What are the benefits of Medicare Part F?

Mar 12, 2021 · Medicare Supplement Plan F is also referred to as Medigap Plan F. It is a supplemental policy that you can buy from a private insurance company. It is only available to Original Medicare beneficiaries who want the additional insurance coverage needed to help pay for their share of the costs.

How much is plan F Medicare?

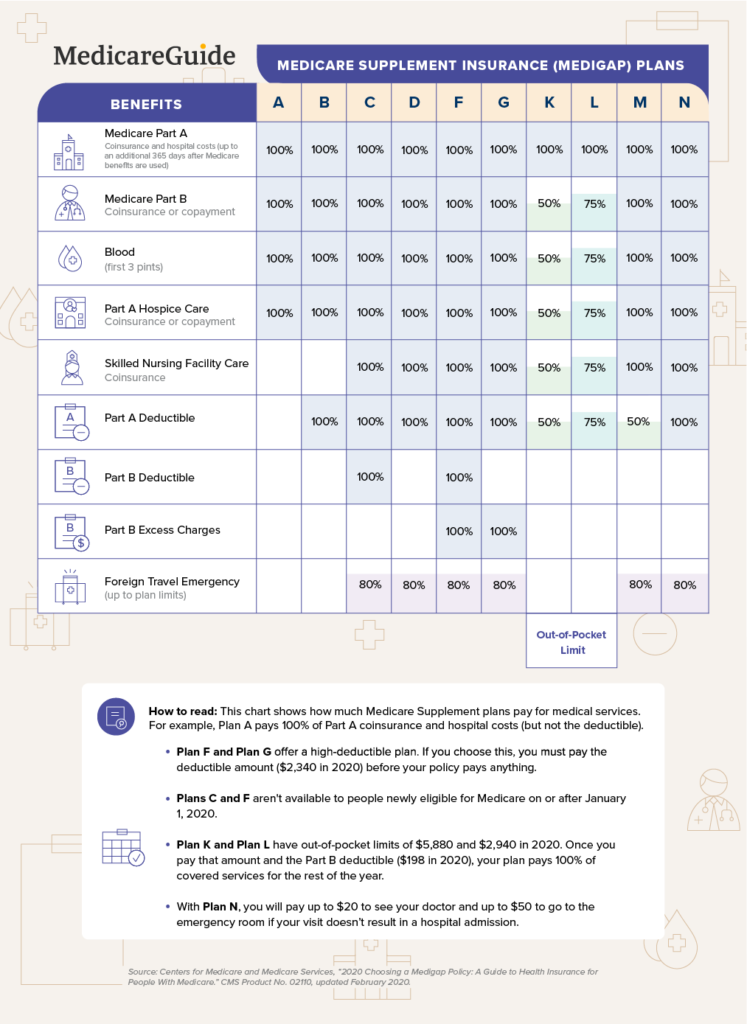

Nov 07, 2019 · Here’s an overview of what Medicare Supplement Plan F may cover and what your costs may be, as well as details on important changes related to this plan. Medicare Supplement Plan F benefits. As mentioned, Medicare Supplement Plan F offers the broadest coverage of all of the standardized Medigap plan offerings (Plans A-N; Plans E, H, I, and J are no longer sold). …

Who is eligible for Medicare Plan F?

Medicare Plan F covers all of the gaps in Original Medicare. It is considered to be the “Cadillac” coverage among the available Medicare supplements today. Plan F gives you first-dollar coverage for all Medicare-approved services.

How much does Medicare Part F cost?

Medigap Plan F is the most comprehensive Medicare Supplement plan. Also referred to as Medicare Supplement Plan F, it covers both Medicare deductibles and all copays and coinsurance, leaving you with nothing out-of-pocket. This post has been updated for 2022. Medicare Supplement Plan F has also been the #1 seller with Baby Boomers for many years.

What is Part F Medicare?

Medicare Plan F is a supplemental Medigap health insurance plan that is offered to individuals who are disabled or over the age of 65. Known better as simply Plan F, the policy is the most comprehensive of the 10 Medigap plans offered in each state.Apr 8, 2022

Who is eligible for Plan F?

Plan F is only available if you first became eligible for Medicare before January 1, 2020 (which means your 65th birthday occurred before January 1, 2020). Or you qualified for Medicare due to a disability before January 1, 2020.Oct 1, 2021

What is the advantage of Medicare Plan F?

Medicare Supplement Plan F offers basic Medicare benefits including: Hospitalization: pays Part A coinsurance plus coverage for 365 additional days after Medicare benefits end. Medical Expenses: pays Part B coinsurance—generally 20% of Medicare-approved expenses—or copayments for hospital outpatient services.Aug 26, 2021

Why is Plan F being discontinued?

The reason Plan F (and Plan C) is going away is due to new legislation that no longer allows Medicare Supplement insurance plans to cover Medicare Part B deductibles. Since Plan F and Plan C pay this deductible, private insurance companies can no longer offer these plans to new Medicare enrollees.Jul 9, 2020

Does Plan F cover drugs?

Medicare Supplement Plan F does not cover prescription drugs. By law, Medicare Supplement plans do not cover prescription drug costs. Medicare beneficiaries who want prescription drug coverage typically have two options: Enroll in a Medicare Advantage (Medicare Part C) plan that includes prescription drug coverage.Dec 15, 2020

Can I go back to Plan F?

In order to keep your Plan F, you don't need to renew or re-enroll every year. As long as you pay your premiums on time, your coverage will continue. You can also switch to another carrier that offers Plan F in the future, if another company offers a better rate that you would like to apply for.

Has Medicare Plan F been discontinued?

Is Medicare Plan F Being Discontinued? No, Medicare Plan F is not being discontinued, but it is no longer an option for those who are new to Medicare. The 2015 Medicare Access and CHIP Reauthorization Act (MACRA) prevented Medicare Supplement plans (F and C, specifically) from providing coverage for Part B deductibles.Nov 23, 2021

Should I switch from Plan F to Plan G?

Two Reasons to switch from Plan F to G Plan G is often considerably less expensive than Plan F. You can often save $50 a month moving from F to G. Even though you will have to pay the one time $233 for the Part B deductible on Medigap G, the monthly savings will be worth it in the long run.Sep 5, 2019

What is the most expensive Medicare Supplement plan?

Because Medigap Plan F offers the most benefits, it is usually the most expensive of the Medicare Supplement insurance plans.

What is the most popular Medigap plan for 2021?

Medigap Plans F and G are the most popular Medicare Supplement plans in 2021.Oct 6, 2021

What is the difference between plan C and plan F?

Plan F covers everything Plan C does, and also covers Medicare Part B excess charges. These two plans are some of the most comprehensive Medicare Supplement Insurance plans you can purchase, which makes them a very attractive option.Dec 2, 2019

Will plan F be grandfathered?

If you enrolled in Plan F before 2020, you will be “grandfathered” into the plan. This gives you the choice to keep the plan past 2020.

Why is Medicare Plan F being discontinued?

Congress passed “The Medicare Access and CHIP Reauthorization Act of 2015”, also known as MACRA, as a way to control Medicare spending. As a result...

Who qualifies for Medicare Part F?

Part F (Medicare Supplement Plan F) is only available to people who became eligible for Medicare before January 1, 2020. If your 65th birthday came...

Is Medicare Plan G Better Than Plan F?

Medicare Supplement Plan F and Plan G are nearly identical. Technically, Plan F is better because it offers first-dollar coverage. However, the one...

What is the Best Medicare Supplement Insurance Plan?

For some, the best means getting the most coverage. Medigap Plan F offers the most coverage possible. It covers ALL the cost gaps in Original Medic...

What Does Plan F Cover at My Doctor’S Office?

All of your preventive care is covered 100% by Medicare Part B. This includes items like: 1. Your annual physicals, well-woman exams and vaccines 2...

What Does Plan F Cover at The Hospital?

Medicare Part A covers inpatient hospital services, skilled nursing, blood transfusions and home health services that occur in the hospital. Medica...

What’S Not Covered by Plan F?

The only things Plan F does NOT cover would be those things that Medicare itself also does not cover, such as: 1. Acupuncture, acupressure and othe...

Does Medicare Plan F Cover Prescriptions?

Medicare decides what is covered and what is not. Medicare Part B covers injectable or infusion drugs given in a clinical setting. If Medicare pays...

Am I Guaranteed to Be Approved For Plan F?

Not always. You will get ONE open enrollment window to choose your first Medicare supplement without health underwriting. This window starts on Par...

Do Different Insurance Companies Have Different Plan F Benefits?

Fortunately NO. We get questions all the time about this – for instance a caller may ask us whether an AARP Plan F is the same as a Mutual of Omaha...

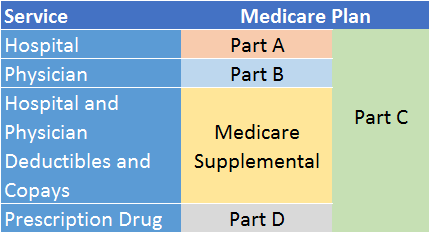

What is Medicare Supplement Plan F?

Medicare Supplement (Medigap) plans may help with certain out-of-pocket health-care costs that Original Medicare doesn’t pay for, such as deductibles, copayments, and coinsurance. Of the 10 standardized plans that may be available in most states, Medicare Supplement Plan F offers the most comprehensive coverage.

When will Medicare stop covering Part B?

If you qualify for Medicare before January 1, 2020: You may be able to buy Medicare Supplement Plan F (or Plan C). You can typically keep your existing Plan F or Plan C. You can talk to your insurance company about how ...

How much is Medicare deductible for 2017?

In 2017, the deductible is $2,200 (note that this amount may change from year to year).

Is Medicare Supplement Plan F the most comprehensive?

Because Medicare Supplement Plan F offers the most comprehensive coverage of the standardized lettered plans offered in most states, premium costs tend to be higher than other plans. Costs may vary by plan, company, and location, so check with the specific insurance company if you’re interested in this plan.

What is Medicare Plan F?

Medicare Plan F covers all of the gaps in Original Medicare. It is considered to be the “Cadillac” coverage among the available Medicare supplements today. Plan F gives you first-dollar coverage for all Medicare-approved services. Whether you have a hospital stay, or a diagnostic exam or a doctor’s visit, you will simply present your Medicare card ...

What does Plan F cover?

Plan F covers that for you. Plan F also pays the 20% for a long list of other Part B services. This includes durable medical equipment, lab work, tests, mental health care, home health, chiropractic adjustments and much more. There is no overall cap on what Plan F will cover, although Medicare itself does impose some caps on certain things like ...

What is Plan F insurance?

Plan F coverage also includes your other doctor visits for illnesses and injuries. Medicare Part B first pays 80%. Then your Plan F supplement pays your deductible and the other 20%. Some doctors charge a 15% excess charge beyond what Medicare pays. Plan F covers that for you.

Does Medicare cover excess charges?

There is no overall cap on what Plan F will cover, although Medicare itself does impose some caps on certain things like physical therapy. Just remember that if Medicare approves the claim, your Plan F will ALWAYS pay. Your Plan F coverage also covers excess charges. In fact, Plan G and Plan G are the only two plans that cover excess charges.

Does Medicare cover travel expenses?

One exception is that Medicare supplement Plan F will cover up to $50,000 in foreign travel emergency benefits. Since this care occurs outside the U.S., Medicare obviously does not cover that. Plan F fortunately will help to pay for emergency health incidents in foreign countries up to the plan limit.

Does Medicare cover outpatient prescriptions?

If Medicare pays its 80% share on such a drug, your Plan F will cover the rest of it. However, neither Original Medicare nor Plan F cover outpatient prescriptions.

Does Medicare cover preventive screening?

Medicare dictates which preventive screenings are allowed – your primary care doctor will know which screenings to provide to you that will be covered. Most doctors will inform you if they offer tests that Medicare does not cover. Plan F coverage also includes your other doctor visits for illnesses and injuries.

What is Medicare Plan F?

Medicare Plan F (also referred to as Medigap Plan F) is the most comprehensive Medicare supplement plan. This plan covers Medicare deductibles and all copays and coinsurance, which means you pay nothing out of pocket throughout the year.

What is Medicare Supplement Plan F?

Medicare Supplement Plan F Coverage is Comprehensive 1 Plan F fully covers both your Part A hospital deductible and your Part B outpatient deductible. 2 It covers all of the 20% that Medicare Part B normally leaves for you to pay. 3 Medicare Plan F covers all Part B excess charges. You will never pay the standard 15% excess charges that doctors under Medicare are allowed to charge for Part B services. 4 Choose any doctor – from over 900,000 physicians in the United States. 5 No referrals required! Medigap plans allow you to see any Medicare specialist whenever you like. You are not required to get a referral from your primary care doctor. 6 Guaranteed renewable. Your coverage can never be canceled due to health conditions or the number of claims you file.

Why is Medicare Plan F so popular?

The reason Medicare Plan F is so well-liked is that it will pay for ALL of the gaps in Original Medicare Part A and Part B, including both your hospital and outpatient deductible. It even pays the 20% that Medicare Part B does not cover.

What is the most comprehensive Medicare plan?

If you became eligible for Medicare on or after January 1, 2020, you’ll find that Plan G is the most comprehensive Medigap plan available to you. (In recent years, Plan G has been the second most popular Medicare Supplement plan, and you can read more on that below.) A Medigap plan, or Medicare Supplement, pays after Medicare to help cover your ...

What happens if you don't have a Supplement?

You would also pay 20% of expensive procedures like surgery because Part B only pays 80%.

What is the best Medigap plan for 2021?

The best Medigap plans in 2021 are still Plan F and Plan G. While Plan F has long been the most popular, Plan G is gaining steam since Plan F is no longer available to new enrollees. Get a quote for both and see which ones offer you the best annual savings.

Does Medicare Supplement Plan F replace Part B?

Medigap plans do not replace your Medicare Part B. You must be enrolled in both Part A and Part B first, then you are eligible to enroll in Medicare Supplement Plan F.

What is Medicare Plan F?

Medicare Plan F provides the most benefits out of all the supplemental Medicare plans available and can help reduce your out-of-pocket expenses. The policy is designed to address most of the coverage gaps in Medicare parts A and B. For this reason, many people covered by the standard Medicare policies are willing to pay ...

What is a plan F?

Plan F is a supplemental policy to the standard Medicare parts A and B plans and can fill many of the gaps of standard Medicare policy and provide broader assistance with out-of-pocket costs. However, not all health insurance gaps will be covered by Plan F.

How much does Medicare Part F cost?

Since Medicare Part F is the is the most comprehensive Medigap policy, the premium can be costly. Typically, these range from $120 to $140 per month for a 65-year-old. However, the exact cost will be determined by your location, plan provider, current health condition, and age and gender. For this reason, it is vital to compare rates for ...

Is Medicare Plan F deductible?

When filing your federal tax return, Medicare Plan F premiums would be tax-deductible. Additionally, any medical expenses that you pay for out-of-pocket can also be deducted on your taxes. You would need to itemize these medical expenses, but the tax deductions could provide valuable additional returns.

What is a high deductible Medicare plan?

What is a high-deductible Medicare Plan F? The benefits within the high-deductible Medicare Plan F policy are the same as the standard Part F policy, though you would have to meet the deductible before you can access its health benefits.

Does Medigap Plan G cover Medicare Part B?

As you can see, Medigap Plan G would not provide coverage for the Medicare Part B deductible. This means if you were to purchase Plan G, you would have to pay the deductible for Part B, which is $185 for 2019, as you receive health services.

Does Medicare cover injectables?

Medicare Plan F does provide coverage for injectable or infusion drugs given in a clinical setting but does not pay for other prescription drugs. The ideal coverage package would include Medicare parts A and B, along with the Part D prescription drug plan and a supplemental Medigap policy such as Plan F.

What is a plan F?

Plan F is a very comprehensive plan, helping cover expenses that original Medicare doesn’t. This includes your deductibles, coinsurance, and copays when receiving medical care. It even covers a portion of your medical expenses during foreign travel.

What is the deductible for Plan F?

High-deductible plan F. Plan F also has a high deductible option. While monthly premiums for this option may be lower, you must pay a deductible before Plan F begins paying for benefits. For 2021, this deductible is set at $2,370.

How to choose a Medicare supplement?

Follow the tips below while shopping for a Medicare supplement plan: 1 Pick a plan. There are several Medicare supplement plans to choose from. The extent of coverage can vary by plan. Review your health-related needs to decide on one that’s right for you. 2 Compare policies. Once you’ve decided on a plan, compare the policies offered by different companies, as costs can vary. Medicare’s website has a helpful tool to compare the policies offered in your area. 3 Consider premiums. Providers can set their premiums in different ways. Some premiums are the same for everyone, while others may increase based on your age. 4 Remember high deductible options. Some plans have a high deductible option. These plans often have lower premiums and may be a good choice for someone who doesn’t anticipate a lot of medical expenses.

How many Medicare Supplement Plans are there?

There are 10 different Medicare supplement plans. You’ll see them designated as letters: A through D, F, G, and K through N. Each of these different plans is standardized, meaning the same set of basic benefits needs to be offered.

Do you have to pay a monthly premium for Medicare?

You’ll have to pay a monthly premium with a Medicare supplement plan. This is in addition to premiums you pay for other parts of Medicare, such as Medicare Part B or Part D. An insurance provider can set their Medicare supplement plan premiums in three different ways: Community rated.

Is Medigap part of Medicare?

It’s actually one of several Medicare supplement insurance ( Medigap) plans. Medigap comprises several plans you can buy to help pay for things that original Medicare (parts A and B ) doesn’t. Keep reading to find out more about plan F, what it includes, and if it may be a good fit for you.

What is the most comprehensive Medicare Supplement?

In most states, the most comprehensive Medicare Supplement insurance plan available will be Plan G. Plan G is similar to Medicare Supplement Plan F, except Plan G does not cover the Part B deductible. (In 2021, the Part B deductible is $203 per year.)

What is the Medicare Access and CHIP Reauthorization Act?

In 2015, Congress passed the Medicare Access and CHIP Reauthorization Act. The act was meant to improve provider payments for covered Medicare services. At the same time, however, Congress knew there’s an increasing strain on the Medicare Trust Fund budget, as more and more people age into Medicare.

Is Medicare Supplement Plan F still available?

Yes. Medicare Supplement Plan F may eventually leave the market, starting in 2020 – but not for everyone. If you have been shopping for a Medicare Supplement (also known as Medigap) insurance plan, you may already know that Medicare Supplement Plan F may cover a lot of your Medicare Part A and Part B out-of-pocket costs.

When will Medicare plan F be available?

Because of a recent federal law, Plan F and Plan C are no longer available for Medicare beneficiaries who became eligible on or after January 1, 2020. If you already had Plan C or Plan F before 2020, you will be able to keep your plan.

Why is Plan F so popular?

Because Plan F provides more benefits than any other type of Medigap plan, Plan F may have higher monthly premiums than other types of Medigap plans in some areas. Other factors such as age, gender, smoking status and health can also affect Medigap plan rates.

What is the deductible for Medicare 2021?

1 Plans F and G offer high-deductible plans that each have an annual deductible of $2,370 in 2021. Once the annual deductible is met, the plan pays 100% of covered services for the rest of the year. The high-deductible Plan F is not available to new beneficiaries who became eligible for Medicare on or after January 1, 2020.

Is Plan F available for 2020?

80 %. * Plan F and Plan C are not available to Medicare beneficiaries who became eligible for Medicare on or after January 1, 2020. If you became eligible for Medicare before 2020, ... you may still be able to enroll in Plan F or Plan C as long as they are available in your area.

Who is Christian Worstell?

Christian Worstell is a licensed insurance agent and a Senior Staff Writer for MedicareAdvantage.com. He is passionate about helping people navigate the complexities of Medicare and understand their coverage options. .. Read full bio