Medicare Supplement Plan M coverage includes the following:

- 100 percent of Part A coinsurance and hospital costs up to an additional 365 days after Medicare benefits are used up

- 50 percent of the Part A deductible

- 100 percent of Part A hospice care coinsurance or copayments

- 100 percent of costs for blood transfusions (first 3 pints)

- 100 percent of skilled nursing facility care coinsurance

Full Answer

What do Medicare Parts A, B, C, D mean?

Apr 12, 2021 · Medicare Supplement Plan M is designed for those who want to pay a lower monthly rate in exchange for paying for half of the annual Part A deductible and all of the usual Part B deductible. If you...

What is covered by Medicare?

Medicare Supplement Plan M is more or less in the middle in terms of the portions of Original Medicare (Part A and Part B) out-of-pocket costs that Medigap plans cover. With a Medigap Plan M policy, the following costs and benefits are covered:

What are the top 5 Medicare supplement plans?

Jun 23, 2020 · Medicare Plan M can help you pay for medical expenses not covered under original Medicare (parts A and B). Like all Medigap plans, Medicare Supplement Plan M doesn’t cover prescription drugs or...

Who qualifies for free Medicare?

Medicare Supplement insurance plan is optional insurance available from private insurance companies. Medicare Supplement (Medigap) Plan M benefits are the same as those of Medigap Plan D, except that with Plan M, you pay half of the Medicare Part A deductible (while Medigap Plan D covers the entire Part A deductible).

What is Medicare supplement M?

Medicare Supplement (Medigap) Plan M was developed to offer a low monthly premium, which is the amount you pay for the plan. In exchange, you'll have to pay half of your Part A hospital deductible. Medigap Plan M is one of the offerings created by the Medicare Modernization Act, which was signed into law in 2003.Jun 23, 2020

What does Medicare Part G mean?

Medicare Plan G is a supplemental Medigap health insurance plan that is available to individuals who are disabled or over the age of 65 and currently enrolled in Medicare. Plan G is one of the most comprehensive Medicare supplement plans that are available to purchase.Jan 24, 2022

What is Medicare Part K?

Medicare Supplement Plan K coverage provides: 50% hospice coverage for Part A coinsurance. 50% of Medicare-eligible expenses for the first 3 pints of blood. 50% Part B coinsurance, except for preventive care services, which are covered 100%Aug 26, 2021

What is Medicare Part N?

Medicare Plan N is coverage that helps pay for the out-of-pocket expenses not covered by Medicare Parts A and B. It has near-comprehensive benefits similar to Medigap Plans C and F (which are not available to new enrollees), but Medicare Plan N has lower premiums. This makes it an attractive option to many people.Nov 23, 2021

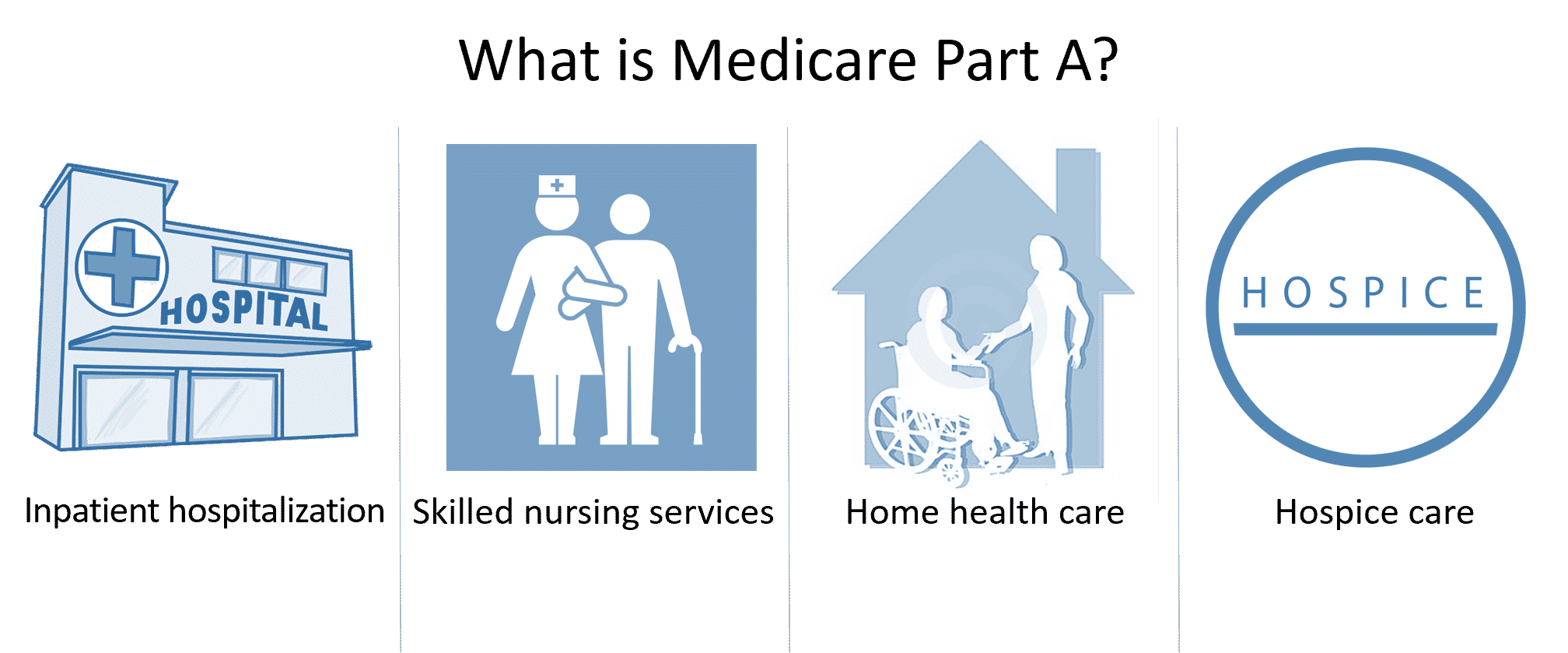

What are the 4 types of Medicare?

There are four parts of Medicare: Part A, Part B, Part C, and Part D.Part A provides inpatient/hospital coverage.Part B provides outpatient/medical coverage.Part C offers an alternate way to receive your Medicare benefits (see below for more information).Part D provides prescription drug coverage.

Does Medicare pay for gym for seniors?

Original Medicare is a fee-for-service health plan that has two parts: Part A (Hospital Insurance) and Part B (Medical Insurance). After you pay a deductible, Medicare pays its share of the Medicare-approved amount, and you pay your share (coinsurance and deductibles). doesn't cover gym memberships or fitness programs.

What is a plan K supplement?

Medigap Plan K is a Medicare Supplement Insurance plan that covers some out-of-pocket expenses for Medicare Part A and Part B beneficiaries. Plan K differs from most other Medigap plan options because it pays only part of the cost of the services it covers, but that reduced coverage also helps keep premium costs down.Feb 2, 2022

Is there a Medicare plan L?

Medigap Plan L covers the basic benefits that all Medicare Supplement insurance plans are required to offer, but covers some costs partially instead of fully. Medigap Plan L covers 100% of the costs of: Medicare Part A coinsurance and hospital costs up to one year after Original Medicare benefits are exhausted.

Does AARP plan k cover Medicare deductible?

Here's a breakdown of the costs Medigap Plan K will cover: Part A coinsurance and hospital costs for up to an additional 365 days after Medicare benefits are exhausted: 100% Part A deductible: 50%Jun 18, 2020

What is difference between Plan G and N?

Plan G and Plan N premiums are lower to reflect that. Plan G will typically have higher premiums than Plan N because it includes more coverage. But it could save you money because out-of-pocket costs with Plan N may equal or exceed the premium difference with Plan G, depending on your specific medical needs.

What is the difference between Plan G and Plan N?

When you compare Plan G vs Plan N, you'll see that Plan G comes with more coverage. However, Plan N will come with a lower monthly premium. In exchange for a lower monthly premium, you agree to pay small copays when visiting the doctor or hospital.

Can I switch from Plan N to Plan G?

Yes, you can. However, it usually still requires answering health questions on an application before they will approve the switch. There are a few companies in a few states that are allowing their members to switch from F to G without review, but most still require you to apply to switch.Jan 14, 2022

What is covered by Medigap Plan M?

With a Medigap Plan M policy, the following costs and benefits are covered: Medicare Part A hospital coinsurance and hospital costs up to a year after Original Medicare benefits are used up.

What is Medicare Supplement?

Medicare Supplement insurance is sold by private insurance companies that set monthly premiums for their policies based on any of three rating systems: community-rated, issue-age-rated, and attained-age-rated. Insurance companies may consider factors such as gender, age, and health status to set premium amounts. So, Medigap Plan M premiums may vary depending on where you buy it, but all Medigap Plan M policies include the same basic benefits.

When do you enroll in Medigap Plan M?

If you want to enroll in Medigap Plan M (or any Medigap policy), you might want to consider enrolling during your six-month Medigap Open Enrollment Period (OEP). This six-month period begins on the first day of the month that you’re both aged 65 or over, and enrolled in Medicare Part B.

Does Medigap Plan M include the same benefits?

So, Medigap Plan M premiums may vary depending on where you buy it, but all Medigap Plan M policies include the same basic benefits.

Does Medicare cover foreign travel?

Medicare Part A deductible (50%) Foreign travel emergency coverage (80% of approved costs up to plan limits) One Original Medicare expense that Medigap Plan M doesn’t cover is the Medicare Part B deductible. Medigap Plan M also doesn’t cover Part B excess charges. Excess charges are an amount that a doctor or physician can charge (up to 15%) ...

What is Medicare Supplement Plan M?

Medicare Supplement (Medigap) Plan M was developed to offer a low monthly premium, which is the amount you pay for the plan. In exchange, you’ll have to pay half of your Part A hospital deductible. Medigap Plan M is one of the offerings created by the Medicare Modernization Act, which was signed into law in 2003.

What are not covered by Plan M?

The following benefits are not covered under Plan M: Part B deductible. Part B excess charges. If your doctor charges a fee above the Medicare assigned rate, this is called a Part B excess charge. With Medigap Plan M, you’re responsible for paying these Part B excess charges. In addition to these exceptions, there are a few other things ...

What states have Medigap Plan M?

If you live in Massachusetts, Minnesota, or Wisconsin, Medigap policies — including the coverage offered through Medigap Plan M — are standardized differently than in other states and may have different names.

How many Medigap plans are there?

In most states, you can choose from among 10 different standardized Medigap plans (A, B, C, D, F, G, K, L, M, and N). Each plan has a different premium and features different coverage options. This gives you the flexibility to choose your coverage based on your budget and your healthcare needs.

What percentage of Medicare pays for outpatient care?

After you’ve met the deductible, Medicare pays for 80 percent of your outpatient care. Then, Medicare Supplement Plan M pays for the other 20 percent. If your surgeon doesn’t accept Medicare’s assigned rates, you’ll have to pay the overage, which is known as the Part B excess charge. You can check with your doctor before receiving care.

Does Medigap cover dental?

Medigap plans also do not cover vision, dental, or hearing care. If that coverage is important to you, you might want to consider Medicare Advantage (Part C), as these plans often include such benefits. As with Medicare Part D, you purchase a Medicare Advantage plan from a private insurance company. It’s important to know that you can’t have both ...

Does Medicare Supplement Plan M cover dental?

Medicare Plan M can help you pay for medical expenses not covered under original Medicare (parts A and B). Like all Medigap plans, Medicare Supplement Plan M doesn’t cover prescription drugs or extra benefits, such as dental, vision, or hearing.

What is an excess charge in Medicare?

Part B “excess charges” are additional costs outside of the Medicare-approved charge. For example, suppose Medicare’s allowed charge for a specialist appointment was $100, and the physician chose not to accept that amount and instead charged an additional 15% for the visit.

How long does Medicare cover hospital coinsurance?

Part A hospital coinsurance and hospital costs up to an additional 365 days after Original Medicare benefits are exhausted. Part A hospice care coinsurance payment or copayment. Part B copayment or coinsurance payment. First three pints of blood for a medical procedure. Skilled nursing facility (SNF) care coinsurance.

What does it mean when a Medigap plan has an out-of-pocket spending limit?

When a Medigap plan has an out-of-pocket spending limit, it means that once you’ve spent that amount on out-of-pocket costs and your yearly Part B deductible, your plan will pay 100% of covered services for the rest of the calendar year.

Does Medicare Supplement have the same coverage as Plan M?

Note that because Medicare Supplement insurance plans are standardized, plans named with the same letter designation include the same coverage no matter where you buy the policy. That is, a Medigap Plan M policy you buy in Nevada has the same benefits as a Plan M policy you buy in Texas. (Plan premiums and availability may differ.)

What is Medicare Supplement Plan M?

Medigap Plan M: the Deductible-sharing Plan. Medicare Supplement Plan M is one of the new Supplements created by the Medicare Modernization Act. It first hit the Medicare insurance market in the summer of 2010. (Sometimes we hear people call it Medicare Part M or Medigap Part M, but the correct term is Plan M.)

Is Plan M a good fit for Medicare?

Plan M could be a good fit for someone who doesn’t expect to visit the hospital often and feels he can afford the occasional cost-sharing . However , it’s important to have a licensed agent who specializes in Medicare Supplements to help you.

Does Medicare Plan M have a deductible?

However, it has a slightly reduced monthly premium in exchange for your willingness to pay half of your hospital deductible and all of your annual outpatient deductible. By sharing in these deductibles as well as excess charges, you get the benefit of reduced premiums.

What is deductible in Medicare?

deductible. The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. at the start of each year, and you usually pay 20% of the cost of the Medicare-approved service, called coinsurance.

What is Medicare for people 65 and older?

Medicare is the federal health insurance program for: People who are 65 or older. Certain younger people with disabilities. People with End-Stage Renal Disease (permanent kidney failure requiring dialysis or a transplant, sometimes called ESRD)

What is the standard Part B premium for 2020?

The standard Part B premium amount in 2020 is $144.60. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA). IRMAA is an extra charge added to your premium.

Do you pay Medicare premiums if you are working?

You usually don't pay a monthly premium for Part A if you or your spouse paid Medicare taxes for a certain amount of time while working. This is sometimes called "premium-free Part A."

Does Medicare Advantage cover vision?

Most plans offer extra benefits that Original Medicare doesn’t cover — like vision, hearing, dental, and more. Medicare Advantage Plans have yearly contracts with Medicare and must follow Medicare’s coverage rules. The plan must notify you about any changes before the start of the next enrollment year.

Does Medicare cover all of the costs of health care?

Original Medicare pays for much, but not all, of the cost for covered health care services and supplies. A Medicare Supplement Insurance (Medigap) policy can help pay some of the remaining health care costs, like copayments, coinsurance, and deductibles.

Does Medicare cover prescription drugs?

Medicare drug coverage helps pay for prescription drugs you need. To get Medicare drug coverage, you must join a Medicare-approved plan that offers drug coverage (this includes Medicare drug plans and Medicare Advantage Plans with drug coverage).