Full Answer

What is Medicare Part F and how does it work?

What Is Medicare Part F? Medicare Part F actually doesn’t exist. When people begin talking about “Part F” or “Part G,” they have likely confused Medigap Plans with the parts of the Medicare program itself. This is simply due to similar wording, with Medicare supplement insurance (Medigap) policies offering Plan A, B, C, D, F, G, K, L, M and N.

What is Medicare Part G and how does it work?

For starters, you need to be enrolled in Original Medicare, or Medicare Parts A and B. Then you can buy Medicare Part G from a private insurance company that serves your ZIP code. Once that’s out of the way, here's how Medicare Part G works: You pay your monthly Medicare Part B premium.

What does Medicare supplement plans F and G cover?

What does Medicare Supplement Plans F and G cover? Medicare Supplement Plans F and G are the only Medigap insurance plans that cover 100% of Medicare Part B “excess charges,” which are the costs a doctor can charge for a service or procedure, if they don’t accept assignment.

What is Medicare Part D and how does it work?

The newest addition to the Medicare alphabet, Part D, helps you pay for prescription drugs. Part D is optional and available to people who are enrolled in Original Medicare (Parts A and B) and most Medicare Advantage plans. Part D plans are offered by private insurance companies that are approved by Medicare.

What is Part E of Medicare?

Medigap Plan E, also known as Medicare Supplement Plan E, is an original Medicare add-on that helps cover your Medicare costs. Medicare Plan E was no longer offered to new Medicare beneficiaries as of 2010, but those who were previously enrolled are still able to keep their plan.

What is Medicare Plan G?

Plan G is a supplemental Medigap health insurance plan that is available to individuals who are disabled or over the age of 65 and currently enrolled in both Part A and Part B of Medicare. Plan G is one of the most comprehensive Medicare supplement plans that are available to purchase.

What are the 4 types of Medicare?

There are four parts of Medicare: Part A, Part B, Part C, and Part D.Part A provides inpatient/hospital coverage.Part B provides outpatient/medical coverage.Part C offers an alternate way to receive your Medicare benefits (see below for more information).Part D provides prescription drug coverage.

What is Part D Medicare used for?

The Medicare Part D program provides an outpatient prescription drug benefit to older adults and people with long-term disabilities in Medicare who enroll in private plans, including stand-alone prescription drug plans (PDPs) to supplement traditional Medicare and Medicare Advantage prescription drug plans (MA-PDs) ...

Is plan F better than plan G?

Although the plans have several similarities, there is one key difference between Plan F and Plan G: With Medicare Plan F, you're getting the plan with the most coverage available. In addition to the above coverage, Plan F also covers Medicare Part B deductible payments. Plan G does not.

What is Medicare Plan F?

Medigap Plan F is a Medicare Supplement Insurance plan that's offered by private companies. It covers "gaps" in Original Medicare coverage, such as copayments, coinsurance and deductibles. Plan F offers the most coverage of any Medigap plan, but unless you were eligible for Medicare by Dec.

Why do I need Medicare Part C?

Medicare Part C provides more coverage for everyday healthcare including prescription drug coverage with some plans when combined with Part D. A Medicare Advantage prescription drug (MAPD) plan is when a Part C and Part D plan are combined. Medicare Part D only covers prescription drugs.

What is covered by Medicare Part C?

Medicare Part C outpatient coveragedoctor's appointments, including specialists.emergency ambulance transportation.durable medical equipment like wheelchairs and home oxygen equipment.emergency room care.laboratory testing, such as blood tests and urinalysis.occupational, physical, and speech therapy.More items...

What are the top 3 Medicare Advantage plans?

The Best Medicare Advantage Provider by State Local plans can be high-quality and reasonably priced. Blue Cross Blue Shield, Humana and United Healthcare earn the highest rankings among the national carriers in many states.

Is it worth getting Medicare Part D?

Most people will need Medicare Part D prescription drug coverage. Even if you're fortunate enough to be in good health now, you may need significant prescription drugs in the future. A relatively small Part D payment entitles you to outsized benefits once you need them, just like with a car or home insurance.

Is it mandatory to have Part D Medicare?

Is Medicare Part D Mandatory? It is not mandatory to enroll into a Medicare Part D Prescription Drug Plan.

What is the most popular Medicare Part D plan?

Best-rated Medicare Part D providersRankMedicare Part D providerMedicare star rating for Part D plans1Kaiser Permanente4.92UnitedHealthcare (AARP)3.93BlueCross BlueShield (Anthem)3.94Humana3.83 more rows•Mar 16, 2022

How much is Medicare deductible for 2021?

Medicare charges a hefty deductible each time you are admitted to the hospital. It changes every year, but for 2021 the deductible is $1,484. You can buy a supplemental or Medigap policy to cover that deductible and some out-of-pocket costs for the other parts of Medicare.

What is Medicare Advantage?

Medicare Advantage is the private health insurance alternative to the federally run original Medicare. Think of Advantage as a kind of one-stop shopping choice that combines various parts of Medicare into one plan.

How much is Part B insurance for 2021?

The federal government sets the Part B monthly premium, which is $148.50 for 2021. It may be higher if your income is more than $88,000. You’ll also be subject to an annual deductible, set at $203 for 2021. And you’ll have to pay 20 percent of the bills for doctor visits and other outpatient services.

When is open enrollment for Medicare 2021?

The next open enrollment will be from Oct. 15 to Dec. 7 , 2021, and any changes you make will take effect in January 2022. Editor’s note: This article has been updated with new information for 2021.

Does Medicare Advantage cover prescription drugs?

Most Medicare Advantage plans also fold in prescription drug coverage. Not all of these plans cover the same extra benefits, so make sure to read the plan descriptions carefully. Medicare Advantage plans generally are either health maintenance organizations (HMOs) or preferred provider organizations (PPOs).

Does Medicare cover wheelchair ramps?

In addition, in recent years the Centers for Medicare and Medicaid Services, which sets the rules for Medicare, has allowed Medicare Advantage plans to cover such extras as wheelchair ramps and shower grips for your home, meal delivery and transportation to and from doctors’ offices.

Does Medicare cover telehealth?

In response to the coronavirus outbreak, Medicare has temporarily expanded coverage of telehealth services . Beneficiaries can use a variety of devices — from phones to tablets to computers — to communicate with their providers.

How many Medicare Supplement Plans are there?

There are 12 standardized Medicare Supplement plans “A” through “L”. The benefits of each plan are different, with the exception that all plans are required to cover the “Basic Benefits” which are identified below.

Is Medicare Supplement the same as Medigap?

The words "Medicare supplement" and MediGap plans are interchangeable and mean exactly the same thing . The descriptions of benefits of each of these plans are in the table below. How to read the chart: If a check mark appears in the column, this means that the MediGap policy covers that benefit up to 100% of the Medicare-approved amount.

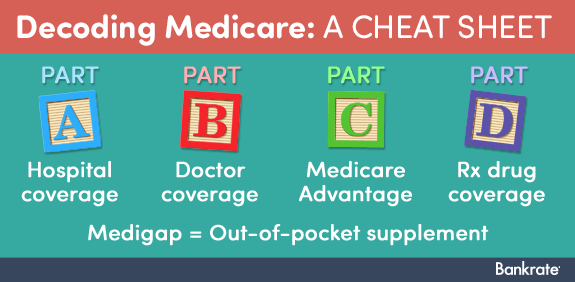

What are the different parts of Medicare?

This is true for other parts and plans as well. In all, there are four parts that make up Medicare coverage: Part A, Part B , Part C and Part D.

What is Medicare Part B?

Medicare Part B helps to pay for outpatient services, like primary care. This includes your doctor office visits, lab tests, preventative care, dialogistic imaging and so on. As you can see, many of these things may take place during a hospital stay, which is why both Part A and Part B are always recommended.

How much does Medicare pay for Part B?

It’s important to note that you pay a premium each month for Part B. Also, after your deductible is met, you typically pay 20% of the Medicare-approved amount for Part B services.

Does Medicare Part F exist?

Medicare Part F actually doesn’t exist. When people begin talking about “Part F” or “Part G,” they have likely confused Medigap Plans with the parts of the Medicare program itself. This is simply due to similar wording, with Medicare supplement insurance (Medigap) policies offering Plan A, B, C, D, F, G, K, L, M and N.

Do you have to enroll in Medicare Advantage before signing up?

So, before signing up, be sure that you compare a Medicare supplement insurance policy to a Medicare Advantage plan. Also, keep in mind that you don’t have to enroll in either.

Does Medicare Part A cover hospital services?

Of course, while Medicare Part A is responsible for hospital related coverage, it won’t necessarily cover all of the services that you may receive while in the hospital. For that reason, it’s still suggested that you sign up for both Part A and Part B coverage to stay protected.

Is Part D required for a prescription?

Part D is not required, although many people opt for it because the relatively low monthly premium typically covers a lot of out-of-pocket prescription drug costs. Keep in mind that there are rules regarding when you can enroll or remove yourself from a Part D plan.

What are the parts of Medicare?

There are four parts of Medicare. Each one helps pay for different health care costs. Part A helps pay for hospital and facility costs . This includes things like a shared hospital room, meals and nurse care. It can also help cover the cost of hospice, home health care and skilled nursing facilities. Part B helps pay for medical costs.

What does Part B cover?

It can also help cover the cost of hospice, home health care and skilled nursing facilities. Part B helps pay for medical costs. This is care that happens outside of a hospital. It includes things like doctor visits and outpatient procedures. It also covers some preventive care, like flu shots.

Does Medicare cover dental?

Some of these plans cover preventive dental, vision and hearing costs. Original Medicare doesn’t. You can see a list of the Medicare Advantage plans we offer and what they cover. Part D helps pay for prescription drugs. Part D plans are only available through private health insurance companies. They’re called prescription drug plans.

Does Medicare Advantage cover generic drugs?

You can read about our prescription drug plans and what they cover. Many Medicare Advantage plans include Part D prescription drug plans built right into them.

How much is a high deductible plan G?

A High Deductible Plan G requires you to pay $2,370 in 2021 before the plan begins to pay. Once you reach the deductible, you will receive the coverage of a regular Plan G. Monthly premiums tend to be lower than regular Plan G because of the high deductible.

How much do you have to pay for Medicare in 2020?

You must pay $2,370 in shared costs before the plan begins to pay. * As of January 1, 2020, new Medicare enrollees are not eligible for Plan C or Plan F. If you were eligible for Medicare before January 1, 2020, but did not enroll, you may still be eligible.

How long does Medicare Part A coinsurance last?

Medicare Part A coinsurance and hospital costs up to an additional 365 days after Medicare benefits run out. * Medicare Supplement Plan F and Plan G also offer a plan with a high deductible in some states. You must pay $2,370 in shared costs before the plan begins to pay.

How long does Medicare open enrollment last?

The Medicare supplement open enrollment period lasts six months. It begins the month you turn 65 and are enrolled in Part B. You can enroll through a private insurance company (via their websites or by phone), or by connecting with a GoHealth licensed insurance agent. Learn more about Medicare Supplement enrollment.

How much will Medicare cost in 2021?

In 2021, you have to pay $2,370 in shared costs before you get the same benefits of regular Plan F. Please note, a High Deductible Plan F also is not available to new Medicare enrollees in 2021.

What is deductible insurance?

A deductible is an amount you pay out of pocket before your insurance company covers its portion of your medical bills. For example: If your deductible is $1,000, your insurance company will not cover any costs until you pay the first $1,000 yourself.

How much does Plan N copay?

While Plan N pays 100% of the Part B coinsurance, providers are allowed to require copays up to $20 for doctor’s visits and up to $50 for emergency room visits .

What is the difference between Medicare Supplement Plan G and Plan F?

The main difference between Medicare Supplement Plan G and Plan F is that MedSup Plan F covers your Medicare Part B deductible. Plan G doesn’t cover that cost. Of course, the Part B deductible is just $198 this year, but a buck is a buck, right? However, MedSup Plan G premiums tend to be cheaper than Plan F premiums.

Why do people choose Medicare Supplement Plan G over Plan F?

One reason to choose Medicare Supplement Plan G over Plan F is that insurance companies no longer offer MedSup Plan F to new Medicare enrollees. Thanks to the Medicare Access and CHIP Reauthorization Act of 2015, insurers can’t sell MedSup Plan F to people who became eligible for Medicare on or after Jan. 1, 2020.

What is Medicare Supplement Plan G?

Medicare Supplement Plan G is a popular and comprehensive MedSup plan. Here's why it may be the best MedSup plan for you. Medicare Part G — or Plan G — is one of the most popular Medicare Supplement plans available. Plan G sits just behind Plan F in terms of popularity among American Medicare enrollees who want a bit more coverage.

What is the deductible for Medicare Part B 2020?

For 2020, the Medicare Part B deductible is $198 per year. After your out-of-pocket costs hit that limit, you’ll pay 20% of the Medicare-approved amount for most of the services Part B covers. That includes care like doctor visits and outpatient therapy. Also, Plan G usually doesn’t cover prescription drugs.

How much does Medicare Supplement Plan G cover?

Up to three pints of blood for medical procedures each year. Medicare Supplement Plan G also covers 80% of medical care you receive while traveling outside the U.S., up to your plan’s limits.

How long after Medicare benefits end can you get a coinsurance?

Part A coinsurance and hospital costs up to an additional 365 days after your standard Medicare benefits end. Part A hospice care coinsurance or copayment. Part B coinsurance or copayment. Part B excess charge. Skilled nursing facility care coinsurance. Up to three pints of blood for medical procedures each year.

Does Medicare Supplement Plan G cover prescriptions?

Also, Plan G usually doesn’t cover prescription drugs. Some MedSup policies used to, but that’s no longer the case. For that, you need to enroll in Medicare Part D. Finally, Medicare Supplement Plan G also won’t cover any of these costs: Dental care. Eye care, including glasses. Hearing aids.

What is the difference between Medicare Supplements Plan F and Plan G?

The only difference when you compare Medicare Supplements Plan F and Plan G is that deductible. Otherwise they function just the same. There is one important feature that Medicare Supplements Plan F and G have over all the other Medigap plans.

What is a Medigap Plan F?

Medigap Plan F is a heavy favorite with individuals who want comprehensive benefits and first-dollar coverage on their health care costs. First-dollar coverage means that both your Part A and Part B deductibles are covered by the plan, so you pay nothing before your Medicare benefits kick in.

What happens if you don't have Medicare?

When you see a provider that doesn’t participate with Medicare, he can charge up to 15% more than the standard Medicare rate for your services. You will pay this money out of pocket unless you have Medigap Plan F or Plan G. It’s definitely something to consider if provider choice is important to you.

How many Medigap plans are there?

There are currently 10 different Medigap plans that are standard across most states. (Massachusetts, Minnesota, and Wisconsin have their own plan standards.) What this means for consumers, however, is that Plan A offered by Company X in Anaheim is exactly the same as Plan A offered by Company Y in Boise.

Which is the most comprehensive Medicare plan?

The most comprehensive plan currently available is Medigap Plan F. It covers all of the gaps in Medicare. The next most comprehensive plan is Plan G, which covers nearly as much, with the Part B deductible being the only difference. Finally, Plan N is probably the third most popular plan because it operates similar to Plan G except ...

How much does a 66 year old spend on Medicare?

The average 66-year-old couple spends about 57% of their Social Security benefits on health care, according to a 2016 study. Learn Medicare for Free: Enroll in 6-Day Medicare Mini Course.

Is Medigap Plan G the same as Plan F?

Medigap Plan G is currently outselling most other Medigap plans because it offers the same broad coverage as Plan F except for the Part B deduct ible, which is $203 in 2021. Medigap Plan G is now the most popular plan among beneficiaries new to Medicare.