What does Medicare supplement plan K cover?

Medicare Supplement insurance Plan K out-of-pocket limit. Medigap Plan K is one of two Medigap plans that includes a yearly out-of-pocket limit, which is $6,220 in 2021. After your out-of-pocket costs have reached this limit (which includes the yearly Part B deductible), Medigap Plan K may cover 100% of your Medicare-covered costs for the rest of the year.

Are Medicare supplement plans worth it?

Mar 07, 2022 · Medicare Supplement Plan K is one of the most popular medical supplement insurance plans. Given that it limits your annual out-of-pocket costs, it is particularly attractive to those with chronic conditions.

What are the best Medicare supplement plans?

Jun 18, 2020 · Medicare Supplement Plan K is one of 10 different Medigap plans and one of the two Medigap plans that has a yearly out-of-pocket limit. Medigap plans are offered in most states to help pay for some...

What do you need to know about Medicare plans?

Jun 23, 2020 · Medicare Supplement Plan K is an insurance policy. Like all Medicare supplement plans, it’s designed to cover the gaps in Original Medicare. Medicare Plan K often has premiums that are less expensive compared to other plans. Medicare Supplement Plan K Plan K doesn’t offer comprehensive coverage as some of the more popular plans.

How do plans L and K differ?

Plan L. Plan L is similar to Plan K, but offers a little more protection. Like Plan K, Plan L pays 100% of the Part A coinsurance and hospital costs and does not cover the Part B deductible, Part B excess charges, or foreign travel emergency costs.Aug 4, 2020

What does plan K mean?

Plan K is one of the Medicare supplement insurance plans also known as Medigap. It has a yearly out-of-pocket limit. Costs include premiums and deductibles. Medigap plans help fill the gaps in healthcare costs not covered by original Medicare (Part A and Part B).

Does AARP plan k cover Medicare deductible?

Here's a breakdown of the costs Medigap Plan K will cover: Part A coinsurance and hospital costs for up to an additional 365 days after Medicare benefits are exhausted: 100% Part A deductible: 50%Jun 18, 2020

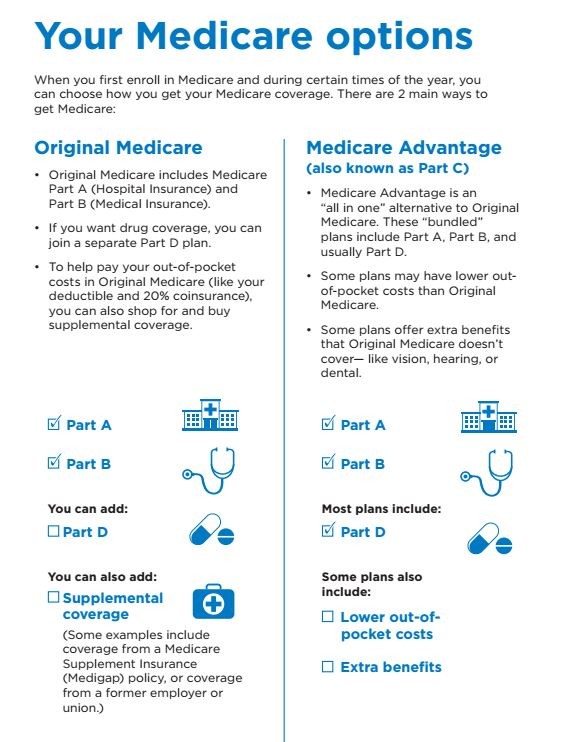

What are the 4 types of Medicare?

There are four parts of Medicare: Part A, Part B, Part C, and Part D.Part A provides inpatient/hospital coverage.Part B provides outpatient/medical coverage.Part C offers an alternate way to receive your Medicare benefits (see below for more information).Part D provides prescription drug coverage.

Is Medicare supplement K plan good?

Medicare Supplement Plan K This plan is a good option if you prefer a lower premium but still want a fair amount of coverage for a wide variety of services. In general, Plan K offers a lower monthly premium than Plan L, but offers higher coinsurance amounts and a higher annual out-of-pocket limit.Aug 26, 2021

What does Medigap K cover?

Medigap Plan K covers the following, according to Medicare.gov: Part A coinsurance and hospital costs up to an additional 365 days after Medicare benefits are used up. Part A deductible (50%). Part A hospice care coinsurance or copayment (50%).Feb 2, 2022

What is Medicare Part F?

Medigap Plan F is a Medicare Supplement Insurance plan that's offered by private companies. It covers "gaps" in Original Medicare coverage, such as copayments, coinsurance and deductibles. Plan F offers the most coverage of any Medigap plan, but it's no longer available to most new Medicare enrollees.Feb 1, 2022

What is the Medicare Part B deductible for 2022?

$233 inMedicare Part B Premium and Deductible The standard monthly premium for Medicare Part B enrollees will be $170.10 for 2022, an increase of $21.60 from $148.50 in 2021. The annual deductible for all Medicare Part B beneficiaries is $233 in 2022, an increase of $30 from the annual deductible of $203 in 2021.Nov 12, 2021

How much does AARP Medicare Supplement plan G cost?

In states with this pricing structure, the average monthly cost for the AARP Medigap Plan G is $124 per month for someone who is 65 years old. At age 75, the average monthly premium is $199, and it's $209 for those aged 85.Jan 24, 2022

What is not covered by Medicare?

Medicare does not cover: medical exams required when applying for a job, life insurance, superannuation, memberships, or government bodies. most dental examinations and treatment. most physiotherapy, occupational therapy, speech therapy, eye therapy, chiropractic services, podiatry, acupuncture and psychology services.Jun 24, 2021

Does Medicare cover dental?

Dental services Medicare doesn't cover most dental care (including procedures and supplies like cleanings, fillings, tooth extractions, dentures, dental plates, or other dental devices). Part A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care.

What Medicare is free?

Part AMost people get Part A for free, but some have to pay a premium for this coverage. To be eligible for premium-free Part A, an individual must be entitled to receive Medicare based on their own earnings or those of a spouse, parent, or child.Dec 1, 2021

Medicare Supplement Insurance Plan K Out-Of-Pocket Limit

Medigap Plan K is one of two Medigap insurance plans that includes a yearly out-of-pocket limit, which is $5,240 in 2018. After your out-of-pocket...

Medicare Supplement Insurance Plan K Benefits

As mentioned, Medigap Plan K offers partial coverage for a variety of Original Medicare costs that you’d normally have to pay out of pocket. This p...

Medicare Supplement Insurance Plan K Costs

One factor to keep in mind with Medigap Plan K is that you may have higher out-of-pocket costs with this Medigap policy. Because the plan only cove...

What Is Medicare Supplement Plan K?

Medicare Supplement Plan K covers services similar to other Medigap plans, but instead of paying all your costs, the plan pays a percentage. The ke...

How Does Medigap Plan K Differ From Plan L?

Generally, Plan K insurance has lower monthly premiums, but involves higher coinsurance amounts and a higher annual out-of-pocket limit than Plan L.

Does AARP Plan K Cover my Medicare deductible?

The AARP-UnitedHealthCare Medicare Supplement Insurance Plan K covers 100% of your Medicare Part A deductible ($1,556). However, it does not cover...

What is Medicare Supplement Plan K?

Takeaway. Medicare Supplement Plan K is one of 10 different Medigap plans and one of the two Medigap plans that has a yearly out-of-pocket limit. Medigap plans are offered in most states to help pay for some of the healthcare costs not covered by original Medicare (Part A and Part B).

Does Medicare cover vision?

Medigap policies also typically do not cover vision, dental, or hearing services. If you want this type of coverage, consider a Medicare Advantage (Part C) plan. Additionally, Medicare supplement plans do not cover outpatient retail prescription medications.

Does Medigap cover one person?

Here’s a breakdown of the costs Medigap Plan K will cover: When you have original Medicare and buy Medicare Supplement Plan K from a private company, your Medigap policy will pay its share of the Medicare-approved amount of covered healthcare costs after Medicare pays its share. Medigap policies only cover one person.

Medicare Supplement Plan K

Plan K doesn’t offer comprehensive coverage as some of the more popular plans. This post will dive deep into Medigap Plan K and by the end you should be able to see if it’s a good fit for your needs. When you’re done, make sure to read about the other Medicare plans available below.

What Medicare Plan K Covers

Medicare Supplement Plan K, also known as Medigap Plan K, doesn’t provide comprehensive coverage – but has some excellent benefits. Plan K will cover your Part A hospital deductible as well as your Medicare Part A hospital costs and coinsurance .

Plan K has Lower Premiums but Less Benefits

Medigap Plan K provides shoppers with several of the typical benefits as other Medicare supplements. The biggest difference is that Plan K will usually have lower premiums.

Medigap Plan K Quotes

Medigap Plan K isn’t as popular as other supplements such as Plan G or Plan N. It’s no always easy to find Plan K quotes as many Medicare Supplement insurance companies will not offer it. Give REMEDIGAP a call today. We know which insurance companies offer Plan K in your state. We can quickly research Medigap rates for you.

What is Plan K?

Plan K is a cost-sharing plan. That means some of the benefits aren’t fully covered. For example, instead of covering the entire Medicare Part A deductible, it only pays 50%. You would have to pay the remaining 50%.

What is a Medigap Plan K?

Medigap Plan K is one of the standardized Medicare Supplement insurance options available in most states. Learn about how Plan K may fit your health care needs.

How much is Medicare Part A deductible?

Medicare Part A Deductible. Medicare Part A comes with a deductible, which is $1,408 per benefit period in 2020. Medigap Plan K will pay for half that deductible for each benefit period. With Plan K, you still have to pay the Medicare Part B deductible, which is $198 in 2020. For more detailed information, read our page about Medicare Supplement ...

Does Medicare cover hospice care?

Hospice care provides medical treatment and care during a terminal illness. Medicare covers these services, but it requires copayments. These copayments include $5 for each symptom and pain relief prescription drugs and 5% of the Medicare-approved amount for inpatient respite care. Plan K covers half of these costs.

What is Medicare Part A coinsurance?

Medicare Part A Coinsurance. Medicare Part A is known as hospital insurance and it includes cost-sharing measures like coinsurance. Inpatient hospital stays covered by Medicare Part A require coinsurance fees if they exceed 60 days. This is the only basic benefit Medigap Plan K covers at 100%.

Is Plan K the same as Plan L?

Plan K is similar to Plan L, but it provides less coverage. To find out which type of plan is the best fit for you, it can be helpful to compare Medicare Supplement quotes.

Does Medicare cover 4 pints of blood?

Original Medicare only covers the four th pint of blood and beyond. If you need blood while in the hospital, Plan K will cover half of the cost of the first 3 pints.

What is Medicare Plan K?

The takeaway. Medicare Plan K is one Medicare supplement plan option. The cost can vary based on location, when you enroll, how the insurance company prices its policies, and more. If you are interested in Medigap Plan K, it pays to shop around online, by phone, or in person.

What is Medicare Supplement Plan K?

Medicare Supplement Plan K is designed to help with some of the out-of-pocket costs that come with traditional Medicare coverage. A Medicare “plan” is different from the “parts” of Medicare — the parts are your covered services through the government and the plans are optional supplemental insurance sold by private companies.

What is issue age rated insurance?

Issue-age rated. Also known as entry-age rated plans, the plan’s pricing is related to the age a person was when they bought the policy. The insurance company can increase the policy premium based on inflation, but not on a person’s increasing age.

What are the benefits of Medicare Supplement Plan K?

The Benefits of a Medicare Supplement Plan K or L 1 You have reasonable out-of-pocket costs when you need medical care, similar to typical Medicare Advantage plans. 2 Your maximum out-of-pocket expense for Medicare-covered deductibles and coinsurance is limited. For 2020, it is $5,880 with Plan K and $2,940 with Plan L. The yearly maximum out-of-pocket costs of Medicare Advantage plans are federally required not to exceed $6,700, but the limit is around $5,000 on average.

How much is Medicare Advantage 2020?

For 2020, it is $5,880 with Plan K and $2,940 with Plan L. The yearly maximum out-of-pocket costs of Medicare Advantage plans are federally required not to exceed $6,700, but the limit is around $5,000 on average. Interested?

How much is Medicare Supplement deductible?

It’s not doctor’s bills but hospital bills that worry many people. When you enter the hospital with Original Medicare, you have an immediate deductible of $1,408, out of your pocket. 1 You could pay that deductible up to five times each calendar year (though five hospital visits in a single year would be rare, and would need to be at least 60 days apart). Without Medicare Supplement coverage, your costs could be much greater. You’d be covered for a 60-day stay, but days 61-90 would require daily coinsurance of $352, and day 91 and beyond would require $704 coinsurance per each “lifetime reserve day” you use. You only have 60 such days to use over your lifetime. After that, you’d pay all the costs.