Medicare Part C is a bundled Medicare plan that incorporates hospital, medical, and prescription drug coverage for most people. It also covers additional services that traditional Medicare plans do not cover, such as dental, hearing, and vision care. However, coverage for these varies between plans.

Full Answer

What is Medicare Part C?

· A Medicare Advantage Plan (like an HMO or PPO) is another Medicare health plan choice you may have as part of Medicare. Medicare Advantage Plans, sometimes called “Part C” or “MA Plans,” are offered by private companies approved by Medicare. If you join a Medicare Advantage Plan, the plan will provide all of your Part A (Hospital Insurance) and Part B …

What is the cost of Medicare Part A 2019?

· Medicare Part C is an alternative way to get your Original Medicare benefits. It is also referred to as a Medicare Advantage plan. In addition to your Original Medicare coverage, a Medicare Part C plan might offer additional benefits like vision and dental care.

What is the average monthly premium for Medicare Part C?

2019 Medicare Part C premiums Medicare Part C plans, also known as Medicare Advantage plans, are sold on the private marketplace. Plan premiums will vary by provider, plan and …

Who is eligible for Medicare Part C?

Beginning for CY 2019 CMS has separated the Medicare Part C Technical Specifications (this ... Medicare Part C Reporting Requirements, or Technical Specifications for answers and, when …

What is covered by Medicare Part C?

Medicare Part C outpatient coveragedoctor's appointments, including specialists.emergency ambulance transportation.durable medical equipment like wheelchairs and home oxygen equipment.emergency room care.laboratory testing, such as blood tests and urinalysis.occupational, physical, and speech therapy.More items...

Does everyone have Medicare Part C?

In general, a person must meet two eligibility requirements to qualify for Medicare Part C: They must already have enrolled in Original Medicare (Medicare Parts A and B). They must live in an area where an insurance provider offers a Medicare Advantage (Part C) plan with the coverage that they require.

What is the advantage of having Medicare Part C?

Medicare Part C plans, also known as Medicare Advantage plans, are optional insurance plans that offer the benefits of both original and additional Medicare coverage. Medicare Part C is a great option for people interested in coverage for prescription drugs, vision and dental services, and more.

What is the difference in Medicare Part C and Part D?

Medicare Part C is an alternative to original Medicare. It must offer the same basic benefits as original Medicare, but some plans also offer additional benefits, such as vision and dental care. Medicare Part D, on the other hand, is a plan that people can enroll in to receive prescription drug coverage.

Do you have to pay for Medicare Part C?

Medicare Part C premiums vary, typically ranging from $0 to $200 for different coverage. You still pay for your Part B premium, though some Medicare Part C plans will help with that cost. Like premiums, deductibles vary with your plan.

Is Medicare Part C the same as supplemental insurance?

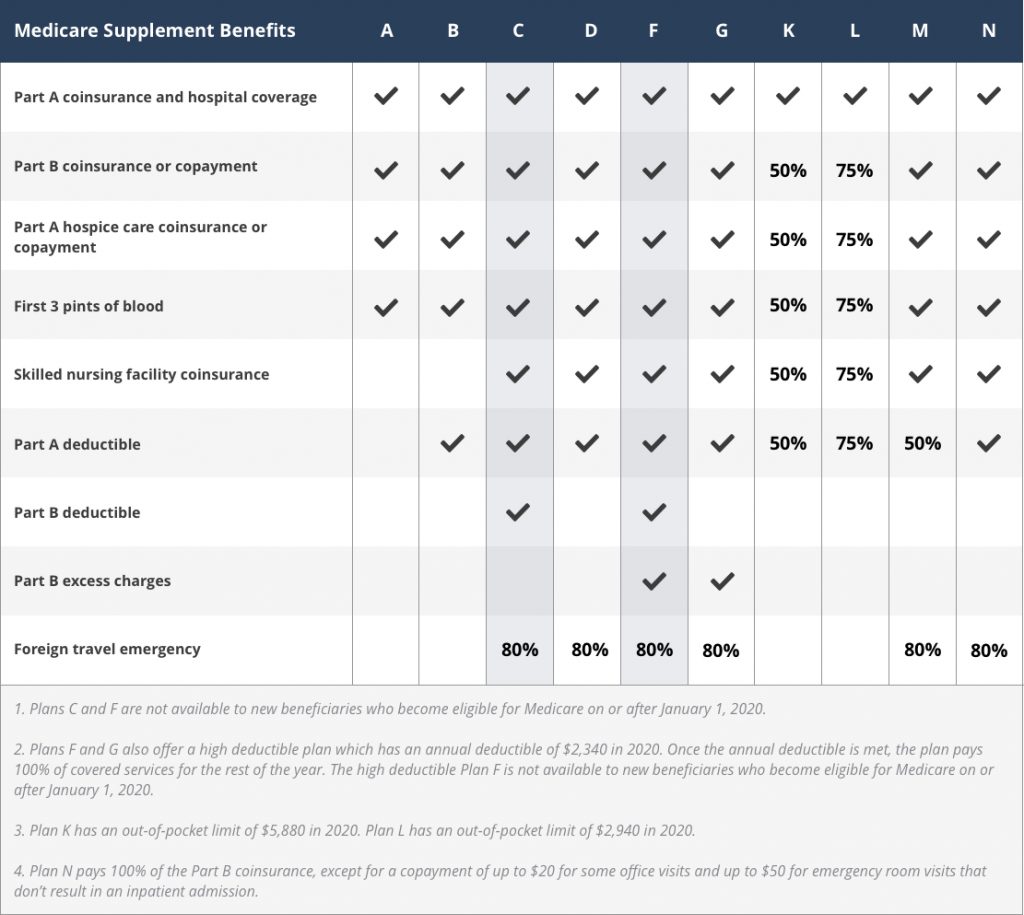

These are also called Part C plans. Medicare Supplement insurance policies, also called Medigap, help pay the out-of-pocket expenses not covered by Original Medicare (Part A and B). It is not part of the government's Medicare program, but provides coverage in addition to it.

Does Medicare Part C replace A and B?

Under Medicare Part C, you are covered for all Medicare parts A and B services. Most Medicare Advantage plans also cover you for prescription drugs, dental, vision, hearing services, and more.

What is Part C of Social Security?

Medicare Advantage Plan (previously known as Part C) includes all benefits and services covered under Part A and Part B — prescription drugs and additional benefits such as vision, hearing, and dental — bundled together in one plan.

What are the negatives of a Medicare Advantage plan?

Medicare Advantage can become expensive if you're sick, due to uncovered copays. Additionally, a plan may offer only a limited network of doctors, which can interfere with a patient's choice. It's not easy to change to another plan. If you decide to switch to a Medigap policy, there often are lifetime penalties.

Can you have both Medicare Part C and D?

Can you have both Medicare Part C and Part D? You can't have both parts C and D. If you have a Medicare Advantage plan (Part C) that includes prescription drug coverage and you join a Medicare prescription drug plan (Part D), you'll be unenrolled from Part C and sent back to original Medicare.

Does Medicare C cover prescriptions?

Unlike Original Medicare, Medicare Part C generally offers coverage for prescription drugs you take at home. The exact prescription drugs that are covered are listed in the plan's formulary. Formularies may vary from plan to plan.

How does Medicare Part C and D work?

Medicare part C is called "Medicare Advantage" and gives you additional coverage. Part D gives you prescription drug coverage.

When is open enrollment for Medicare Part C?

If you miss the initial enrollment period, open enrollment runs from October 15 through December 7 every year. You can sign up for original Medicare online through the Social Security Administration website. You can compare and shop for Medicare Part C plans online through Medicare’s plan finder tool.

What factors are considered when choosing a Medicare Part C plan?

Other factors. A study of over 800,000 beneficiaries found that factors such as the market share of the organization and star rating were also considered when choosing a Medicare Part C plan.

Does Medicare Supplemental Insurance work?

If you have Medicare coverage but only need additional help with costs, a Medicare supplemental insurance (Medigap) policy might work for you. For some people, Medicare Part C is an additional cost that they just can’t afford — in this case, shopping around for Part D and Medigap coverage may help save money.

Is Medicare Part C a good plan?

These plans are optional, but if you need more than just basic hospital and medical insurance, Medicare Part C might be a good option for you. If you’re happy with your current Medicare coverage and are only interested in receiving prescription drug coverage, a stand-alone Medicare Part D plan may be the best option.

Is there a cap on Medicare Part C?

There are many advantages of having Medicare Part C, including a yearly cap on how much you’ll pay out of pocket. Still, the initial costs can add up before you hit that cap, so it’s important to consider all your medical and financial factors when choosing a Medicare Part C plan.

Does Medicare offer Part C?

If you already receive coverage through a major insurance company, it may offer Medicare Part C plans. Some of the major insurance companies that offer Medicare Part C are: There are two main types of Medicare Advantage plans offered, which we’ll go over in detail next.

Can you be on Medicare Advantage with end stage renal disease?

Due to law passed by Congress that went into effect in 2021, people with end stage renal disease (ESRD) are eligible to enroll in a broader range of Medicare Advantage plans. Before this law, most plans would not accept you or limit you to a Special Needs Plan (SNP) if you had a diagnosis of ESRD.

What are the benefits of Medicare Part C?

Medicare Part C plans can also offer additional benefits today, such as over-the-counter medications, transportation to and from doctor appointments, and adult daycare services.

What are the parts of Medicare?

There are four basic parts to Medicare. Part A and Part B make up Original Medicare. Part A covers care you receive while you are in the hospital. Part B helps pay for expenses, like doctor visits and some medical equipment. Medicare Part C is an alternative way to get your Original Medicare coverage.

When do you enroll in Medicare?

This is the period when you first become eligible for Medicare. This enrollment period begins three months before the month you turn 65. It includes your birthday month and the three months following.

Is Medicare Part D a stand alone plan?

Medicare Part D is prescription drug coverage. You can have a stand-alone prescription drug plan with Original Medicare, or you might have a Medicare Advantage plan that includes prescription medication benefits.

What is Medicare Advantage?

Find Plans. Summary: Medicare Part C, also known as Medicare Advantage, is an alternative way to get your Original Medicare benefits. These plans often offer additional coverage for services like prescription drugs, vision and dental care. Plans vary in terms of both cost and benefits. You will likely have different Medicare Advantage plans ...

Is hospice covered by Medicare Part C?

Medicare Part C includes your Part A and Part B benefits. The only exception is hospice care, which is still covered under Part A. Many Medicare Advantage plans offer additional coverage beyond Original Medicare. Some of those benefits might include:

How much is Medicare Part C?

Plan premiums will vary by provider, plan and location. The Centers for Medicare and Medicaid Services (CMS) reports that the average Medicare Advantage plan premium in 2019 will be $28.00 per month.

What is Medicare Part A?

2019 Medicare Part A premium. Medicare Part A (hospital insurance) helps provide coverage for inpatient care costs at hospitals and other types of inpatient facilities.

What are the factors that affect Medicare Supplement?

It's important to note that several factors can affect the Medicare Supplement plan premiums in 2019, such as gender, smoking status and where you live.

What is Medicare Supplement Insurance?

Medicare Supplement Insurance (Medigap) provides coverage for some of the out-of-pocket costs that Medicare Part A and Part B don't cover. This can include costs such as Medicare deductibles, copayments, coinsurance and more. Medigap plans are sold by private insurance companies so there is no standard premium.

Does Medicare Part D cover prescriptions?

Medicare Part D plans, which provide coverage exclusively for prescription medications, are also sold by private insurance companies, so Part D plan premiums will vary from plan to plan.

What is the COLA for 2019?

The COLA in 2019 is 2.8 percent. An additional income bracket was added in 2019. In 2020, the IRMAA will be indexed to inflation for the first time since 2010. It’s expected that the income thresholds that determine when someone pays a Medicare IRMAA will rise slightly in 2020.

Is Medicare Part B optional?

Medicare Part B is optional. You will likely be automatically enrolled in Part B (with the option to drop it) if you are automatically enrolled in Medicare Part A.

When are Part C data submissions due?

Data submissions are due by 11:59 p.m. Pacific time on the date of the reporting deadline.

How long does a grievance have to be for Part C?

According to MMA statute, all Part C organizations must provide meaningful procedures for hearing and resolving grievances between an enrollee and the Plan, including an entity or individual through which the Organization provides benefits. A grievance is any complaint or dispute, other than an organization determination, or appeal about any aspect of the operations, activities, or behavior of a Part C organization, regardless of whether remedial action is requested. Part C organizations are required to notify enrollees of their decision no later than 30 days after receiving their grievance based on the enrollee’s health condition. An extension up to 14 days is allowed if it is requested by the enrollee, or if the Part C Organization needs additional information and documents that this extension is in the interest of the enrollee. An expedited grievance that involves refusal by a Part C organization to process an enrollee’s request for an expedited organization determination or redetermination requires a response from the Part C organization within 24 hours.

Is Medicare covered by Part C?

National PACE Plans and 1833 Cost Plans are excluded from reporting all Part C Reporting Requirements reporting sections. Additionally, Medicare/Medicaid Plans (MMPs) are now excluded from reporting for Grievances, Organization/Determinations and Reconsiderations, and continue to be excluded from the following reporting sections: Employer Group Sponsors, Special Needs Plans and Enrollment/Disenrollment. Please report MMPs as instructed for other

Is Medicare Part C separate from Part D?

Beginning for CY 2019 CMS has separated the Medicare Part C Technical Specifications (this document) and the Medicare Part C Reporting Requirements into two (2) separate documents. Having two separate documents aligns with what Medicare Part D has published for Part D reporters, and provides business operations with better flexibility when making changes prompted by internal or industry suggestions.

Does CMS grant extensions?

Generally, CMS does not grant extensions of reporting deadlines, as these have been established and published well in advance. It is our expectation that organizations do their best with the information provided in the most current versions of the business requirements and technical specifications to prepare the data to be submitted in a timely fashion. Any assumptions that organizations may make in order to submit data timely should be fully documented and defensible under audit. CMS will consider appropriate “Resubmission Requests” through the Plan Reporting Module (PRM).

What is Part C insurance?

Part C plans may also include costs such as deductibles and coinsurance (or copayments). A deductible represents the amount of money you must pay out of your own pocket for covered services during a calendar year before your Medicare Advantage plan coverage kicks in.

What are the costs of Medicare Advantage?

What Other Costs Do Medicare Advantage Plans Have in 2020? 1 A deductible represents the amount of money you must pay out of your own pocket for covered services during a calendar year before your Medicare Advantage plan coverage kicks in. Some Medicare Advantage plans may offer a $0 deductible. 2 Coinsurance or copayments are the portion of the bill that you must pay for covered services after you meet your annual deductible. Coinsurance is generally a percentage of the bill while copayments are typically a flat fee.

Does Medicare Advantage cover hospital insurance?

Medicare Advantage plans must offer at least the same benefits that are covered by Medicare Part A (hospital insurance) and Part B (medical insurance). Medicare Advantage plan carriers are able to also offer extra benefits that Original Medicare (Part A and Part B) don’t cover. In addition to prescription drug coverage that is offered by many ...

Does Medicare Advantage have a deductible?

Some Medicare Advantage plans may offer a $0 deductible. Coinsurance or copayments are the portion of the bill that you must pay for covered services after you meet your annual deductible. Coinsurance is generally a percentage of the bill while copayments are typically a flat fee.

How much does Medicare Advantage cost?

The average premium for a Medicare Part C plan (also known as Medicare Advantage) was $35.55 per month in 2018. 1. Medicare Advantage plans are sold by private insurance companies. Part C plan costs can vary depending on several factors, including what plan you have and where you live.

Does Part C cover all prescription drugs?

In addition to prescription drug coverage that is offered by many plans, some Part C plans may also cover some or all of the following: Not all benefits are available in all plans — benefits can vary widely and plans in your area may not offer the benefits above.

How much will Medicare cost in 2021?

Most people don't pay a monthly premium for Part A (sometimes called " premium-free Part A "). If you buy Part A, you'll pay up to $471 each month in 2021. If you paid Medicare taxes for less than 30 quarters, the standard Part A premium is $471. If you paid Medicare taxes for 30-39 quarters, the standard Part A premium is $259.

How much is the Part B premium for 91?

Part B premium. The standard Part B premium amount is $148.50 (or higher depending on your income). Part B deductible and coinsurance.

What is temporary care?

Temporary care provided in a nursing home, hospice inpatient facility, or hospital so that a family member or friend who is the patient's caregiver can rest or take some time off.

How much is coinsurance for days 91 and beyond?

Days 91 and beyond: $742 coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime). Beyond Lifetime reserve days : All costs. Note. You pay for private-duty nursing, a television, or a phone in your room.

What is Medicare Advantage Plan?

A Medicare Advantage Plan (Part C) (like an HMO or PPO) or another Medicare health plan that offers Medicare prescription drug coverage. Creditable prescription drug coverage. In general, you'll have to pay this penalty for as long as you have a Medicare drug plan.

Does Medicare cover room and board?

Medicare doesn't cover room and board when you get hospice care in your home or another facility where you live (like a nursing home). $1,484 Deductible for each Benefit period . Days 1–60: $0 Coinsurance for each benefit period. Days 61–90: $371 coinsurance per day of each benefit period.

How much does Medicare pay for outpatient therapy?

After your deductible is met, you typically pay 20% of the Medicare-approved amount for most doctor services (including most doctor services while you're a hospital inpatient), outpatient therapy, and Durable Medical Equipment (DME) Part C premium. The Part C monthly Premium varies by plan.