The monthly Part D premium can be deducted from railroad retirement or social security benefits paid by the RRB, if the beneficiary contacts his or her Part D plan and requests that the RRB withhold Part D premiums. The RRB also withholds Part D income-related adjustment amounts from benefit payments. Medicare prescription drug plans are voluntary. To enroll, individuals must have Medicare Part A, and must live in the prescription drug benefit plan's service area.

Can the Railroad Retirement Board deduct part D premiums?

Also, the monthly Part D premium can be deducted from railroad retirement or social security benefits paid by the RRB if the beneficiary submits a request for withholding to his or her Part D plan. The RRB also withholds Part D income-related adjustments from benefit payments.

Does the Railroad Retirement Board (RRB) cover Medicare?

If you receive Railroad Retirement benefits or disability annuity benefits from the railroad at the time of eligibility for Medicare, you are automatically enrolled in Medicare Parts A and B by the RRB.

Does the railroad pay for retirement benefits?

Medicare Coverage for Railroad Retirees When people are eligible for either Social Security benefits or Railroad Retirement Benefits, they will qualify for Medicare due to age or disability. You may be turning 65 years old, or you may be under 65 and have a disability.

What does the Railroad Retirement Board do?

The Railroad Retirement Board also administers aspects of the Medicare program and has administrative responsibilities under the Social Security Act and the Internal Revenue Code. In carrying out its mission, the Railroad Retirement Board will pay benefits to the right people, in the right amounts, in a

What's the difference between railroad Medicare and regular Medicare?

A: The only difference is that retired railroad beneficiaries have their Part B benefits administered by the Palmetto GBA Railroad Retirement Board Specialty Medicare Administrative Contractor (RRB SMAC) regardless of where they live. Members should be certain to advise providers of this when they receive treatment.

What is Railroad Retirement Medicare?

The Medicare program covers railroad workers just like workers under social security. Railroad retirement payroll taxes include a Medicare hospital insurance tax just like social security payroll taxes.

What is Medicare Part D pay for?

Medicare Part D, the prescription drug benefit, is the part of Medicare that covers most outpatient prescription drugs. Part D is offered through private companies either as a stand-alone plan, for those enrolled in Original Medicare, or as a set of benefits included with your Medicare Advantage Plan.

Is railroad Medicare a Medicare Advantage plan?

Yes, Railroad Medicare beneficiaries can choose to enroll in Medicare Advantage plans.

Can you receive social security and railroad retirement at the same time?

Answer: Yes, you can apply for and receive both benefits, but the Tier 1 portion of your Railroad Retirement Annuity will be reduced by the amount of your Social Security benefit, so you may not receive more in total benefits.

Can a person draw social security and railroad retirement?

6. Another unique characteristic of RRB 's benefit structure is that to receive benefits under the Railroad Retirement Act an individual must cease all employment in RRB -covered positions. 7. Some workers are eligible for both Social Security and RRB benefits.

Is it mandatory to have Part D Medicare?

Is Medicare Part D Mandatory? It is not mandatory to enroll into a Medicare Part D Prescription Drug Plan.

Do I have to pay Part D?

You're required to pay the Part D IRMAA, even if your employer or a third party (like a teacher's union or a retirement system) pays for your Part D plan premiums. If you don't pay the Part D IRMAA and get disenrolled, you may also lose your retirement coverage and you may not be able to get it back.

When did Medicare Part D become mandatory?

The MMA also expanded Medicare to include an optional prescription drug benefit, “Part D,” which went into effect in 2006.

How do I find railroad Medicare?

The Medicare card of a person with Railroad Medicare is unique, as seen below, with the RRB logo in the upper left corner and “Railroad Retirement Board” at the bottom.

How much is the average railroad pension?

The average age annuity being paid by the Railroad Retirement Board (RRB) at the end of fiscal year 2020 to career rail employees was $3,735 a month, and for all retired rail employees the average was $2,985. The average age retirement benefit being paid under social security was approximately $1,505 a month.

Can you lose your railroad retirement?

Once a current connection is established at the time the railroad retirement annuity begins, an employee never loses it, no matter what kind of work is performed thereafter.

What is Medicare Part A?

Hospital Insurance ( Medicare Part A ), which helps pay for inpatient care in hospitals and skilled nursing facilities (following a hospital stay), some home health care services, and hospice care.

What is the RRB?

The Railroad Retirement Board (RRB) enrolls railroad retirement beneficiaries in the program, deducts Medicare premiums from monthly benefit payments, and assists in certain other ways.

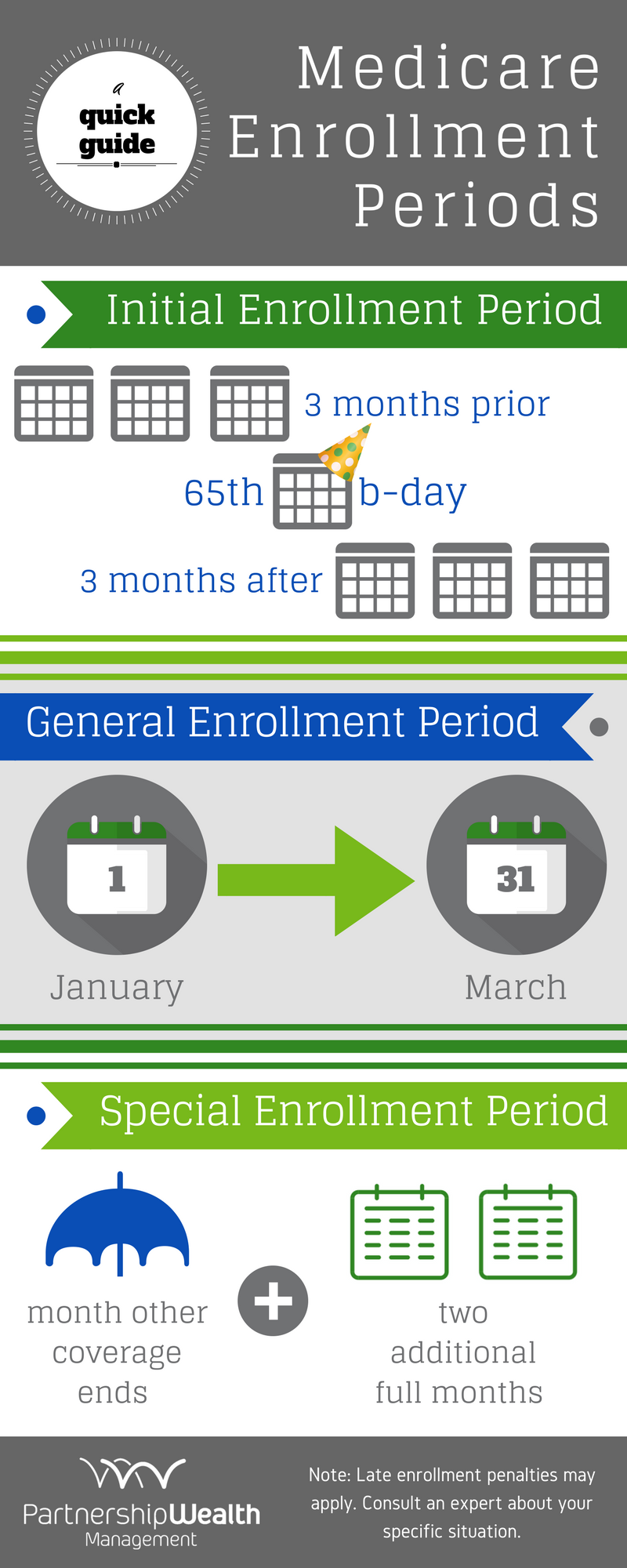

What is the enrollment period for Medicare?

Special Enrollment Period for People Covered Under a Group Health Plan#N#If you are age 65 or older and covered under a group health plan, either from your own or your spouse’s current employment, you have a special enrollment period in which to sign up for Medicare Part B. This means that you may delay enrolling in Medicare Part B without having to wait for a general enrollment period and paying the 10 percent premium surcharge for late enrollment. The special enrollment period rules allow you to: 1 enroll in Medicare Part B anytime while you are covered under the group health plan based on current employment; or 2 enroll in Medicare Part B during the 8-month period that begins the month after your group health coverage ends or employment ends, whichever comes first.

What is the deductible for hospital care in 2021?

In 2021, the hospital insurance deductible amount is $1,484. If you receive medical services from a doctor, you pay a yearly deductible amount as well as a coinsurance amount for each visit. In 2021, the medical insurance deductible is $203.

What age does Medicare cover?

Medicare is our country’s health insurance program for people age 65 or older, certain people with disabilities who are under age 65, and people of any age who have permanent kidney failure.

How much is Part B insurance for 2021?

The income-related Part B premiums for 2021 are $207.90, $297.00, $386.10, $475.20, or $504.90, depending on how much a beneficiary’s adjusted gross income exceeds $88,000 (or $176,000 for a married couple.

Can a spouse get Medicare if they are divorced?

Under certain conditions, your spouse, divorced spouse, surviving divorced spouse, widow (er), or a dependent parent may be eligible for Medicare hospital insurance based on your work record when he or she turns 65. Eligibility for family members under age 65.--.

Where is the railroad retirement board on my Medicare card?

Your Medicare card is similar to the new Medicare cards that all beneficiaries receive, with the exception that “Railroad Retirement Board” is printed in a red banner at the bottom of the card .

What happens if you receive a railroad retirement?

If you receive Railroad Retirement benefits or disability annuity benefits from the railroad at the time of eligibility for Medicare, you are automatically enrolled in Medicare Parts A and B by the RRB. After the RRB automatically enrolls you, you receive your Medicare card together with a letter from the RRB explaining ...

What is the RRB?

The RRB administers insurance and retirement benefits to all railroad workers in the country. Instead of getting retirement benefits from the U.S. Social Security Administration as other workers do, the RRB provides railroad workers and their families with retirement benefits, along with unemployment and sickness benefits, ...

Do you have to go through the Social Security Administration if you are employed by the railroad?

However, if you have end-stage renal disease (ESRD) and qualify for Medicare, you must go through the Social Security Administration even if you are employed by the railroad.

Does Medicare cover railroad employees?

Medicare offers coverage to railroad employees just as it does for people who have Social Security. The payroll taxes of railroad employees include railroad retirement and Medicare hospital insurance taxes.

What is the number to call a railroad retirement board?

Call a Licensed Agent: 833-271-5571. Due to COVID-19, the Railroad Retirement Board closed offices as of March 16, 2020. We’ll keep you updated on when offices reopen. In the meantime, visit RRB.gov to learn about your online self-serve options.

How long do you have to enroll in Medicare if you have end stage renal disease?

Whether you become eligible for Medicare via age or disability, you’ll have seven months, called your Initial Enrollment Period (IEP), in which to enroll.

What is the RRB in 2020?

Licensed Insurance Agent and Medicare Expert Writer. June 15, 2020. Before the Social Security Administration (SSA) was formed, the Railroad Retirement Board (RRB) developed retirement, disability, and unemployment benefits for railroad workers who were hit hard by the Great Depression. Today, the RRB offers railroad workers a similar safety net.

When do you become eligible for Medicare?

Typically, you’ll become eligible when you turn 65 or reach your 25th month of receiving disability benefits. The main difference is that the RRB classifies disability differently than the SSA does, so check with a representative ...

Does Medicare pay through the RRB?

Generally, your Medicare costs through the RRB will be the same as those paid by people who qualify for Medicare via Social Security. Just like workers outside the railroad industry, you’ll see Medicare deductions from your paycheck during your working years.

Does RRB have Medicare?

Today, the RRB offers railroad workers a similar safety net. RRB beneficiaries can tap into Medicare benefits, much like Social Security beneficiaries, with a few differences. If you are a railroad worker, learn what you can expect from Medicare in terms of eligibility, enrollment, costs, and health benefits—and how your RRB benefits differ ...

Do you pay Medicare Part D premiums through RRB?

If you add Medicare Part D, Medigap, or Medicare Advantage, you’ll pay additional premiums for these as well, but not through your RRB income checks. You’ll pay for each of these coverages separately, directly to the insurance company that provides each plan.

What Medicare Parts does RRB automatically enroll you in?

If you are receiving Railroad Retirement benefits or railroad disability annuity checks when you become eligible for Medicare, RRB should automatically enroll you in Medicare Parts A and B . You should receive your red, white, and blue Medicare card and a letter from RRB explaining that you have been enrolled in Medicare.

What to do if you are not collecting Railroad Retirement?

If you are not collecting Railroad Retirement benefits when you turn 65, you should contact your local RRB field office to enroll in Medicare. If you are under 65 and have a disability, you will have to fulfill different eligibility requirements to qualify for Medicare.

Does Medicare Part B get deducted from your check?

If you receive Railroad Retirement benefits or railroad disability annuity checks, your Medicare Part B premium should be automatically deducted from your check each month. If you do not qualify for premium-free Part A, it will also be deducted from your check.