What is the main benefit of Medicare Part D?

The Medicare Part D program provides an outpatient prescription drug benefit to older adults and people with long-term disabilities in Medicare who enroll in private plans, including stand-alone prescription drug plans (PDPs) to supplement traditional Medicare and Medicare Advantage prescription drug plans (MA-PDs) ...

What is Medicare Part D and how does it work?

It is an optional prescription drug program for people on Medicare. Medicare Part D is simply insurance for your medication needs. You pay a monthly premium to an insurance carrier for your Part D plan. In return, you use the insurance carrier's network of pharmacies to purchase your prescription medications.

What does Medicare Part D specifically cover?

All plans must cover a wide range of prescription drugs that people with Medicare take, including most drugs in certain protected classes,” like drugs to treat cancer or HIV/AIDS. A plan's list of covered drugs is called a “formulary,” and each plan has its own formulary.

What are the two types of Medicare Part D plan?

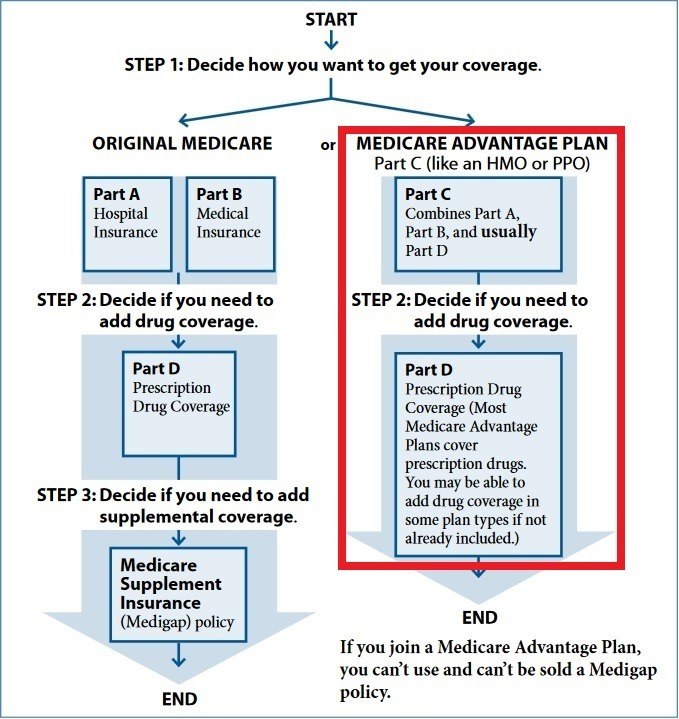

The plan can be a “stand-alone” Part D drug plan — one that offers only drug coverage and is the type that can be used by people enrolled in the original Medicare program. Or it can be a Medicare Advantage plan (such as an HMO or PPO) that offers Part D drug coverage as well as medical coverage in its benefits package.

Is it worth getting Medicare Part D?

Most people will need Medicare Part D prescription drug coverage. Even if you're fortunate enough to be in good health now, you may need significant prescription drugs in the future. A relatively small Part D payment entitles you to outsized benefits once you need them, just like with a car or home insurance.

Do I have to pay for Medicare Part D?

You're required to pay the Part D IRMAA, even if your employer or a third party (like a teacher's union or a retirement system) pays for your Part D plan premiums. If you don't pay the Part D IRMAA and get disenrolled, you may also lose your retirement coverage and you may not be able to get it back.

What is not covered in Medicare Part D?

Drugs not covered under Medicare Part D Weight loss or weight gain drugs. Drugs for cosmetic purposes or hair growth. Fertility drugs. Drugs for sexual or erectile dysfunction.

Do I need Medicare Part D if I don't take any drugs?

No. Medicare Part D Drug Plans are not required coverage. Whether you take drugs or not, you do not need Medicare Part D.

Which medication would not be covered under Medicare Part D?

Medicare does not cover:Drugs used to treat anorexia, weight loss, or weight gain. ... Fertility drugs.Drugs used for cosmetic purposes or hair growth. ... Drugs that are only for the relief of cold or cough symptoms.Drugs used to treat erectile dysfunction.More items...

What is the most popular Medicare Part D plan?

Best-rated Medicare Part D providersRankMedicare Part D providerMedicare star rating for Part D plans1Kaiser Permanente4.92UnitedHealthcare (AARP)3.93BlueCross BlueShield (Anthem)3.94Humana3.83 more rows•Mar 16, 2022

What is the maximum out of pocket for Medicare Part D?

Medicare Part D, the outpatient prescription drug benefit for Medicare beneficiaries, provides coverage above a catastrophic threshold for high out-of-pocket drug costs, but there is no cap on total out-of-pocket drug costs that beneficiaries pay each year.

What is the difference between Part C and Part D Medicare?

Medicare Part C is an alternative to original Medicare. It must offer the same basic benefits as original Medicare, but some plans also offer additional benefits, such as vision and dental care. Medicare Part D, on the other hand, is a plan that people can enroll in to receive prescription drug coverage.

How to decide if you need Medicare Part D?

How To Decide If You Need Part D. Medicare Part D is insurance. If you need prescription drug coverage, selecting a Part D plan when you’re eligible to enroll is probably a good idea—especially if you don’t currently have what Medicare considers “creditable prescription drug coverage.”. If you don’t elect Part D coverage during your initial ...

How long do you have to be in Medicare to get Part D?

You must have either Part A or Part B to get it. When you become eligible for Medicare (usually, when you turn 65), you can elect Part D during the seven-month period that you have to enroll in Parts A and B. 2. If you don’t elect Part D coverage during your initial enrollment period, you may pay a late enrollment penalty ...

What is Medicare Part D 2021?

Luke Brown. Updated July 15, 2021. Medicare Part D is optional prescription drug coverage available to Medicare recipients for an extra cost. But deciding whether to enroll in Medicare Part D can have permanent consequences—good or bad. Learn how Medicare Part D works, when and under what circumstances you can enroll, ...

How long can you go without Medicare Part D?

You can terminate Part D coverage during the annual enrollment period, but if you go 63 or more days in a row without creditable prescription coverage, you’ll likely face a penalty if you later wish to re-enroll. To disenroll from Part D, you can: Call Medicare at 1-800-MEDICARE.

How to disenroll from Medicare?

Call Medicare at 1-800-MEDICARE. Mail or fax a letter to Medicare telling them that you want to disenroll. If available, end your plan online. Call the Part D plan directly; the issuer will probably request that you sign and return certain forms.

What happens if you don't have Part D coverage?

The late enrollment penalty permanently increases your Part D premium. 3. Prescription drug coverage that pays at least ...

What is Tier 3 drug?

Tier 3: Non-preferred brand name drugs with higher copayments. Specialty: Drugs that cost more than $670 per month, the highest copayments 4. A formulary generally includes at least two drugs per category; one or both may be brand-name or one may be a brand name and the other generic.

What is Medicare Part D?

It is an optional prescription drug program for people on Medicare. Medicare Part D is simply insurance for your medication needs. You pay a monthly premium to an insurance carrier for your Part D plan. In return, you use the insurance carrier’s network of pharmacies to purchase your prescription medications.

Why switch to a different Medicare Part D plan?

Then you later switch mid-year to a different Medicare Part D plan because you moved out of state. Your new plan will already see that you have paid the deductible for that year. The costs for the coverage gap and catastrophic coverage work the same way. Part D drug plans also have changes from year to year.

What are the rules for Medicare?

Medicare allows drug plan carriers to apply certain rules for safety reasons and also for cost containment. The most common utilization rules that you may run into are: 1 Quantity Limits – a restriction on how much medication you can purchase at one time or upon each refill. If your doctor prescribes more than the quantity limit, then the insurance company will need him to file an exception form to explain why more is needed. 2 Prior Authorization – a requirement that you or your doctor must obtain plan approval before allowing a pharmacy to dispense your medication. The insurance company may ask for proof that the prescription is medically necessary before they allow it. This usually affects medications that are expensive or very potent. The doctor must show why this specific medication is necessary for you and why alternative drugs might be harmful or ineffective. 3 Step Therapy – the plan requires you to try less expensive alternative medications that treat the same condition before they will consider covering the prescribed medication. If the alternative medication works, both you and the insurance company save money. If it doesn’t, your doctor will need to help you file a drug exception with your carrier to request coverage for the original medication prescribed. He will need to explain why you need the more expensive medication when less expensive alternatives are available. Often this requires that he shows that you have already tried less expensive alternatives that were not effective.

What is the Medicare Part D deductible for 2021?

In 2021, the allowable Medicare Part D deductible is $445. Plans may charge the full Part D deductible, a partial deductible, or waive the deductible entirely. You will pay the network discounted price for your medications until your plan tallies that you have satisfied the deductible. After that, you enter initial coverage.

What are Part D restrictions?

Part D plan restrictions are common with pain medications, narcotics and opiates .

What is Tier 3 copay?

Maybe a Tier 3 is a preferred brand name for a $40 copay, and so on. The insurance company tracks the spending by both you and the insurance company until you have together spent a total of $4,130 in 2021. After you’ve reached the initial coverage limit for the year, you enter the coverage gap.

Is Part D a Medicare plan?

Part D drug plans are among the most confusing Medicare topics. All too often people join a plan without checking to make sure the formulary includes their medications. Sometimes they also miss that one of their medications has step therapy rules applied.

What is Medicare Part D?

Medicare Part D is an optional program that covers prescription drugs, with federally approved plans offered by private insurers. Most recipients pay a monthly premium that varies by plan, plus co-pays and other potential costs. Introduced in 2006, Part D is Medicare’s most recent ...

What is Part D insurance?

Often Part D coverage uses a tiered cost-sharing structure. This means you will pay a different price for different categories of drugs. In general, you’ll pay more in copays or coinsurance for brand-name drugs and less for generics.

What is creditable prescription drug coverage?

Creditable prescription drug coverage is coverage from your or a spouse’s employer or union that pays on average at least the same amount as Medicare standard drug coverage. Keep in mind the national base beneficiary premium often increases each year.

How much will Medicare pay for prescription drugs in 2021?

In 2021 when you and your insurer have paid $4,130 in prescription drug costs, you are then responsible for 25% of all of your medicine costs. The higher cost-sharing you pay in the donut hole continues until you enter into what’s known as Medicare Part D catastrophic coverage.

What is the Medicare Advantage premium for 2021?

The monthly premium for Medicare Part D plans varies. In 2021, the National Base Beneficiary Premium is $33.06, which will give you a comparison point while you shop. If you get drug coverage through a Medicare Advantage plan, your prescription drug coverage is often rolled into your Advantage plan premium.

How much will Medicare Part D cost in 2021?

If you delay joining when you’re first eligible and you don’t already have prescription drug coverage, you’ll pay 1% of the standard Medicare Part D premium ($33.06 in 2021) times the number of full months you didn’t have prescription drug coverage, and that number is added to your monthly premium.

How long does it take to enroll in Medicare Advantage?

This is the seven-month period starting three months before the month you turn 65, including your birthday month ...

What is a Part D plan?

The best Medicare Part D plans not only help you manage the cost of prescription drugs, they also play a role in ensuring medicines stay affordable and they can protect against future price hikes. Roughly 70% of Americans signed up for Medicare supplement with a Part D plan, ...

How long does Medicare Part D last?

There are three different enrollment periods for Medicare Part D, as follows: Initial enrollment period: This covers a total of seven months - three months before you turn 65, your birthday month itself, and then the three months directly after your 65th birthday. So seven months in total.

What is the Medicare Part D deductible for 2020?

In 2020, the allowable Medicare Part D deductible is $435. Depending on the provider you choose, plans may either charge the full deductible, a partial, or waive the deductible (zero deductible). You pay the network discounted price for prescription drugs until your plan equals the deductible.

What is the best Medicare Part D provider?

The best Medicare Part D providers include AARP, Humana Medicare Rx, WellCare, and Cigna-HealthSpring. If you’re eligible for Part D coverage, the three main considerations you’re likely to make are your current health, budget, and any medicine you take.

What are the deductibles for Medicare?

Deductibles apply to services covered under Part A and B. Medicare Part C (Medicare Advantage Plans) and Medicare Part D are optional and have their own premiums. If you live in a low income household, you may qualify for a subsidy to reduce the overall cost of Medicare.

Is AARP a good Medicare plan?

AARP Medicare Rx, with services provided by United Healthcare, is an excellent all-round provider of Medicare Part D plans and is the only range of plans backed by AARP. This is the best Medicare Part D plan option for seniors as it mixes low co-pays with competitive premiums and has a network of preferred providers.

Does Medicare Part D have monthly premiums?

Similar to other commercial health insurance plans, Medicare Part D Prescription Drug Plans vary with the monthly premiums, depending on the company and the coverage and the prescriptions you need covered. Expert Advice.

Available Medicare Part D Plans in 2022

In 2022, competing insurers offer a broad spectrum of Medicare Part D plans with different benefits. You have two options to cover your prescription drug costs: First, a ‘Stand-alone’ Medicare PDP Part D plan, which can be added both to original Medicare itself or a Medicare Supplemental Policy (Medigap).

How do Medicare Part D plans work?

Most Part D plans are using preferred pharmacy networks and formulary cost-sharing tiers, where out of pocket expenses are lower as long as you use those preferred pharmacies, and higher, if you purchase your medication outside of the preferred network.

Premiums for Part D plans in 2022

All stand-alone Part D plans have a monthly premium, which varies by the plan, and is in addition to your Part B premium. If you enroll in a Medicare Advantage Plan that includes prescription drug coverage, your monthly premium for the plan typically already includes prescription drug coverage. Deductibles are also very common for Part D plans.

The Donut Hole 2022

For 2022, drugs purchased in the coverage gap will be continue to be discounted to 25 percent of the cost of all your prescription drugs from the time you enter the gap until you reach catastrophic coverage. Plan subscribers have to pay 25% for generic drugs or brand-name drugs .

Compare Medicare Part D plans for 2022

It is very important that you thoroughly compare your plan options, no matter whether you intend to join a Part D plan for the first time, or are already enrolled in a plan. Premiums and benefits vary widely among plan policies, and those who remain in the same plan will on average overpay an estimated 20 percent.

Extra help for prescription drugs costs

For persons with limited resources who have difficulties paying the premiums and/or out-of-pocket costs for Part D, a federal financial aid program called Special Assistance is available to help. To find out, whether you qualify, call Social Security at 1-800-772-1213 (TTY 1-800-325-0778).

Who sells Medicare Part D?

Medicare Part D plans are sold by private insurance companies . These insurance companies are generally free to set their own premiums for the plans they sell. Medicare Part D plan costs in any particular area may depend partly on the cost of other plans being sold in the same area by competing carriers. Cost-sharing.

What is Part D premium?

Your Part D deductible is the amount that you must spend out of your own pocket for covered drugs in a calendar year before the plan kicks in and begins providing coverage.

What is the Medicare donut hole?

After 2020, Medicare Part D plans have a shrunken coverage gap, or “donut hole,” which represents a temporary limit on what the plan will cover for prescription drugs. You enter the Part D donut hole once you and your plan have spent a combined $4,130 on covered drugs in 2021.

How much is Medicare Part D 2021?

How much does Medicare Part D cost? As mentioned above, the average premium for Medicare Part D plans in 2021 is $41.64 per month. The table below shows the average premiums and deductibles for Medicare Part D plans in 2021 for each state. Learn more about Medicare Part D plans in your state.

What is the average Medicare Part D premium for 2021?

The average Part D plan premium in 2021 is $41.64 per month. 1. Because Original Medicare (Part A and Part B) does not cover retail prescription drugs in most cases, millions of Medicare beneficiaries turn to Medicare Part D or Medicare Advantage prescription drug (MA-PD) plans to get help paying for their drugs.

How much will Part D cost in 2021?

You enter the Part D donut hole once you and your plan have spent a combined $4,130 on covered drugs in 2021. Once you reach the coverage gap, you will pay up to 25 percent of the cost of covered brand name and generic drugs until you reach total out-of-pocket spending of $6,550 for the year in 2021.

Does Medicare Advantage cover Part A?

Medicare Advantage plans (also called Medicare Part C) provide all of the same coverage as Medicare Part A and Part B, and many plans include some additional benefits that Original Medicare doesn’t cover. Read additional medicare costs guides to learn more about Medicare costs and how they will affect you.