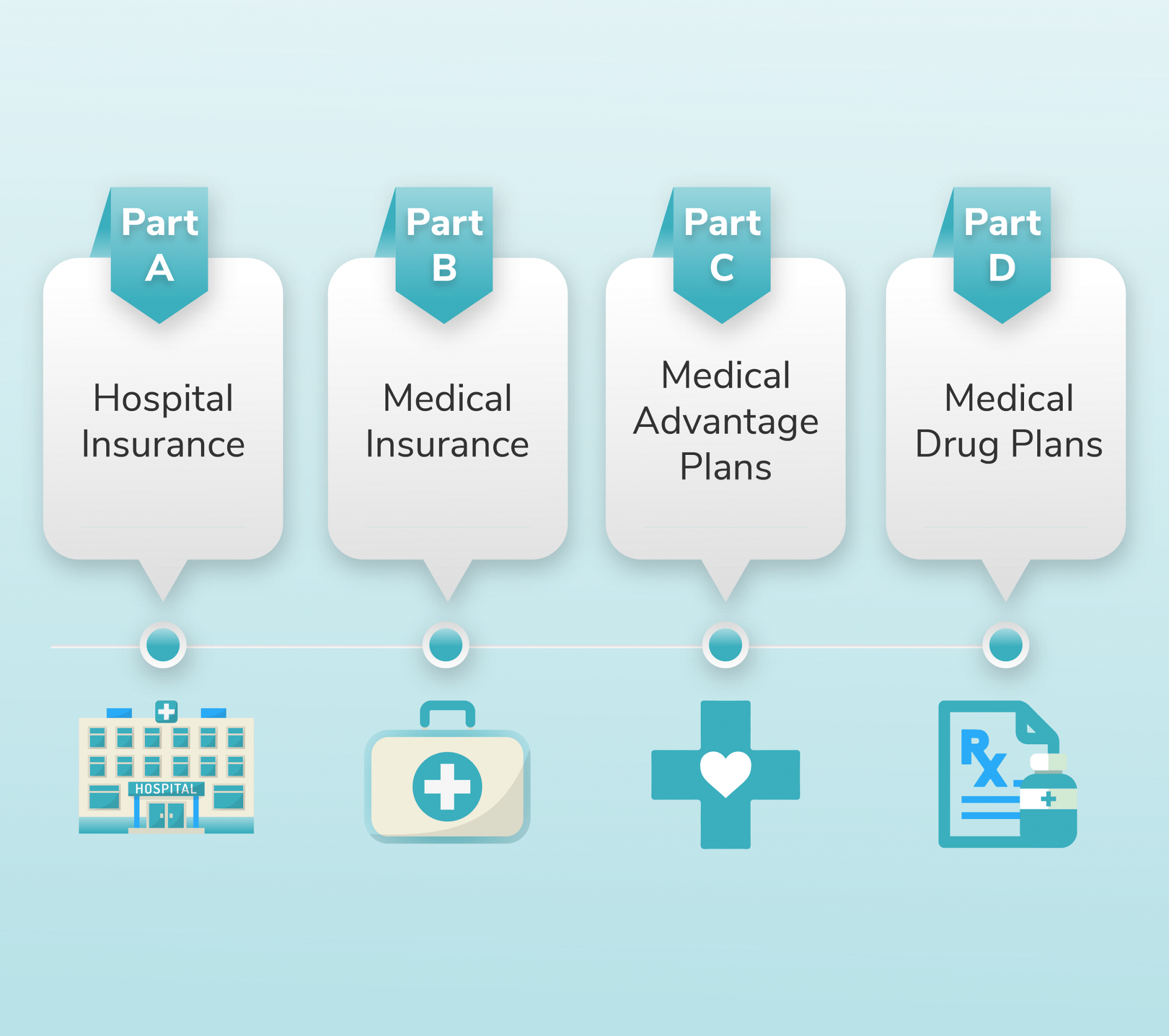

Medicare Part D

Medicare Part D, also called the Medicare prescription drug benefit, is an optional United States federal-government program to help Medicare beneficiaries pay for self-administered prescription drugs through prescription drug insurance premiums. Part D was originally propo…

What drugs are covered in Part D?

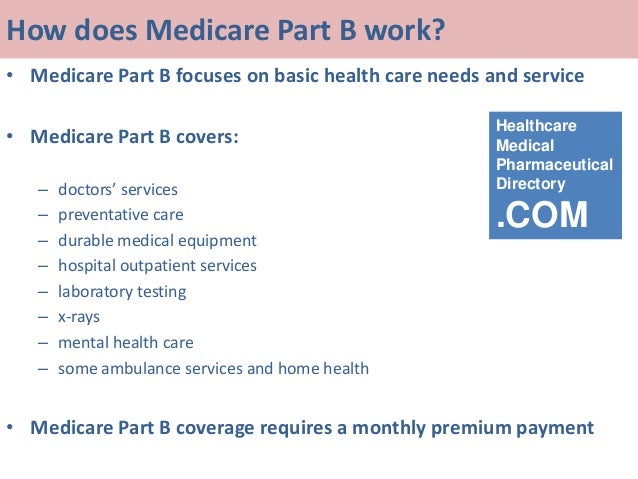

Nov 29, 2021 · Medicare Part D is an optional Medicare insurance program that provides coverage for prescription medications. You will pay a monthly premium for your Part D coverage, but it can be a beneficial add-on to your other Medicare programs for medications you are currently taking or may need to take in the future.

What you should know about Medicare Part D?

Mar 06, 2022 · Definition of Medicare Part D. Part D is an optional Medicare benefit that helps pay for your prescription drug expenses. If you want this coverage, you will have to pay an additional premium. Private insurance companies contract with the federal government to offer Part D programs through the Medicare system.

What do you need to know about Medicare Part D?

Part D plans are only required to cover a certain number of drugs in specific drug classes. However, Medicare Part D plans can decide to cover a particular generic and exclude the corresponding brand-name drug from coverage.

What is covered by Medicare Part D?

Get Started. Summary: Medicare Part D is prescription drug coverage for Medicare beneficiaries. You get it as a stand-alone plan with Original Medicare or included in a Medicare Advantage plan. Medicare Part D may have formularies, or lists of covered prescription drugs, and tiers, which is a price structure that covers brand and generic prescription drugs differently.

What is the advantage of having Medicare Part D?

Advantages of Part D Prescription Drug plans include: Cost protection: Part D plans help protect against high-cost prescription drugs by offering various levels of cost coverage for different “tiers” of drugs. Low premiums help make these plans affordable.Oct 1, 2021

What is the main problem with Medicare Part D?

The real problem with Medicare Part D plans is that they weren't set up with the intent of benefiting seniors. They were set up to benefit: –Pharmacies, by having copays for generic medications that are often far more than the actual cost of most of the medications.

Do you automatically get Part D with Medicare?

You'll be automatically enrolled in a Medicare drug plan unless you decline coverage or join a plan yourself.

Does Medicare Part D come out of your Social Security check?

Your Medicare Part B premiums will be automatically deducted from your Social Security benefits. Most people receive Part A without paying a premium. You can choose to have your Part C and Part D premiums deducted from your benefits. Medicare allows you to pay online or by mail without a fee.Dec 1, 2021

What is the most popular Medicare Part D plan?

Best-rated Medicare Part D providersRankMedicare Part D providerMedicare star rating for Part D plans1Kaiser Permanente4.92UnitedHealthcare (AARP)3.93BlueCross BlueShield (Anthem)3.94Humana3.83 more rows•Mar 16, 2022

Do I need Medicare Part D if I don't take any drugs?

Even if you don't take drugs now, you should consider joining a Medicare drug plan or a Medicare Advantage Plan with drug coverage to avoid a penalty. You may be able to find a plan that meets your needs with little to no monthly premiums. 2. Enroll in Medicare drug coverage if you lose other creditable coverage.

What drugs are not covered by Medicare Part D?

Medicare does not cover:Drugs used to treat anorexia, weight loss, or weight gain. ... Fertility drugs.Drugs used for cosmetic purposes or hair growth. ... Drugs that are only for the relief of cold or cough symptoms.Drugs used to treat erectile dysfunction.More items...

What are the four prescription drug coverage stages?

Throughout the year, your prescription drug plan costs may change depending on the coverage stage you are in. If you have a Part D plan, you move through the CMS coverage stages in this order: deductible (if applicable), initial coverage, coverage gap, and catastrophic coverage.Oct 1, 2021

Does Medicare Part D have copays?

No type of Medicare drug coverage may have a deductible more than $445 in 2021. Some plans don't charge a deductible. You pay copayments or coinsurance for your prescription drugs after you pay the deductible. You pay your share, and your plan pays its share for covered drugs.

How much does Medicare take out of Social Security in 2021?

The standard Medicare Part B premium for medical insurance in 2021 is $148.50. Some people who collect Social Security benefits and have their Part B premiums deducted from their payment will pay less.Nov 24, 2021

How are Medicare Part D premiums paid?

Part D Financing The monthly premium paid by enrollees is set to cover 25.5% of the cost of standard drug coverage. Medicare subsidizes the remaining 74.5%, based on bids submitted by plans for their expected benefit payments.Oct 13, 2021

What is deducted from your monthly Social Security check?

You can have 7, 10, 12 or 22 percent of your monthly benefit withheld for taxes. Only these percentages can be withheld. Flat dollar amounts are not accepted. Sign the form and return it to your local Social Security office by mail or in person.

How to decide if you need Medicare Part D?

How To Decide If You Need Part D. Medicare Part D is insurance. If you need prescription drug coverage, selecting a Part D plan when you’re eligible to enroll is probably a good idea—especially if you don’t currently have what Medicare considers “creditable prescription drug coverage.”. If you don’t elect Part D coverage during your initial ...

How long do you have to be in Medicare to get Part D?

You must have either Part A or Part B to get it. When you become eligible for Medicare (usually, when you turn 65), you can elect Part D during the seven-month period that you have to enroll in Parts A and B. 2. If you don’t elect Part D coverage during your initial enrollment period, you may pay a late enrollment penalty ...

What is Medicare Part D 2021?

Luke Brown. Updated July 15, 2021. Medicare Part D is optional prescription drug coverage available to Medicare recipients for an extra cost. But deciding whether to enroll in Medicare Part D can have permanent consequences—good or bad. Learn how Medicare Part D works, when and under what circumstances you can enroll, ...

How long can you go without Medicare Part D?

You can terminate Part D coverage during the annual enrollment period, but if you go 63 or more days in a row without creditable prescription coverage, you’ll likely face a penalty if you later wish to re-enroll. To disenroll from Part D, you can: Call Medicare at 1-800-MEDICARE.

How to disenroll from Medicare?

Call Medicare at 1-800-MEDICARE. Mail or fax a letter to Medicare telling them that you want to disenroll. If available, end your plan online. Call the Part D plan directly; the issuer will probably request that you sign and return certain forms.

What happens if you don't have Part D coverage?

The late enrollment penalty permanently increases your Part D premium. 3. Prescription drug coverage that pays at least ...

What is Tier 3 drug?

Tier 3: Non-preferred brand name drugs with higher copayments. Specialty: Drugs that cost more than $670 per month, the highest copayments 4. A formulary generally includes at least two drugs per category; one or both may be brand-name or one may be a brand name and the other generic.

What is Medicare Part D?

It is an optional prescription drug program for people on Medicare. Medicare Part D is simply insurance for your medication needs. You pay a monthly premium to an insurance carrier for your Part D plan. In return, you use the insurance carrier’s network of pharmacies to purchase your prescription medications.

Why switch to a different Medicare Part D plan?

Then you later switch mid-year to a different Medicare Part D plan because you moved out of state. Your new plan will already see that you have paid the deductible for that year. The costs for the coverage gap and catastrophic coverage work the same way. Part D drug plans also have changes from year to year.

What are the rules for Medicare?

Medicare allows drug plan carriers to apply certain rules for safety reasons and also for cost containment. The most common utilization rules that you may run into are: 1 Quantity Limits – a restriction on how much medication you can purchase at one time or upon each refill. If your doctor prescribes more than the quantity limit, then the insurance company will need him to file an exception form to explain why more is needed. 2 Prior Authorization – a requirement that you or your doctor must obtain plan approval before allowing a pharmacy to dispense your medication. The insurance company may ask for proof that the prescription is medically necessary before they allow it. This usually affects medications that are expensive or very potent. The doctor must show why this specific medication is necessary for you and why alternative drugs might be harmful or ineffective. 3 Step Therapy – the plan requires you to try less expensive alternative medications that treat the same condition before they will consider covering the prescribed medication. If the alternative medication works, both you and the insurance company save money. If it doesn’t, your doctor will need to help you file a drug exception with your carrier to request coverage for the original medication prescribed. He will need to explain why you need the more expensive medication when less expensive alternatives are available. Often this requires that he shows that you have already tried less expensive alternatives that were not effective.

How does each drug plan work?

Each drug plan will separate its medications into tiers. Each tiers has a copy amount that you will pay. For example, a plan might assign a $7 copay for a Tier 1 generic medication. Maybe a Tier 3 is a preferred brand name for a $40 copay, and so on.

What happens if you take a medication that is not on the formulary?

If you take a medication that is not on the formulary, such as a compound medication, you will have to file an exception to try to get that drug approved. Not all exceptions are approved, so be aware that you may pay out of pocket for any medication that is not covered by your plan or by Part D as a whole.

What are Part D restrictions?

Part D plan restrictions are common with pain medications, narcotics and opiates .

When does Medicare Part D change?

Part D drug plans also have changes from year to year. Your plan’s benefits, formulary, pharmacy network, provider network, premium and/or co-payments/co-insurance may change on January 1st of each year. Medicare gives you an Annual Election Period during which you can change your plan if you desire to do so.

What is Medicare Part D?

Medicare Part D plans are like any insurance that provides lower-costing coverage for your prescription drugs. And like any other insurance coverage, you usually pay the plan a monthly premium, you may have an initial deductible that you must pay first before your insurance coverage begins to pay a portion of your drug costs, ...

How many parts are there in Medicare Part D 2021?

The following information describes how the basic or model 2021 Medicare Part D prescription drug plan is separated into four main parts. Depending on your prescription drug needs, you may only go into one or two parts of your Part D coverage (and if you spend over $6,550 in prescription drugs you might go into all four parts ...

What happens when you meet your initial coverage limit?

Once you meet your plan's Initial Coverage Limit, you will exit the Initial Coverage Phase and enter the Coverage Gap. (As a note, most people never leave their Medicare drug plan's Initial Coverage Phase). Part 3 - The Coverage Gap or Donut Hole - In this phase of coverage, you will receive a 75% discount on all formulary drugs ...

What is Part 2 of Medicare?

Part 2 - The Initial Coverage Phase - Once you meet your plans Initial Deductible (if any), your drug plan then provides cost-sharing coverage for formulary drugs. Cost-sharing is where you and your Medicare Part D plan share in the retail cost of covered drugs with co-insurance (a percentage of retail, such as 25%) or co-payment ...

What percentage of Donut Hole Discount is applied to brand name formulary?

In such as plan, a member who purchases a brand-name medication that also has coverage in the Donut Hole will actually receive the brand-name drug manufacturer's portion of the Donut Hole Discount (70% ) is also applied to the brand-name formulary drug purchase.

Does Medicare Part D have a deductible?

Many Medicare Part D plans (both PDPs and MAPDs) have a $0 deduct ible and provide "first dollar coverage" for your formulary prescriptions. You can see our Medicare Part D Plan Finder for examples of Medicare plans with different deductibles (just choose your state to see plans in your area).

Does Medicare cover all prescription drugs?

And it is important to understand that no Medicare Part D plan covers all prescription drugs. Part D plans are only required to cover a certain number of drugs in specific drug classes. However, Medicare Part D plans can decide to cover a particular generic and exclude the corresponding brand-name drug from coverage.

What is Medicare Part D?

Select your county. Get Started. Summary: Medicare Part D is prescription drug coverage for Medicare beneficiaries. You get it as a stand-alone plan with Original Medicare or included in a Medicare Advantage plan. Medicare Part D may have formularies, or lists of covered prescription drugs, and tiers, which is a price structure ...

How long does Medicare Part D last?

You’re first eligible to sign up for Medicare Part D during your Initial Enrollment Period, which lasts for seven months. This is the time frame three months before your 65th birthday, includes your birthday month, and lasts for three months after your 65th birthday.

What is a formulary in Medicare?

A formulary is the list of prescription drugs that your Part D plan covers. Formularies may vary from plan to plan but Medicare dictates that all or “substantially” all prescription drugs in certain protected classes are covered.

How long does a disability last?

If you qualify because you’re receiving disability benefits, your Initial Enrollment Period starts three months before your 25th month of disability benefits from the Social Security Administration (SSA) or Railroad Retirement Board (RRB) and also lasts seven months. If you miss your Initial Enrollment Period, you can sign up for Medicare Part D ...

When is Medicare Part D late enrollment?

This takes place from October 15 to December 7. You may pay a late-enrollment penalty if you sign up for Medicare Part D after having gone 63 days or more without “creditable” prescription drug coverage after your Initial Enrollment Period is over.

Do you have to pay a penalty for Medicare Part D?

Creditable prescription drug coverage must pay on average at least as much as standard Medicare prescription drug coverage. You may have to pay this penalty as long as you’re enrolled in the Medicare Part D Prescription Drug Plan.

Does Medicare Advantage cover prescription drugs?

Most but not all Medicare Advantage plans cover prescription drugs. A Medicare Advantage plan may charge a premium in addition to the Medicare Part B premium you still have to pay. Some Medicare Advantage plans also charge a separate deductible for prescription drugs.

What is deductible in Medicare?

deductible. The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. at the start of each year, and you usually pay 20% of the cost of the Medicare-approved service, called coinsurance.

What is Medicare for people 65 and older?

Medicare is the federal health insurance program for: People who are 65 or older. Certain younger people with disabilities. People with End-Stage Renal Disease (permanent kidney failure requiring dialysis or a transplant, sometimes called ESRD)

What is the standard Part B premium for 2020?

The standard Part B premium amount in 2020 is $144.60. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA). IRMAA is an extra charge added to your premium.

Do you pay Medicare premiums if you are working?

You usually don't pay a monthly premium for Part A if you or your spouse paid Medicare taxes for a certain amount of time while working. This is sometimes called "premium-free Part A."

Does Medicare Advantage cover vision?

Most plans offer extra benefits that Original Medicare doesn’t cover — like vision, hearing, dental, and more. Medicare Advantage Plans have yearly contracts with Medicare and must follow Medicare’s coverage rules. The plan must notify you about any changes before the start of the next enrollment year.

Does Medicare cover all of the costs of health care?

Original Medicare pays for much, but not all, of the cost for covered health care services and supplies. A Medicare Supplement Insurance (Medigap) policy can help pay some of the remaining health care costs, like copayments, coinsurance, and deductibles.

Does Medicare cover prescription drugs?

Medicare drug coverage helps pay for prescription drugs you need. To get Medicare drug coverage, you must join a Medicare-approved plan that offers drug coverage (this includes Medicare drug plans and Medicare Advantage Plans with drug coverage).