The Medicare Plus Card offers discounts on prescription drugs, dental, vision and hearing care. To use the card, you must find a pharmacy, dentist, eye doctor or hearing doctor who will accept the card and apply the discount to your appointment or product.

Do Medicare Advantage plans include prescription drug coverage?

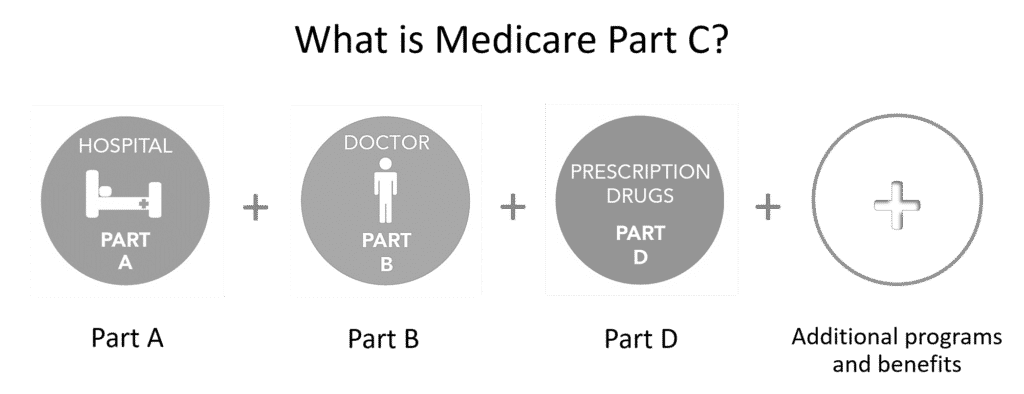

Medicare Advantage Plans may also offer prescription drug coverage that follows the same rules as Medicare Prescription Drug Plans. Medicare Advantage (also known as Part C) is an “all in one” alternative to Original Medicare. These “bundled” plans include Part A, Part B, and usually Part D. Not sure what kind of coverage you have?

What do Medicare health plans cover?

What Medicare health plans cover Medicare health plans include Medicare Advantage, Medical Savings Account (MSA), Medicare Cost plans, PACE, MTM Preventive & screening services Part B covers many preventive services.

What is a Medicare PLUS card and how does it work?

What’s a Medicare Plus Card? The Medicare Plus Card is billed as a “non-government resource to discounts and savings.” It was created by Medicare World, which describes itself as “the nation’s largest non-government resource for information and tools for those on Medicare.”

What are the different types of Medicare benefits?

Medicare Part A (Hospital Insurance) Part A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care. Medicare Part B (Medical Insurance) Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services. Medicare Part D (prescription drug coverage)

What is a Medicare Plus plan?

The Medicare Plus Card offers discounts on prescription drugs, dental, vision and hearing care. To use the card, you must find a pharmacy, dentist, eye doctor or hearing doctor who will accept the card and apply the discount to your appointment or product.

What are the 2 types of Medicare plans?

Original Medicare includes Medicare Part A (Hospital Insurance) and Part B (Medical Insurance). You can join a separate Medicare drug plan to get Medicare drug coverage (Part D). You can use any doctor or hospital that takes Medicare, anywhere in the U.S.

What are the negatives of a Medicare Advantage plan?

Medicare Advantage can become expensive if you're sick, due to uncovered copays. Additionally, a plan may offer only a limited network of doctors, which can interfere with a patient's choice. It's not easy to change to another plan. If you decide to switch to a Medigap policy, there often are lifetime penalties.

What are the 4 types of Medicare?

There are four parts of Medicare: Part A, Part B, Part C, and Part D.Part A provides inpatient/hospital coverage.Part B provides outpatient/medical coverage.Part C offers an alternate way to receive your Medicare benefits (see below for more information).Part D provides prescription drug coverage.

Why do I need Medicare Part C?

Medicare Part C provides more coverage for everyday healthcare including prescription drug coverage with some plans when combined with Part D. A Medicare Advantage prescription drug (MAPD) plan is when a Part C and Part D plan are combined. Medicare Part D only covers prescription drugs.

What are the top 3 Medicare Advantage plans?

The Best Medicare Advantage Provider by State Local plans can be high-quality and reasonably priced. Blue Cross Blue Shield, Humana and United Healthcare earn the highest rankings among the national carriers in many states.

Can you switch back to Medicare from Medicare Advantage?

Yes, you can elect to switch to traditional Medicare from your Medicare Advantage plan during the Medicare Open Enrollment period, which runs from October 15 to December 7 each year. Your coverage under traditional Medicare will begin January 1 of the following year.

What is the difference between Original Medicare and Medicare Advantage?

Original Medicare covers inpatient hospital and skilled nursing services – Part A - and doctor visits, outpatient services and some preventative care – Part B. Medicare Advantage plans cover all the above (Part A and Part B), and most plans also cover prescription drugs (Part D).

Who is the largest Medicare Advantage provider?

UnitedHealthcareUnitedHealthcare is the largest provider of Medicare Advantage plans and offers plans in nearly three-quarters of U.S. counties.

What parts of Medicare are free?

Part A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care. coverage if you or your spouse paid Medicare taxes for a certain amount of time while working. This is sometimes called "premium-free Part A." Most people get premium-free Part A.

Is it necessary to have supplemental insurance with Medicare?

For many low-income Medicare beneficiaries, there's no need for private supplemental coverage. Only 19% of Original Medicare beneficiaries have no supplemental coverage. Supplemental coverage can help prevent major expenses.

Which is better PPO or HMO?

HMO plans typically have lower monthly premiums. You can also expect to pay less out of pocket. PPOs tend to have higher monthly premiums in exchange for the flexibility to use providers both in and out of network without a referral. Out-of-pocket medical costs can also run higher with a PPO plan.

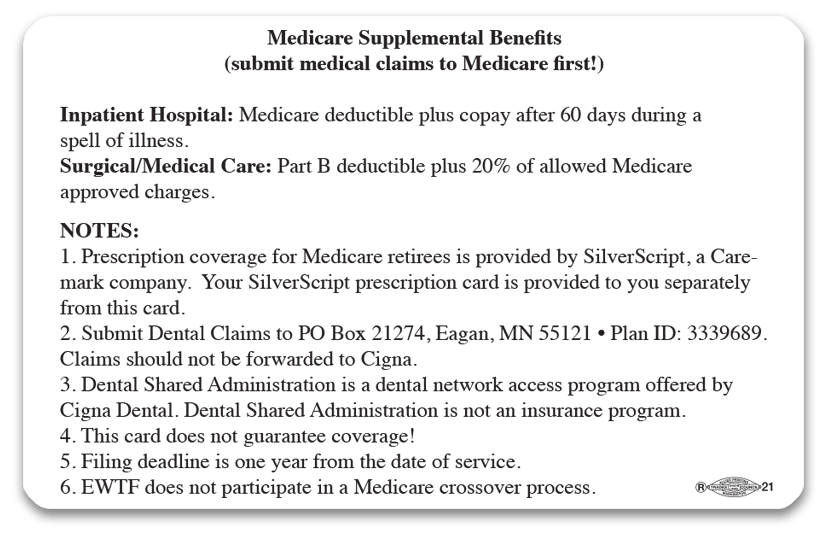

What is Medicare Supplement Insurance?

You can get a Medicare Supplement Insurance (Medigap) policy to help pay your remaining out-of-pocket costs (like your 20% coinsurance). Or, you can use coverage from a former employer or union, or Medicaid.

What are the extra benefits that Medicare doesn't cover?

Plans may offer some extra benefits that Original Medicare doesn’t cover—like vision, hearing, and dental services.

What happens if you don't get Medicare?

If you don't get Medicare drug coverage or Medigap when you're first eligible, you may have to pay more to get this coverage later. This could mean you’ll have a lifetime premium penalty for your Medicare drug coverage . Learn more about how Original Medicare works.

How much does Medicare pay for Part B?

For Part B-covered services, you usually pay 20% of the Medicare-approved amount after you meet your deductible. This is called your coinsurance. You pay a premium (monthly payment) for Part B. If you choose to join a Medicare drug plan (Part D), you’ll pay that premium separately.

What is Medicare Advantage Plan?

Medicare Advantage Plan (Part C) A type of Medicare health plan offered by a private company that contracts with Medicare. Medicare Advantage Plans provide all of your Part A and Part B benefits, excluding hospice. Medicare Advantage Plans include: Health Maintenance Organizations. Preferred Provider Organizations.

What is the original Medicare?

Original Medicare. Original Medicare is a fee-for-service health plan that has two parts: Part A (Hospital Insurance) and Part B (Medical Insurance). After you pay a deductible, Medicare pays its share of the Medicare-approved amount, and you pay your share (coinsurance and deductibles). (Part A and Part B) or a.

Does Medicare have other coverage?

You may also have other coverage, like employer or union, military, or veterans' benefits. Learn about how Medicare works with other insurance.

What is Medicare Plus Card?

The Medicare Plus Card is billed as a “non-government resource to discounts and savings.” It was created by Medicare World, which describes itself as “the nation’s largest non-government resource for information and tools for those on Medicare.”

How many dentists accept Medicare Plus?

The company that provides the Medicare Plus Card claims that the card is accepted at 80,000 dentists, 59,000 pharmacies, 10,000 vision centers and 1,500 hearing centers. The Medicare Plus Card also claims to provide card holders with:

Is there any real risk involved with acquiring a Medicare Plus Card?

Is there any real risk involved with acquiring a Medicare Plus Card? Not necessarily, unless you don’t want to be inundated with anymore spam emails or phone calls. As long as you can find a provider who will accept the card, it may save you a few bucks here and there if you don’t have a Medicare Advantage plans, a Medicare Part D plan, or other drug, vision, dental or hearing plan.

Can you use a discount card with Medicare?

In fact, federal anti-kickback laws prohibit the use of drug coupons or discount cards to be used in conjunction with Medicare drug coverage. That means if you have a Medicare Advantage plan with prescription drug coverage or a Medicare Part D plan, you must choose to use either your plan or the discount card when filling a prescription. It would be illegal to use both.

Is Medicare Plus a savings card?

Despite its name, the Medicare Plus Card is not actually tied to Medicare or the federal Medicare program in any way. It is essentially just a savings or discount card, not unlike many other similar discount cards available to consumers.

Does Medicare Plus offer additional savings?

The Medicare Plus Card may or may not offer any additional savings to Medicare Advantage plan members, as private insurance plans and health care providers often do not allow for any additional discounts to be applied.

Does Medicare Plus cover dental?

The Medicare Plus Card markets itself as providing coverage for things not covered by Medicare. While it’s true that Original Medicare (Medicare Part A and Part B) does not cover prescription drugs, dental, vision or hearing, these benefits are commonly offered by Medicare Advantage (Medicare Part C) plans, which are sold by private insurance companies. If you have a Medicare Advantage plan that includes some of these benefits, you may not need to consider getting the Medicare Plus Card.

How much of Medicare coinsurance do you pay?

at the start of each year, and you usually pay 20% of the cost of the Medicare-approved service, called coinsurance. If you want drug coverage, you can add a separate drug plan (Part D).

What is Medicare for people 65 and older?

Medicare is the federal health insurance program for: People who are 65 or older. Certain younger people with disabilities. People with End-Stage Renal Disease (permanent kidney failure requiring dialysis or a transplant, sometimes called ESRD)

What is a medicaid supplement?

A Medicare Supplement Insurance (Medigap) policy can help pay some of the remaining health care costs, like copayments, coinsurance, and deductibles. Some Medigap policies also cover services that Original Medicare doesn't cover, like medical care when you travel outside the U.S.

How much will Medicare cost in 2021?

If you aren't eligible for premium-free Part A, you may be able to buy Part A. You'll pay up to $471 each month in 2021. If you paid Medicare taxes for less than 30 quarters, the standard Part A premium is $458. If you paid Medicare taxes for 30–39 quarters, the standard Part A premium is $259.

What is deductible in Medicare?

deductible. The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. at the start of each year, and you usually pay 20% of the cost of the Medicare-approved service, called coinsurance.

What is the standard Part B premium for 2020?

The standard Part B premium amount in 2020 is $144.60. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA). IRMAA is an extra charge added to your premium.

Do you pay Medicare premiums if you are working?

You usually don't pay a monthly premium for Part A if you or your spouse paid Medicare taxes for a certain amount of time while working. This is sometimes called "premium-free Part A."

What is Medicare Supplement Insurance?

Medicare Supplement Insurance (Medigap) is extra insurance you can buy from a private company that helps pay your share of costs in Original Medicare.

What extra benefits does Medicare not cover?

Some extra benefits (that Original Medicare doesn’t cover – like vision, hearing, and dental services )

How to get free health insurance counseling?

Contact your local State Health Insurance Assistance Program (SHIP) to get free personalized health insurance counseling. SHIPs aren’t connected to any insurance company or health plan.

Do you pay monthly premiums for Part B?

Most plans have a monthly premium that you pay in addition to your Part B premium. You’ll also pay other costs when you get prescriptions.

How does Medicare work with other insurance?

When there's more than one payer, "coordination of benefits" rules decide which one pays first. The "primary payer" pays what it owes on your bills first, and then sends the rest to the "secondary payer" (supplemental payer) ...

What is the phone number for Medicare?

It may include the rules about who pays first. You can also call the Benefits Coordination & Recovery Center (BCRC) at 1-855-798-2627 (TTY: 1-855-797-2627).

What is a Medicare company?

The company that acts on behalf of Medicare to collect and manage information on other types of insurance or coverage that a person with Medicare may have, and determine whether the coverage pays before or after Medicare. This company also acts on behalf of Medicare to obtain repayment when Medicare makes a conditional payment, and the other payer is determined to be primary.

How long does it take for Medicare to pay a claim?

If the insurance company doesn't pay the claim promptly (usually within 120 days), your doctor or other provider may bill Medicare. Medicare may make a conditional payment to pay the bill, and then later recover any payments the primary payer should have made. If Medicare makes a. conditional payment.

What is a group health plan?

If the. group health plan. In general, a health plan offered by an employer or employee organization that provides health coverage to employees and their families.

What is the difference between primary and secondary insurance?

The insurance that pays first (primary payer) pays up to the limits of its coverage. The one that pays second (secondary payer) only pays if there are costs the primary insurer didn't cover. The secondary payer (which may be Medicare) may not pay all the uncovered costs.

How many employees does a spouse have to have to be on Medicare?

Your spouse’s employer must have 20 or more employees, unless the employer has less than 20 employees, but is part of a multi-employer plan or multiple employer plan. If the group health plan didn’t pay all of your bill, the doctor or health care provider should send the bill to Medicare for secondary payment.

What is Medicare Advantage?

Medicare Advantage Plans may also offer prescription drug coverage that follows the same rules as Medicare drug plans. .

What do I need to know about Medicare?

What else do I need to know about Original Medicare? 1 You generally pay a set amount for your health care (#N#deductible#N#The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay.#N#) before Medicare pays its share. Then, Medicare pays its share, and you pay your share (#N#coinsurance#N#An amount you may be required to pay as your share of the cost for services after you pay any deductibles. Coinsurance is usually a percentage (for example, 20%).#N#/#N#copayment#N#An amount you may be required to pay as your share of the cost for a medical service or supply, like a doctor's visit, hospital outpatient visit, or prescription drug. A copayment is usually a set amount, rather than a percentage. For example, you might pay $10 or $20 for a doctor's visit or prescription drug.#N#) for covered services and supplies. There's no yearly limit for what you pay out-of-pocket. 2 You usually pay a monthly premium for Part B. 3 You generally don't need to file Medicare claims. The law requires providers and suppliers to file your claims for the covered services and supplies you get. Providers include doctors, hospitals, skilled nursing facilities, and home health agencies.

Should I get a supplemental policy?

You may already have employer or union coverage that may pay costs that Original Medicare doesn't. If not, you may want to buy a Medicare Supplement Insurance (Medigap) policy.

What is Part A (Hospital Insurance)?

Part A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care.

What is deductible in Medicare?

deductible. The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. ) before Medicare pays its share. Then, Medicare pays its share, and you pay your share (. coinsurance.

What factors affect Medicare out of pocket costs?

Whether you have Part A and/or Part B. Most people have both. Whether your doctor, other health care provider, or supplier accepts assignment. The type of health care you need and how often you need it.

What is a coinsurance percentage?

Coinsurance is usually a percentage (for example, 20%). An amount you may be required to pay as your share of the cost for a medical service or supply, like a doctor's visit, hospital outpatient visit, or prescription drug. A copayment is usually a set amount, rather than a percentage.