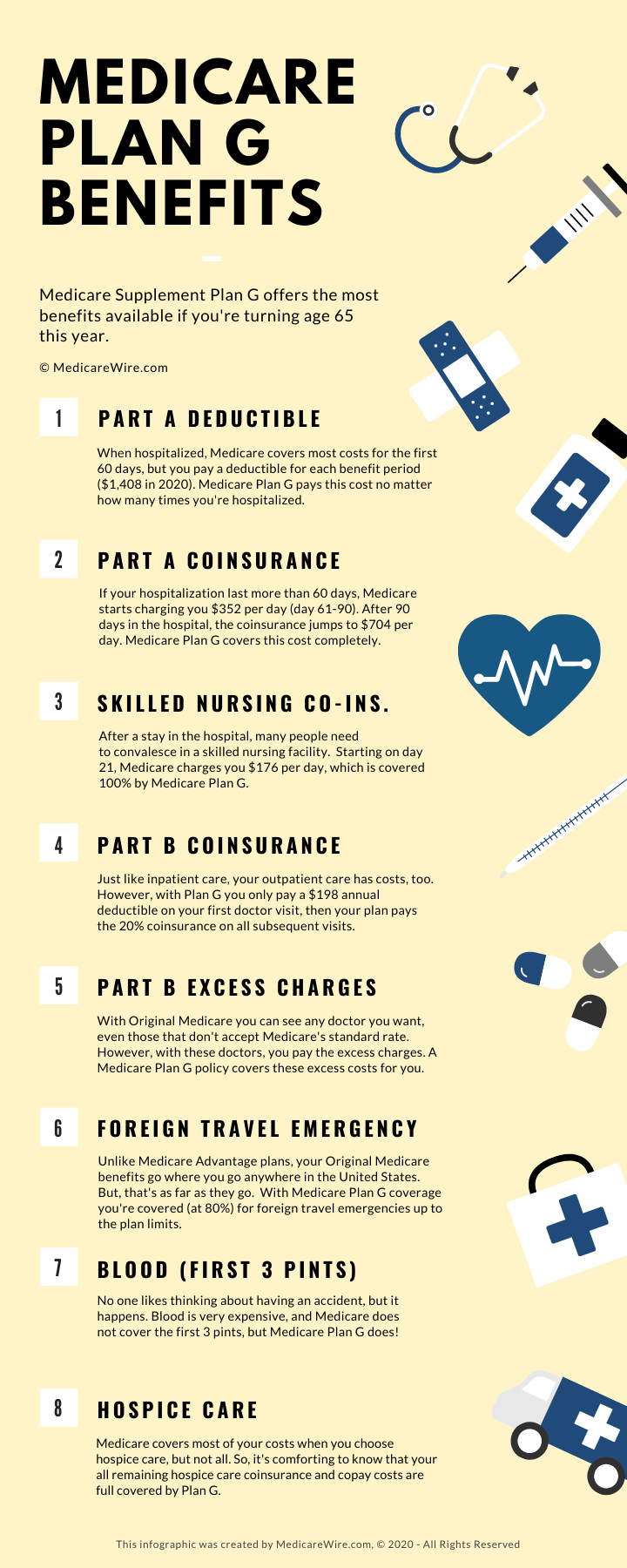

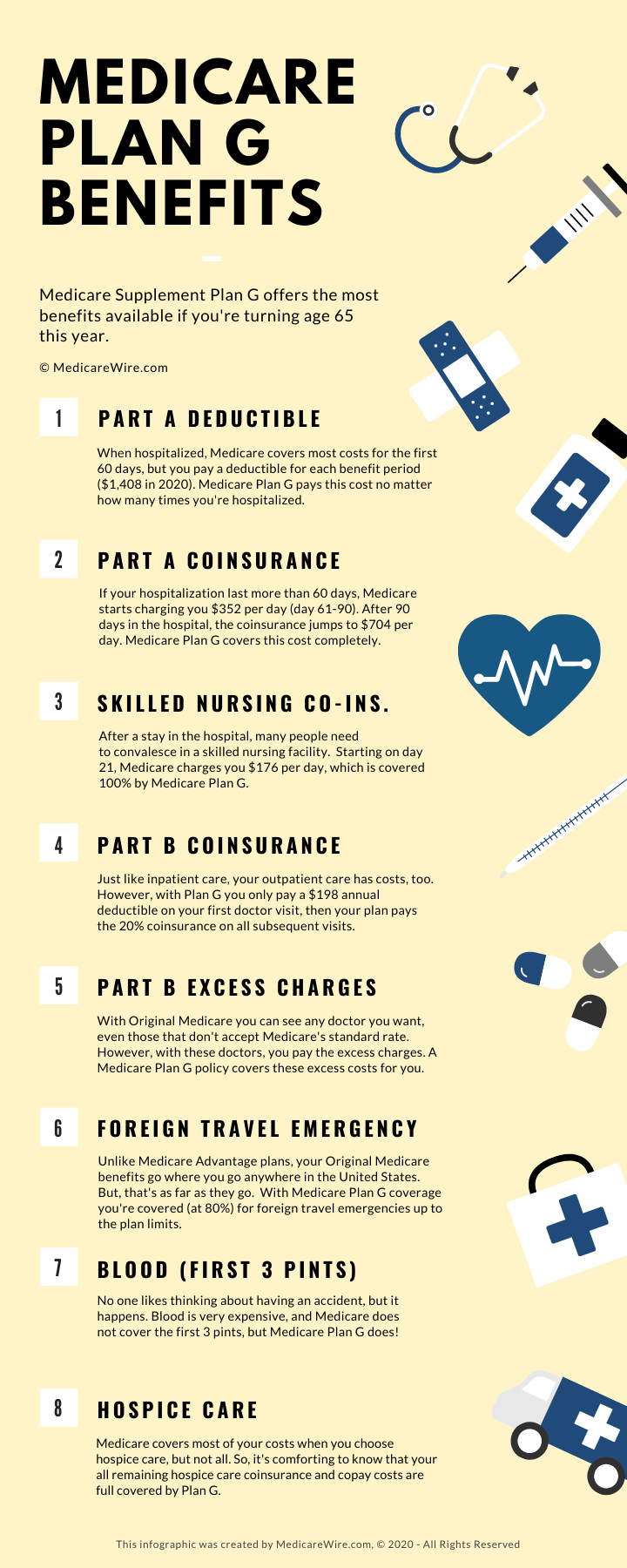

Medicare Plan G is a supplemental health insurance plan thats designed to offset expenses that arent covered by Original Medicare. Plan G policies may be useful for people who are enrolled in Medicare Part A and Medicare Part Bbut need an extra plan to cover copays, coinsurance, and other expenses.

What does Medicare Part G cover and more?

Nov 11, 2020 · Medicare Part G — or Plan G — is one of the most popular Medicare Supplement plans available. Plan G sits just behind Plan F in terms of popularity among American Medicare enrollees who want a bit more coverage. Why? One reason is Medicare Supplement Plan G provides coverage that is nearly as comprehensive as what Plan F provides.

What is plan F and G in Medicare?

What is Medicare Plan G? Medicare Part G – Known as Medicare Plan G – is now the most popular Medigap Plan Available. Medicare Supplement Plan G covers 100% of the gaps in Medicare Part A & B with only one small deductible to pay. More people will enroll in Medicare Plan G this year than any other Medigap plan.

What is the deductible for Medicare Part?

Sep 22, 2021 · Medicare Plan G is a supplemental health insurance plan thats designed to offset expenses that arent covered by Original Medicare. Plan G policies may be useful for people who are enrolled in Medicare Part A and Medicare Part Bbut need an extra plan to cover copays, coinsurance, and other expenses.

What age can you get Medicare Part?

What does Medicare Supplement Plan G cover? Plan G is a comprehensive Medigap policy. It pays for all of the following expenses in full: Deductible for Part A; Coinsurance for Part A; Hospitalization costs under Medicare Part A; Medicare Part A coinsurance or payment for hospice; Coinsurance for skilled nursing facilities; The blood (first 3 pints)

How Does Medicare Plan G work?

Plan G covers everything that Medicare Part A and B cover at 100% except for the Part B deductible. This means that you won't pay anything out-of-pocket for covered services and treatments after you pay the deductible.

Does Medicare Plan G cover prescriptions?

Medicare Plan G does not cover outpatient retail prescriptions that are typically covered by Medicare Part D. It does, however, cover the coinsurance on all Part B medications. These prescriptions are typically for medications used for treatment within a clinical setting, such as for chemotherapy.May 27, 2020

What is the difference between Part G and Part F Medicare?

Although the plans have several similarities, there is one key difference between Plan F and Plan G: With Medicare Plan F, you're getting the plan with the most coverage available. In addition to the above coverage, Plan F also covers Medicare Part B deductible payments. Plan G does not.

Is Medicare G the best plan?

Medicare Plan G is currently the most comprehensive Medicare Supplement plan in terms of the coverage it offers. If you desire stability and knowing what to expect from your health care costs (and if you can afford the premium), Medicare Plan G may be the best option for you.

What is the deductible for Plan G in 2021?

$2,370Effective January 1, 2021, the annual deductible amount for these three plans is $2,370. The deductible amount for the high deductible version of plans G, F and J represents the annual out-of-pocket expenses (excluding premiums) that a beneficiary must pay before these policies begin paying benefits.

What is the monthly premium for Plan G?

Medicare Plan G will cost between $199 and $473 per month in 2020, according to Medicare.gov. You'll see a range of prices for Medicare supplement policies since each insurance company uses a different pricing method for plans.Jan 24, 2022

What are the 4 types of Medicare?

There are four parts of Medicare: Part A, Part B, Part C, and Part D.Part A provides inpatient/hospital coverage.Part B provides outpatient/medical coverage.Part C offers an alternate way to receive your Medicare benefits (see below for more information).Part D provides prescription drug coverage.

Should I switch from F to G?

Two Reasons to switch from Plan F to G Plan G is often considerably less expensive than Plan F. You can often save $50 a month moving from F to G. Even though you will have to pay the one time $233 for the Part B deductible on Medigap G, the monthly savings will be worth it in the long run.Sep 5, 2019

Is Plan G better than Plan F?

Is Medicare Plan G better than Plan F? Medicare Plan G is not better than Plan F because Medicare Plan G covers one less benefit than Plan F. It leaves you to pay the Part B deductible whereas Medigap Plan F covers that deductible.Feb 18, 2021

Does Medicare Plan G have a maximum out-of-pocket?

No out-of-pocket limit Original Medicare doesn't have an out-of-pocket limit. Similarly, Plan G has no out-of-pocket limit to protect you from spending too much on covered health care in a year. If you are interested in an out-of-pocket limit, consider Plan K or Plan L.Dec 12, 2019

What is the deductible for Plan G in 2022?

$2,490Effective January 1, 2022, the annual deductible amount for these three plans is $2,490. The deductible amount for the high deductible version of plans G, F and J represents the annual out-of-pocket expenses (excluding premiums) that a beneficiary must pay before these policies begin paying benefits.

What is the most expensive Medicare Supplement plan?

Because Medigap Plan F offers the most benefits, it is usually the most expensive of the Medicare Supplement insurance plans.

What does Medicare Part G cover?

Medicare Part G fully pays these healthcare costs: Medicare Part A deductible. Part A coinsurance and hospital costs up to an additional 365 days a...

What are the differences between Medicare Supplement Plan G and Plan F?

The main difference between Medicare Supplement Plan G and Plan F is that MedSup Plan F covers your Medicare Part B deductible. Plan G doesn’t cove...

Why should I choose Medicare Supplement Plan G over Plan F?

One reason to choose Medicare Supplement Plan G over Plan F is that insurance companies no longer offer MedSup Plan F to new Medicare enrollees.

Medicare Plan G Coverage

Probably the easiest way to explain what Medicare Plan G covers, is to simply explain what it doesn’t cover. Medigap Plan G pays 100% of the gaps in Medicare (All costs) except for the annual Medicare Part B deductible.

Medicare Supplement Plan G – What it Pays

The following is a list of the rest of the items that Medicare Plan G pays. These are the most common things you might run into when using your coverage.

Medicare Plan G vs Plan F

Medicare plan F used to be the plan with the highest coverage. It paid 100% of all your medical bills for you, including the Medicare Part B deductible.

Medicare Part G Cost

Medicare Plan G varies in cost based on where you live, your age, gender, tobacco use, and if you qualify for a household discount or not. The cost for Plan G Medicare ranges from $85 – $120 per month.

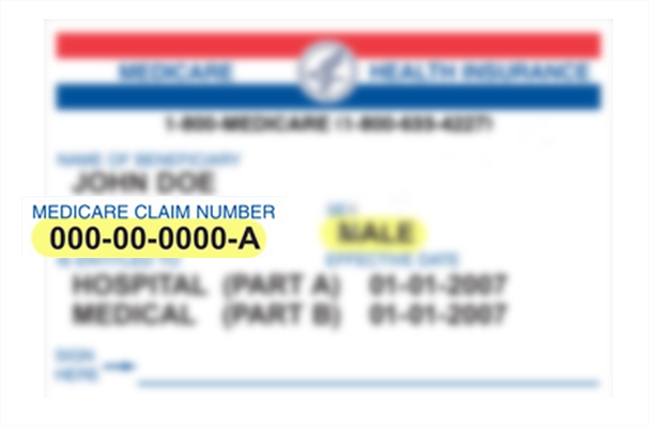

Determine Which Medicare Supplement Plan Gs Are Available

Medicare offers a Find a Plan database to help you search for Medigap plans by ZIP code. For more accurate pricing, enter your age, gender, and whether or not you use tobacco. Scroll to Medicare Plan G or Medicare Plan G High-Deductible to get a quick overview of costs and coverage.

Where Can You Buy Medicare Supplement Plan G

Private insurance companies sell Medigap policies. You can use Medicares search tool to find out which plans are offered in your area. Youll need to enter your ZIP code and select your county to see available plans. Each plan will be listed with a monthly premium range, other potential costs, and what is and isnt covered.

Medicare Supplement Plan G

Medigap is supplemental insurance plan sold by private companies to help cover original Medicare costs, such as deductibles, copayments, and coinsurance.

Is Medicare Plan F Being Discontinued

Yes, Medicare Plan F has been discontinued. The last possible day for new enrollment was December 31, 2019. If you currently have Medicare Plan F, you can continue with the plan, if you so decide. This distinction is worth noting when reviewing the differences involved with Medicare Plan F vs. Plan G.

Why Consider Plan G

Plan G is the top-of-the-line Medigap option if youre newly eligible for Medicare. Depending on where you live in the country, it can range from $99 per month to $476 per month for the plan premium, which is $1,188 to $5,712 per year. For the premium, which is higher than for other Medigap policies, youll get more comprehensive coverage.

How Much Does Medicare Supplement Plan G Cost

What you pay for Medicare Supplement Plan G coverage is based on several factors, including:

What Does Plan G Cover

Plan F is considered the top-of-the-line Medigap policy. It covers 100% of the gaps in Medicare. Plan Gs coverage is nearly as good with one exception: Plan G does not cover the Part B deductible, which is $203 in 2021.

What does Medicare Supplement Plan G cover?

Plan G is a comprehensive Medigap policy. It pays for all of the following expenses in full:

Who is eligible to sign up for Medicare Supplement Plan G?

During Medigap open enrollment, you can purchase a Medigap policy for the first time. This is a 6-month term that begins the month you turn 65 and sign up for Medicare Part B.

Where can I get Medicare Supplement Plan G?

Private insurance firms sell Medigap policies. To get an idea of which plans are available in your area, visit Medicare’s search tool.

Why is Medicare Plan G so popular?

It is because Medigap Plan G is also a long-term rate saver. Medicare Supplemental Plan G has a lower rate increase trend from year to year than Plan F.

What is the difference between Medigap Plan G and Plan N?

With Plan N you will be responsible for the Part B deductible as well as excess charges. With Medigap Plan G, you will be responsible for the Part B deductible but you will have no excess charges.

What is a small deductible for Medicare?

Medigap Plan G: A Small Deductible = Big Savings. Medicare Plan G, also called Medigap Plan G, is an increasingly popular Supplement for several reasons. First, Plan G covers each of the gaps in Medicare except for the annual Part B deductible. This deductible is only $203 in 2021. In fact, if you have a Plan F that has been in place for years, ...

Why is Medicare Supplement G more expensive than Plan N?

Medicare Supplement G usually costs more than Plan N, because it covers more. People seem to like the security and peace of mind that a comprehensive policy like Plan G seems to offer. Want to know which companies offer the best Medicare Plan G policies. Read our Plan G Reviews here or attend one of our free New to Medicare webinars ...

How long does a hospital stay last after Medicare runs out?

It also covers the expensive daily copays that you might encounter for a hospital stay that runs longer than 60 days. It provides an additional 365 days in the hospital after Medicare runs out, and it covers your skilled nursing facility co-insurance, too.

What is Plan G?

After that, Plan G provides full coverage for all of the gaps in Medicare. It pays for your hospital deductible, copays and coinsurance. It also covers the 20% that Part B doesn’t cover.

Does Medicare pay for inpatient hospital?

So, it helps to pay for inpatient hospital costs, such as blood transfusions, skilled nursing, and hospice care. It also covers outpatient medical services such as doctor visits, lab work, diabetes supplies, durable medical equipment, x-rays, ambulance, surgeries and much more. Medicare pays first, then Plan G pays all the rest after you pay ...

Medigap insurance

It is common practice as people become older to rely on healthcare insurance to cover unforeseen medical expenses. Even if a person has just one serious health complication, the financial assets can quickly decrease.

Medigap insurers

While there are medicare choices available to help the elderly with medical bills that they can not pay due to their income, there are still some gaps in coverage that leave many seniors without the best possible treatment.

How much does the medicare part g cost?

As people reach the age where they are eligible for medicare, they begin to wonder how much Medigap would cost. Medigap is a health insurance supplement that compensates for the percentage of medical expenditures that medicare does not cover.

Things to consider for Medigap plans

This insurance covers medical procedures performed at a medicare provider that has been approved by medicare. By following the following considerations, one can make a good decision while purchasing Medigap insurance:

Benefits of Medigap insurance

The US government collaborated with private insurance companies to establish Medigap supplement insurance, which was designed specifically for disabled people and the elderly to provide them with government-administered comprehensive health care.

How and when to change Medigap?

Medigap insurance is supplemental coverage for persons on Medicare that is provided by private health insurance firms. Medigap insurance can assist pay for medical expenses that Medicare does not cover or supplement Medicare payments so that the patient pays less out of pocket. There are a variety of Medigap policies to choose from.

Conclusion

The informed consumer understands the significance of Medigap insurance plans. Given that Medicare is an insufficient system that only provides limited coverage for typical medical treatments, Medigap is unquestionably important for people who anticipate visiting the hospital on a regular basis.