What's the difference between Medicare Parts A, B, C?

Part B is medical insurance. Together with Part A, which is hospital insurance, it is called original Medicare. Part B covers doctors' visits, and the accompanying Part A covers hospital visits. Medicare Part C, also called Medicare Advantage, is an alternative to original Medicare.

Is part C and Original Medicare the same?

Medicare Part C, commonly called Medicare Advantage, is an alternative to Original Medicare. It provides nearly all the same benefits plus some extra coverage. Most Medicare Part C plans come with vision, dental, hearing and prescription drug coverage, none of which are covered by Original Medicare.

What is the average cost of Medicare Part C?

The industries, programs, and fraud tactics which the DOJ pursued most intensely encompassed prescription opioid manufacturers, Medicare Advantage Plans (Medicare Part C), unlawful kickbacks ... As the population ages and healthcare costs increase Medicare ...

What is covered by Medicare Part F?

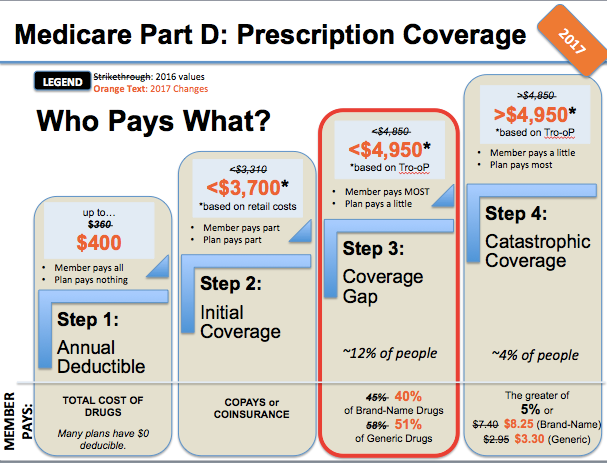

... Part D is an outpatient prescription drug benefit available to people who have Medicare (Part A and/or Part B). While technically Part D is optional coverage, Medicare “encourages” you to enroll in Part D by assessing a late penalty if you don’t.

What is Medicare Part F?

Medigap Plan F is a Medicare Supplement Insurance plan that's offered by private companies. It covers "gaps" in Original Medicare coverage, such as copayments, coinsurance and deductibles. Plan F offers the most coverage of any Medigap plan, but unless you were eligible for Medicare by Dec.

What does Medicare Part C do?

Medicare Part C provides more coverage for everyday healthcare including prescription drug coverage with some plans when combined with Part D. A Medicare Advantage prescription drug (MAPD) plan is when a Part C and Part D plan are combined. Medicare Part D only covers prescription drugs.

What are Medigap plans C and F?

Summary: Medicare Supplement (Medigap) insurance Plan C is one of the most comprehensive of the 10 standardized Medigap insurance plans available in most states. Out of the 10, only Medigap Plan F offers more coverage. Medigap Plan C covers most Medicare-approved out-of-pocket expenses.

Is there a part F for Medicare?

What is Medicare Part F? Medicare Part F is one of the 10 MedSup policies Americans enrolled in Original Medicare can buy if they want additional health coverage, or if they want help paying for their Medicare Part A and Part B coverage.

Do you pay for Medicare Part C?

Medicare Part C premiums vary, typically ranging from $0 to $200 for different coverage. You still pay for your Part B premium, though some Medicare Part C plans will help with that cost. Like premiums, deductibles vary with your plan.

What are the 4 types of Medicare?

There are four parts of Medicare: Part A, Part B, Part C, and Part D.Part A provides inpatient/hospital coverage.Part B provides outpatient/medical coverage.Part C offers an alternate way to receive your Medicare benefits (see below for more information).Part D provides prescription drug coverage.

Is plan C better than plan F?

Medicare Supplement (Medigap) insurance Plan C is one of the most comprehensive of the 10 standardized Medigap insurance plans available in most states. Out of the 10, only Medigap Plan F offers more coverage. Medigap Plan C covers most Medicare-approved out-of-pocket expenses.

What is the difference between plan F and C?

Plan F covers everything Plan C does, and also covers Medicare Part B excess charges. These two plans are some of the most comprehensive Medicare Supplement Insurance plans you can purchase, which makes them a very attractive option.

Why did Medicare get rid of plan F?

The reason Plan F (and Plan C) is going away is due to new legislation that no longer allows Medicare Supplement insurance plans to cover Medicare Part B deductibles. Since Plan F and Plan C pay this deductible, private insurance companies can no longer offer these plans to new Medicare enrollees.

What is Senior plan F?

Medigap Plan F is one of the Medicare Supplement Insurance plans. Medigap plan F covers the most benefits of all Medicare Supplement plans, and is the most popular plan for Seniors 65 and over. These plans are regulated, which means every insurance company that offers Plan F must offer the exact same benefits.

Why should I keep plan F?

PLAN F PROVIDES COMPREHENSIVE COVERAGE…AT A COST Because Plan F covers the annual Part B deductible, members of the plan are free to visit doctors, hospitals, and other healthcare providers as often as they'd like, with no out-of-pocket costs.

Does Medicare Plan F cover vision?

Plan F is one of the most comprehensive Medicare supplement plans you can purchase, but it doesn't cover everything. This plan will not cover the following: Things that Medicare doesn't normally cover, like acupuncture, vision exams and dental work, are not included in Plan F coverage.

What is High Deductible Plan F?

The coverage for a high-deductible Plan F is nearly the same as Medicare Supplement Plan F, but you’re required to satisfy an annual deductible bef...

What is High Deductible Plan G?

A high-deductible Plan G requires you to pay an annual deductible before the plan begins to pay. Once you reach the deductible, you will receive th...

Is Medigap Plan C and Medicare Part C the same?

No. Even though Medigap Plan C and Medicare Part C sound similar, they are very different. Medigap is Medicare Supplement Insurance that helps cove...

How can I enroll in a Medicare Supplement plan?

To be eligible for a Medicare Supplement plan, you must enroll in Original Medicare (Parts A and B). The Medigap open enrollment period lasts six m...

Are there other options rather than enrolling in a Medigap plan?

Yes. Consider enrolling in a Medicare Advantage (Part C) plan, an alternative to Original Medicare that comes with additional benefits and features...

How long does Medicare Part A coinsurance last?

Medicare Part A coinsurance and hospital costs up to an additional 365 days after Medicare benefits run out. * Medicare Supplement Plan F and Plan G also offer a plan with a high deductible in some states. You must pay $2,370 in shared costs before the plan begins to pay.

What is deductible insurance?

A deductible is an amount you pay out of pocket before your insurance company covers its portion of your medical bills. For example: If your deductible is $1,000, your insurance company will not cover any costs until you pay the first $1,000 yourself.

How long does Medicare open enrollment last?

The Medicare supplement open enrollment period lasts six months. It begins the month you turn 65 and are enrolled in Part B. You can enroll through a private insurance company (via their websites or by phone), or by connecting with a GoHealth licensed insurance agent. Learn more about Medicare Supplement enrollment.

How much will Medicare cost in 2021?

In 2021, you have to pay $2,370 in shared costs before you get the same benefits of regular Plan F. Please note, a High Deductible Plan F also is not available to new Medicare enrollees in 2021.

How much do you have to pay for Medicare in 2020?

You must pay $2,370 in shared costs before the plan begins to pay. * As of January 1, 2020, new Medicare enrollees are not eligible for Plan C or Plan F. If you were eligible for Medicare before January 1, 2020, but did not enroll, you may still be eligible.

How much does Plan N copay?

While Plan N pays 100% of the Part B coinsurance, providers are allowed to require copays up to $20 for doctor’s visits and up to $50 for emergency room visits .

Is Plan G a comprehensive plan?

In that case, you may want to consider joining Plan G. It’s a comprehensive plan, covering many of the costs associated with Original Medicare. Original Medicare is a fee-for- service health insurance program available to Americans aged 65 and older and some individuals with disabilities.

What is Medicare Part B?

Medicare Part B helps to pay for outpatient services, like primary care. This includes your doctor office visits, lab tests, preventative care, dialogistic imaging and so on. As you can see, many of these things may take place during a hospital stay, which is why both Part A and Part B are always recommended.

What are the different parts of Medicare?

This is true for other parts and plans as well. In all, there are four parts that make up Medicare coverage: Part A, Part B , Part C and Part D.

How much does Medicare pay for Part B?

It’s important to note that you pay a premium each month for Part B. Also, after your deductible is met, you typically pay 20% of the Medicare-approved amount for Part B services.

Does Medicare Part F exist?

Medicare Part F actually doesn’t exist. When people begin talking about “Part F” or “Part G,” they have likely confused Medigap Plans with the parts of the Medicare program itself. This is simply due to similar wording, with Medicare supplement insurance (Medigap) policies offering Plan A, B, C, D, F, G, K, L, M and N.

Do you have to enroll in Medicare Advantage before signing up?

So, before signing up, be sure that you compare a Medicare supplement insurance policy to a Medicare Advantage plan. Also, keep in mind that you don’t have to enroll in either.

Does Medicare Part A cover hospital services?

Of course, while Medicare Part A is responsible for hospital related coverage, it won’t necessarily cover all of the services that you may receive while in the hospital. For that reason, it’s still suggested that you sign up for both Part A and Part B coverage to stay protected.

Is Part D required for a prescription?

Part D is not required, although many people opt for it because the relatively low monthly premium typically covers a lot of out-of-pocket prescription drug costs. Keep in mind that there are rules regarding when you can enroll or remove yourself from a Part D plan.

What is Medicare Part F?

Medicare Part F is one of the 10 MedSup policies Americans enrolled in Original Medicare can buy if they want additional health coverage, or if they want help paying for their Medicare Part A and Part B coverage. Beyond that, Part F is the most comprehensive of all the MedSup plans on the market today.

How to lower Medicare Supplement Part F?

One way to lower what you pay for Medicare Supplement Part F is to move to an area where this kind of coverage costs less than it does where you live now. Not many people are going to go to such lengths to save a few dollars a month, though, so here are a handful of other options for cutting your MedSup Plan F costs:

What is the most popular Medicare supplement plan?

Medicare Part F is the most popular Medicare supplement plan around. Here’s why, plus what it covers and costs. The good news for Americans who aren’t entirely happy with the health coverage Original Medicare provides them is that they have options. In particular, they have options when it comes to finding supplemental insurance ...

What does Plan F mean?

It means it helps the people who buy it with all of the payment gaps left open by Medicare Part A and Part B. To put that another way, it often means that those who enroll in Plan F rarely, if ever, have to worry about out-of-pocket costs when they visit a doctor or otherwise seek medical assistance.

How long does Medicare cover coinsurance?

Part A coinsurance and hospital costs up to an additional 365 days after you’ve used up your standard Medicare benefits. Part A hospice care coinsurance or copayment. Part B coinsurance or copayment. Part B excess charge. Skilled nursing facility care coinsurance. First three pints of blood each year.

Which Medicare Supplement Plan is the most expensive?

Medicare Supplement Plan F is great because it provides the most coverage of the 10 currently available MedSup plans. That coverage comes at a cost, however; specifically, Plan F is the most expensive of all the MedSup policies on the market today.

How to figure out how much you have to pay for Plan F?

To figure out how much you may have to pay for Plan F coverage, contact a number of insurance companies that sell the policies in your ZIP code. Compare the prices they quote you and then make your decision based on that.

What is Medicare Part C?

Medicare Part C. Part C is also known as Medicare Advantage. Private health insurance companies offer these plans. When you join a Medicare Advantage plan, you still have Medicare. The difference is the plan covers and pays for your services instead of Original Medicare.

What is hospice care?

Medicare Part A covers hospice care for terminally ill patients who will live six months or less. Patients agree to receive services that focus on providing comfort and that replace the Medicare benefits to treat an illness.

Does Medicare cover chiropractic care?

Medicare has some coverage for chiropractic care if it’s medically necessary. Part B covers a chiropractor’s manual alignment of the spine when one or more bones are out of position. Medicare doesn’t cover other chiropractic tests or services like X-rays, massage therapy or acupuncture.

Does Medicare cover assisted living?

Medicare doesn’t cover costs to live in an assisted living facility or a nursing home. Medicare Part A may cover care in a skilled nursing facility if it is medically necessary. This is usually short term for recovery from an illness or injury.

Is Medicaid part of Medicare?

Medicare and Medicaid (called Medical Assistance in Minnesota) are different programs. Medicaid is not part of Medicare. Here’s how Medicaid works for people who are age 65 and older: It’s a federal and state program that helps pay for health care for people with limited income and assets.

Does Medicare cover colonoscopy?

If you had a different screening for colorectal cancer called a flexible sigmoidoscopy, Medicare covers a screening colonoscopy if it is 48 months or longer after that test. Eye exams. Medicare doesn’t cover routine eye exams to check your vision if you wear eyeglasses or contacts.

What are the parts of Medicare?

There are four parts to Medicare: A, B, C , and D. Part A is automatic and includes payments for treatment in a medical facility. Part B is automatic if you do not have other healthcare coverage, such as through an employer or spouse. Part C, called Medicare Advantage, is a private-sector alternative to traditional Medicare.

How much does Medicare Part A cost?

Medicare Part A covers the costs of hospitalization. When you enroll in Medicare, you receive Part A automatically. For most people, there is no monthly cost, but there is a $1,484 deductible in 2021 ($1,408 in 2020). 1

How much is Part B insurance in 2021?

1 If you're on Social Security, this may be deducted from your monthly payment. 11 . The annual deductible for Part B is $198 in 2020 and rises to $203 in 2021.

What is the Medicare deductible?

The Medicare deductibles, coinsurance and copays listed are based on the 2019 numbers approved by the Centers for Medicare and Medicaid Services. You can go to any hospital, doctor or other health care provider in the U.S. or its territories that accepts Medicare.

Is Blue Cross Medicare endorsed by the government?

This is a solicitation of insurance. We may contact you about buying insurance. Blue Cross Medicare Supplement plans aren't connected with or endorsed by the U.S. government or the federal Medicare program. If you're currently enrolled in Plan A or Plan C, you can stay with your plan as long as you pay your premium.

Does Medicare cover Part B?

The new MACRA law doesn’t allow Medicare supplement plans to cover the Part B deductible for people who are eligible for Medicare on or after Jan. 1, 2020. Because Plans C, F and high-deductible F cover the Part B deductible, they will no longer be available for beneficiaries who become eligible for Medicare on or after Jan. 1, 2020.

What is Medicare Part C?

Medicare Part C, also called Medicare Advantage, is an alternative to original Medicare. It is an all-in-one bundle that includes medical insurance, hospital insurance, and prescription drug coverage. Medicare Part D offers only prescription drug coverage. Below, we examine the differences between Medicare Part B and Part C in terms ...

Does Medicare have a monthly premium?

Every year, each Medicare plan sets out the amount it will charge for premiums, deductibles, and services. The amount varies among plans, and some plans offer zero premiums. Also, because a person must have enrolled in Medicare Part A and Part B to qualify for Medicare Advantage, they must pay the Part B monthly premium.

Does Medicare Part A cover dental care?

As original Medicare comprises Part A and Part B, a person who enrolls in Part B is automatically enrolled in Part A, which covers inpatient hospital care, hospice care, skilled nursing facility care, lab tests, and home health care. Medicare Part A and Part B do not cover the following: prescription drugs. dental care.

Does Medicare pay for Part A?

A person with Plan B also has Plan A, but most people with original Medicare do not pay a Part A monthly premium. However, a $1,484 deductible is payable for Part A hospital inpatient services for each benefit period, together with coinsurance that varies from $0 to $742.