How much does Medicare cost at age 65?

17.9 percent in 2016—up from a 17.7 percent share in 2015. SOURCE: Centers for Medicare & Medicaid Services, Office of the Actuary, National Health Statistics Group. 2 Growth in National Health Expenditures and

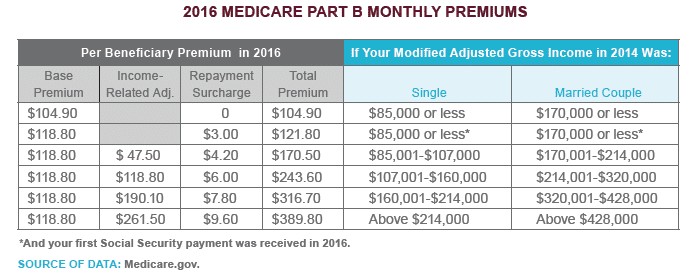

What is the monthly premium for Medicare Part B?

Feb 02, 2015 · Reduce Medicare Coverage of Bad Debts: For most institutional provider types, Medicare currently reimburses 65 percent of bad debts resulting from beneficiaries’ non‑payment of deductibles and coinsurance after providers have made reasonable efforts to collect the unpaid amounts. Starting in 2016, this proposal would reduce bad debt payments to 25 percent over 3 …

Is Medicare Part B premium?

Oct 14, 2015 · For employees, the Medicare payroll tax rate is 1.45 percent on all earnings, bringing the combined Social Security and Medicare payroll tax for employees to 7.65 percent—with only the Social ...

Is Medicare Part B deductible?

Nov 16, 2015 · It's Official: Medicare Part B Premiums Will Rise 16% In 2016 For Some Seniors. Ashlea Ebeling. Senior Contributor. Opinions expressed by Forbes Contributors are their own. Nov 16, 2015,04:57pm ...

What was Medicare premiums in 2016?

Some people already signed up for Part B could see a hike in premiums.How Much You'll Pay for Medicare Part B in 2016Single Filer IncomeJoint Filer Income2016 Monthly PremiumUp to $85,000Up to $170,000$121.80 or $104.90*$85,001 - $107,000$170,001 - $214,000$170.50$107,001 - $160,000$214,001 - $320,000$243.602 more rows

What is the Medicare percentage?

1.45%The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total.

What is the 2016 Medicare Tax Rate This rate is applied to what maximum level of salary and wages?

The Social Security portion is 6.20% on earnings up to the applicable taxable maximum amount. The Medicare portion is 1.45% on all earnings....2016 Payroll Tax Unchanged; Tax Brackets Nudge Up.2016 Tax Rates: Married Filing Joint ReturnIf Taxable Income Is:The Tax Rate Is:Over $466,950$130,578.50 plus 39.6% of the excess over $466,9507 more rows•Oct 15, 2015

What was the Social Security limit for 2016?

Contribution and benefit bases, 1937-2022YearAmount2014117,0002015118,5002016118,5002017127,20013 more rows

How is Medicare calculated?

Medicare premiums are based on your modified adjusted gross income, or MAGI. That's your total adjusted gross income plus tax-exempt interest, as gleaned from the most recent tax data Social Security has from the IRS.

What is the Medicare percentage for 2021?

1.45%2021-2022 FICA tax rates and limitsEmployee paysEmployer paysMedicare tax1.45%.1.45%.Total7.65%7.65%Additional Medicare tax0.9% (on earnings over $200,000 for single filers; $250,000 for joint filers)1 more row•Jan 13, 2022

How do you calculate additional Medicare tax 2021?

It is paid in addition to the standard Medicare tax. An employee will pay 1.45% standard Medicare tax, plus the 0.9% additional Medicare tax, for a total of 2.35% of their income....What is the additional Medicare tax?StatusTax thresholdmarried tax filers, filing separately$125,0003 more rows•Sep 24, 2020

How is FICA tax calculated 2016?

To calculate FICA tax contribution for an employee, multiply their gross pay by the Social Security and Medicare tax rates. For example, if an employee's taxable wages are $700 for the week, their social security contribution would be: $700.00 x 6.2% = $43.40.Feb 24, 2020

What percentage is federal income tax?

The federal individual income tax has seven tax rates ranging from 10 percent to 37 percent (table 1). The rates apply to taxable income—adjusted gross income minus either the standard deduction or allowable itemized deductions. Income up to the standard deduction (or itemized deductions) is thus taxed at a zero rate.

What is the Medicare tax rate for 2017?

1.45%Note: The 7.65% tax rate is the combined rate for Social Security and Medicare. The Social Security portion is 6.20% on earnings up to the applicable taxable-maximum amount. The Medicare portion is 1.45% on all earnings....2017 Payroll Taxes Will Hit Higher Incomes.Tax Rate2017 Taxable Income2016 Taxable Income39.6%$235,351+233,476+6 more rows•Oct 19, 2016

At what age is Social Security no longer taxed?

At 65 to 67, depending on the year of your birth, you are at full retirement age and can get full Social Security retirement benefits tax-free.

What is the max Social Security benefit for 2021?

The cap, which is the amount of earnings subject to Social Security tax, is $147,000 in 2022, up from $142,800 in 2021. Social Security benefits are calculated by combining your 35 highest-paid years (if you worked for more than 35 years).

The Four Parts of Medicare

Part A ($195.4 billion gross fee‑for‑service spending in 2016): Medicare Part A pays for inpatient hospital, skilled nursing facility, home health...

2016 Legislative Proposals

The FY 2016 Budget includes a package of Medicare legislative proposals that will save a net $423.1 billion over 10 years. The proposals are scored...

Affordable Care Act Highlights Strengthening Medicare

The Affordable Care Act takes numerous steps to strengthen the quality, accessibility, and sustainability of care provided to Medicare beneficiarie...

Highlights of The Protecting Access to Medicare Act

On April 1, 2014, the President signed the Protecting Access to Medicare Act into law. The law prevented an estimated reduction in physician paymen...

Highlights of The Improving Medicare Post-Acute Care Transformation Act of 2014

The Improving Medicare Post-Acute Care Transformation Act mandates that CMS develop and implement a post-acute care standardized and interoperable...

How much money did Medicare spend in 2016?

In FY 2016, the Office of the Actuary has estimated that gross current law spending on Medicare benefits will total $672.6 billion. Medicare will provide health insurance to 57 million individuals who are 65 or older, disabled, or have end-stage renal disease.

What is the Medicare budget for 2016?

The FY 2016 Budget includes a package of Medicare legislative proposals that will save a net $423.1 billion over 10 years. The proposals are scored off the President’s Budget adjusted baseline, which assumes a zero percent update to Medicare physician payments. These reforms will strengthen Medicare by more closely aligning payments with the costs of providing care, encouraging health care providers to deliver better care and better outcomes for their patients, and improving access to care for beneficiaries. The Budget includes investments to reform Medicare physician payments and accelerate physician participation in high-quality and efficient healthcare delivery systems. Finally, it makes structural changes in program financing that will reduce Federal subsidies to high income beneficiaries and create incentives for beneficiaries to seek high value services. Together, these measures will extend the Hospital Insurance Trust Fund solvency by approximately five years.

What is the authority for a program to prevent prescription drug abuse in Medicare Part D?

Establish Authority for a Program to Prevent Prescription Drug Abuse in Medicare Part D: HHS requires Part D sponsors to conduct drug utilization review, which assesses the prescriptions filled by a particular enrollee.

How many people are in Medicare Part D in 2016?

In 2016, the number of beneficiaries enrolled in Medicare Part D is expected to increase by about 3.5 percent to 43.7 million , including about 12.6 million beneficiaries who receive the low‑income subsidy.

How much has Medicare saved?

Cumulatively since enactment of the Affordable Care Act, 9.4 million beneficiaries have saved a total of $15 billion on prescription drugs. The FY 2016 Budget includes a package of Medicare legislative proposals that will save a net $423.1 billion over 10 years.

What are the goals of CMS for FY 2016?

Clinical Quality Improvement: The key goals for FY 2016 are improving the health status of communities; delivering patient-centered, reliable, accessible, and safe care; and better care at lower costs. Through improving cardiac health, reducing disparities in diabetic care, using immunization information systems and meaningful use of health IT to improve prevention coordination, CMS aims to improve the health status ofbeneficiaries. These goals will also be achieved by efforts to reduce healthcare‑associated infections, healthcare‑associated conditions in nursing homes, and hospital readmissions and adverse drug events.

What is Medicare Part C?

Part C ($198.0 billion gross spending in 2016): Medicare Part C, the Medicare Advantage program, pays plans a capitated monthly payment to provide all Part A and B services, and Part D services, if offered by the plan.

What is the Social Security earnings limit for 2016?

Earnings Limit Unchanged. The annual earnings limit for those who both work and claim Social Security benefits will stay at $15,720 in 2016 for individuals who opt to receive benefits early (ages 62 through 65). For those who turn 66 in 2016, the earning limit remains at $41,880.

What is the tax rate for Medicare and Social Security?

Note: The 7.65% tax rate is the combined rate for Social Security and Medicare. The Social Security portion is 6.20% on earnings up to the applicable taxable maximum amount. The Medicare portion is 1.45% on all earnings. Source: Social Security Administration.

What is the Medicare payroll tax rate?

For employees, the Medicare payroll tax rate is 1.45 percent on all earnings, bringing the combined Social Security and Medicare payroll tax for employees to 7.65 percent—with only the Social Security portion limited to the $118,500 earned-income threshold.

When was Revenue Procedure 2015-53 issued?

The IRS issued Revenue Procedure 2015-53 at the end of October 2015, with annual inflation adjustments for income tax provisions including 2016 taxable income ranges for singles, married (filing jointly), married (filing separately), and heads of households. While there was no statutory increase in tax rates for 2016, ...

Is there a Social Security increase for 2016?

On Oct. 15, 2015, the Social Security Administration (SSA) announced that there will be no increase in monthly Social Security benefits in 2016, and that the maximum amount of wages subject to Social Security taxes will also remain unchanged at $118,500. Earnings above this amount are not subject to the Social Security portion ...

Did the CPI increase in 2016?

While there was no statutory increase in tax rates for 2016, the modest CPI increase did nudge income tax brackets slightly upward, which could mean lower taxes for employees whose income stayed flat. (For a look back at 2015 tax brackets, see 2015 Income Tax Rates and Ranges .) 2016 Tax Rates: Single Filing Individual Return.

Will HR adjust payroll taxes in 2016?

HR professionals won’t have to adjust their payroll tax systems in 2016 for a Social Security FICA increase, as the amount of earned income subject to Social Security taxes won’t change, given the absence of inflation and tepid wage increases over the past year. But the modest amount of inflation this year was enough to cause small upward ...