What is the difference between a Medicare PDP and MAPD?

Mar 07, 2022 · Medicare Part D prescription drug plans are also known as PDPs. These are standalone plans that can be purchased through private insurance companies. PDPs provide coverage for prescription drugs and medications and may also cover some vaccines too. Original Medicare (Parts A & B) doesn't provide prescription drug coverage.

What is the best Medicare Prescription Plan?

A Part D prescription drug plan (PDP) – or “stand-alone prescription drug plan” – is one of two main ways Medicare beneficiaries can enroll in Medicare coverage for prescription drugs. The Medicare Part D benefit is offered through private insurers, either as a stand-alone Part D plan (PDP) or a Medicare Advantage plan that has prescription drug benefits (MAPD).

Does Medicare cover Tier 5 drugs?

Mar 06, 2022 · Definition of Medicare Part D . Part D is an optional Medicare benefit that helps pay for your prescription drug expenses. If you want this coverage, you will have to pay an additional premium. Private insurance companies contract with the federal government to offer Part D programs through the Medicare system.

What is Medicare Part D policy?

Oct 30, 2014 · Medicare Part D is Medicare’s prescription drug program offered through private companies. While many think that the enhanced plans offered better drug coverage that generally is not the case. Let us explain the real differences between the two prescription drug plans. What Makes a Plan Enhanced?

What does PDP mean in Medicare?

Medicare Prescription Drug PlanMedicare Cost Plan Join a Medicare Prescription Drug Plan (PDP). These plans add coverage to Original Medicare, and can be added to one of these: • A Medicare Savings Account (MSA) Plan.

Is PDP the same as Part D?

A Medicare Prescription Drug plan (PDP) is an insurance policy that covers take-home drugs prescribed by a doctor. Out-of-pocket costs usually apply. PDPs are also known as Medicare Part D. Private insurance companies sell these plans, following approval by Medicare.

Why do Medicare Part D plans have different premiums?

Another reason some prescriptions may cost more than others under Medicare Part D is that brand-name drugs typically cost more than generic drugs. And specialty drugs used to treat certain health conditions may be especially expensive.

Why is Medicare charging me for Part D?

If you have a higher income, you might pay more for your Medicare drug coverage. If your income is above a certain limit ($87,000 if you file individually or $174,000 if you're married and file jointly), you'll pay an extra amount in addition to your plan premium (sometimes called “Part D-IRMAA”).

What does a PDP cover?

What is a PDP (Prescription Drug Plan)? Medicare Part D prescription drug plans are also known as PDPs. These are standalone plans that can be purchased through private insurance companies. PDPs provide coverage for prescription drugs and medications and may also cover some vaccines too.

Do I need Medicare Part D if I don't take any drugs?

Even if you don't take drugs now, you should consider joining a Medicare drug plan or a Medicare Advantage Plan with drug coverage to avoid a penalty. You may be able to find a plan that meets your needs with little to no monthly premiums. 2. Enroll in Medicare drug coverage if you lose other creditable coverage.

What is the most popular Medicare Part D plan?

Best-rated Medicare Part D providersRankMedicare Part D providerMedicare star rating for Part D plans1Kaiser Permanente4.92UnitedHealthcare (AARP)3.93BlueCross BlueShield (Anthem)3.94Humana3.83 more rows•Mar 16, 2022

Is Medicare Part D automatically deducted from Social Security?

If you receive Social Security retirement or disability benefits, your Medicare premiums can be automatically deducted. The premium amount will be taken out of your check before it's either sent to you or deposited.Dec 1, 2021

Who has the cheapest Part D drug plan?

SilverScript Medicare Prescription Drug Plans Although costs vary by zip code, the average nationwide monthly premium cost of the SmartRX plan is only $7.08, making it the most affordable Medicare Part D plan on the market.

What is the average cost of a Medicare Part D plan?

Premiums vary by plan and by geographic region (and the state where you live can also affect your Part D costs) but the average monthly cost of a stand-alone prescription drug plan (PDP) with enhanced benefits is about $44/month in 2021, while the average cost of a basic benefit PDP is about $32/month.

Are Medicare Part B premiums going up in 2021?

In November 2021, CMS announced the monthly Medicare Part B premium would rise from $148.50 in 2021 to $170.10 in 2022, a 14.5% ($21.60) increase.Jan 12, 2022

What is the cost of Medicare Part D for 2022?

Part D. The average monthly premium for Part coverage in 2022 will be $33, up from $31.47 this year. As with Part B premiums, higher earners pay extra (see chart below). While not everyone pays a deductible for Part D coverage — some plans don't have one — the maximum it can be is $480 in 2022 up from $445.Dec 31, 2021

What is a PDP plan?

A Part D prescription drug plan (PDP) – or “stand-alone prescription drug plan” – is one of two main ways Medicare beneficiaries can enroll in Medicare coverage for prescription drugs. The Medicare Part D benefit is offered through private insurers, either as a stand-alone Part D plan (PDP) or a Medicare Advantage plan that has prescription drug ...

Can you get PDP with Medicare?

A PDP can be purchased by beneficiaries with Original Medicare coverage (with or without a Medigap plan) and – in some cases –by Medicare Advantage (MA) beneficiaries who don’t have a prescription drug benefit included in their MA plan.

What is Medicare Part D?

Key Takeaways. Medicare Part D is an optional coverage available for a cost that can help pay for prescription drugs. Medicare Part D is sold by private insurance companies that have contracted with Medicare to offer it to people eligible for Medicare. Not all Part D plans operate everywhere, nor do all of the plans offer ...

What drugs are covered by Part D?

Drugs covered by each Part D plan are listed in their “formulary,” and each formulary is generally required to include drugs in six categories or protected classes: antidepressants, antipsychotics, anticonvulsants, immunosuppressants for treatment of transplant rejection, antiretrovirals, and antineoplastics.

What are the different tiers of Medicare?

The drugs in the plan’s formulary may be further placed into different tiers that determine your cost. For example: 1 Tier 1: The most generic drugs with the lowest copayments 2 Tier 2: Preferred brand-name drugs with medium copayments 3 Tier 3: Non-preferred brand name drugs with higher copayments 4 Specialty: Drugs that cost more than $670 per month, the highest copayments 4

How long can you go without Medicare Part D?

You can terminate Part D coverage during the annual enrollment period, but if you go 63 or more days in a row without creditable prescription coverage, you’ll likely face a penalty if you later wish to re-enroll. To disenroll from Part D, you can: Call Medicare at 1-800-MEDICARE.

What happens if you don't have Part D coverage?

The late enrollment penalty permanently increases your Part D premium. 3. Prescription drug coverage that pays at least ...

How to disenroll from Medicare?

Call Medicare at 1-800-MEDICARE. Mail or fax a letter to Medicare telling them that you want to disenroll. If available, end your plan online. Call the Part D plan directly; the issuer will probably request that you sign and return certain forms.

What happens if you don't enroll in Part D?

Not enrolling in Part D during the initial enrollment period could result in a late-enrollment penalty that permanently increases your Part D premium.

What is Medicare PDP?

Medicare PDP: Basic Vs. Enhanced Drug Plans. Medicare Part D is Medicare’s prescription drug program offered through private companies. While many think that the enhanced plans offered better drug coverage that generally is not the case. Let us explain the real differences between the two prescription drug plans.

What is the phone number for Medicare?

If you have an urgent matter or need enrollment assistance, call us at 800-930-7956. By submitting your question here, you agree that a licensed sales representative may respond to you about Medicare Advantage, Prescription Drug, and Medicare Supplement Insurance plans.

Which has lower cost sharing?

Basic Plans Generally Have Lower Cost-Sharing. Basic plans generally have lower cost-sharing costs than enhanced prescription drug plans. Nearly a third of all enhanced drug plans charge more than the average for preferred brand name drugs, more than half charge more for non-preferred brand drugs, and nearly 75% charge more for specialty tiered ...

Can you get better drugs with enhanced insurance?

Most people think you get better drugs from an enhanced plan but that isn’t necessarily the case. In actuality, most basic and enhanced plans offered by the same insurance company cover identical drug formularies (list of drug coverage).

Does Kaiser have a deductible?

According to the Kaiser Family Foundation (KFF) more than two-thirds of enhanced prescription drug plans do not have a deductible, whereas only 12% of basic plans offer a $0 deductible. When a basic plan offers a $0 deductible they make up these costs by charging more in cost-sharing (copays and coinsurance (% charged), ...

What is Medicare Part D?

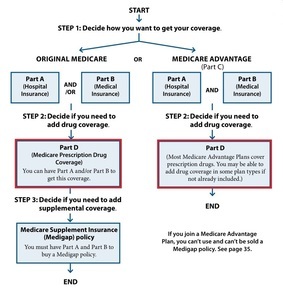

Medicare Part D plans provide supplemental prescription benefits to Medicare beneficiaries for outpatient prescription drugs. Members have the option to purchase a stand-alone Part D plan or have prescription benefits through Part C plans, which are a combination of hospital coverage (Medicare Advantage) and medical insurance (Medicare Part B).

What is the Medicare Coverage Gap Discount Program?

To prioritize affordability, the Medicare Coverage Gap Discount Program promotes manufacturer discounts to all drug offerings in Part D plans. Only pharmaceutical manufacturers that signed a Discount Program agreement had its medications covered in Part D plans as of 2011.

Who is the CEO of UnitedHealthcare?

Michael Anderson, CEO of Medicare Part D, UnitedHealthcare. “In assessing prescription drug coverage, we encourage people to consider the following when choosing a plan: your drugs, your pharmacy, and your total costs,” Anderson said. Part D plans have formularies, or a list of medications covered by the plan.

Can formularies change?

But formularies can change throughout the year as therapies change, new drugs are released, and new medical information becomes available. If the Food and Drug Administration (FDA) marks a drug as unsafe, health plans must also remove it from its formulary. Therefore, formularies can be ever-changing.

Does Medicare Part D cover outpatient prescriptions?

Medicare Part D plan offerings cover outpatient prescription medications. And enrollment has doubled since the start of the program.

How to get prescription drug coverage

Find out how to get Medicare drug coverage. Learn about Medicare drug plans (Part D), Medicare Advantage Plans, more. Get the right Medicare drug plan for you.

What Medicare Part D drug plans cover

Overview of what Medicare drug plans cover. Learn about formularies, tiers of coverage, name brand and generic drug coverage. Official Medicare site.

How Part D works with other insurance

Learn about how Medicare Part D (drug coverage) works with other coverage, like employer or union health coverage.

What is Medicare Part D?

Medicare Part D plans are private insurance plans. Insurance companies are free to design plan benefits and cost-sharing structures to meet the needs of their members, as long as they follow Medicare’s rules for minimum coverage requirements. Your costs and benefits may be different with each plan available in your area.

When do you enter the coverage gap?

In 2020, you enter the coverage gap once you and your insurance company spend ...

What is the maximum deductible for 2020?

The 2020 maximum deductible set by CMS is $435, however, insurers can set their deductible below the limit. According to research by the Kaiser Family Foundation, 86% of stand-alone Part D prescription drug plans have an annual deductible.

Does Medicare Supplement Insurance cover Part D?

Also remember a Medicare Supplement Insurance Plan doesn’t cover any costs associated with Medicare Part D coverage. Finally, compare pharmacy networks and benefits such as mail-order pharmacies. If you have a preferred pharmacy and it’s not in a plan’s network, you may be happier with a different plan.

Does Medicare cover prescription drugs?

Medicare Part D coverage for prescription drugs is technically optional , but if you enroll in Original Medicare (Part A and Part B), there is very little coverage for prescription medications you take at home. For that reason, most Medicare enrollees choose to buy a Medicare Part D plan to help pay for prescription drugs.

What Does Part D Cover?

Who Isn’T Covered by Part D?

- Medicare patients are eligible for Part D supplemental plans, and over 70 percent of all beneficiaries takeadvantage of this benefit. But several plan options Medicare eligible patients have include prescription benefits, including most Medicare Advantage plans, Medicare Part C plans, Veteran Affairs coverage, and TRICARE. Patients on these insurance plans likely do not ne…

What Do Part D Plans Mean For Pharma?

- Step therapy or fail first methods are built into many Part D formularies. Patients often must trya plan’s preferred medicine and fail before receiving authorization to take the original medication a provider prescribed. Not only can this lower patient adherence to medication, but it can also have detrimental effects on patient health outcomes. Del...

What Is The Future of Part D?

- As Part D plans are still in their infancy compared to other public plans, they continue to develop. A growing elderly population means more individuals will be eligible for Medicare and more individuals will need supplemental Part D coverage. “As the needs and preferences of the Medicare-eligible population continue to evolve, we are committed to offering diverse plan optio…