What is covered by Medicare Part D?

Apr 16, 2020 · Summary: The Centers for Medicare and Medicaid Services (CMS) sets the maximum Medicare Part D deductible each year. In 2020, the maximum Part D deductible is $435, but depending on where you live, you may find a plan with a lower deductible or even no deductible at all. Find affordable Medicare plans in your area.

Who is eligible for Medicare Part D?

Jan 24, 2020 · Changes to the Part D Annual Deductible in 2020. The annual deductible is the amount you must pay before your insurer begins to cover the costs of your prescriptions. While individual plans can set different deductible amounts, Medicare imposes a maximum limit. In 2020, plans cannot set their deductible higher than $435.

Can Medicare Part D be deducted from Social Security?

Dec 30, 2021 · The average annual deductible for a stand-alone Medicare Part D prescription drug plan in 2020 was $405.

What is Medicare Plan D deductible?

Dec 12, 2019 · Deductibles vary between plans, but CMS sets a maximum deductible each year ($435 in 2020). 7 That means you might have a lower deductible or even no deductible, but you won’t have one higher than the maximum CMS sets.

What is the 2020 Medicare Part D deductible?

Month you reach your $445 deductible Once you meet your deductible, you may not be covered 100%. You may still be responsible for copayments and coinsurance every time you fill a prescription. Do you have any questions about your Medicare Part D deductibles?

What is the Medicare Part D deductible for 2021?

$445Medicare Part D, also known as prescription drug coverage, is the part of Medicare that helps you pay for prescription drugs. When you enroll in a Part D plan, you are responsible for paying your deductible, premium, copayment, and coinsurance amounts. The maximum Medicare Part D deductible for 2021 is $445.

Does Medicare D have a deductible?

This is the amount you must pay each year for your prescriptions before your Medicare drug plan pays its share. Deductibles vary between Medicare drug plans. No Medicare drug plan may have a deductible more than $480 in 2022. Some Medicare drug plans don't have a deductible.

Do all Part D drug plans have a deductible?

Plans can have no deductible or any amount up to the standard amount. A plan determines which medications are subject to its deductible. In many plans, that's Tiers 3, 4 and 5 drugs.Mar 9, 2021

What is the max out-of-pocket for Medicare Part D?

3, out-of-pocket drug spending under Part D would be capped at $2,000, while under H.R. 19 and the Senate Finance bill, the cap would be set at $3,100 (both amounts exclude the value of the manufacturer price discount).Jul 23, 2021

What is the best Medicare Part D plan?

Best-rated Medicare Part D providersRankMedicare Part D providerMedicare star rating for Part D plans1Kaiser Permanente4.92UnitedHealthcare (AARP)3.93BlueCross BlueShield (Anthem)3.94Humana3.83 more rows•Mar 16, 2022

What is yearly deductible for Medicare?

The Medicare Part B deductible is $233. Once met, you pay 20 percent of the Medicare-approved amount for most doctor services, outpatient therapy and durable medical equipment.

Does Medicare Part D have copays?

No type of Medicare drug coverage may have a deductible more than $445 in 2021. Some plans don't charge a deductible. You pay copayments or coinsurance for your prescription drugs after you pay the deductible. You pay your share, and your plan pays its share for covered drugs.

Do I need Medicare Part D if I don't take any drugs?

Even if you don't take drugs now, you should consider joining a Medicare drug plan or a Medicare Advantage Plan with drug coverage to avoid a penalty. You may be able to find a plan that meets your needs with little to no monthly premiums. 2. Enroll in Medicare drug coverage if you lose other creditable coverage.

What is the most a Part D sponsor can set for a drug deductible?

[80] This is called the Deductible Phase, or Stage 1. After meeting the deductible, the beneficiary pays 25% of the cost of a covered Part D prescription drug up to the initial coverage limit of $4,130 ($1,032.50).

How Does Medicare Plan D work?

It is an optional prescription drug program for people on Medicare. Medicare Part D is simply insurance for your medication needs. You pay a monthly premium to an insurance carrier for your Part D plan. In return, you use the insurance carrier's network of pharmacies to purchase your prescription medications.

Do I Need A Medicare Part D Plan?

If you have Original Medicare (Part A and Part B) and want prescription drug coverage for prescription drugs you take at home, you will likely have...

What Is The Medicare Deductible For A Medicare Part D Plan?

A Medicare deductible is the amount you must pay each year for your prescription drugs before your Medicare Part D Prescription Drug Plan begins to...

How Else Do Stand-Alone Medicare Part D Plans differ?

Unlike Medicare Part D deductibles, Medicare doesn’t set a dollar limit for Medicare Part D premiums. Your plan sets the amount for your monthly pr...

What is the deductible for Part D?

Changes to the Part D Annual Deductible in 2020. The annual deductible is the amount you must pay before your insurer begins to cover the costs of your prescriptions. While individual plans can set different deductible amounts, Medicare imposes a maximum limit.

What is a Part D plan?

Part D plans are offered by private insurers as stand-alone plans or as part of a Medicare Advantage plan. These carriers determine the monthly premium recipients pay and carriers may offer a selection of plans at different monthly price points. Factors that determine how much the monthly premium will be include the copay ...

How much is Part D deductible for 2021?

If your plan’s Part D deductible is the maximum amount of $445 in 2021, it might take you longer to pay that amount than if your plan has a lower deductible, like $200. Once you meet your deductible, you may still have some costs for your medications. Some plans require you to pay a copayment or coinsurance every time you pick up a prescription.

What is Medicare Part D?

Medicare Part D is prescription drug coverage. You don’t get it automatically when you sign up for a Medicare prescription drug plan. Medicare prescription drug plans are offered by private, Medicare-approved insurance companies that may charge premiums and deductibles for your coverage. Plans usually also charge coinsurance or copayment amounts ...

What is a tier in Medicare?

Tiers are price categories of medications in the formulary. Typically, the lowest-priced tier includes generic drugs, while higher tiers include brand-name drugs. Higher tiers could also be set for specialty medications that might cost more than most brand name drugs. The tiers can affect your Medicare Part D deductible.

Do you have to pay coinsurance for Medicare?

Some plans require you to pay a copayment or coinsurance every time you pick up a prescription. This also varies from plan to plan. Make sure you understand the additional expenses like copayments when you are comparing Medicare Part D plans. You may want to compare deductibles and other plan costs when shopping for a Medicare prescription drug ...

Does Medicare Advantage have coinsurance?

Plans usually also charge coinsurance or copayment amounts for each covered medication. There are two types of Medicare prescription drug plans. Each type might have a deductible. Medicare Advantage prescription drug plans include your Medicare Part A, Part B, and Part D coverage in a single plan. Not every Medicare Advantage plan includes ...

How much is Part D insurance in 2020?

Nationwide, the average monthly Part D premium in 2020 is $30. 1 If you find a plan that’s cheaper, it might be tempting to snag it and call it a day. Unfortunately, premiums aren’t the only cost Part D beneficiaries encounter. You may also come up against deductibles, copayments or coinsurance, and other out-of-pocket costs.

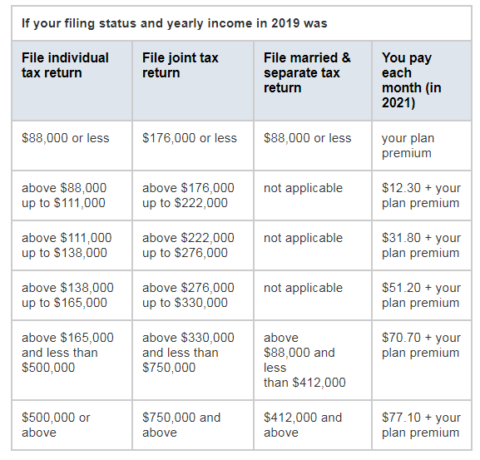

What is Medicare premium based on?

The Medicare portion based on your income. The insurer’s portion, which varies from plan to plan. The Medicare portion of your premium depends on your Modified Adjusted Gross Income (MAGI) from your most recent tax return.

Who is Kathryn from Baby Boomers?

Kathryn is a Medicare and geriatric specialist who has appeared on Baby Boomers, OppLoans, and Best Company. Her readers don’t need a degree in government-speak to get the right coverage because Kathryn sifts through Medicare’s parts, plans, and premiums to distill only the most useful information. Her favorite place in the world is a hammock that swings peacefully between two crabapple trees somewhere in New Mexico’s Gila National Forest.

What is the difference between copayment and coinsurance?

Copayment: a set dollar amount—such as $10—that you pay for covered prescription drugs. Coinsurance: a percentage of the cost—like 20%—that you pay for prescription drugs. Generally, your copayment or coinsurance will change depending on what drugs you take.

Is eligibility.com a Medicare provider?

Eligibility.com is a DBA of Clear Link Technologies, LLC and is not affiliated with any Medicare System Providers.

How much is Medicare Part D 2020?

According to 2020 eHealth research, the average deductibles for stand-alone Medicare Part D plans in the study increased from $335 in 2019 to $405 in 2020.*. Some Medicare Part D plans have $0 deductibles, which means you are only responsible for a set copayment or coinsurance amount when you pick up your prescription drugs.

What are the tiers of Medicare Part D?

Medicare Part D plan prescription drug tiers are usually set such that the lower the tier number , the less expensive the drug, as in the following example:: Tier 1: preferred generic, generally the lowest cost tier. Tier 2: generic, generally cost more than tier 1. Tier 3: preferred brand, generally cost more than tier 2.

What is deductible in Medicare?

You may have various out of pocket costs with Medicare insurance, including copayments, coinsurance, and deductibles. “Deductible” is a common term in insurance. Generally the lower the deductible, the less you are responsible for paying out-of-pocket before your insurance coverage kicks in.

What is tier 5?

Tier 5: specialty tier, generally cost more than tier 4. Tier 6: select care drugs. If you only take generic prescription drugs, for example, you may not be subjected to the deductible in certain plans.

What is the maximum deductible for Medicare Part D 2021?

When you enroll in a Part D plan, you are responsible for paying your deductible, premium, copayment, and coinsurance amounts. The maximum Medicare Part D deductible for 2021 is $445.

What is Medicare Part D copayment?

The Medicare Part D copayment and coinsurance amounts are the costs you pay after your Part D deductible has been met. Depending on the plan you choose, you will either owe copayments or coinsurance fees.

What is a donut hole in Medicare?

Most Medicare Part D plans have a coverage gap , also called a “ donut hole .”. This coverage gap happens when you’ve reached the limit of what your Part D plan will pay for your prescription drugs. This limit is lower than your catastrophic coverage amount, however, which means that you will have a gap in your coverage.

How much do you owe for generic drugs?

Once you hit the coverage gap, you will owe 25 percent of the cost of the generic drugs covered by your plan. You pay 25 percent and your plan pays the remaining 75 percent.

What is a prescription drug plan?

Prescription drug plan formularies cover both brand-name and generic drugs from the commonly prescribed drug categories. Before you enroll in a Part D plan, check that your medications are covered under the plan’s formulary. When you enroll in Part D, there are plan fees in addition to your original Medicare costs.

How long can you go without prescription drug coverage?

If you go without prescription drug coverage for a period of 63 consecutive days or more after you initially enroll in Medicare, you will be charged a permanent Medicare Part D late enrollment penalty. This penalty fee is added to your prescription drug plan premium each month you are not enrolled.

Is Medicare Part D mandatory?

Medicare Part D coverage is mandatory as a Medicare beneficiary, so it is important to choose a plan that works for you. When shopping around for prescription drug coverage, consider which of your medications are covered and how much they will cost.

What is the maximum deductible for Medicare Part D 2021?

In 2021, the maximum deductible for Medicare Plan D is $445. Medicare Part D helps pay for brand name and generic drugs that have been prescribed by a doctor. A person must have original Medicare, parts A and B, to be eligible for a PDP. Private insurance companies approved by Medicare administer Part D plans, and they must provide ...

What will Medicare cover in 2021?

According to the Kaiser Family Foundation (KFF), in 2021, around 89% of Medicare Advantage plans will include cover for prescription drugs. An individual can compare plans using the Medicare Advantage plan finder.

What is the best Medicare plan?

We may use a few terms in this piece that can be helpful to understand when selecting the best insurance plan: 1 Deductible: This is an annual amount that a person must spend out of pocket within a certain time period before an insurer starts to fund their treatments. 2 Coinsurance: This is a percentage of a treatment cost that a person will need to self-fund. For Medicare Part B, this comes to 20%. 3 Copayment: This is a fixed dollar amount that an insured person pays when receiving certain treatments. For Medicare, this usually applies to prescription drugs.

Does Medicare Part D cover private insurance?

Private insurance companies approved by Medicare administer Part D plans, and they must provide a standard level of coverage . The companies must also offer different coverage and cost-sharing options, which may mean a person pays a different amount for prescription drugs based on the plan purchased.

What is a Medicare deductible?

What is a deductible? A deductible is the amount of money a person pays for their healthcare before their insurer starts to cover costs. Medicare Part D charges a deductible that usually changes each year. As a general rule, the higher the deductible, the lower the monthly premium.

What is monthly premium?

monthly premiums: the amount the insurance company charges every month for the policy. copayments and coinsurance: the fixed price (copayment) or percentage amount (coinsurance) applied after meeting the deductible. late enrollment penalty: the amount added to the monthly premium when a person delays enrolling in Medicare Part D, ...

What is the late enrollment penalty?

late enrollment penalty: the amount added to the monthly premium when a person delays enrolling in Medicare Part D, payable for the entire time the policy is active. coverage gap: a temporary limit on drug coverage (also called the donut hole) that starts after a specific amount has been paid to cover drugs.

What is the Medicare premium for 2020?

The standard monthly premium for Medicare Part B enrollees will be $144.60 for 2020, an increase of $9.10 from $135.50 in 2019. The annual deductible for all Medicare Part B beneficiaries is $198 in 2020, an increase of $13 from the annual deductible of $185 in 2019. The increase in the Part B premiums and deductible is largely due ...

How much will Medicare premiums decline in 2020?

As previously announced, as a result of CMS actions to drive competition, on average for 2020, Medicare Advantage premiums are expected to decline by 23 percent from 2018, and will be the lowest in the last thirteen years while plan choices, benefits and enrollment continue to increase. Premiums and deductibles for Medicare Advantage ...

What percentage of Medicare Part B premiums are based on income?

Since 2007, a beneficiary’s Part B monthly premium is based on his or her income. These income-related monthly adjustment amounts (IRMAA) affect roughly 7 percent of people with Medicare Part B. The 2020 Part B total premiums for high income beneficiaries are shown in the following table: Beneficiaries who file.

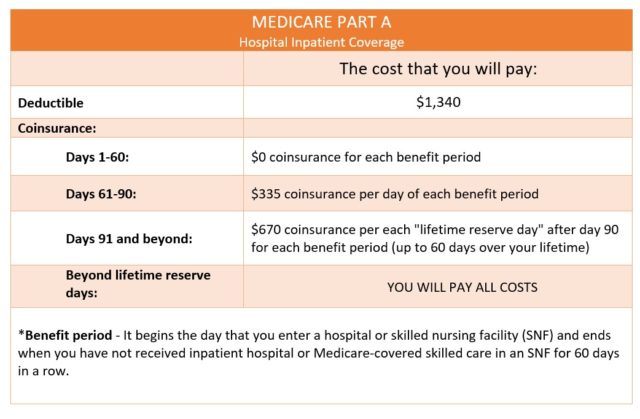

What is Medicare Part A?

Medicare Part A Premiums/Deductibles. Medicare Part A covers inpatient hospital, skilled nursing facility, and some home health care services. About 99 percent of Medicare beneficiaries do not have a Part A premium since they have at least 40 quarters of Medicare-covered employment. The Medicare Part A inpatient hospital deductible ...

How much is coinsurance for 2020?

In 2020, beneficiaries must pay a coinsurance amount of $352 per day for the 61st through 90th day of a hospitalization ($341 in 2019) in a benefit period and $704 per day for lifetime reserve days ($682 in 2019). For beneficiaries in skilled nursing facilities, the daily coinsurance for days 21 through 100 of extended care services in ...

Is Medicare Part B deductible higher in 2020?

Each year the Medicare premiums, deductibles, and copayment rates are adjusted according to the Social Security Act. For 2020, the Medicare Part B monthly premiums and the annual deductible are higher than the 2019 amounts.

What is the Medicare Part D deductible for 2021?

If you are on Medicare, you probably familiar with the Medicare Prescription Drug plan.

This plan has a Medicare Part D Deductible

It changes every year. Also, if you don't sign up for this “optional” plan, you could wind up with significant penalties later on.