What are the 4 phases of Part D coverage?

What is the Part D Irmaa for 2021?

| IRMAA Table | 2021 |

|---|---|

| More than $165,000 but less than $500,000 | $70.70 + Plan premium |

| More than or equal to $500,000 | $77.10 +Plan premium |

| Married filing jointly | |

| More than $176,000 but less than or equal to $222,000 | $12.30 + Plan premium |

What is Tier 3 in Medicare Part D?

What is the most popular Medicare Part D plan?

| Rank | Medicare Part D provider | Medicare star rating for Part D plans |

|---|---|---|

| 1 | Kaiser Permanente | 4.9 |

| 2 | UnitedHealthcare (AARP) | 3.9 |

| 3 | BlueCross BlueShield (Anthem) | 3.9 |

| 4 | Humana | 3.8 |

How is Part D premium determined?

What is the cost of Part D for 2022?

What is a Tier 5 specialty drug?

How does Medicare Part D work?

What does plan D cover in Medicare?

Is GoodRx better than Medicare Part D?

Can you use GoodRx If you have Medicare Part D?

Do I need Medicare Part D if I don't take any drugs?

What is Medicare Part A?

Medicare Part A is the hospital portion, covering services related to hospital stays, skilled nursing facilities, nursing home care, hospice and home healthcare. Under the Affordable Care Act, Part A alone counts as minimum essential coverage, so if this is all you sign up for, you’ll meet the law’s requirements. Most people don’t pay a premium for Part A because it’s paid for via work-based taxes. If, over the course of your working life, you’ve accumulated 40 quarter credits, then you won’t pay a premium for Part A. This applies to nearly all enrollees, but some do pay a premium as follows:

How much does Medicare Part B cost?

Medicare Part B covers medical care, including regular trips to the doctor and anything considered “medically necessary” for you. How much you pay for Part B coverage depends on different factors, such as when you enroll and your yearly income. The standard premium in 2017 is $134 a month for new enrollees, but this number actually only applies to about 30 percent of Part B beneficiaries. The remaining majority pay about $109 a month – but this will change in 2018. The standard premium applies to:

What is the donut hole in Medicare?

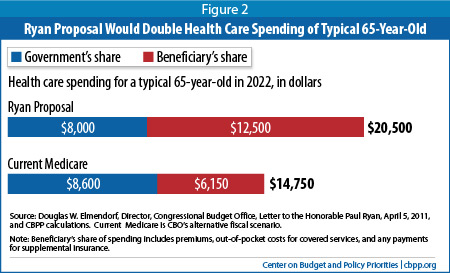

If you have Medicare Part D, then you may face a situation known as the donut hole (or coverage gap). This happens when you hit your plan’s initial coverage limit ($3,750 in 2018) but still need to buy prescriptions. Until you hit the catastrophic coverage limit – i.e., the other side of the “donut” – you’ll be responsible for the full cost of your medications.

How much is the penalty for Medicare Part B?

For Part B, the penalty is 10 percent of your premium (charged on top of the premium rate) for each 12-month period that you didn’t have Part B coverage when you could have. The penalty lasts for as long as you have Part B. Medicare Part B has other costs as well.

How much is Medicare premium in 2017?

The standard premium in 2017 is $134 a month for new enrollees, but this number actually only applies to about 30 percent of Part B beneficiaries. The remaining majority pay about $109 a month – but this will change in 2018. The standard premium applies to:

Does Medicare Advantage cover Part B?

If you have Medicare Advantage, then you will pay the Part B premium as well as any premiums that your plan charges. Medicare Advantage must cover Part B services. Income thresholds will change in 2018.

Does Medicare Part B have higher income?

Of course, higher-income enrollees are subject to even higher rates for Medicare Part B. If you earn above the standard income threshold, then you’ll be charged an “Income-Related Monthly Adjustment Amount” (IRMAA) along with the standard premium. When determining income, Medicare uses income information from the IRS, which dates two years back. In 2018, income determinations will be based on what you earned in 2016.

What is a Part D specialty tier?

Under the final rule, Part D plans may establish a second specialty tier, splitting specialty drugs between a non-preferred specialty tier and a preferred specialty tier, with the preferred tier carrying lower cost-sharing obligations than the non-preferred tier. By allowing plans to apply differential co-insurance obligations to specialty drugs, this dual specialty tier model is designed to give plans flexibility to incentivize beneficiaries to select lower-cost specialty drugs.

When will Medicare Part D be finalized?

Some provisions were finalized in June of 2020, however, a few items were not finalized until January 15, 2021, when CMS issued the contract year 2022 Medicare Advantage and Part D Final Rule.

What is specialty tier cost threshold?

The specialty tier cost threshold for a given drug will be based on a 30-day equivalent supply of the ingredient cost reported on the prescription drug event (PDE) as opposed to the negotiated price of the drug.

Why is CMS codifying current methodologies for cost sharing and calculations relative to the specialty tier?

To improve transparency, CMS codified current methodologies for cost-sharing and calculations relative to the specialty tier, with some modifications.

How much does Part D cost in 2021?

Currently, CMS permits Part D plans to place drugs that cost over a specified threshold (for contract year 2021, $670/month) in a single specialty tier. Within the specialty tier, plans may charge higher co-insurance—up to 25 or 33 percent, depending on the plan’s deductible.

How to reduce Part D costs?

Reduce costs for Part D enrollees, not only through direct cost-sharing savings associated with a lower cost-sharing, “ preferred” specialty tier, but also indirectly, through the lowered premiums for all Part D enrollees that could result from better rebates on specialty-tier Part D drugs’

Is Part D coverage unfavorable?

CMS did mention that commenters suggested that Part D enrollees stabilized on a specialty drug be exempt from unfavorable coverage changes (for example, increased cost-sharing) resulting from a secondary specialty tier. In response, CMS referenced the tiering exception process and the qualification that cost-sharing for patients only has the potential to decrease with the addition of a second “preferred” specialty tier.

What does Medicare Part D cover?

All plans must cover a wide range of prescription drugs that people with Medicare take, including most drugs in certain protected classes,” like drugs to treat cancer or HIV/AIDS. A plan’s list of covered drugs is called a “formulary,” and each plan has its own formulary.

What are the tiers of Medicare?

Here's an example of a Medicare drug plan's tiers (your plan’s tiers may be different): Tier 1—lowest. copayment. An amount you may be required to pay as your share of the cost for a medical service or supply, like a doctor's visit, hospital outpatient visit, or prescription drug.

How many prescription drugs are covered by Medicare?

Plans include both brand-name prescription drugs and generic drug coverage. The formulary includes at least 2 drugs in the most commonly prescribed categories and classes. This helps make sure that people with different medical conditions can get the prescription drugs they need. All Medicare drug plans generally must cover at least 2 drugs per ...

Why does Medicare change its drug list?

Your plan may change its drug list during the year because drug therapies change, new drugs are released, or new medical information becomes available.

How many drugs does Medicare cover?

All Medicare drug plans generally must cover at least 2 drugs per drug category, but plans can choose which drugs covered by Part D they will offer. The formulary might not include your specific drug. However, in most cases, a similar drug should be available.

What is tiering exception?

A tiering exception is a drug plan's decision to charge a lower amount for a drug that's on its non-preferred drug tier. You or your prescriber must request an exception, and your doctor or other prescriber must provide a supporting statement explaining the medical reason for the exception. .

What is a drug plan's list of covered drugs called?

A plan’s list of covered drugs is called a “formulary,” and each plan has its own formulary. Many plans place drugs into different levels, called “tiers,” on their formularies. Drugs in each tier have a different cost. For example, a drug in a lower tier will generally cost you less than a drug in a higher tier.

What is Medicare Part D?

Prescription drug coverage, or Medicare Part D, is a relatively new feature of Medicare, but millions of seniors take advantage of the program to help lower their prescription drug costs. Here’s what you need to know about Medicare Part D and the costs for 2018.

How long do you have to sign up for Part D?

If you want to enroll in Part D coverage, make sure you do it at the right time: the seven-month period around your 65 th birthday month, including the three months leading up to it. If not, you could be penalized for signing up 63 days or more after your Initial Enrollment Period is over. If you don’t sign up during your Initial Enrollment Period, you will have to wait for the Fall Open Enrollment Period, which is October 15 – December 7, and you could be penalized.

What is the coverage gap for prescription drugs?

Once your out-of-pocket drug costs have reached $3,750, you fall into the coverage gap, also known as the donut hole. This means your plan stops paying for your prescription drugs until you reach catastrophic coverage. For 2018, catastrophic coverage begins once your out-of-pocket expenses have reached $5,000. Until you reach that, there are coverage gap discounts available to you: in 2018, name brand drugs will be discounted 65% and generic drugs will be discounted 56%. All payments (including discounts) will count toward your out-of-pocket costs and help you reach catastrophic coverage.

Do Part D plans require copays?

Copays and coinsurance are also typical under Part D plans. Some plans require you to pay a certain percentage of prescription drug costs (coinsurance), while others charge a fixed dollar amount (copayment). Prescription drug costs also depend on whether the drug is name brand or generic.

What is the contract year for Medicare and Medicaid?

Federal Register :: Medicare and Medicaid Programs; Contract Year 2022 Policy and Technical Changes to the Medicare Advantage Program, Medicare Prescription Drug Benefit Program, Medicaid Program, Medicare Cost Plan Program, and Programs of All-Inclusive Care for the Elderly

Does Medicare allow tiering exceptions?

Currently, Medicare allows a tiering exception, which is a way to request to obtain a non-preferred drug at the lower cost-sharing terms applicable to drugs in a preferred tier, if clinical requirements are met. CMS clarified that under the new rule, tiering exceptions within the specialty tier would be allowed.

How many phases of Medicare Part D?

Medicare Part D has four phases of coverage. The first phase is the deductible phase, followed by the initial coverage phase, the “donut hole phase,” and finally the catastrophic phase. The patient usually will pay completely out of pocket in the deductible phase before having some coverage on their prescription costs. After the initial coverage phase, a patient reaches the coverage gap phase and usually pays more out of pocket.

How much will Medicare pay for specialty drugs in 2021?

Across plans covering the drugs, on average the drugs will cost Medicare patients at least $3,000 annually in 2021, with one drug costing more than $17,000.

How much does Revlimid cost?

According to our research, the average annual out-of-pocket cost for Revlimid across Medicare Part D plans is $17,142. But depending on the plan an enrollee is covered under, they could pay the max annual out-of-pocket annual cost for Revlimid, $20,013, or the minimum at $2,818. That’s almost an $18,000 difference in price.

What is OOP in Medicare?

Estimated out-of-pocket costs for top-filled specialty drugs: All Medicare Part D estimated out-of-pocket (OOP) costs were ascertained using the Centers for Medicare & Medicaid Services (CMS) Prescription Drug Plan Formulary, Pharmacy Network, and Pricing Information files. These data include specific formulary structures, benefits, plans, and networks, and they are updated monthly and quarterly. We used 2021 Quarter 1 files in our analysis. Our analysis does not include National PACE plans, employer-sponsored plans, and demonstration plans per Medicare’s documentation.

What is specialty medicine?

The definition of a specialty medication varies. But according to IQVIA and the Congressional Budget Office (CBO), specialty medications must treat a chronic, complex, or rare disease and have at least four of the following seven characteristics:

Does Medicare cover multiple myeloma?

A Medicare Part D patient who is newly diagnosed with multiple myeloma will hopefully be on a plan where they are near the minimum out-of-pocket costs for Revlimid; otherwise, they may be facing a considerable amount to pay each year.

When will CMS allow a second specialty tier?

Permitting a Second, “Preferred,” Specialty Tier in Part D. Under the final rule, beginning January 1, 2022, CMS is allowing Part D plans to have a second, “preferred” specialty tier with a lower cost sharing amount than their other specialty tier. This change is designed to give Part D plans more tools to negotiate better deals with manufacturers ...

What is the final rule for Part D?

The final rule will require Part D plans to offer real-time comparison tools to enrollees starting January 1, 2023, so enrollees have access to real-time formulary and benefit information, including cost-sharing, to shop for lower-cost alternative therapies under their prescription drug benefit plan. Enrollees would be able to compare cost sharing to find the most cost-effective prescription drugs for their health needs. For example, if a doctor recommends a specific cholesterol-lowering drug, the enrollee could look up what the copay would be and see if a different, similarly effective option might save the enrollee money. With this tool, enrollees will be better able to know what they’ll need to pay before they’re standing at the pharmacy cash counter.

What is CMS contract year 2021?

In the June 2, 2020 Federal Register, the Centers for Medicare & Medicaid Services (CMS) issued the Contract Year 2021 Policy and Technical Changes to the Medicare Advantage Program, Medicare Prescription Drug Benefit Program, and Medicare Cost Plan Program final rule (85 FR 33796) that implemented a subset of the proposals from the February 2020 proposed rule (85 FR 9002). That final rule focused on more immediate regulatory actions and was primarily intended to implement certain changes before the contract year 2021, stemming from the Bipartisan Budget Act of 2018 (BBA of 2018) and the 21st Century Cures Act (Cures Act). That final rule also codified several existing CMS policies and implemented other technical changes.

Is CMS updating its sub-regulatory guidance?

CMS will be updating its sub-regulatory guidance to be co-extensive with the policies in the final regulation and eliminate from guidance any inconsistencies, so it is clear the final regulation text sets forth the complete extent of CMS requirements.