parts A and B) don’t cover, such as dental, vision, and hearing. Part C is not affected by IRMAA.

What is the state health insurance program?

The State Health Insurance Assistance Program (SHIP) provides free assistance with your Medicare questions. You can find out how to contact your state’s SHIP program here. Medicaid. Medicaid is a joint federal and state program that assists people who have a lower income or resources with their medical costs.

Does IRMAA affect Part A?

It covers inpatient stays at locations such as hospitals, skilled nursing facilities, and mental health facilities. IRMAA doesn’t affect Part A. In fact, most people who have Part A don’t even pay a monthly premium for it.

Does Medicare pay monthly premiums?

Many parts of Medicare involve paying a monthly premium. In some cases, your monthly premium may be adjusted based on your income. One such case might be an income-related monthly adjustment amount (IRMAA). IRMAA applies to Medicare beneficiaries who have higher incomes. Keep reading to learn more about IRMAA, how it works, ...

What is IRMAA in Medicare?

IRMAA is an acronym for, “the Income Related monthly Adjustment Amount.” What IRMAA does is increase the amount you are required to pay for Medicare part B and D based upon how much income you receive in retirement. These increased payments present themselves in the form of surcharges tacked onto the standard Medicare part B and D premiums. In other words, IRMAA requires Individuals who make more money to pay more for Medicare to help foot the Medicare bills for individuals who make less money. Whether or not you will be subject to IRMAA is entirely dependent upon your income in retirement.

What is the IRMAA?

The Income Related monthly Adjustment Amount (IRMAA) is an additional surcharge that raises the amount higher income individuals will pay for Medicare. IRMAA applies to Medicare parts B and D.

How much will Medicare cost in 2021?

In 2021, the average expenditure for part B is set at $594.00 a month. In other words, the government expects that the overall national expense for Medicare Part B divided by the number of individuals enrolled in Medicare part B will result in an average cost of $594.00 per person per month. Of course, $594.00 is not what retirees pay ...