Medicare Plan F, Plan G and Plan N are three of the most comprehensive Medicare Supplemental Insurance plans that can help you reduce unexpected, out-of-pocket expenses and stabilize your health care spending. If you have Medicare Parts A and B, then you are eligible to apply for and purchase these plans.

Full Answer

What is the best Medicare supplement plan?

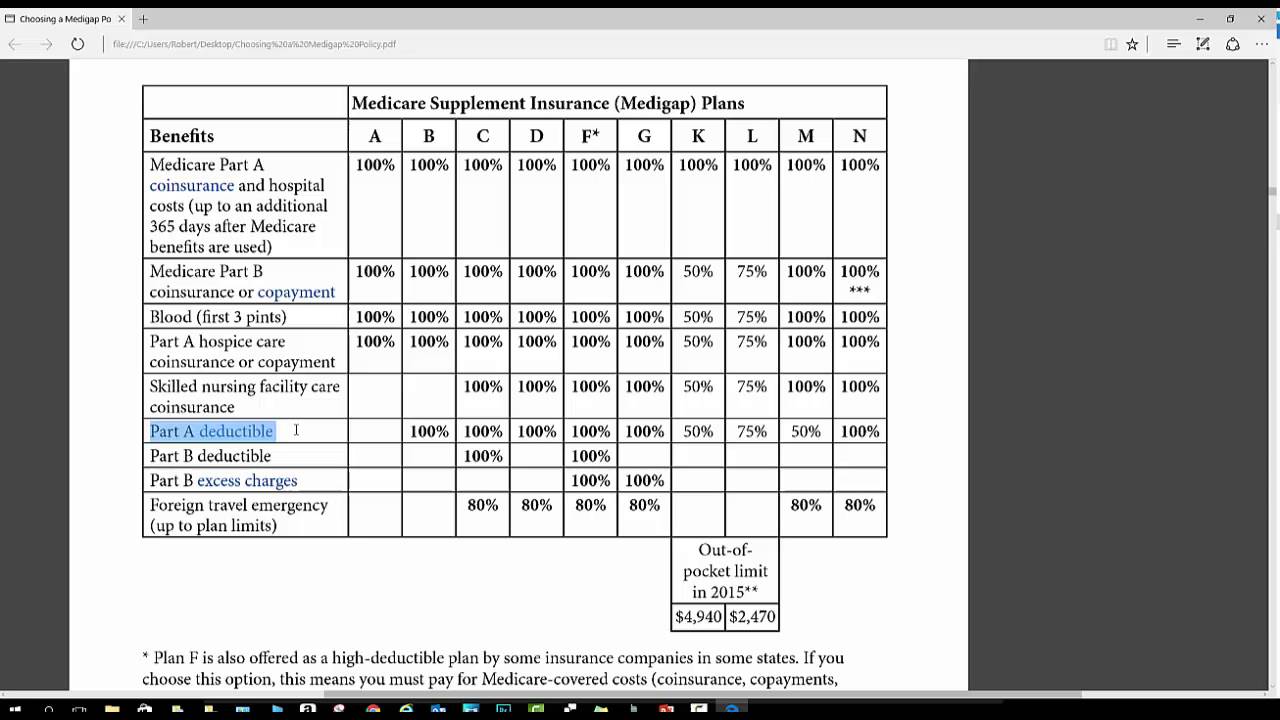

- Medicare Supplement Insurance helps you manage out-of-pocket costs for covered services

- Also called Medigap because it covers “gaps” in costs after Medicare Parts A and B pay their share

- Medigap Plans C and F, which cover the Medicare Part B deductible, are being discontinued in 2020

What does Blue Cross Medicare supplement plan F cover?

Blue Cross Medicare Supplement Plan F pays the Medicare Part A hospital deductible and coinsurance, the Part B deductible, and excess charges. Additionally, it covers foreign travel agency care and skilled nursing facility coinsurance, explains BlueCross BlueShield of Illinois.

How much does Medicare Part F cost?

Since Medicare Part F is the is the most comprehensive Medigap policy, the premium can be costly. Typically, these range from $120 to $140 per month for a 65-year-old. However, the exact cost will be determined by your location, plan provider, current health condition, and age and gender.

What is AARP Medicare supplement plan F?

Medicare Supplement Plan F is a specific type of Medicare Supplement plan. Medicare Supplement (also called Medigap) insurance may help pay for out-of-pocket costs of Medicare Part A and Part B. Is AARP doing away with Plan F? According to AARP, Medicare Supplement Plan F provides the most coverage, and as a result, it’s the most popular plan among those eligible for Medicare.

What is High Deductible Plan F?

The coverage for a high-deductible Plan F is nearly the same as Medicare Supplement Plan F, but you’re required to satisfy an annual deductible bef...

What is High Deductible Plan G?

A high-deductible Plan G requires you to pay an annual deductible before the plan begins to pay. Once you reach the deductible, you will receive th...

Is Medigap Plan C and Medicare Part C the same?

No. Even though Medigap Plan C and Medicare Part C sound similar, they are very different. Medigap is Medicare Supplement Insurance that helps cove...

How can I enroll in a Medicare Supplement plan?

To be eligible for a Medicare Supplement plan, you must enroll in Original Medicare (Parts A and B). The Medigap open enrollment period lasts six m...

Are there other options rather than enrolling in a Medigap plan?

Yes. Consider enrolling in a Medicare Advantage (Part C) plan, an alternative to Original Medicare that comes with additional benefits and features...

What’S Covered on Medigap Plan F?

Medigap Plan F is a heavy favorite with individuals who want comprehensive benefits and first-dollar coverage on their health care costs. First-dol...

What’S Covered Under Medigap Plan G?

Medigap Plan G is currently outselling most other Medigap plans because it offers the same broad coverage as Plan F except for the Part B deductibl...

What’S Covered Under Medigap Plan N?

This is another fast-selling plan because it offers a good balance between protection against catastrophic out-of-pocket expenses and affordable pr...

When Comparing Medicare Plan F vs Plan G vs Plan N

Be sure to give some thought to the type of coverage you think you’ll want over the long term. Here’s why:In most cases, you do not have a guarante...

What is the difference between a plan F and a plan G?

With Plan F, you’ll have zero out of pocket costs outside your monthly premium. This is because it’s a first-dollar coverage plan. This means the first dollar is covered by Medicare. You have no deductible, no coinsurance, and no copays. All you have to pay is your monthly premium. With a Plan G, the only cost you have to pay out ...

Which is better, Plan G or Plan F?

Plan G is not too far behind. Is Plan F the best Medicare Supplement plan? Plan F is the plan that will give you the most comprehensive coverage. So, in regards to coverage, yes, Plan F is the best Medicare Supplement plan since it gives you the most coverage.

Does Medigap have standardized benefits?

However, these charges are not common. Some states don’t even allow them. With Medigap plans, the benefits are standardized by the federal government. Meaning, it doesn’t matter which carrier you choose to enroll with, the benefits across each letter plan are exactly the same.

Can I switch to a Medicare Advantage plan?

Can I change from a Medicare Advantage plan to Plan G, Plan N, or Plan F? Yes, you can change from a Medicare Advantage plan to a Medigap with Guarantee Issue Rights during the first 12 months of enrolling in a Medicare Advantage plan. After that, you may need to wait until the Annual Enrollment Period to switch.

Is Plan N a good plan?

Then there’s Plan N. Plan N is great for those that are okay paying a small copay when they visit the doctors or hospital. These small copays keep the monthly premium low. If you find yourself going to the doctor’s office often, you may want to consider Plan G.

Can you change your Medicare plan without underwriting?

But, you may need to answer health questions first. There are times when you’re eligible for Guarantee Issue Rights, in which case you could change plans without underwriting. The plans you’re eligible to enroll in, depend on when you became Medicare eligible.

Do you have to pay out of pocket for a Plan G?

All you have to pay is your monthly premium. With a Plan G, the only cost you have to pay out of pocket is the Part B deductible. After you’ve met the deductible, Plan G will cover the rest, just like Plan F. Then there’s Plan N. Plan N is great for those that are okay paying a small copay when they visit the doctors or hospital.

What is the difference between Medicare Supplements Plan F and Plan G?

The only difference when you compare Medicare Supplements Plan F and Plan G is that deductible. Otherwise they function just the same. There is one important feature that Medicare Supplements Plan F and G have over all the other Medigap plans.

What is a Medigap Plan F?

Medigap Plan F is a heavy favorite with individuals who want comprehensive benefits and first-dollar coverage on their health care costs. First-dollar coverage means that both your Part A and Part B deductibles are covered by the plan, so you pay nothing before your Medicare benefits kick in.

What happens if you don't have Medicare?

When you see a provider that doesn’t participate with Medicare, he can charge up to 15% more than the standard Medicare rate for your services. You will pay this money out of pocket unless you have Medigap Plan F or Plan G. It’s definitely something to consider if provider choice is important to you.

How many Medigap plans are there?

There are currently 10 different Medigap plans that are standard across most states. (Massachusetts, Minnesota, and Wisconsin have their own plan standards.) What this means for consumers, however, is that Plan A offered by Company X in Anaheim is exactly the same as Plan A offered by Company Y in Boise.

Which is the most comprehensive Medicare plan?

The most comprehensive plan currently available is Medigap Plan F. It covers all of the gaps in Medicare. The next most comprehensive plan is Plan G, which covers nearly as much, with the Part B deductible being the only difference. Finally, Plan N is probably the third most popular plan because it operates similar to Plan G except ...

How much does a 66 year old spend on Medicare?

The average 66-year-old couple spends about 57% of their Social Security benefits on health care, according to a 2016 study. Learn Medicare for Free: Enroll in 6-Day Medicare Mini Course.

Is Medigap Plan G the same as Plan F?

Medigap Plan G is currently outselling most other Medigap plans because it offers the same broad coverage as Plan F except for the Part B deduct ible, which is $203 in 2021. Medigap Plan G is now the most popular plan among beneficiaries new to Medicare.

What is Medicare Plan F?

Medicare Plan F, Plan G and Plan N are Medicare Supplement Insurance plans that can be purchased to help supplement your Original Medicare benefits. These popular plan options can help you cover the extra out-of-pocket costs that Original Medicare doesn’t cover.

Is Medicare Plan F still available?

Medicare Plan F is no longer available to new enrollees as of 2020, though it is still an option for people who were eligible for Medicare before 2020. People who already are enrolled in this plan are also able to keep it. It is also the only plan which covers the yearly Part B deductible (which is $198 in 2020).

Is Medicare Plan G the same as Medicare Plan F?

For new enrollees looking for a comprehensive plan that is very similar to Medicare Plan F, Medicare Plan G is a great option. This plan covers everything that Plan F covers EXCEPT the $198 Part B annual deductible that may need to be paid out-of-pocket. Because Plan G offers slightly less coverage than Plan F, it will usually have a less expensive monthly premiums, though these prices will vary depending on the insurance company offering the plan.

Which is better, Plan F or Plan G?

Plan F is the most comprehensive plan. It covers one more benefit than Plan G. Plan G typically has higher premiums than Plan N because it includes more coverage. You could save money with Plan N because out-of-pocket costs with Plan N may equal or exceed the premium difference with Plan G.

Why is Plan G higher than Plan N?

Plan G and Plan N premiums are lower to reflect that. 7. Plan G will typically have higher premiums than Plan N because it includes more coverage. But it could save you money because out-of-pocket costs with Plan N may equal or exceed the premium difference with Plan G, depending on your specific medical needs.

When is the best time to buy Medicare Supplement Plan?

The best time to purchase your Medicare Supplement plan is during the Medigap Open Enrollment Period, the six-month period that begins on the first day of the month in which you are 65 or older and enrolled in Medicare Part B.

Which Medicare plan pays 100% of Part B coinsurance?

Plan N will pay 100% of the Part B coinsurance, except for copays of up to $20 for certain office visits and up to $50 for emergency room visits when you’re not admitted to the hospital. Medicare Supplement Plan F is the most comprehensive plan. Plan F covers one more benefit than Plan G, which is the Part B deductible.

Is Medicare Part B deductible?

Plan F, which covers Medicare Part B deductible, is not available to those newly eligible for Medicare on or after January 1, 2020. However, if you already have Plan F or its high-deductible version, you can keep it. Plans F and G offer a high-deductible option, though not every carrier offers them.

Does Medicare cover out of pocket costs?

While Original Medicare covers most things, there are out-of-pocket costs like deductibles, copayments, and coinsurance. Those gaps can be covered by purchasing Medicare Supplement Plans F, G, or N. These policies are standardized across states, meaning they all must provide roughly the same coverage no matter which state you live in.

Is Plan F better than Plan G?

However, if the premium for Plan F is minimal compared to Plan G , it may be the better option . Another thing to consider is that in 2020, Plan F will be going away, however, those who already have Plan F can be grandfathered in to keep it. If you’re looking for another similar option, consider High-Deductible Plan F.

Do you have to pay a deductible on a Plan G or F?

Therefore, even though you will have to pay a deductible, you can save money overall if Plan G has a lower premium than Plan F. However, because pricing varies among plans, states, and individuals, this isn’t always true – sometimes there will be minimal difference in the premium cost.

Which is the Best Plan: F vs G vs N?

In terms of coverage, the most comprehensive plan on the market is Plan F. Plan F covers every gap in Medicare. The second most comprehensive plan is Plan G. Plan G covers nearly as much as Plan F, with the Part B deductible being the only difference between the two plans.

How are Medigap Plans are Standardized?

In most states, there are presently 10 separate, standardized Medigap plans (Massachusetts, Minnesota, and Wisconsin have their own plan standards). For consumers, this simply means that Medigap Plan A offered by Company X in San Francisco is the exact same plan as Medigap Plan A offered by Company Y in Denver.

Medigap Plan F

Medigap Plan F is by far and away the favorite Medicare Supplement plan of choice for people that want comprehensive benefits and first-dollar coverage on their healthcare costs. First-dollar coverage means that the plan covers both your Parts A & B deductibles, so you pay absolutely nothing, even before your Medicare benefits kick in.

Medigap Plan G

Recent trends show Medigap Plan G outperforming other Medigap plans in terms of enrollment. This is likely because Plan G offers the same broad coverage as Plan F, minus the Part B deductible, which is $203 in 2021.

Medigap Plan N

Plan N is also a popular option because it balances out protection against immense out-of-pocket expenses with affordable premiums.

Comparing Medicare Plan F vs Plan G vs Plan N

Take your time when looking over coverage plans, and think about plans with a long-term lens. This is an important decision.