What is Medicare supplement plan m?

Medigap Plan M: the Deductible-sharing Plan. Medicare Supplement Plan M is one of the new Supplements created by the Medicare Modernization Act. It first hit the Medicare insurance market in the summer of 2010. (Sometimes we hear people call it Medicare Part M or Medigap Part M, but the correct term is Plan M.)

What is Medigap plan m?

· Medicare Supplement Plan M (Medigap Plan M) is one of the newer Medigap plan options. This plan is designed for people who want to pay a lower monthly rate (premium) in exchange for paying for half...

What is Medicare Part M (part m)?

· Plan M is a cost-sharing Medigap plan. When you enroll in this plan, you’re responsible for 50% of your Part A deductible. Yet, the premiums for Plan M are lower than those of some other Medigap plans, so many enrollees are able to justify the out-of-pocket costs. Medicare Supplement Plan M Coverage

When did Medicare Part M come out?

· Medigap Plan M is one of the offerings created by the Medicare Modernization Act, which was signed into law in 2003. Plan M was designed for people who are comfortable with cost-sharing and don’t...

Is there a plan M?

Medicare Supplement Plan M provides coverage for many seniors in the United States. A low-premium policy, Plan M is great for those who are prepared to cover out-of-pocket health care expenses.

What is Medigap M?

Medicare Supplement Plan M is more or less in the middle in terms of the portions of Original Medicare (Part A and Part B) out-of-pocket costs that Medigap plans cover.

What does MA plan stand for in medical terms?

A Medicare Advantage is another way to get your Medicare Part A and Part B coverage. Medicare Advantage Plans, sometimes called "Part C" or "MA Plans," are offered by Medicare-approved private companies that must follow rules set by Medicare.

What are 4 types of Medicare plans?

There are four parts of Medicare: Part A, Part B, Part C, and Part D.Part A provides inpatient/hospital coverage.Part B provides outpatient/medical coverage.Part C offers an alternate way to receive your Medicare benefits (see below for more information).Part D provides prescription drug coverage.

What is the deductible for Medicare Plan N?

$1,556What does Plan N cover? Plan N covers the Medicare Part A deductible of $1,556, coinsurance for Parts A and B, three pints of blood and covers 80% of medical costs incurred during foreign travel. Plan N does not provide coverage for the Medicare Part B deductible ($233 in 2022).

What is Medigap Plan N?

Medigap Plan N is a “plan” and not a “part” of Medicare, such as Part A and Part B, which cover your basic medical needs. Medicare Supplement Plan N is one type of insurance policy that you can purchase to help lower your out-of-pocket costs from Medicare.

Which of the following defines a Medicare Advantage MA plan?

Which of the following defines a Medicare Advantage (MA) Plan? MA Plans are health plan options approved by Medicare and offered by private insurance companies.

What is Ma Mapd and PDP plan?

A "PDP" is the abbreviation used for a stand-alone Medicare Part D "prescription drug plan". A PDP provides coverage of your out-patient prescription drugs that are found on the plan's formulary. An "MAPD" is the abbreviation for a "Medicare Advantage plan that offers prescription drug coverage".

What is the difference between MA and MAPD plans?

A MAPD plan is a Medicare Advantage plan that includes Medicare Part D prescription drug coverage. Medicare Advantage plans offer all the coverage of original Medicare (parts A and B), and often include additional services. When a Medicare Advantage plan offers prescription drug coverage, it is known as a MAPD plan.

What are the top 3 Medicare Advantage plans?

List of Medicare Advantage plansCategoryCompanyRatingBest overallKaiser Permanente5.0Most popularAARP/UnitedHealthcare4.2Largest networkBlue Cross Blue Shield4.1Hassle-free prescriptionsHumana4.01 more row•Feb 16, 2022

What is the best rated Medicare plan?

Blue Cross Blue Shield, Humana and United Healthcare earn the highest rankings among the national carriers in many states. Overall, Aetna Medicare ranks the best in the most (23) states. That said, there is no single “best plan.” Your needs and preferences will determine the best choice for you.

What are the two types of Medicare plans?

There are 2 main ways to get Medicare: Original Medicare includes Medicare Part A (Hospital Insurance) and Part B (Medical Insurance). If you want drug coverage, you can join a separate Medicare drug plan (Part D).

What is the difference between Medigap Plan M and Medigap Plan M?

Because Medigap Plan M offers the same coverage no matter what insurance company offers the plan, the main difference is cost. Insurance companies don’t offer the plans at the same monthly premium, so it makes sense to shop around for the lowest-cost policy.

What is the eligibility for Medicare Supplement Plan M?

To be eligible for Medicare Supplement Plan M, you must be enrolled in original Medicare Part A and Part B. You must also live within an area where this plan is sold by an insurance company.

What to do before committing to Medigap Plan M?

Before committing to Medigap Plan M or any other Medigap plan, review your needs with a licensed agent who specializes in Medicare supplements to help you. You can also contact your state’s State Health Insurance Assistance Program (SHIP) for free help in understanding available policies.

Does Medigap pay its share of charges?

Your Medigap policy pays its share of the charges.

Does Medicare supplement plan increase deductible?

Once you choose a Medicare supplement plan, the deductibles can increase on a yearly basis.

What letters are used to name plans?

Most companies name the plans by uppercase letters A, B, C, D, F, G, K, L, M, and N.

Why do private health insurance companies sell Medicare Supplement Plans?

Private health insurance companies sell Medicare supplement plans to help reduce out-of-pocket expenses and sometimes pay for services that Medicare doesn’t cover. People also call these Medigap plans.

What is Medicare Supplement Plan M?

Medicare Supplement Plan M provides coverage for many seniors in the United States. A low-premium policy, Plan M is great for those who are prepared to cover out-of-pocket health care expenses.

What is a plan M?

Plan M is a cost-sharing Medigap plan. When you enroll in this plan, you’re responsible for 50% of your Part A deductible. Yet, the premiums for Plan M are lower than those of some other Medigap plans, so many enrollees are able to justify the out-of-pocket costs.

Is Plan M still available?

Yes, Plan M still exists and is available for eligible beneficiaries to enroll.

Does Medicare Supplement include vision?

Neither Original Medicare nor any Medicare Supplement plan includes vision coverage. However, you can pair your coverage with a stand-alone vision plan.

Does Medicare Supplement Plan cover prescription drugs?

No Medicare Supplement plan currently on the market offers prescription drug coverage. You’ll need to enroll in a stand-alone Part D plan for coverage of drugs your doctor prescribes for your to take at home.

Is Plan M deductible or excess?

Plan M’s only expenses for which the beneficiary is fully responsible are the Part B deductible and Part B excess charges. However, not every state allows excess charges, and even in the ones that do, they are rare. The best course of action is to make sure your providers accept Medicare assignment before making appointments.

Which is better, Plan M or Plan K?

Of the three cost-sharing Medigap plan options, Plan M offers the most comprehensive coverage. The only cost-sharing involved in Plan M is 50% of your Part A deductible, whereas Plan K and Plan L require more. Certainly, you’ll also have better coverage with Plan M than with Original Medicare alone.

What is Medigap Plan M?

Medigap Plan M is one of the offerings created by the Medicare Modernization Act, which was signed into law in 2003. Plan M was designed for people who are comfortable with cost-sharing and don’t expect frequent hospital visits. Read on to learn what’s covered and not covered under Medicare Supplement Plan M.

What are not covered by Plan M?

The following benefits are not covered under Plan M: Part B deductible. Part B excess charges. If your doctor charges a fee above the Medicare assigned rate, this is called a Part B excess charge. With Medigap Plan M, you’re responsible for paying these Part B excess charges. In addition to these exceptions, there are a few other things ...

How many Medigap plans are there?

In most states, you can choose from among 10 different standardized Medigap plans (A, B, C, D, F, G, K, L, M, and N). Each plan has a different premium and features different coverage options. This gives you the flexibility to choose your coverage based on your budget and your healthcare needs.

Does Medicare Supplement Plan M cover dental?

Medicare Plan M can help you pay for medical expenses not covered under original Medicare (parts A and B). Like all Medigap plans, Medicare Supplement Plan M doesn’t cover prescription drugs or extra benefits, such as dental, vision, or hearing.

What percentage of Medicare pays for outpatient care?

After you’ve met the deductible, Medicare pays for 80 percent of your outpatient care. Then, Medicare Supplement Plan M pays for the other 20 percent. If your surgeon doesn’t accept Medicare’s assigned rates, you’ll have to pay the overage, which is known as the Part B excess charge. You can check with your doctor before receiving care.

Does Medicare pay for outpatient follow up?

After you’ve met the deductible, Medica re pays for 80 percent of your outpatient care.

Do you have to be enrolled in Medicare to get a plan M?

You must first be enrolled in original Medicare to be eligible for Medicare Plan M or any other Medigap plan.

How it works

When Medicare pays for services, you’re responsible for certain out-of-pocket costs unless you have Medicare Supplement Insurance, or Medigap, to help cover them. Medigap plans are only for Original Medicare members — they’re not compatible with Medicare Advantage.

How much does Medigap Plan M cost?

Medigap plans are standardized and regulated by the government but sold by private companies. Those companies set premiums according to factors including age, location and tobacco use. In a representative North Carolina ZIP code (27406) in 2022, monthly Medigap Plan M premiums for a 65-year-old nonsmoker range from $72 to $260.

Compare alternative plans

About the author: Alex Rosenberg is a NerdWallet writer focusing on Medicare and information technology. He has written about health, tech, and public policy for over 10 years. Read more

What is Medicare Advantage?

Medicare Advantage is Medicare-approved plan from a private company that offers an alternative to Original Medicare for your health and drug coverage. These “bundled” plans include Part A, Part B, and usually Part D. Plans may offer some extra benefits that Original Medicare doesn’t cover — like vision, hearing, and dental services. Medicare Advantage Plans have yearly contracts with Medicare and must follow Medicare’s coverage rules. The plan must notify you about any changes before the start of the next enrollment year.

What is deductible in Medicare?

deductible. The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. at the start of each year, and you usually pay 20% of the cost of the Medicare-approved service, called coinsurance.

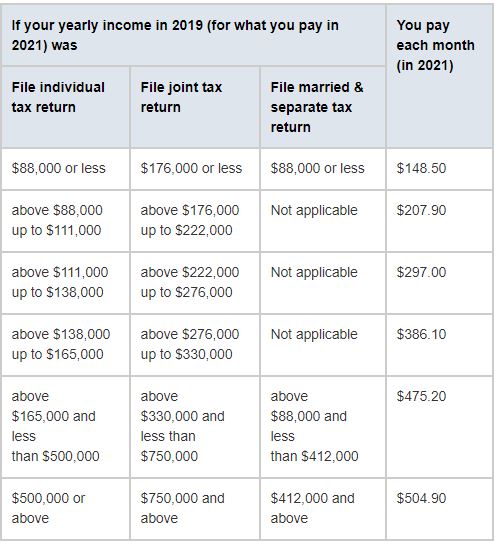

How much is Part B premium for 2021?

Most people will pay the standard Part B premium amount. The standard Part B premium amount in 2021 is $148.50. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA). IRMAA is an extra charge added to your premium.

Does Medicare cover prescription drugs?

Medicare drug coverage helps pay for prescription drugs you need. To get Medicare drug coverage, you must join a Medicare-approved plan that offers drug coverage (this includes Medicare drug plans and Medicare Advantage Plans with drug coverage).

Does Medicare Advantage have yearly contracts?

Medicare Advantage Plans have yearly contracts with Medicare and must follow Medicare’s coverage rules. The plan must notify you about any changes before the start of the next enrollment year. Learn about the types of Medicare Advantage Plans. Each Medicare Advantage Plan can charge different. out-of-pocket costs.

What is a medicaid supplement?

A Medicare Supplement Insurance (Medigap) policy can help pay some of the remaining health care costs, like copayments, coinsurance, and deductibles. Some Medigap policies also cover services that Original Medicare doesn't cover, like medical care when you travel outside the U.S.

How much of Medicare coinsurance do you pay?

at the start of each year, and you usually pay 20% of the cost of the Medicare-approved service, called coinsurance. If you want drug coverage, you can add a separate drug plan (Part D).

Does Medigap Plan M cover Medicare Part B?

It will offer the core benefits of covering the Part A hospital coinsurance, skilled nursing facility benefits, and hospice coinsurance. However, Plan M will not cover the Medicare Part B ...

Does Plan M cover Part B?

However, Plan M will not cover the Medicare Part B deductible, which is $203 in 2021 and it will only cover half of the Part A deductible which is $1,484 in 2021. Also, once the Medicare Part B deductible is met, you will not be responsible for co-payments for physician appointments.

What is managed care plan?

Managed-care plans or Advantage plans bundles all health-care coverage under one neat plan. MA plans decide on rate amounts, making prices different from plan to plan. Processing payments are done through the private plan, not Medicare.

What are the benefits of Medicare managed care?

Benefits can include routine vision, dental and hearing services. Additionally, managed care plans offer prescription drug coverage. The cost of medications out-of-pocket can be financially exhausting. Medicare managed care plans can provide some relief.

Which managed care plan has the most restrictions?

The Health Maintenance Organization carries the most restrictions of all managed care plans. With no surprise, it’s also the least expensive option – making it the most popular.

Does managed care plan limit doctors?

On the other hand, managed care plans may limit beneficiaries to only the doctors within the plan’s network. If having the freedom to see any healthcare provider of choice is important, remember that Advantage plans limit provider options. While traveling within the country, managed care pays for emergency services only.

Does Medicare Supplement cover gaps?

Medicare Supplement plans or Medigap policies also cover some gaps that Medicare doesn’t. However, Supplement insurance works in combination with Original Medicare.

Is Medicare Supplement the same as Managed Care?

Managed-care plans and Medicare Supplement plans are not the same. This misconception is common. Both provide additional benefits to Original Medicare. However, they serve two totally different purposes. Managed-care plans or Advantage plans bundles all health-care coverage under one neat plan.

Do you pay deductible on out of network Medicare?

Members pay no deductible amount, and co-payments are low for in-network services. Out-of-network coverage is like PPO coverage. Members pay the deductible amount, plus a percent of the doctors’ cost for services.

What is Medicare Part A?

Medicare Part A is health insurance offered by the federal government to United States citizens and legal immigrants who have permanently resided in the U.S. without a break for at least five years. You’re eligible if you’re 65 and older or under age 65 with certain disabilities. You may also qualify at any age if you have end-stage renal disease or amyotrophic lateral sclerosis (also known as Lou Gehrig’s disease). Together with Medicare Part B, it makes up what is known as Original Medicare, the federally administered health-care program. Medicare Part A helps pay for the cost of inpatient hospital care, while Part B covers outpatient medical services.

How long do you have to pay Medicare premiums?

Most people don’t pay a monthly premium for Medicare Part A as long as you or your spouse paid Medicare taxes for a minimum of 10 years (40 quarters) while working. If you haven’t worked long enough but your spouse has, you may be able to qualify for premium-free Part A based on your spouse’s work history.

How long does Medicare Part A last?

If you do not automatically qualify for Medicare Part A, you can do so during your Initial Enrollment Period, which starts three months before you turn 65, includes the month you turn 65, and lasts for three additional months after you turn 65.

How old do you have to be to get Medicare?

You are 65 or older and meet the citizenship or residency requirements. You are under age 65, disabled, and your premium-free Medicare Part A coverage ended because you returned to work. You have not paid Medicare taxes through your employment or have not worked the required time to qualify for premium-free Part A.

When do you get Medicare if you are 65?

You will receive your Medicare card in the mail three months before the 25th month of disability.

When do you enroll in Medicare Part A?

If you’re currently receiving retirement benefits from Social Security or the Railroad Retirement Board (RRB), you’re automatically enrolled in both Medicare Part A and Part B starting the first day of the month you turn age 65.

How much is Medicare Part A deductible for 2021?

Medicare Part A cost-sharing amounts (for 2021) are listed below. Inpatient hospital care: Medicare Part A deductible: $1,484 for each benefit period. Medicare Part A coinsurance: $0 coinsurance for the first 60 days of each benefit period. $371 a day for the 61st to 90th days of each benefit period. $742 a day for days 91 and beyond per each ...