How Exactly Does Medicare Part D Work?

- Annual Deductible. The allowable Medicare Part D deductible for 2022 is $480. ...

- Initial Coverage. Once you’ve reached your annual deductible, you will pay a copay for your medications. ...

- The Coverage Gap. After you’ve reached the initial coverage limit, you’ll enter into the coverage gap stage. ...

- Catastrophic Coverage. ...

What drugs are covered in Part D?

- Oral cancer drugs: Medicare helps pay for some oral cancer drugs you take by mouth if the same drug is available in injectable form or the drug is a prodrug ...

- Oral anti-nausea drugs: Medicare helps pay for oral anti-nausea drugs used as part of an anti-cancer chemotherapeutic regimen if they’re administered before, at, or within 48 hours of chemotherapy or ...

- Self-administered drugs in hospital outpatient settings: Medicare may pay for some self-administered drugs, like drugs given through an IV. ...

What you should know about Medicare Part D?

You are eligible for a Medicare Part D plan if:

- You are 65 years of age or older.

- You have a qualifying disability for which you have been receiving Social Security Disability Insurance (SSDI) for more than 24 months.

- You have been diagnosed with End-Stage Renal Disease (permanent kidney failure requiring a kidney transplant or dialysis).

- You are entitled to Medicare Part A or Part B.

What do you need to know about Medicare Part D?

- You’ll want to go to medicare.gov’s Medicare Plan Finder, an online tool that allows you to compare Part D plans available in your ZIP code.

- On the plan finder page, you’ll be asked to enter the prescriptions you take. ...

- You can also find out how many “stars” the federal government has given to the plans available in your area. ...

What is covered by Medicare Part D?

QUINCY (WGEM) - For those of you with a Medicare D plan, a list of vaccines is now covered for you in Adams County. Starting on Monday, the Adams County Health Department will begin offering vaccines for Shingles, Tetanus, Hepatitis A and B, and more.

What does Medicare Part D pay for?

The Medicare Part D program provides an outpatient prescription drug benefit to older adults and people with long-term disabilities in Medicare who enroll in private plans, including stand-alone prescription drug plans (PDPs) to supplement traditional Medicare and Medicare Advantage prescription drug plans (MA-PDs) ...

Do you automatically get Part D with Medicare?

You'll be automatically enrolled in a Medicare drug plan unless you decline coverage or join a plan yourself.

Is it worth getting Medicare Part D?

Most people will need Medicare Part D prescription drug coverage. Even if you're fortunate enough to be in good health now, you may need significant prescription drugs in the future. A relatively small Part D payment entitles you to outsized benefits once you need them, just like with a car or home insurance.

What are the 4 phases of Part D coverage?

Throughout the year, your prescription drug plan costs may change depending on the coverage stage you are in. If you have a Part D plan, you move through the CMS coverage stages in this order: deductible (if applicable), initial coverage, coverage gap, and catastrophic coverage.

What drugs are not covered by Medicare Part D?

Medicare does not cover:Drugs used to treat anorexia, weight loss, or weight gain. ... Fertility drugs.Drugs used for cosmetic purposes or hair growth. ... Drugs that are only for the relief of cold or cough symptoms.Drugs used to treat erectile dysfunction.More items...

What is the maximum out of pocket for Medicare Part D?

Medicare Part D, the outpatient prescription drug benefit for Medicare beneficiaries, provides coverage above a catastrophic threshold for high out-of-pocket drug costs, but there is no cap on total out-of-pocket drug costs that beneficiaries pay each year.

What is the main problem with Medicare Part D?

The real problem with Medicare Part D plans is that they weren't set up with the intent of benefiting seniors. They were set up to benefit: –Pharmacies, by having copays for generic medications that are often far more than the actual cost of most of the medications.

Do I need Medicare Part D if I don't take any drugs?

No. Medicare Part D Drug Plans are not required coverage. Whether you take drugs or not, you do not need Medicare Part D.

What happens if I don't have Medicare Part D?

If you don't sign up for a Part D plan when you are first eligible to do so, and you decide later you want to sign up, you will be required to pay a late enrollment penalty equal to 1% of the national average premium amount for every month you didn't have coverage as good as the standard Part D benefit.

When did Medicare Part D become mandatory?

The MMA also expanded Medicare to include an optional prescription drug benefit, “Part D,” which went into effect in 2006.

Do all Medicare Part D plans have deductible?

Deductibles vary between Medicare drug plans. No Medicare drug plan may have a deductible more than $480 in 2022. Some Medicare drug plans don't have a deductible.

What is the deductible for Part D in 2022?

$480 inWhat is the Medicare Part D Deductible for 2022? The maximum deductible for Part D is $480 in 2022.

When did Medicare Part D become mandatory?

The MMA also expanded Medicare to include an optional prescription drug benefit, “Part D,” which went into effect in 2006.

Does Medicare Part D renew automatically?

Like Medicare Advantage, your Medicare Part D (prescription drug) plan should automatically renew. Exceptions would be if Medicare does not renew the contract with your insurance company or the company no longer offers the plan.

When can you enroll in Medicare Part D?

Enrollment Periods This period is from October 15 through December 7 each year. Coverage begins the following January 1. For people who are new to Medicare, the Initial Enrollment Period (IEP) for Part D is 7 months long.

Do I need Medicare Part D if I don't take any drugs?

No. Medicare Part D Drug Plans are not required coverage. Whether you take drugs or not, you do not need Medicare Part D.

How to decide if you need Medicare Part D?

How To Decide If You Need Part D. Medicare Part D is insurance. If you need prescription drug coverage, selecting a Part D plan when you’re eligible to enroll is probably a good idea—especially if you don’t currently have what Medicare considers “creditable prescription drug coverage.”. If you don’t elect Part D coverage during your initial ...

How long do you have to be in Medicare to get Part D?

You must have either Part A or Part B to get it. When you become eligible for Medicare (usually, when you turn 65), you can elect Part D during the seven-month period that you have to enroll in Parts A and B. 2. If you don’t elect Part D coverage during your initial enrollment period, you may pay a late enrollment penalty ...

What is Medicare Part D 2021?

Luke Brown. Updated July 15, 2021. Medicare Part D is optional prescription drug coverage available to Medicare recipients for an extra cost. But deciding whether to enroll in Medicare Part D can have permanent consequences—good or bad. Learn how Medicare Part D works, when and under what circumstances you can enroll, ...

How long can you go without Medicare Part D?

You can terminate Part D coverage during the annual enrollment period, but if you go 63 or more days in a row without creditable prescription coverage, you’ll likely face a penalty if you later wish to re-enroll. To disenroll from Part D, you can: Call Medicare at 1-800-MEDICARE.

How to disenroll from Medicare?

Call Medicare at 1-800-MEDICARE. Mail or fax a letter to Medicare telling them that you want to disenroll. If available, end your plan online. Call the Part D plan directly; the issuer will probably request that you sign and return certain forms.

What happens if you don't have Part D coverage?

The late enrollment penalty permanently increases your Part D premium. 3. Prescription drug coverage that pays at least ...

What is Tier 3 drug?

Tier 3: Non-preferred brand name drugs with higher copayments. Specialty: Drugs that cost more than $670 per month, the highest copayments 4. A formulary generally includes at least two drugs per category; one or both may be brand-name or one may be a brand name and the other generic.

What is Medicare Part D?

It is an optional prescription drug program for people on Medicare. Medicare Part D is simply insurance for your medication needs. You pay a monthly premium to an insurance carrier for your Part D plan. In return, you use the insurance carrier’s network of pharmacies to purchase your prescription medications.

Why switch to a different Medicare Part D plan?

Then you later switch mid-year to a different Medicare Part D plan because you moved out of state. Your new plan will already see that you have paid the deductible for that year. The costs for the coverage gap and catastrophic coverage work the same way. Part D drug plans also have changes from year to year.

What are the rules for Medicare?

Medicare allows drug plan carriers to apply certain rules for safety reasons and also for cost containment. The most common utilization rules that you may run into are: 1 Quantity Limits – a restriction on how much medication you can purchase at one time or upon each refill. If your doctor prescribes more than the quantity limit, then the insurance company will need him to file an exception form to explain why more is needed. 2 Prior Authorization – a requirement that you or your doctor must obtain plan approval before allowing a pharmacy to dispense your medication. The insurance company may ask for proof that the prescription is medically necessary before they allow it. This usually affects medications that are expensive or very potent. The doctor must show why this specific medication is necessary for you and why alternative drugs might be harmful or ineffective. 3 Step Therapy – the plan requires you to try less expensive alternative medications that treat the same condition before they will consider covering the prescribed medication. If the alternative medication works, both you and the insurance company save money. If it doesn’t, your doctor will need to help you file a drug exception with your carrier to request coverage for the original medication prescribed. He will need to explain why you need the more expensive medication when less expensive alternatives are available. Often this requires that he shows that you have already tried less expensive alternatives that were not effective.

What is the Medicare Part D deductible for 2021?

In 2021, the allowable Medicare Part D deductible is $445. Plans may charge the full Part D deductible, a partial deductible, or waive the deductible entirely. You will pay the network discounted price for your medications until your plan tallies that you have satisfied the deductible. After that, you enter initial coverage.

What are Part D restrictions?

Part D plan restrictions are common with pain medications, narcotics and opiates .

What is Tier 3 copay?

Maybe a Tier 3 is a preferred brand name for a $40 copay, and so on. The insurance company tracks the spending by both you and the insurance company until you have together spent a total of $4,130 in 2021. After you’ve reached the initial coverage limit for the year, you enter the coverage gap.

Is Part D a Medicare plan?

Part D drug plans are among the most confusing Medicare topics. All too often people join a plan without checking to make sure the formulary includes their medications. Sometimes they also miss that one of their medications has step therapy rules applied.

Overview

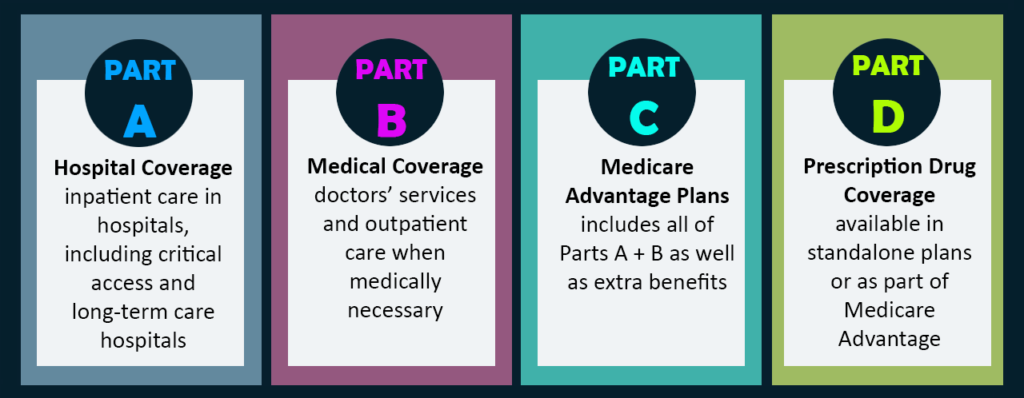

A Medicare Prescription Drug Plan (PDP), or Part D, is the part of Medicare that provides coverage for prescription medications. Anyone who is eligible for Original Medicare (Parts A & B) can sign up for one of these plans, which are offered by private companies approved by Medicare.

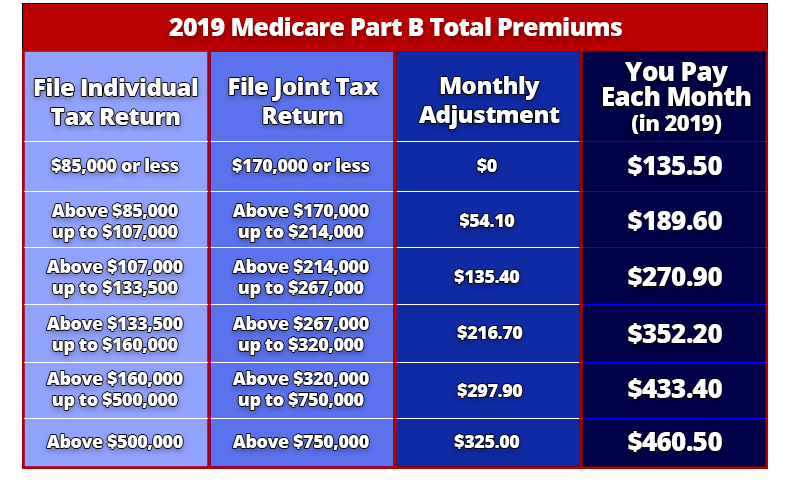

What is the monthly premium for a Medicare Prescription Drug Plan?

Premiums vary by plan. The national average monthly premium for a Prescription Drug Plan (PDP) in 2019 is $33.19, though you may pay more or less depending on your plan, your income, and where you live.

Can you have a Medicare Prescription Drug Plan and private insurance?

Sometimes. It depends on what type of your private insurance you have.

What is creditable coverage?

Creditable coverage meets a minimum set standards. As it relates to Prescription Drug Plans (Part D), creditable coverage must be at least as good as the standard Medicare Prescription Drug Plan (PDP). As long as you have creditable coverage, you can delay signing up for a PDP without the risk of incurring a penalty.

What is the coverage gap or donut hole?

Medicare Prescription Drug Plans (Part D) have a coverage gap, also known as the “donut hole.” Once you have received a certain level of benefits from your plan, you enter a coverage reduction period, where you will face higher out-of-pocket costs until you qualify for catastrophic coverage.

What is catastrophic coverage?

After your total prescription drug costs reach $5,000 in 2018, you enter catastrophic coverage, and your insurer will cover 95% of your costs.

What are the Part D drug tiers?

Each Medicare Prescription Drug Plan (Part D) has a list of covered drugs, divided into different tiers. Typically there are four or five tiers, depending on the plan.

How long is the Part D enrollment period?

The Part D special enrollment period is a 63-day period that allows you to enroll in Part D without penalty. The special enrollment period is intended to cover you if you have Original Medicare but still have an insurance plan from your employer or union that covers your prescription drug costs.

How much does Medicare pay for brand name drugs?

According to Medicare.gov, once you have entered the coverage gap, you will pay 25 percent of the cost of brand-name prescription drugs. Of the remaining 75 percent, 70 percent will be covered by the manufacturer of the drug, and 5 percent will be covered by your insurance, even though you are in the coverage gap.

What percentage of Medicare will pay for generic drugs?

When you buy generic drugs in the coverage gap, you will still only pay 25 percent of the cost. Medicare will pay the remaining 75 percent directly. This means that only the amount you actually paid, 25 percent, will count as an out-of-pocket expense. In this case, you pay the same amount, but reach your annual out-of-pocket limit more slowly.

When does Medicare open enrollment start?

Each year from October 15 to December 7, Medicare offers open enrollment, meaning you can freely make changes to your plans without penalty. During this time, you can choose to enroll in a Part D plan, and your coverage will begin on January 1 of the following year.

Does Medicare Part D cover prescription drugs?

Medicare Part D plans cover prescription drug costs . Plans are offered by private insurance companies, and the coverage gap can be a little complicated. Read to find out more about these plans.

What is Medicare Part D?

Medicare Part D is the prescription drug benefit that is available to those on Medicare. It is available either as a standalone plan or is part of some Medicare health plans, such as Medicare Advantage. It’s designed to lower the cost of buying medication. Each Medicare Part D plan includes a “formulary” or list of drugs it covers, and plans organize the different types of drugs into different tiers within this formulary based on cost and availability. All plans that cover prescription drug coverage–like a Medicare Advantage plan that includes drug costs—are required to cover at least the standard Medicare Part B benefit.

Is Medicare Part D included in Medicare?

No, Medicare Part D is not included in the automatic Original Medicare plan, but it can be added on during the initial enrollment window three months before and three months after turning 65. When you turn 65 and start taking out social security checks you are automatically enrolled in Medicare Parts A and B. This means while things like hospital visits, office appointments and some equipment is covered, prescription drug costs are not covered until you enroll in Medicare Part D via a standalone plan or a health plan that includes it.

What is Medicare program?

A Medicare program to help people with limited income and resources pay Medicare prescription drug program costs , like premiums, deductibles, and coinsurance. with your prescription drug costs. If you don't join a plan, Medicare will enroll you in one to make sure you don't miss a day of coverage.

What is a copayment for Medicare?

A copayment is usually a set amount, rather than a percentage. For example, you might pay $10 or $20 for a doctor's visit or prescription drug. for each drug. If you don't join a drug plan, Medicare will enroll you in one to make sure you don't miss a day of coverage.

What is the state pharmaceutical assistance program?

State Pharmaceutical Assistance Program. Each state decides how its State Pharmaceutical Assistance Program (SPAP) works with Medicare prescription drug coverage. Some states give extra coverage when you join a Medicare drug plan. Some states have a separate state program that helps with prescriptions.

Do you have to have a Medicare drug plan to get tricare?

Most people with TRICARE entitled to Part A must have Part B to keep TRICARE drug benefits. If you have TRICARE, you don’t need to join a Medicare drug plan.

Can you join a Medicare plan without a penalty?

, you'll have a special enrollment period to join a Medicare drug plan without a penalty when COBRA ends.

Does Medicare help with housing?

, you won't lose your housing assistance. However, your housing assistance may be reduced as your prescription drug spending decreases.

Does Medicare pay for prescription drugs?

Your drug costs are covered by Medicare. You'll need to join a Medicare drug plan for Medicare to pay for your drugs. In most cases, you'll pay a small amount for your covered drugs. If you have full coverage from Medicaid and live in a nursing home, you pay nothing for covered prescription drugs.