What drugs are covered by Part D?

Mar 06, 2022 · Definition of Medicare Part D Part D is an optional Medicare benefit that helps pay for your prescription drug expenses. If you want this coverage, you will have to pay an additional premium. Private insurance companies contract with the federal government to offer Part D programs through the Medicare system.

How much does Medicare Part D coverage cost?

Apr 06, 2022 · Medicare Part D provides prescription drug coverage for Medicare beneficiaries. The out-of-pocket costs with a Medicare Part D plan include your premiums, deductibles and coinsurance. Medicare Part D is offered by private insurers, but regulated by the federal government, and you can sign up for a plan on the Medicare website.

What are the best Medicare Part D plans?

Dec 28, 2021 · What is Medicare Part D? Medicare Part D is prescription drug coverage. You can access Medicare Part D coverage by purchasing a standalone Prescription Drug Plan (PDP) or as part of a bundled Medicare Advantage (Part C) plan (also known as an ‘MA-PD’ plans). Both types of plans are provided by private health insurance companies.

What plans are available for Medicare Part D?

Apr 16, 2021 · Part D, which is your prescription drug coverage. Because there is very little prescription drug coverage in Original Medicare, Congress created Part D as part of the Medicare Modernization Act in 2003. Medicare Part D is designed to help make medications more affordable for people enrolled in Medicare.

What is Medicare Part D and how does it work?

It is an optional prescription drug program for people on Medicare. Medicare Part D is simply insurance for your medication needs. You pay a monthly premium to an insurance carrier for your Part D plan. In return, you use the insurance carrier's network of pharmacies to purchase your prescription medications.

What is the main benefit of Medicare Part D?

The Medicare Part D program provides an outpatient prescription drug benefit to older adults and people with long-term disabilities in Medicare who enroll in private plans, including stand-alone prescription drug plans (PDPs) to supplement traditional Medicare and Medicare Advantage prescription drug plans (MA-PDs) ...Jun 4, 2019

What is not covered under Medicare Part D?

Drugs not covered under Medicare Part D Weight loss or weight gain drugs. Drugs for cosmetic purposes or hair growth. Fertility drugs. Drugs for sexual or erectile dysfunction.Jun 5, 2021

What does Medicare Part D cover for the patient?

Medicare Part D, the prescription drug benefit, is the part of Medicare that covers most outpatient prescription drugs. Part D is offered through private companies either as a stand-alone plan, for those enrolled in Original Medicare, or as a set of benefits included with your Medicare Advantage Plan.

What is the most popular Medicare Part D plan?

Best-rated Medicare Part D providersRankMedicare Part D providerMedicare star rating for Part D plans1Kaiser Permanente4.92UnitedHealthcare (AARP)3.93BlueCross BlueShield (Anthem)3.94Humana3.83 more rows•Mar 16, 2022

Is Medicare Part D automatically deducted from Social Security?

If you receive Social Security retirement or disability benefits, your Medicare premiums can be automatically deducted. The premium amount will be taken out of your check before it's either sent to you or deposited.Dec 1, 2021

Do I need Medicare Part D if I don't take any drugs?

Even if you don't take drugs now, you should consider joining a Medicare drug plan or a Medicare Advantage Plan with drug coverage to avoid a penalty. You may be able to find a plan that meets your needs with little to no monthly premiums. 2. Enroll in Medicare drug coverage if you lose other creditable coverage.

What is the Medicare Part D deductible for 2021?

$445Medicare Part D, also known as prescription drug coverage, is the part of Medicare that helps you pay for prescription drugs. When you enroll in a Part D plan, you are responsible for paying your deductible, premium, copayment, and coinsurance amounts. The maximum Medicare Part D deductible for 2021 is $445.

Is Part D mandatory?

Is Medicare Part D Mandatory? It is not mandatory to enroll into a Medicare Part D Prescription Drug Plan.

How do I know if I have Medicare Part D?

Checking Part D Is Easy and Simple Conveniently, one can go online to Medicare.gov to check eligibility and status in any part of Medicare. When it comes to Medicare prescription drug coverage, beneficiaries will choose whether to have a combination plan or a stand-alone drug plan.

Who has the cheapest Part D drug plan?

SilverScript Medicare Prescription Drug Plans Although costs vary by zip code, the average nationwide monthly premium cost of the SmartRX plan is only $7.08, making it the most affordable Medicare Part D plan on the market.

Do you have to pay for Medicare Part D?

How much does Part D cost? Most people only pay their Part D premium. If you don't sign up for Part D when you're first eligible, you may have to pay a Part D late enrollment penalty. If you have a higher income, you might pay more for your Medicare drug coverage.

What does Medicare Part D cover?

All plans must cover a wide range of prescription drugs that people with Medicare take, including most drugs in certain protected classes,” like drugs to treat cancer or HIV/AIDS. A plan’s list of covered drugs is called a “formulary,” and each plan has its own formulary.

How many drugs does Medicare cover?

All Medicare drug plans generally must cover at least 2 drugs per drug category, but plans can choose which drugs covered by Part D they will offer. The formulary might not include your specific drug. However, in most cases, a similar drug should be available.

How many prescription drugs are covered by Medicare?

Plans include both brand-name prescription drugs and generic drug coverage. The formulary includes at least 2 drugs in the most commonly prescribed categories and classes. This helps make sure that people with different medical conditions can get the prescription drugs they need. All Medicare drug plans generally must cover at least 2 drugs per ...

When will Medicare start paying for insulin?

Starting January 1, 2021, if you take insulin, you may be able to get Medicare drug coverage that offers savings on your insulin. You could pay no more than $35 for a 30-day supply. Find a plan that offers this savings on insulin in your state. You can join during Open Enrollment (October 15 – December 7, 2020).

What are the tiers of Medicare?

Here's an example of a Medicare drug plan's tiers (your plan’s tiers may be different): Tier 1—lowest. copayment. An amount you may be required to pay as your share of the cost for a medical service or supply, like a doctor's visit, hospital outpatient visit, or prescription drug.

Does Medicare cover opioids?

Your plan may notify you of any formulary changes that affect drugs you’re taking. Medicare drug coverage includes drugs for medication-assisted treatment for opioid use disorders.

What is formulary exception?

A formulary exception is a drug plan's decision to cover a drug that's not on its drug list or to waive a coverage rule. A tiering exception is a drug plan's decision to charge a lower amount for a drug that's on its non-preferred drug tier.

What is Medicare Part D?

Key Takeaways. Medicare Part D is an optional coverage available for a cost that can help pay for prescription drugs. Medicare Part D is sold by private insurance companies that have contracted with Medicare to offer it to people eligible for Medicare. Not all Part D plans operate everywhere, nor do all of the plans offer ...

What drugs are covered by Part D?

Drugs covered by each Part D plan are listed in their “formulary,” and each formulary is generally required to include drugs in six categories or protected classes: antidepressants, antipsychotics, anticonvulsants, immunosuppressants for treatment of transplant rejection, antiretrovirals, and antineoplastics.

What are the different tiers of Medicare?

The drugs in the plan’s formulary may be further placed into different tiers that determine your cost. For example: 1 Tier 1: The most generic drugs with the lowest copayments 2 Tier 2: Preferred brand-name drugs with medium copayments 3 Tier 3: Non-preferred brand name drugs with higher copayments 4 Specialty: Drugs that cost more than $670 per month, the highest copayments 4

How long can you go without Medicare Part D?

You can terminate Part D coverage during the annual enrollment period, but if you go 63 or more days in a row without creditable prescription coverage, you’ll likely face a penalty if you later wish to re-enroll. To disenroll from Part D, you can: Call Medicare at 1-800-MEDICARE.

What happens if you don't have Part D coverage?

The late enrollment penalty permanently increases your Part D premium. 3. Prescription drug coverage that pays at least ...

How to disenroll from Medicare?

Call Medicare at 1-800-MEDICARE. Mail or fax a letter to Medicare telling them that you want to disenroll. If available, end your plan online. Call the Part D plan directly; the issuer will probably request that you sign and return certain forms.

What happens if you don't enroll in Part D?

Not enrolling in Part D during the initial enrollment period could result in a late-enrollment penalty that permanently increases your Part D premium.

What is Part D insurance?

Part D coverage is generally provided through a network of pharmacies that are contracted with the Part D insurance provider . Network pharmacies generally include retail pharmacies and may include mail-order pharmacies as well. You will generally be required to fill your prescription at in-network pharmacies.

What are the requirements for Medicare Part D?

Each Medicare Part D plan must cover at least a standard level of coverage that is set by the government. In general, Part D plans cover: 1 Prescription drugs 2 Biologics (drugs made of natural sources that are not chemically synthesized such as allergy shots and gene therapies) 3 Insulin and medical supplies associated with the injection of Insulin (such as syringes, needles, swabs, and gauze) 4 Certain vaccines

How long do you have to wait to enroll in Part D?

If at any point after you are first eligible for Part D, you have a continuous period of 63 days where you do not have ‘creditable drug coverage’ you will have to pay a Late Enrollment Penalty.

When does Medicare Part D start?

If you are turning 65, your Initial Enrollment Period for Part D coverage coincides with your general Medicare Initial Enrollment Period, which is the 7-month period that starts 3 months before the month you turn 65.

What is extra help for medicaid?

Extra Help is a program that is can help people with low income (defined as <150% of the Federal Poverty Line) pay for Medicare prescription drug plan costs. Extra Help can pay for costs like premiums and out-of-pocket costs. To find out if you qualify you will need to fill out an Application for Extra Help with Medicare Prescription Drug Plan Costs (form SSA-1020) online. If you apply to the State Medicaid office, the state Medicaid office will also check if you are eligible for other low-income assistance.

How long do you have to enroll in Part D if you have creditable coverage?

If you are eligible to defer enrollment penalty-free because you have creditable coverage, you must enroll in a Part D plan within 63 days of losing creditable drug coverage to avoid penalties. This a one-time Special Enrollment Period (SEP) where you can select a new Medicare prescription drug plan (PDP or MA-PD). If you miss this SEP you must enroll during the Annual Enrollment Period.

What happens if you reach the $6,550 gap?

When you have reached Catastrophic Coverage, you will pay much lower copays and coinsurances. For 2021, once you reach Catastrophic Coverage you will pay the greater of 5% coinsurance or $9.20 for branded drugs and $3.70 for generic drugs.

Why was Medicare Part D created?

Because there is very little prescription drug coverage in Original Medicare, Congress created Part D as part of the Medicare Modernization Act in 2003. Medicare Part D is designed to help make medications more affordable for people enrolled in Medicare.

How many Medicare Part D plans are there in 2021?

According to the Kaiser Family Foundation, the average Medicare beneficiary has 30 stand-alone Medicare Part D prescription drug plans to choose from in 2021. It’s important to comparison shop to find the one that’s right for you.

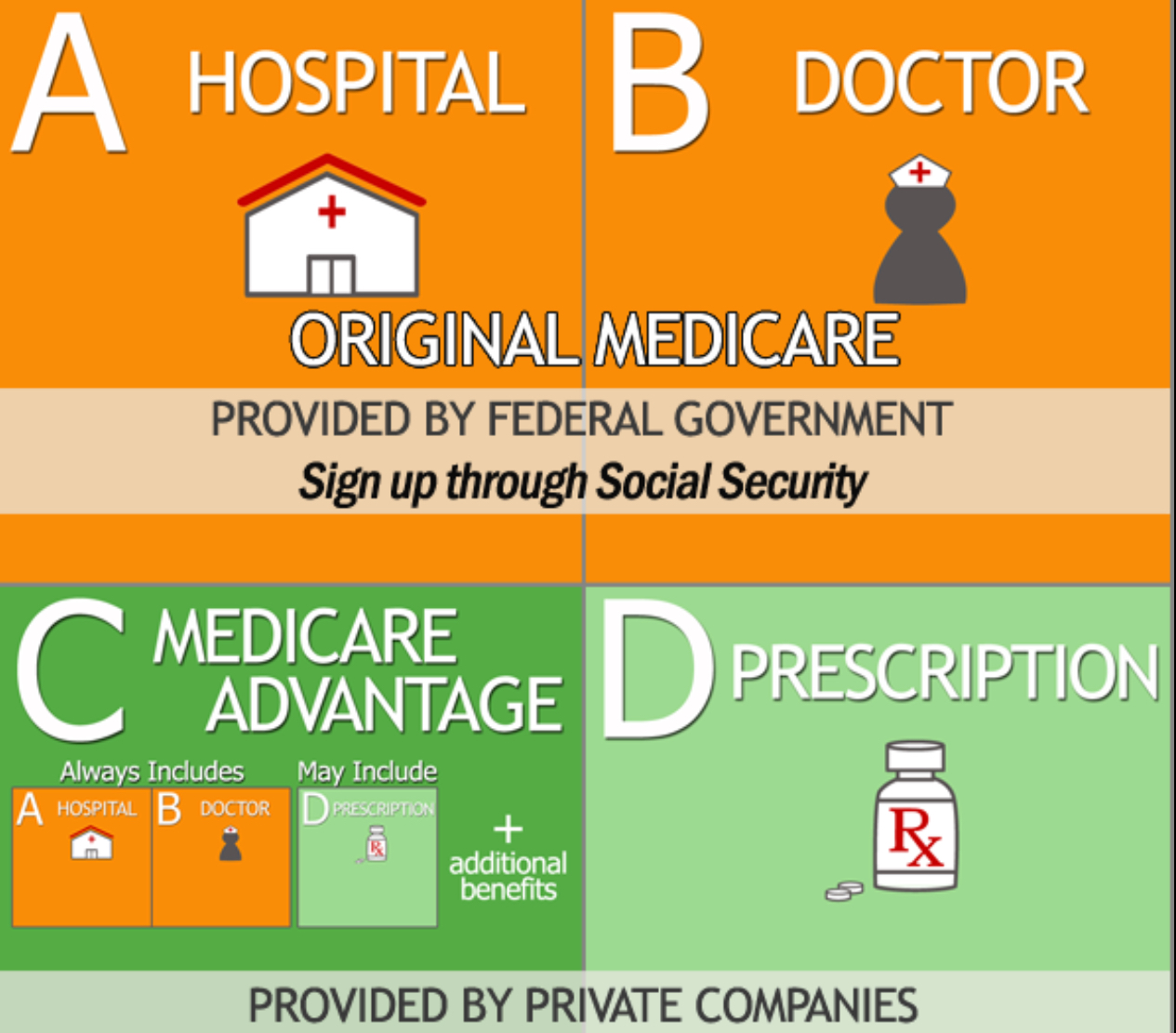

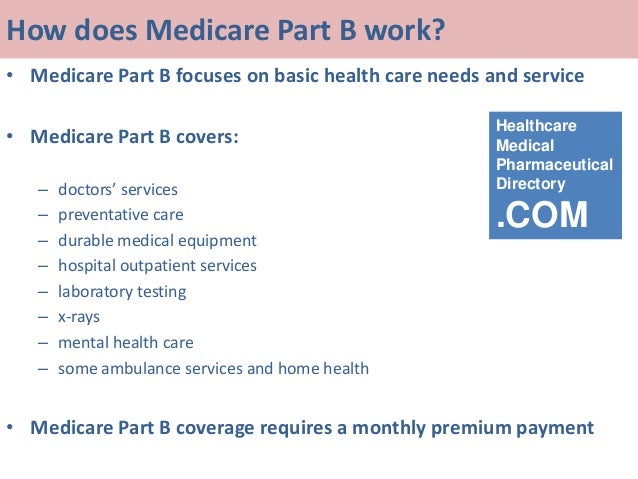

What are the different types of Medicare?

There are four parts to the Medicare program: 1 Part A, which is your hospital insurance 2 Part B, which covers outpatient services and durable medical equipment (Part A and Part B are called Original Medicare) 3 Part C, or Medicare Advantage, which offers an alternate way to get your benefits under Original Medicare 4 Part D, which is your prescription drug coverage

What is a formulary in Medicare?

Each Medicare prescription drug plan uses a formulary, which is a list of medications covered by the plan and your costs for each. Most plans use a tiered copayment system. Prescription drugs in the lowest tiers, usually generic medications, have lower copayments.

How much is coinsurance for 2021?

If you and your plan spend more than $4,130 on prescription medications in 2021, special coverage rules kick in.

What is coinsurance in Medicare?

Copayments (flat fee you pay for each prescription) Coinsurance (percentage of the actual cost of the medication ) Many Medicare Advantage plans include prescription drug coverage. If you enroll in a plan with Part D included, you typically won’t pay a separate premium for the coverage. You generally pay one monthly premium for Medicare Advantage.

What happens if you don't have Medicare Part D?

If you go without creditable prescription drug coverage and you don’t enroll in Part D when you are first able, you’ ll pay a penalty of 1% of the national base premium for each month you go without coverage. You pay this penalty for as long as you have Medicare Part D coverage.

What insurance companies offer Medicare Part D?

Cuba nski, Juliette, Anthony Damico, and Tricia Neuman. “ 10 Things to Know About Medicare Part D Coverage and Costs in 2019 .”. Aetna, Humana, and Blue Cross Blue Shield are some of the many insurance companies that offer Medicare Advantage plans with prescription drug coverage.

Who is eligible for Medicare Part D?

Those 65 or older who are entitled to or already enrolled in Medicare are eligible for Part D drug insurance. Also eligible are people who have received Social Security Disability Insurance (SSDI) benefits for more than 24 months and those who have been diagnosed with end-stage renal disease. 9. SilverScript.

What medications are covered by Medicare?

Policies vary by which medications they cover, and how much you must pay. But even the least expensive prescription drug plans must cover most of the generic and brand name drugs and the insulin preparations that are generally needed by people on Medicare. And, it must cover all or most of the drugs in the following categories: 1 Anticancer drugs (unless covered by Medicare Part B ), 2 Antidepressants, 3 Antipsychotic medications, 4 Anticonvulsive treatments for seizure disorders, 5 HIV/AIDS treatments, 6 Immunosuppressant medications, 5 and 7 Opium Treatment Programs (OTP) and at least one naloxone product for $0 copay or low-cost sharing. 6

When is Medicare open enrollment?

A separate election period, called the Medicare Advantage Open Enrollment Period, from January 1-March 31 allows you to change Medicare Advantage plans (with or without drug coverage) or switch to Original Medicare and join a Part D prescription drug plan.

What is coinsurance in Medicare?

Copayment/Coinsurance. A drug plan may have either copayments (a set amount you pay for medications in each tier) or coinsurance, a percentage that you pay for the price of the drug. 12. U.S. Government Website for Medicare. “ Copayment/coinsurance in drug plans .” medicare.gov (accessed April 2020).

Does Medicare cover insulin?

But even the least expensive prescription drug plans must cover most of the generic and brand name drugs and the insulin preparations that are generally needed by people on Medicare.

What is a special enrollment period for Medicare?

Certain life events — such as moving to a new address, moving in or out of an institution (such as a skilled nursing facility or prison), and other special situations — can provide a special enrollment period for making changes to Medicare Advantage and Medicare prescription drug coverage. 15

What is the difference between tetanus and diphtheria?

Diphtheria is a bacterial infection that can cause weakness, sore throat, fever, and swollen glands in the neck, according to the Centers for Disease Control and Prevention. It may also cause damage to the heart, kidneys, and nerves. Tetanus is also a bacterial infection that can cause lockjaw, muscle spasms, seizures, changes in blood pressure and a fast heart rate. Breathing difficulty caused by tetanus can lead to death, according to the CDC. The Tdap vaccine helps prevent diphtheria and tetanus, according to the CDC. Generally Medicare Prescription Drug Plans (Part D) cover all commercially-available shots needed to prevent illness, such as the Tdap. Contact your plan for more information about Medicare Part D vaccine coverage.

Why is it important to stay up to date on your shots?

While no one enjoys getting shots, staying up to date on your vaccines could have important health benefits; they could help you avoid disease, hospitalization, and even death. According to U.S. Department of Health & Human Services, a vaccine is a product that produces immunity from disease.

Is the flu contagious?

According to the Centers for Disease Control and Prevention (CDC), influenza (flu) is a contagious respiratory illness. Symptoms might include fever, body aches, cough, runny nose, and fatigue. Flu complications in adults age 65 or older could result in hospitalization or death.

Is hospice covered by Medicare?

A Medicare Advantage plan is another way to get you Part A and Part B benefits although you must continue to pay your Part B premium as well as any premium the plan may charge. Hospice benefits are still covered directly under Medicare Part A.

Does Medicare cover shingles?

Very rarely, shingles can lead to pneumonia, hearing problems, blindness, brain inflammation or death, according to the CDC. The shingles shot isn’t covered by Medicare Part A or Part B, but is generally covered by Medicare Prescription Drug Plans (Part D). Medicare Part D plans generally cover all commercially-available vaccines. You will have to contact your plan for specific information about coverage of a particular vaccine.

How to get Medicare Part D?

Either way you decide to get Medicare Part D coverage, there are a few things to keep in mind: 1 Not every plan will cover every prescription drug. If you’re on medications, you might want to make sure your Medicare prescription drug plan covers them. Each plan has its own formulary – that’s a list of prescription drugs the plan covers. 2 Even if you find a plan that covers your prescriptions, know that a plan may change its formulary anytime. Your plan will notify you when necessary. 3 Every fall, your plan will send you Annual Notice of Change and Evidence of Coverage documents. Check to see how your coverage may be changing next year, including if any of your medications will be dropped from the formulary, or if your costs are going up. 4 You don’t have to sign up for prescription drug coverage under Medicare Part D. But if you decide to sign up after your Medicare Initial Enrollment Period, you could face a Part D late enrollment penalty.

Does Medicare have a spending limit?

Medicare Advantage plans have annual maximum out-of-pocket spending limits. If you pay up to that limit within a calendar year, the plan generally pays for your covered medical expenses for the rest of that year. This spending limit may vary from plan to plan and from year to year.

Does Medicare cover all prescriptions?

Not every plan will cover every prescription drug. If you’re on medications, you might want to make sure your Medicare prescription drug plan covers them. Each plan has its own formulary – that’s a list of prescription drugs the plan covers. Even if you find a plan that covers your prescriptions, know that a plan may change its formulary anytime.

What is Part D premium?

Your Part D deductible is the amount that you must spend out of your own pocket for covered drugs in a calendar year before the plan kicks in and begins providing coverage.

How much is Medicare Part D 2021?

How much does Medicare Part D cost? As mentioned above, the average premium for Medicare Part D plans in 2021 is $41.64 per month. The table below shows the average premiums and deductibles for Medicare Part D plans in 2021 for each state. Learn more about Medicare Part D plans in your state.

What is the difference between generic and brand name drugs?

Generic drugs are typically on lower tiers and cost less, while brand name drugs and specialty drugs are typically on higher tiers and cost more. Medicare Part D plans are sold by private insurance companies. These insurance companies are generally free to set their own premiums for the plans they sell.

Does Medicare Part D have coinsurance?

Medicare Part D plan costs in any particular area may depend partly on the cost of other plans being sold in the same area by competing carriers. Cost-sharing. Some Medicare Part D plans have deductibles and copayments or coinsurance. The cost of your Part D premium may depend on the amounts of coinsurance or copayments you pay with your plan, ...

What is the Medicare donut hole?

After 2020, Medicare Part D plans have a shrunken coverage gap, or “donut hole,” which represents a temporary limit on what the plan will cover for prescription drugs. You enter the Part D donut hole once you and your plan have spent a combined $4,130 on covered drugs in 2021.

Does Medicare Advantage cover Part A?

Medicare Advantage plans (also called Medicare Part C) provide all of the same coverage as Medicare Part A and Part B, and many plans include some additional benefits that Original Medicare doesn’t cover. Read additional medicare costs guides to learn more about Medicare costs and how they will affect you.

What is coinsurance and copayment?

Copayments and coinsurance are the amounts that you must pay once your plan’s coverage does begin. A copayment is usually a fixed dollar amount (such as $5) while coinsurance is most often a percentage of the cost (such as 20 percent). Plans might have different copayment or coinsurance amounts for each tier of drugs.