What is the Medicare Part D deductible for Part D?

The insurance company can have a deductible less than the amount listed, but it cannot be more. Then in 2016, the Medicare Part D deductible increased $40 to $360. In 2017 there was another $40 jump to $400.

What is the Medicare Part a hospital deductible for 2018?

The Medicare Part A annual inpatient hospital deductible that beneficiaries pay when admitted to the hospital will be $1,340 per benefit period in 2018, an increase of $24 from $1,316 in 2017.

What does Medicare Part D cost in 2018?

In 2018, Part D costs include: If you have Medicare Part D, then you may face a situation known as the donut hole (or coverage gap). This happens when you hit your plan’s initial coverage limit ($3,750 in 2018) but still need to buy prescriptions.

What are the 2018 Medicare Part A and Part B premiums?

On November 17, 2017, the Centers for Medicare & Medicaid Services (CMS) released the 2018 premiums, deductibles, and coinsurance amounts for the Medicare Part A and Part B programs. Medicare Part B covers physician services, outpatient hospital services, certain home health services, durable medical equipment, and other items.

What is a yearly deductible on Part D Medicare?

Summary: The Medicare Part D deductible is the amount you pay for your prescription drugs before your plan begins to help. In 2021, the Medicare Part D deductible can't be greater than $445 a year. You probably know that being covered by insurance doesn't mean you can always get services and benefits for free.

What was Medicare deductible for 2018?

The Medicare Part B deductible, which covers physician and outpatient services, will remain at $183 for 2018.

Is there a deductible for Part D?

Summary: The Medicare Part D deductible is an amount you might have to pay each year before your Medicare Part D benefits kick in. The Medicare Part D deductible is determined by your plan but the maximum deductible allowed in 2022 is $480.

How does deductible work on Medicare Part D?

Deductible phase Most Medicare part D plans have a deductible, or a certain amount of money before the plan kicks in. So, that means you'll pay 100% of your prescription costs until you reach your deductible.

What was the Medicare deductible for 2019?

(Note: Most Medicare beneficiaries are exempt from paying the Medicare Part A premium since they or their spouse paid into Medicare while working.) The 2019 Part A deductible is $1,364 — $24 more than in 2018.

What was the Medicare deductible for 2017?

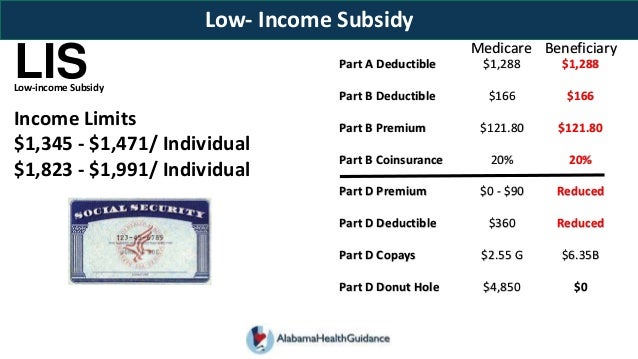

$183 inCMS also announced that the annual deductible for all Medicare Part B beneficiaries will be $183 in 2017 (compared to $166 in 2016). Premiums and deductibles for Medicare Advantage and prescription drug plans are already finalized and are unaffected by this announcement.

What is the max out-of-pocket for Medicare Part D?

The out-of-pocket spending threshold is increasing from $6,550 to $7,050 (equivalent to $10,690 in total drug spending in 2022, up from $10,048 in 2021).

What is the 2022 Part D deductible?

What is the Medicare Part D Deductible for 2022? The maximum deductible for Part D is $480 in 2022.

What is the Medicare Part D deductible for 2022?

$480The initial deductible will increase by $35 to $480 in 2022. After you meet the deductible, you pay 25% of covered costs up to the initial coverage limit. Some plans may offer a $0 deductible for lower cost (Tier 1 and Tier 2) drugs.

How do I find out my deductible?

“Your deductible is typically listed on your proof of insurance card or on the declarations page. If your card is missing or you'd rather look somewhere else, try checking your official policy documents. Deductibles are the amount of money that drivers agree to pay before insurance kicks in to cover costs.

Do all Medicare Part D plans have the same deductible?

This is the amount you must pay each year for your prescriptions before your Medicare drug plan pays its share. Deductibles vary between Medicare drug plans. No Medicare drug plan may have a deductible more than $480 in 2022.

How do I find out my Medicare deductible?

Deductibles for Original Medicare You can find out if you've met your Medicare Part A or Part B deductible for the year at MyMedicare.gov.

How Much Does Medicare Part D Cost?

Medicare participants typically have to pay several types of costs in order to be part of a Medicare Part D plan. However, the government agency th...

What Does Medicare Part D Cover?

The biggest challenge in selecting a Medicare Part D plan is that each one can have a different customized list of drugs that it covers. Often, you...

Don't Miss Out on The Prescription Drugs That You Need

Part D is the newest part of Medicare coverage, but it has quickly become an essential part of the program for seniors seeking to control their hea...

What is Medicare Part D?

Prescription drug coverage, or Medicare Part D, is a relatively new feature of Medicare, but millions of seniors take advantage of the program to help lower their prescription drug costs. Here’s what you need to know about Medicare Part D and the costs for 2018.

How long do you have to sign up for Part D?

If you want to enroll in Part D coverage, make sure you do it at the right time: the seven-month period around your 65 th birthday month, including the three months leading up to it. If not, you could be penalized for signing up 63 days or more after your Initial Enrollment Period is over. If you don’t sign up during your Initial Enrollment Period, you will have to wait for the Fall Open Enrollment Period, which is October 15 – December 7, and you could be penalized.

What is the coverage gap for prescription drugs?

Once your out-of-pocket drug costs have reached $3,750, you fall into the coverage gap, also known as the donut hole. This means your plan stops paying for your prescription drugs until you reach catastrophic coverage. For 2018, catastrophic coverage begins once your out-of-pocket expenses have reached $5,000. Until you reach that, there are coverage gap discounts available to you: in 2018, name brand drugs will be discounted 65% and generic drugs will be discounted 56%. All payments (including discounts) will count toward your out-of-pocket costs and help you reach catastrophic coverage.

Do Part D plans require copays?

Copays and coinsurance are also typical under Part D plans. Some plans require you to pay a certain percentage of prescription drug costs (coinsurance), while others charge a fixed dollar amount (copayment). Prescription drug costs also depend on whether the drug is name brand or generic.

2018 Medicare Advantage Premium & Deductible Averages By State

Florida was the low-cost leader when comparing average Medicare Advantage premiums among the states. Florida’s 2018 Medicare Advantage plans have an average monthly premium of $17.06. North Dakota, in contrast, is over six times that amount with an average premium of $116.25 for its Medicare Advantage plans.

2018 Medicare Part D Plans By State

When comparing state averages for monthly premiums among stand-alone Medicare Part D drug plans, Delaware, Maryland, and the Washington D.C. region tied for the lowest in 2018. The average Medicare Part D premium in these three regions was $40.98. This average was 22 percent lower than the national average of $52.36.

Conclusion

As Medicare beneficiaries prepare to shop this Open Enrollment Period for new insurance plans, they should remember that other plan attributes can be just as important as premiums and deductibles. For example, healthcare provider networks and caps on annual out-of-pocket costs are especially important to examine among Medicare Advantage plans.

Methodology

Premiums and deductibles for Medicare health and drug plans were obtained from the 2018 MA Landscape Source Files and 2018 PDP Landscape Source Files published by cms.gov on September 29, 2017 ( https://www.cms.gov/Medicare/Prescription-Drug-Coverage/PrescriptionDrugCovGenIn/index.html?redirect=/PrescriptionDrugCovGenIn/02_EnrollmentData.asp last accessed on October 2, 2017).

Author

This analysis was written by Kev Coleman, Head of Research & Data at HealthPocket with data collection performed by Michael Bass. Correspondence regarding this study can be directed to Mr. Coleman at [email protected].

How many Medicare beneficiaries are in Part D?

Enrollment. More than 43 million Medicare beneficiaries, or 72 percent of all Medicare beneficiaries nationwide, are enrolled in Part D plans. This total includes plans open to everyone and employer-only group plans for retirees of a former employer or union (Figure 2). Most Part D enrollees (58 percent) are in stand-alone prescription drug plans ...

What percentage of Medicare Part D enrollees are in stand alone plans?

Most Part D enrollees (58 percent) are in stand-alone prescription drug plans (PDPs), but a rising share (42 percent in 2018, up from 28 percent in 2006) are in Medicare Advantage prescription drug plans (MA-PDs), reflecting overall enrollment growth in Medicare Advantage.

How much is the PDP premium in 2018?

Deductibles: More than 4 in 10 PDP and MA-PD enrollees are in plans that charge no Part D deductible, but a larger share of PDP enrollees than MA-PD enrollees are in plans that charge the standard deductible amount of $405 in 2018.

How much is Part D PDP?

Premiums: Monthly Part D PDP premiums average $41 in 2018, but premiums vary widely among the most popular PDPs, ranging from $20 per month for Humana Walmart Rx to $84 per month for AARP Medicare Rx Preferred. Overall, average monthly PDP premiums increased by a modest 2 percent in 2018.

How much does a LIS beneficiary pay in 2018?

On average, the 1.2 million LIS beneficiaries paying Part D premiums in 2018 pay $26 per month, or more than $300 per year (Figure 12). This amount is up 13 percent from 2017 and is nearly three times the amount in 2006.

How much is MA PD premium?

The average MA-PD premium is $34 in 2018, which includes Part D and other benefits.

Do Part D plans charge coinsurance?

The vast majority of Part D plans (both PDPs and MA-PDs) charge copayments for preferred brand-name drugs rather than coinsurance. Among Part D enrollees in plans that use copayments for preferred brands, enrollees typically face lower copayments in PDPs than MA-PDs (Figure 9).

Find out more about your Medicare prescription drug benefits

Dan Caplinger has been a contract writer for the Motley Fool since 2006. As the Fool's Director of Investment Planning, Dan oversees much of the personal-finance and investment-planning content published daily on Fool.com.

How much does Medicare Part D cost?

Medicare participants typically have to pay several types of costs in order to be part of a Medicare Part D plan. However, the government agency that oversees Medicare doesn't set fixed amounts for most of those costs.

What does Medicare Part D cover?

The biggest challenge in selecting a Medicare Part D plan is that each one can have a different customized list of drugs that it covers.

Don't miss out on the prescription drugs that you need

Part D is the newest part of Medicare coverage, but it has quickly become an essential part of the program for seniors seeking to control their healthcare expenses. By finding out what a Part D plan will cover and how much it will cost, you'll be in a better position to choose the right plan to meet your specific medical needs.

How much Medicare Part D coverage is there in 2018?

will increase from $4,950 in 2017 to $5,000 in 2018. begins once you reach your Medicare Part D plan’s initial coverage limit ($3,750 in 2018) and ends when you spend a total of $5,000 out of pocket in 2018.

When will Medicare Part D enrollment start in 2022?

If you would like for us to send you an email as additional 2022 Medicare Part D plan information comes online and when enrollment begins (October 15th), please complete the form below. We will NOT share your information with any third-parties.

How much does Medicare pay for a donut hole?

Medicare Part D beneficiaries who reach the Donut Hole will also pay a maximum of 44% co-pay on generic drugs purchased while in the coverage gap (a 56% discount). For example: If you reach the 2018 Donut Hole, and your generic medication has a retail cost of $100, you will pay $44.

Does Medicare Part D have a variation?

However, CMS does allow Medicare Part D plans to offer a variation on the defined standard benefits (for example, a Medicare Part D plan can offer a $0 Initial Deductible). will be increased by $5 to $405 in 2018. will increase from $3,700 in 2017 to $3,750 in 2018. will increase from $4,950 in 2017 to $5,000 in 2018.

How much is Medicare Part A deductible?

The Medicare Part A annual inpatient hospital deductible that beneficiaries pay when admitted to the hospital will be $1,340 per benefit period in 2018, an increase of $24 from $1,316 in 2017. The Part A deductible covers beneficiaries’ share of costs for the first 60 days of Medicare-covered inpatient hospital care in a benefit period.

What is the deductible for Medicare Part B?

The annual deductible for all Medicare Part B beneficiaries will be $183 in 2018, the same annual deductible in 2017. Premiums and deductibles for Medicare Advantage and Medicare Prescription Drug plans are already finalized and are unaffected by this announcement. Since 2007, beneficiaries with higher incomes have paid higher Medicare Part B ...

What is Medicare Part A?

Medicare Part A Premiums/Deductibles. Medicare Part A covers inpatient hospital, skilled nursing facility, and some home health care services. About 99 percent of Medicare beneficiaries do not have a Part A premium since they have at least 40 quarters of Medicare-covered employment. The Medicare Part A annual inpatient hospital deductible ...

What is the Medicare Part B premium?

Medicare Part B Premiums/Deductibles. Medicare Part B covers physician services, outpatient hospital services, certain home health services, durable medical equipment, and other items. The standard monthly premium for Medicare Part B enrollees will be $134 for 2018, the same amount as in 2017.

How much is the Part B premium in 2018?

The 30 percent of all Part B enrollees who are not subject to the “hold harmless” provision will pay the full premium of $134 per month in 2018. Part B enrollees who were held harmless in 2016 ...

When did Medicare Part A and B premiums come out?

2018 Medicare Parts A & B Premiums and Deductibles. On November 17, 2017 , the Centers for Medicare & Medicaid Services (CMS) released the 2018 premiums, deductibles, and coinsurance amounts for the Medicare Part A and Part B programs.

How much will Social Security increase in 2018?

After several years of no or very small increases, Social Security benefits will increase by 2.0 percent in 2018 due to the Cost of Living adjustment.

How to get prescription drug coverage

Find out how to get Medicare drug coverage. Learn about Medicare drug plans (Part D), Medicare Advantage Plans, more. Get the right Medicare drug plan for you.

What Medicare Part D drug plans cover

Overview of what Medicare drug plans cover. Learn about formularies, tiers of coverage, name brand and generic drug coverage. Official Medicare site.

How Part D works with other insurance

Learn about how Medicare Part D (drug coverage) works with other coverage, like employer or union health coverage.

What is Medicare Part D?

1 The law created what we now know of as Medicare Part D, an optional part of Medicare that provides prescription drug coverage. Part D plans are run by private insurance companies, not the government.

What is a Part D premium?

Part D Premiums. A premium is the amount of money you spend every month to have access to a health plan. The government sets no formal restrictions on premium rates and prices may change every year. 3 Plans with extended coverage will cost more than basic-coverage plans.

What is the donut hole in Medicare?

In fact, it has a big hole in it. The so-called donut hole is a coverage gap that occurs after you and Medicare have spent a certain amount of money on your prescription medications.

What is the maximum deductible for 2021?

A deductible is the amount of money you spend out-of-pocket before your prescription drug benefits begin. Your plan may or may not have a deductible. The maximum deductible a plan can charge for 2021 is set at $445, 2 an increase of $10 from 2020.

How much does a generic cost for Part D?

For a generic drug, you will pay $25 and your Part D plan will pay $75. In all Part D plans in 2020, after you've paid $6,550 in out-of-pocket costs for covered medications, you leave the donut hole and reach catastrophic coverage, where you will pay only $3.70 for generic drugs and $9.20 for brand-name medications each month or 5% the cost ...

What is NBBP in Medicare?

The NBBP is a value used to calculate how much you owe in Part D penalties if you sign up late for benefits. Your best bet is to avoid Part D penalties altogether, so be sure to use this handy Medicare calendar to enroll on time.

Can Medicare Part D be expensive?

A Word From Verywell. Prescription medications can be costly, but don't let that intimidate you. Know what your Medicare Part D plan covers and how much you can expect to pay. With this information in hand, you can budget for the year ahead and keep any surprises at bay.

2018 Medicare Advantage Premium & Deductible Averages by State

2018 Medicare Part D Plans by State

- When comparing state averages for monthly premiums among stand-alone Medicare Part D drug plans, Delaware, Maryland, and the Washington D.C. region tied for the lowest in 2018. The average Medicare Part D premium in these three regions was $40.98. This average was 22 percent lower than the national average of $52.36. In 2016, the state of Hawaii had been the stat…

Conclusion

- As Medicare beneficiaries prepare to shop this Open Enrollment Period for new insurance plans, they should remember that other plan attributes can be just as important as premiums and deductibles. For example, healthcare provider networks and caps on annual out-of-pocket costs are especially important to examine among Medicare Advantage plans. Likewise, covered drugs…

Methodology

- Premiums and deductibles for Medicare health and drug plans were obtained from the 2018 MA Landscape Source Files and 2018 PDP Landscape Source Files published by cms.gov on September 29, 2017 (https://www.cms.gov/Medicare/Prescription-Drug-Coverage/PrescriptionDrugCovGenIn/index.html?redirect=/PrescriptionDrugCovGenIn/02_Enroll…

Author

- This analysis was written by Kev Coleman, Head of Research & Data at HealthPocket with data collection performed by Michael Bass. Correspondence regarding this study can be directed to Mr. Coleman at [email protected].